10 Day Demand Letter Template

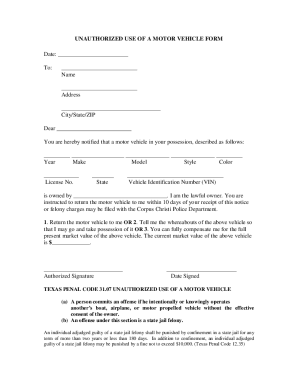

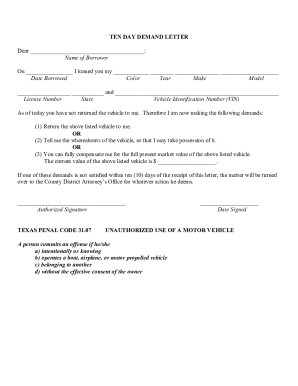

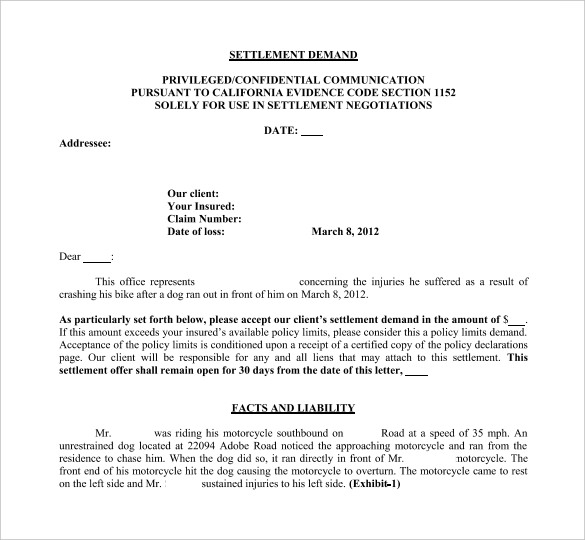

For example in corpus christi texas the police department allows the owner of a motor vehicle to demand return of the vehicle from someone who is unlawfully keeping it either because it was stolen or because it was borrowed and now is not returning it.

