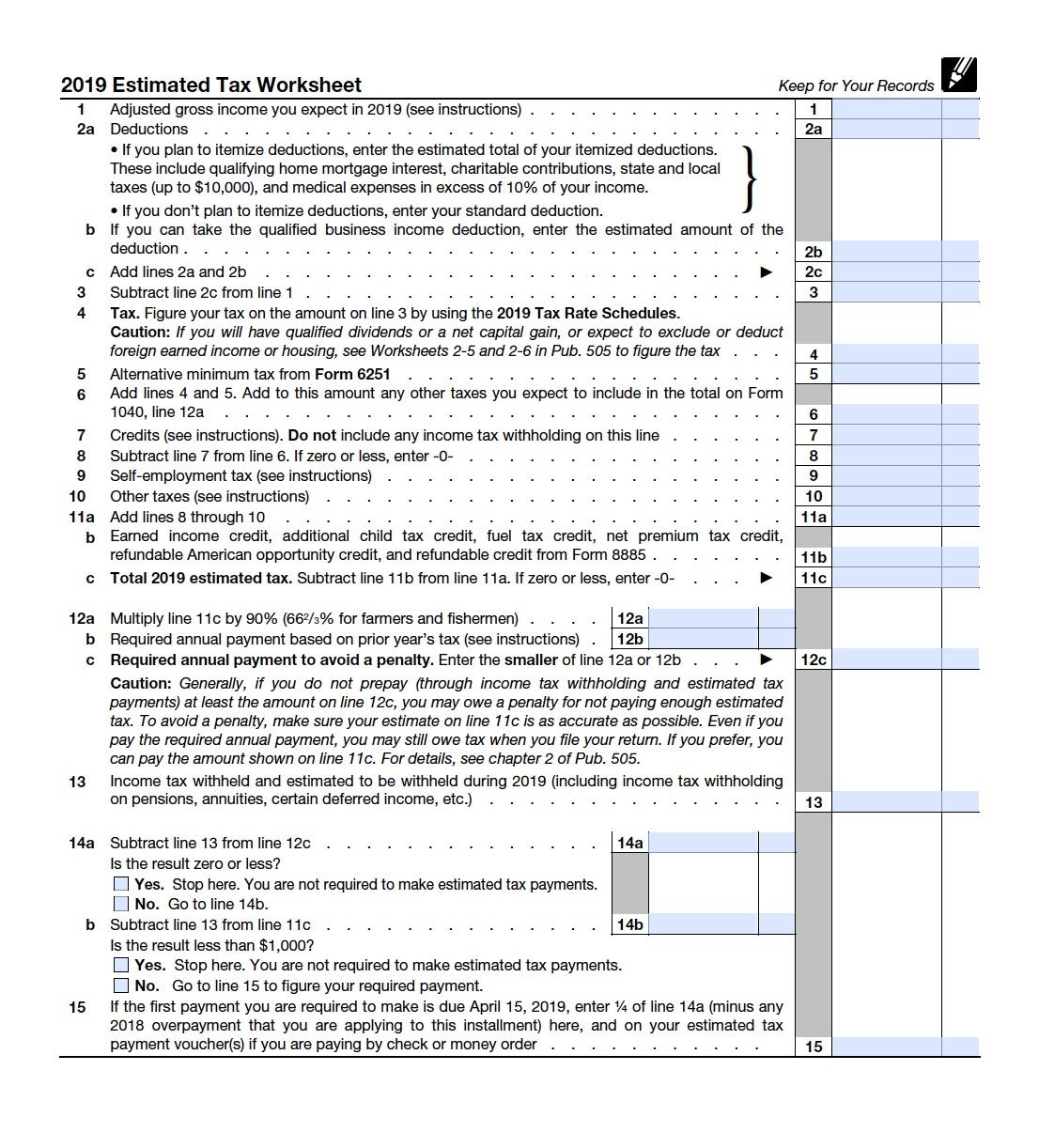

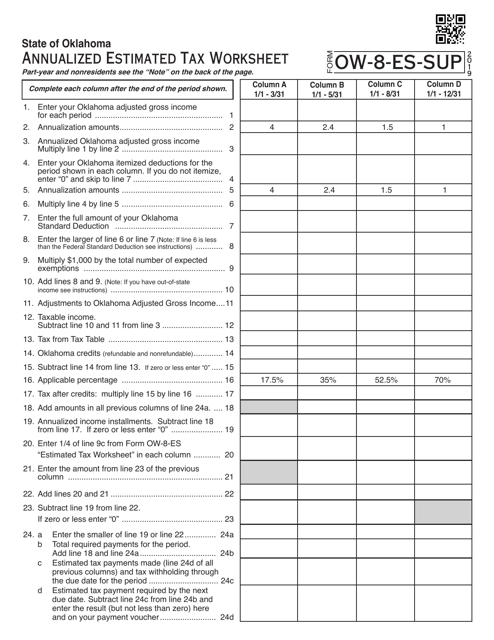

2019 Estimated Tax Worksheet

20 2019 affects some individual tax returns that taxpayers will file for 2020.

