2020 W2 Form Printable

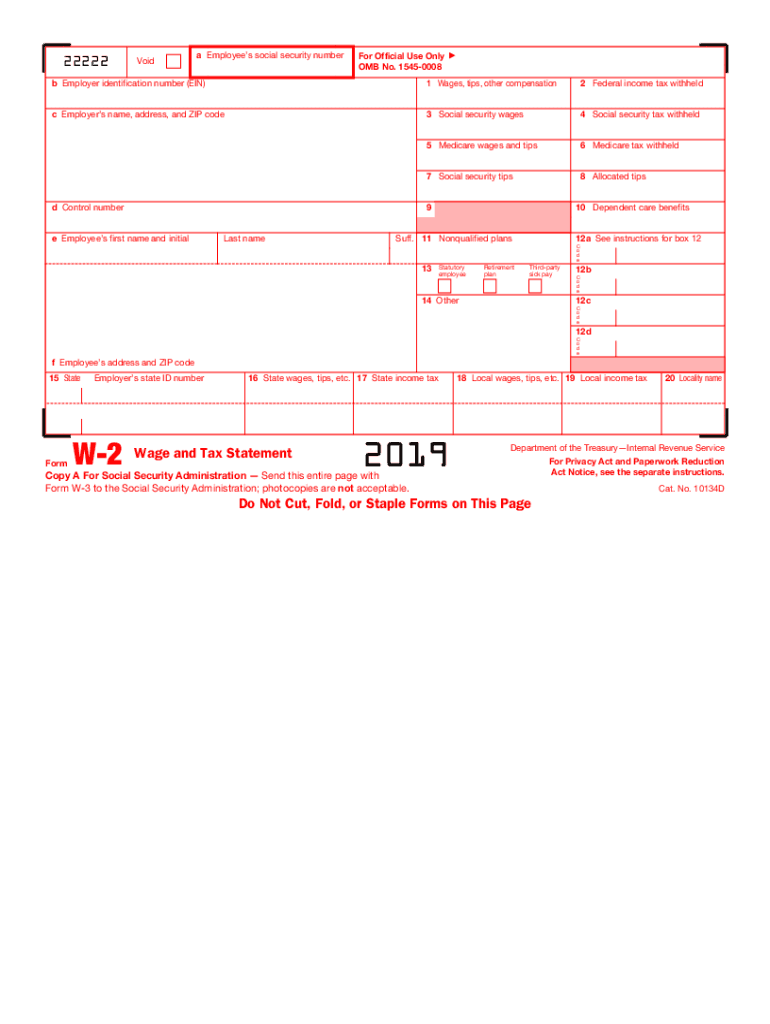

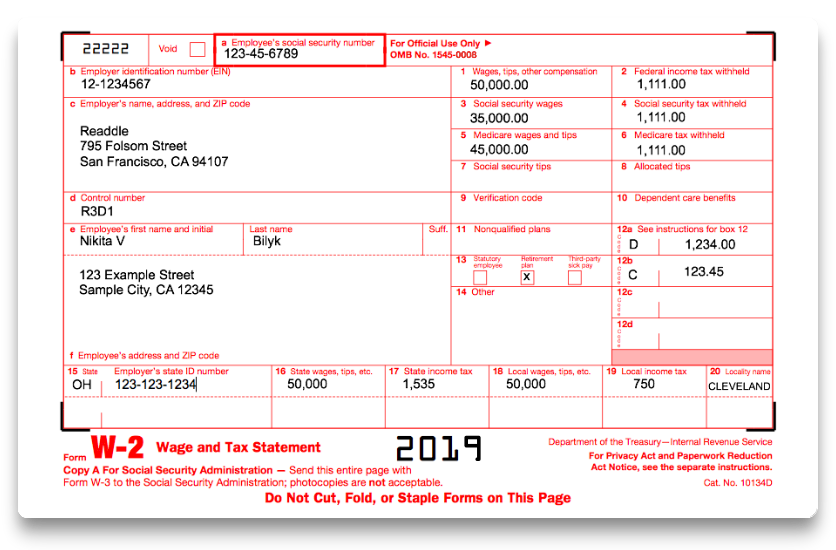

Information about form w 2 wage and tax statement including recent updates related forms and instructions on how to file.