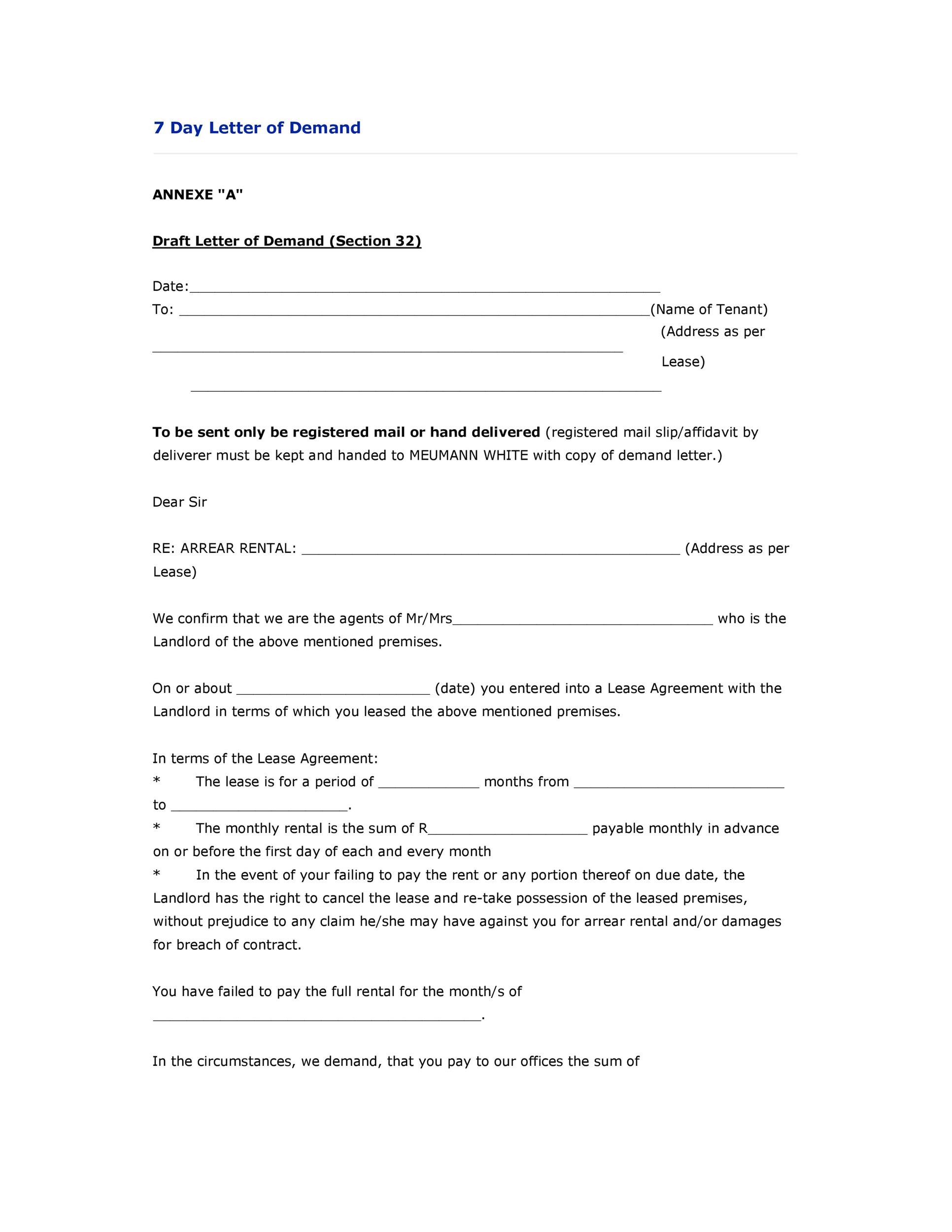

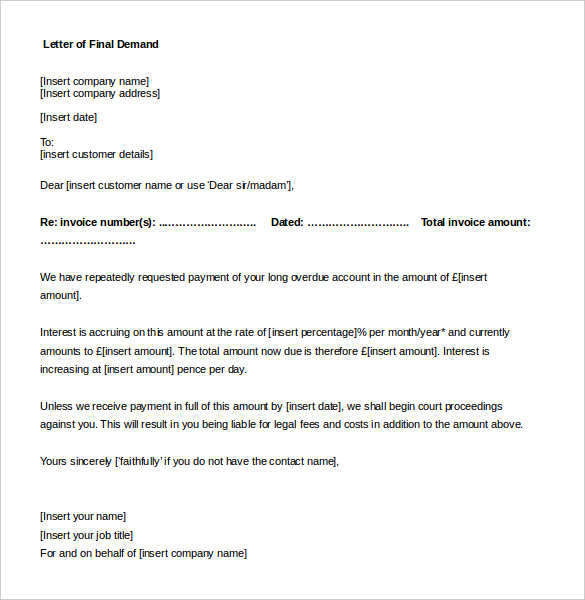

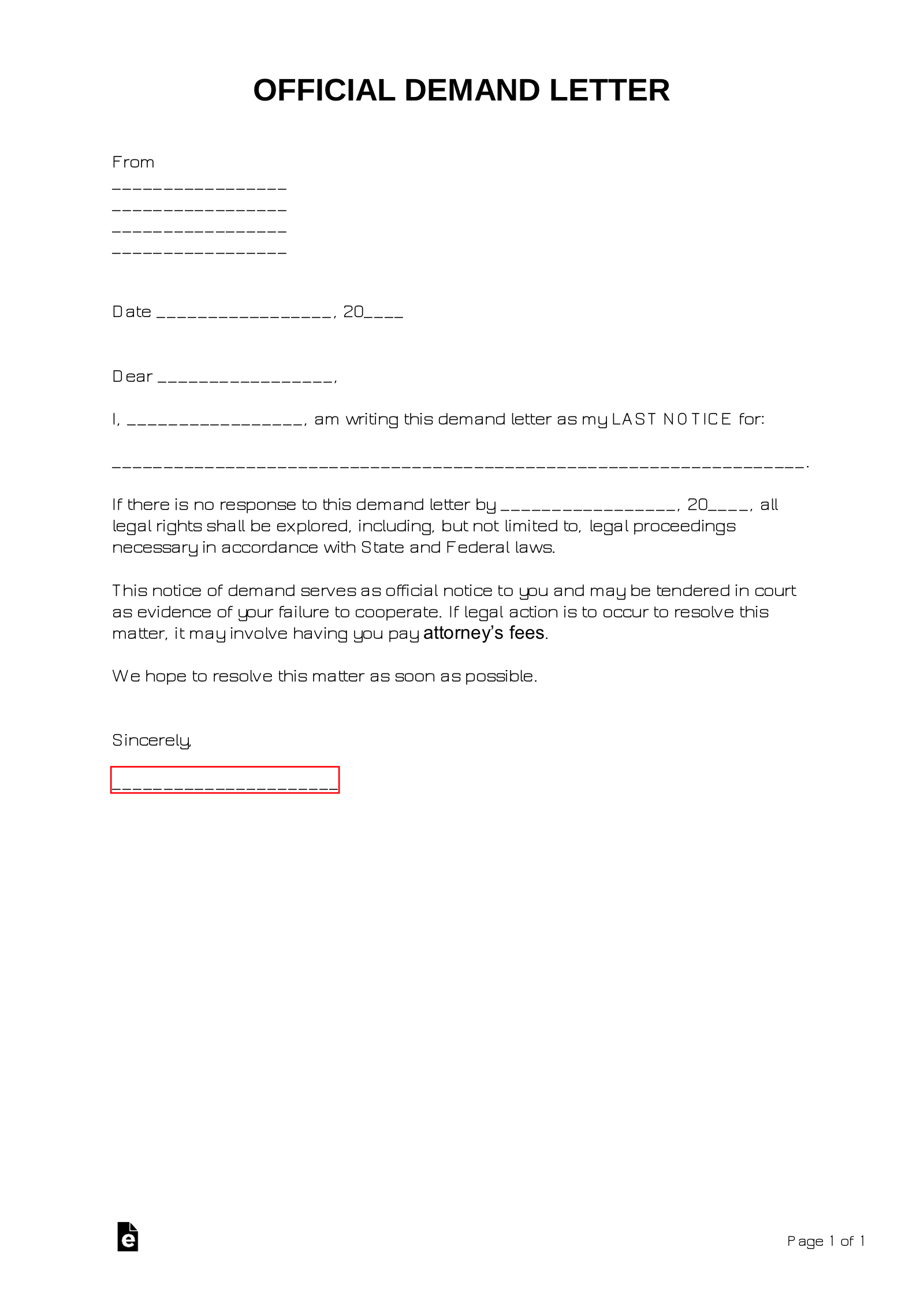