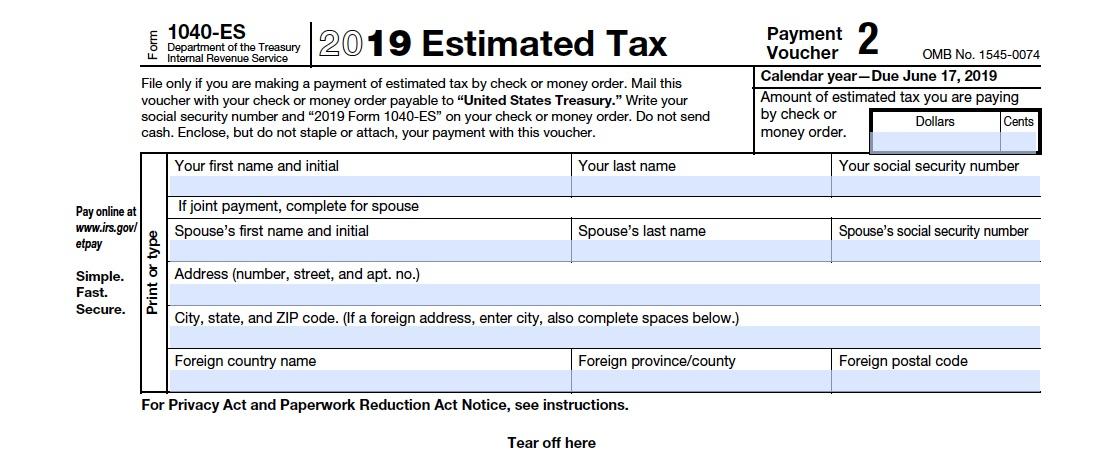

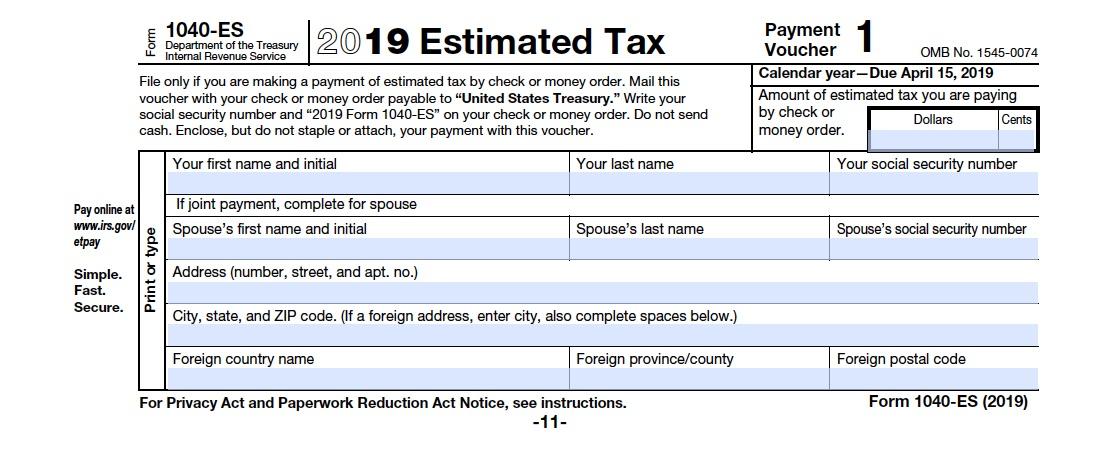

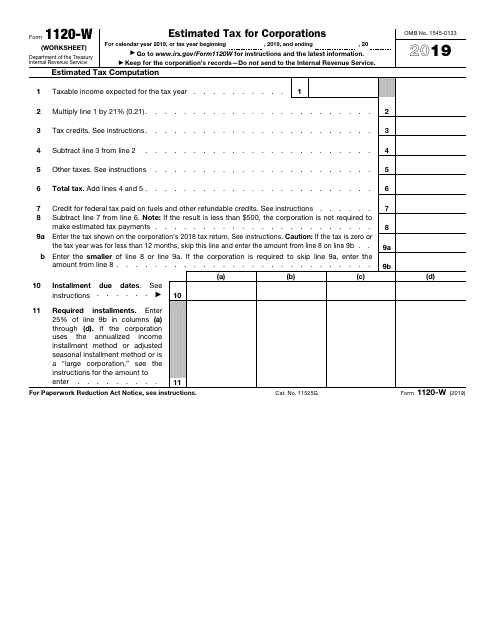

2019 estimated tax worksheet. Pay all of your estimated tax by january 15 2020. For fiscal year estates pay the total estimated tax by the 15th day of the 1st. 2019 estimated tax worksheetline 4 qualified dividends and capital gain tax worksheet worksheet 2 62019 estimated tax worksheetline 4 foreign earned income tax worksheet worksheet 2 72019 annualized estimated tax worksheet. In this case dont make estimated tax payments for 2019.