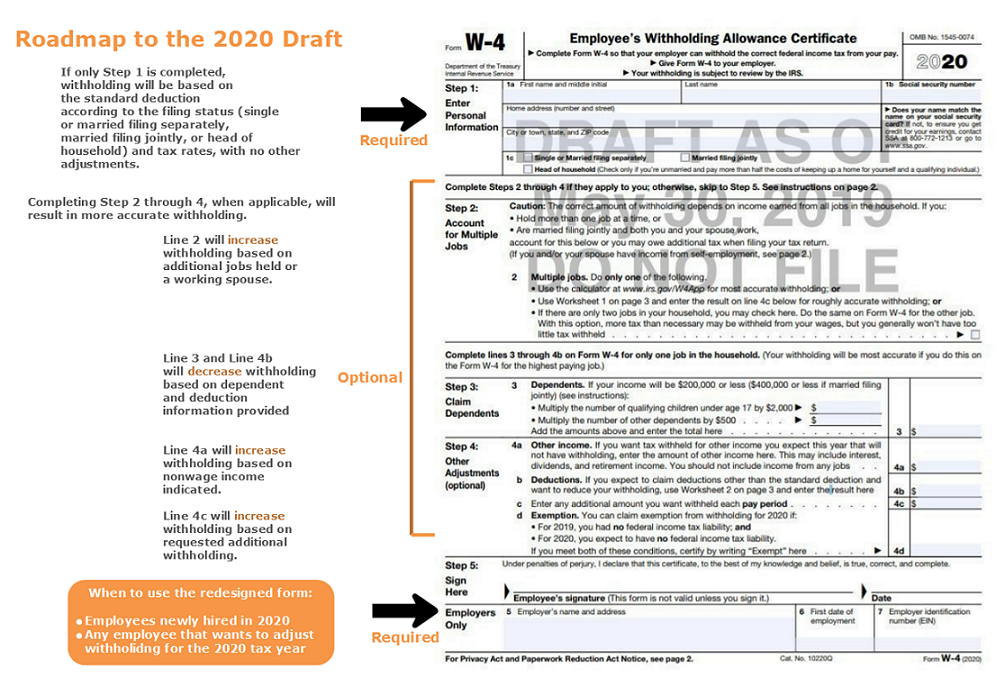

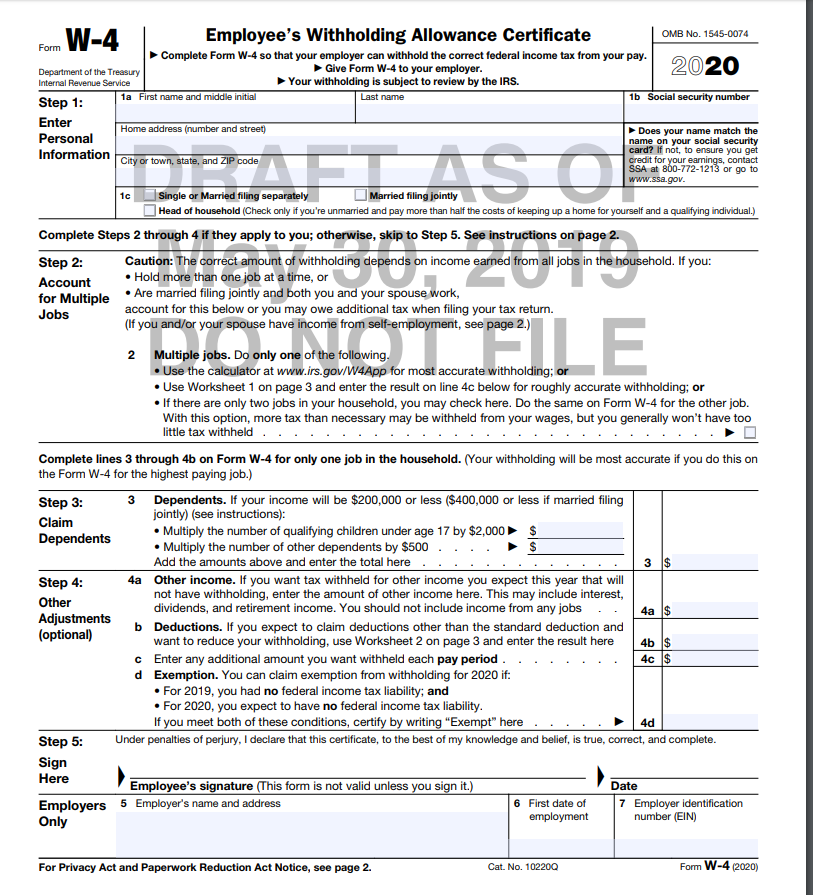

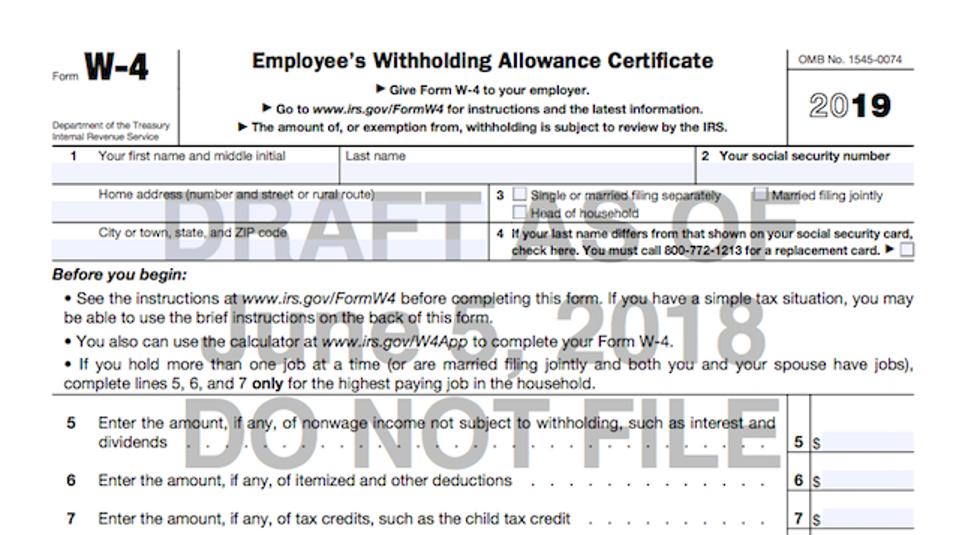

2020 w2 form printable. W2 form 2020 printable posted on november 4 2019 february 15 2020 by editor posted in irs the internal revenue service requires all employers to report wages paid to their employees and taxes withheld from their pay. Step 2 of the redesigned form w 4 lists three different options you should choose from to make the necessary withholding adjustments. The irs works with the treasury department on form w 4 employees withholding allowance certificate whenever it needs an update. Send this entire page with form w 3 to the social security administration.

Download the form and print it out whenever you need it. Form 941 schedule b employers record of federal tax liability. Note that to be accurate you should furnish a 2020 form w 4 for all of these jobs. W 2 form 2020 printable get your free w 2 wage and tax statement free from the irs.

Form w 2 is filed by employers to report wages tips and other compensation paid to employees as well as fica and withheld income taxes. The old form w 4 accounted for multiple jobs using detailed instructions and worksheets that many employees may have overlooked. Form w 2 is intended for wage and tax statement. Copy afor social security administration.

Form w 4 2020 employees withholding certificate department of the treasury internal revenue service complete form w 4 so that your employer can withhold the correct federal income tax from your pay. What is a w 2 form. An employer has to fill out the w 2 and further send to employees and the us department of revenue. In this form an employer provides detailed information about the amount he paid to employees and deducted taxes.

W2 form 2020 printable posted on october 27 2019 february 15 2020 by editor posted in irs the irs requires every employee to complete a few forms including the w 4 employees withholding allowance certificate. Wage and tax statement. You may also print out copies for filing with state or local governments distribution to your employees and for your records.

/w2-9ca13523f4d74e958b821aab63af2e60.png)