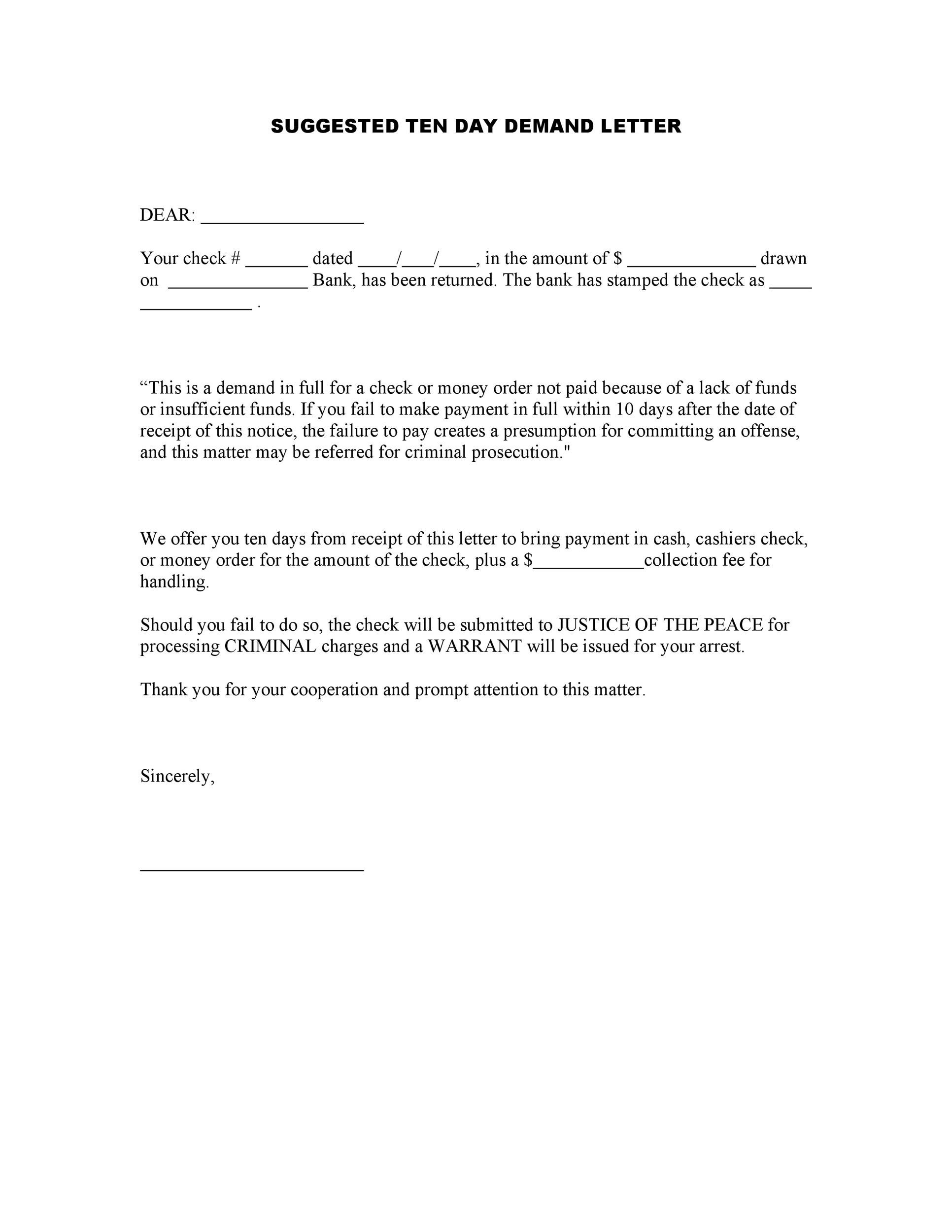

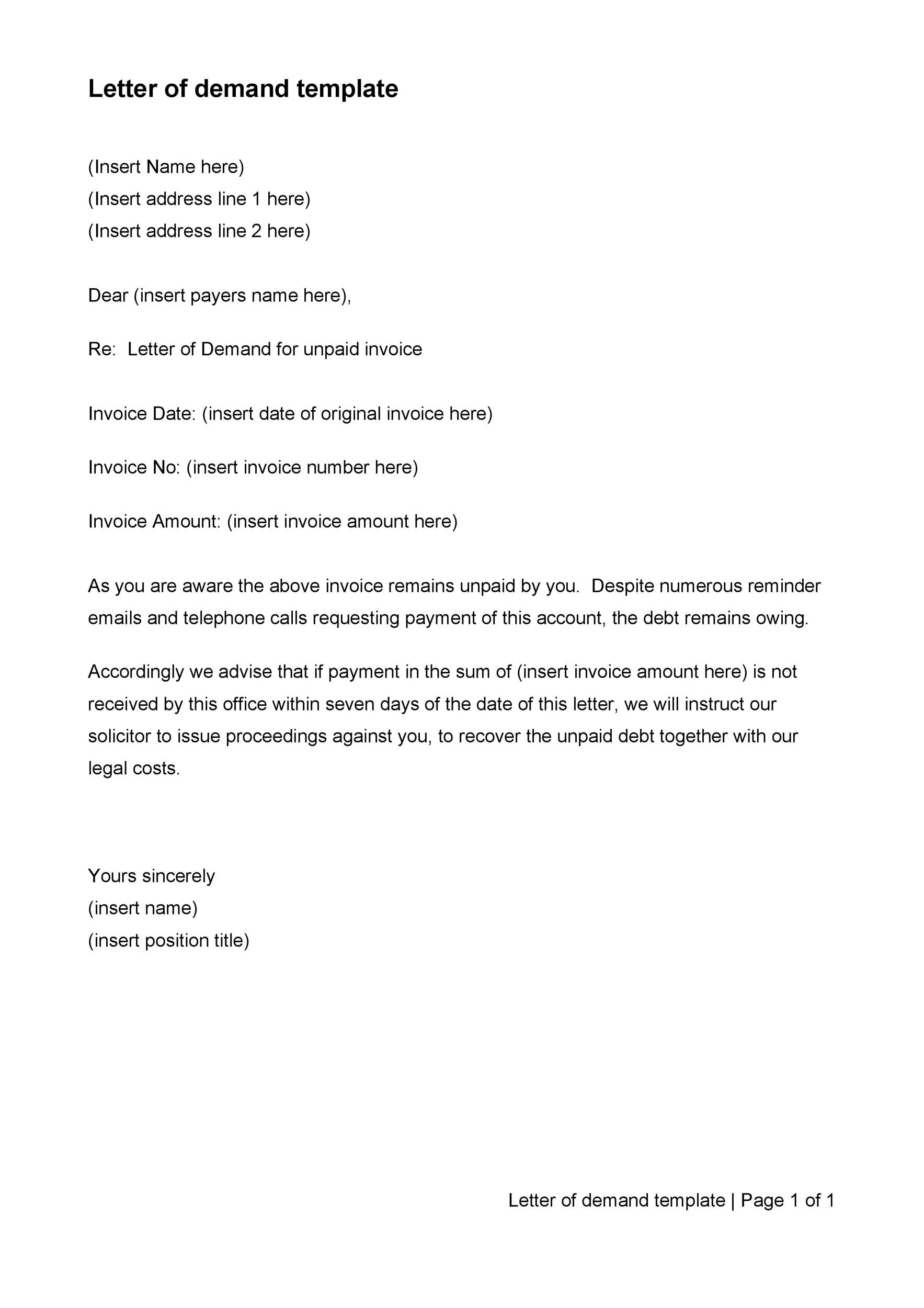

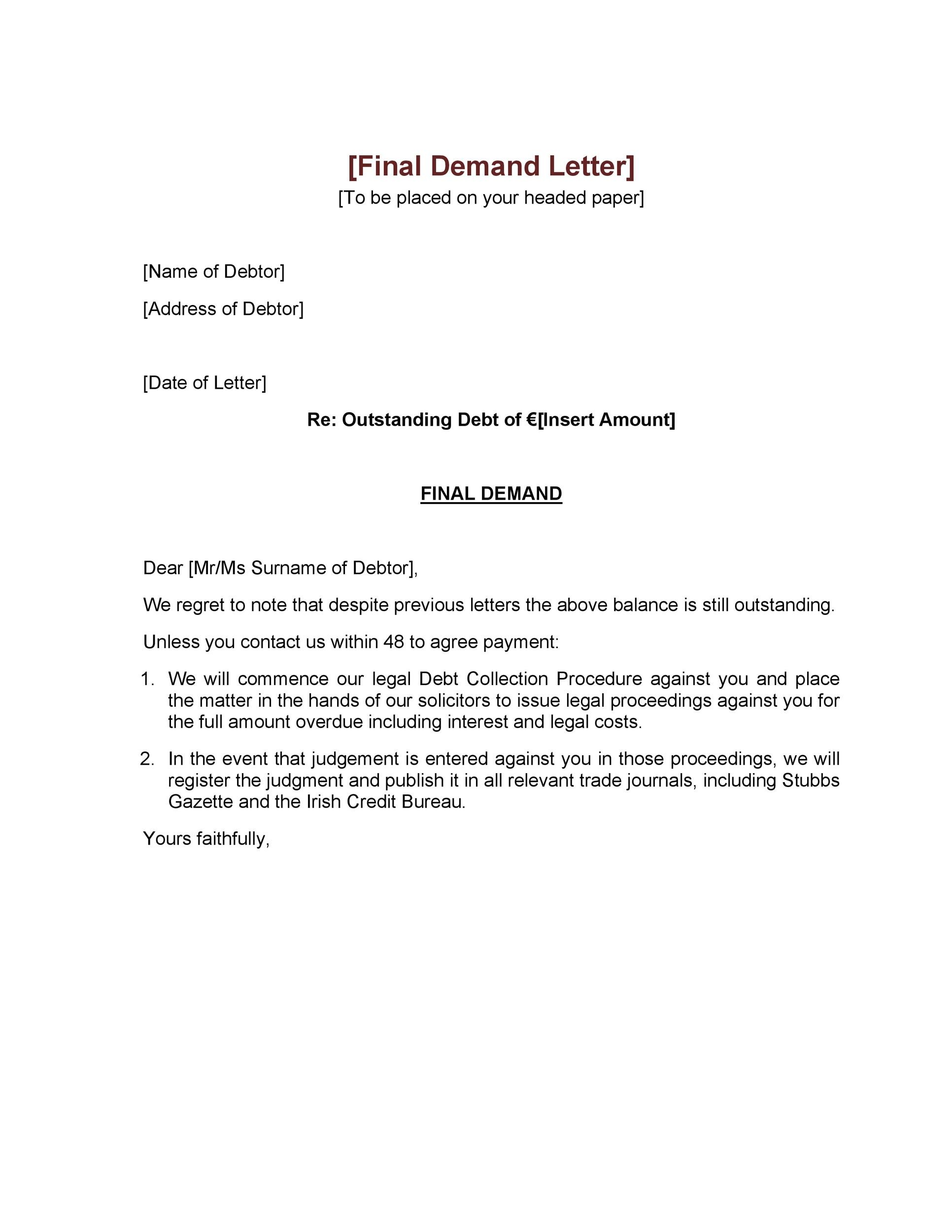

10 day demand letter template. When creating a formal or business letter discussion style and also format is crucial to earning a good impression. Assortment of 10 day demand letter template that will completely match your demands. Variety of 10 day demand letter template that will perfectly match your needs. Variety of 10 day demand letter template that will flawlessly match your demands.