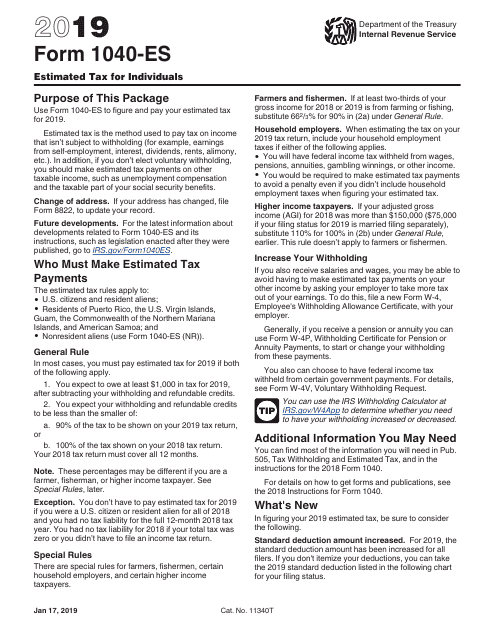

Use form 540 es estimated tax for individuals and the 2019 ca estimated tax worksheet to determine if you owe estimated tax for 2019 and to figure the required amounts. Estimated tax is the method used to pay tax on income that is not subject to withholding for example earnings from self employment interest dividends rentsalimony etc. Legislation enacted on dec. File your 2019 form 1040 by march 2 2020 and pay the total tax due.

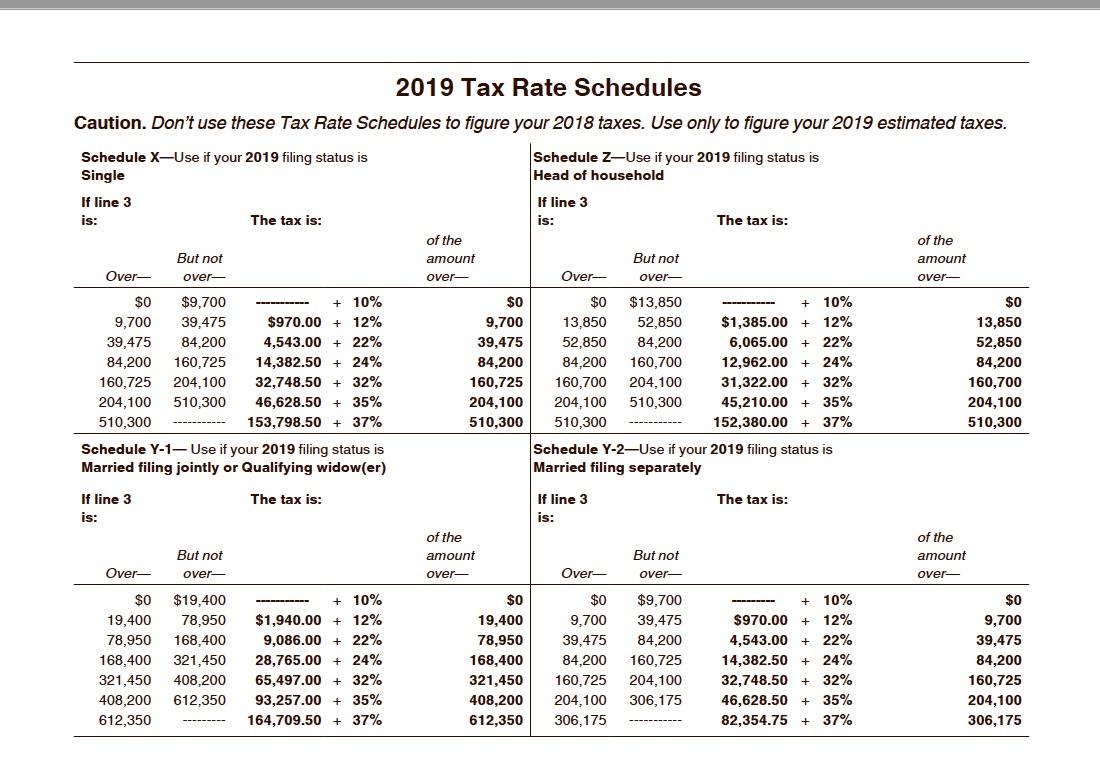

2019 north carolina individual estimated income tax instructions and worksheet. Use this package to figure and pay your estimated tax. Use 100 of the 2019 estimated total tax. The itemized deduction for mortgage insurance if they pay mortgage insurance premiums.

Publication 505 tax withholding and estimated tax how to figure estimated tax 2019 estimated tax worksheet. Pay the total estimated tax line 16 of the 2019 estimated tax worksheet by january 15 2020. You are on a fiscal year if your 12 month tax period ends on any day except december 31. This primarily affects taxpayers who claim.

Use 100 last years amount from the line above. File form 1041 for 2019 by march 1 2020 and pay the total tax due. Recent tax law changes for taxpayers who itemize. Estimated tax is the tax you expect to owe in 2019 after subtracting the credits you plan to take and tax you expect to have withheld.

Choose which to use. The itemized deduction for medical and dental expenses. In this case 2019 estimated tax payments arent required to avoid a penalty. Use worksheet 2 1 to help guide you through the information about completing.

The department will be able to process 2019 personal income tax estimated payments made in 2019 if taxpayers complete and mail a pa 40esr i declaration of estimated tax coupon to the department along with their check for the estimated tax amount.