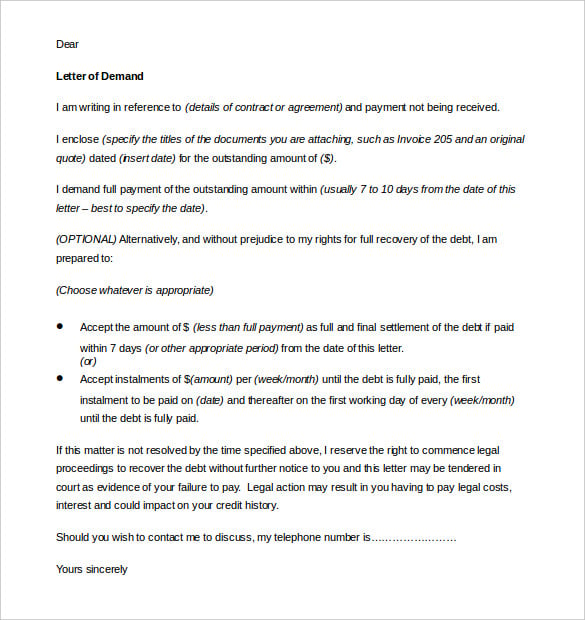

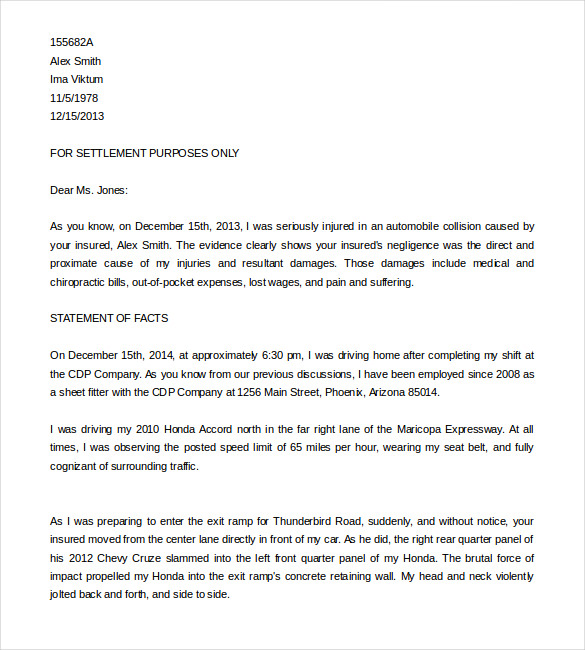

Assortment of 10 day demand letter template that will perfectly match your requirements. Name of borrower on i loaned you my date borrowed color year make model and license number state vehicle identification number vin as of today you have not returned the vehicle to me. Creditors often use a 10 day demand letter to prompt a debtor into paying back a debt or otherwise returning property. It might be a merchant that refuses to issue a refund a debtor who does not repay or some other unpaid financial obligation whatever the case these disputes can drag on indefinitely.

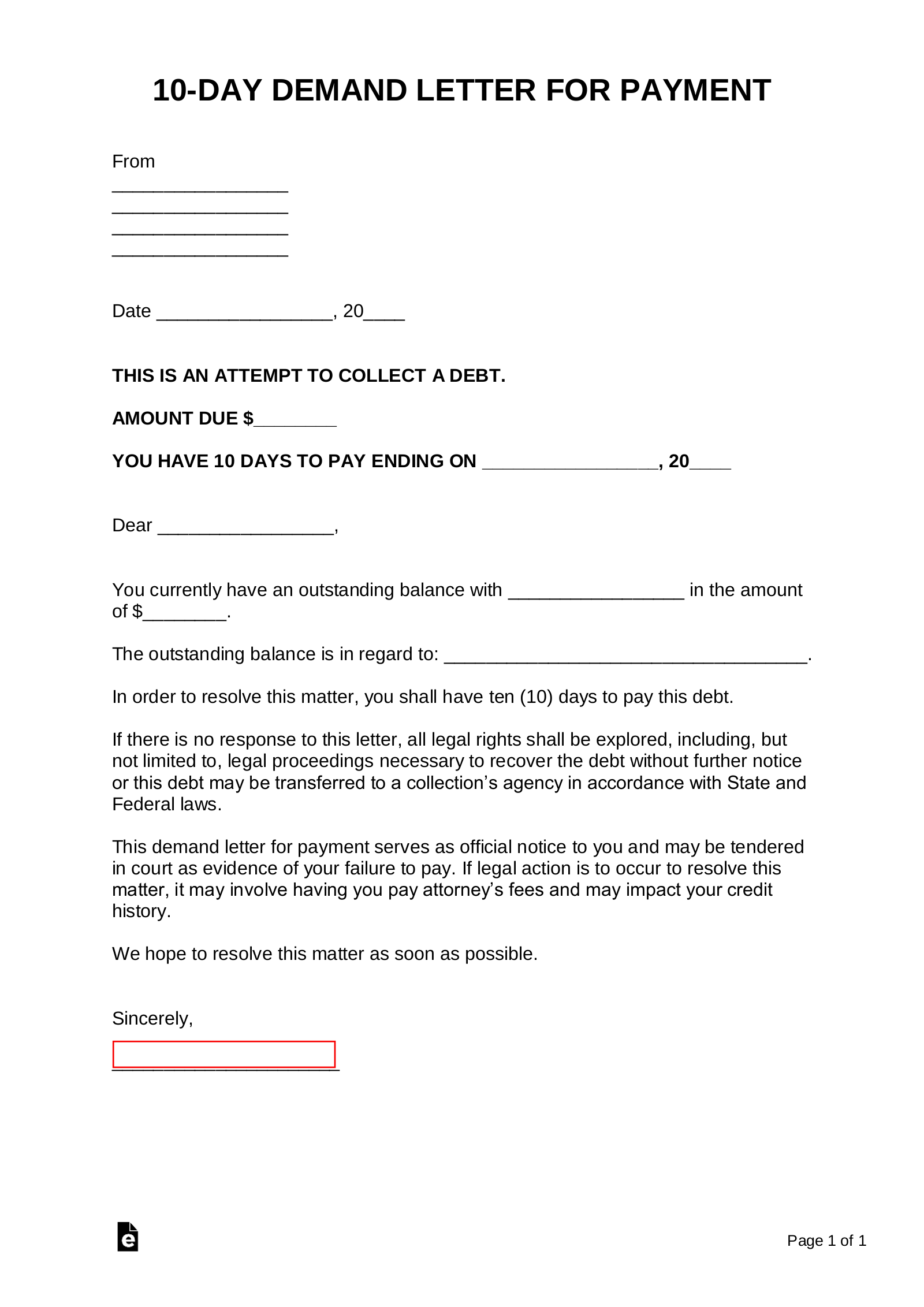

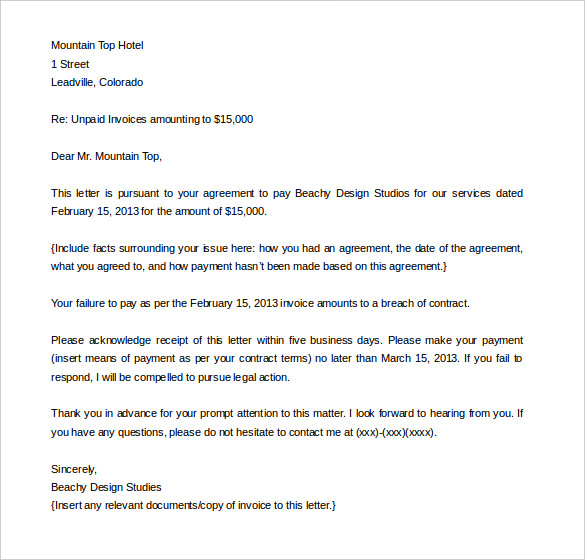

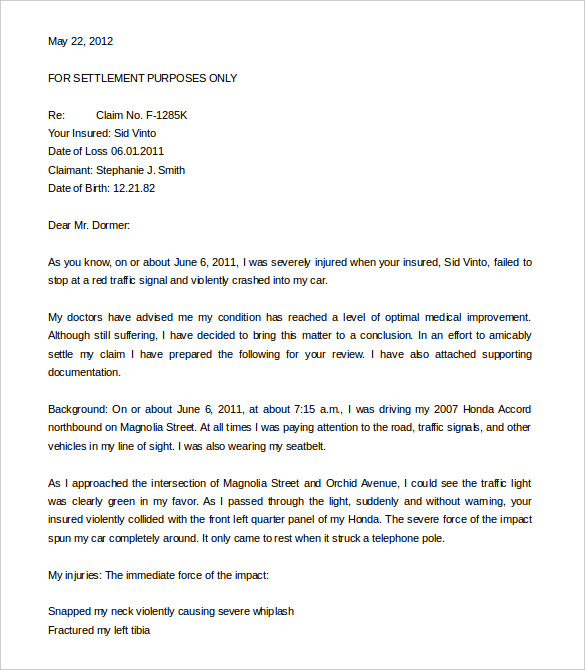

The 10 day demand letter for payment is a document requesting a recipient to cure a violation or debt. Ten day demand letter date. A demand letter for payment is a request for money owed that is commonly the last notice to the debtor. 10 day demand letter template ms word printable.

When creating a formal or organisation letter discussion style and also style is essential to earning an excellent initial impression. These templates supply outstanding instances of how you can structure such a letter and include example web content to function as an overview of. 10 days of the receipt of this letter. Luckily a demand letter template can help you write a letter demanding for full and timely compensation for accidents or damages caused by the carelessness of another party.

The party owed should include language that motivates the debtor to make a payment. Incentives such as a discount if the debtor decides to pay or threatening to send the debt to collections occasionally can help to influence resolving the matter.