Best Way To Keep Track Of Receipts For Taxes

7 tips for keeping receipts organized for tax time stay away from cash using cash for expenses seems to be the absolute death nail for my clients trying to keep good bookkeeping records and.

Best way to keep track of receipts for taxes. Buy color coded folders to store your receipts and documentation so you can easily find the documentation you need later. Always keep receipts bank statements invoices payroll records and any other documentary evidence that supports an item of income deduction or credit shown on your tax return. If you are going to claim a. Employment tax records must be kept for at least four years.

The eight small business record keeping rules. August 17th 2017. So despite my difficulties heres 3 ways ive learned to survive the drowning sensation of finding receipts at tax prep time. Experts say keeping receipts is still the best way to assess your annual spending accurately.

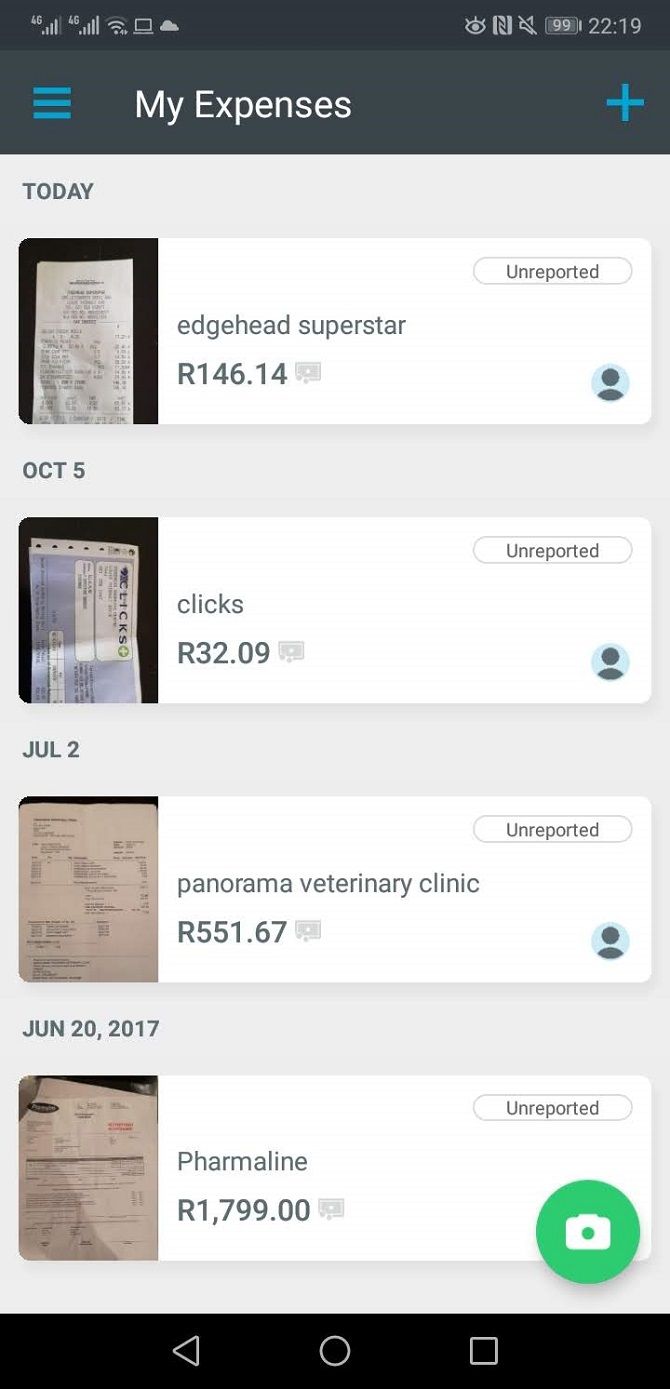

The irs is not a big fan of estimating your expenses. The best way to keep track of something you will need at the end of the year is to put it in a place you know you will find it. That means youll avoid sitting down to do your taxes during tax season and realizing you need to track down months old documentation. With a shoeboxed account you can keep track of business receipts no matter where you are.

Such as a properly labeled file folder or safe box. This is because if your tax returns are audited they need to be able to meet the strict substantiation requirements of the irs. Best ways to keep track of inventory receipts for taxes amazon seller tips strategies 9 comments as an amazon fba seller one thing that you will notice pretty quickly is how many receipts start piling up around you. The art of keeping receipts for your taxes.

But youll want to get your business off on the right foot by keeping your receipts filed from the beginning so that you can find them when needed and tweak your organizing method as you go. Most supporting documents need to be kept for at least three years. Contractors track receipts in several ways and youll eventually find the method that works the best for you. Keeping track of receipts for your small business is very important.

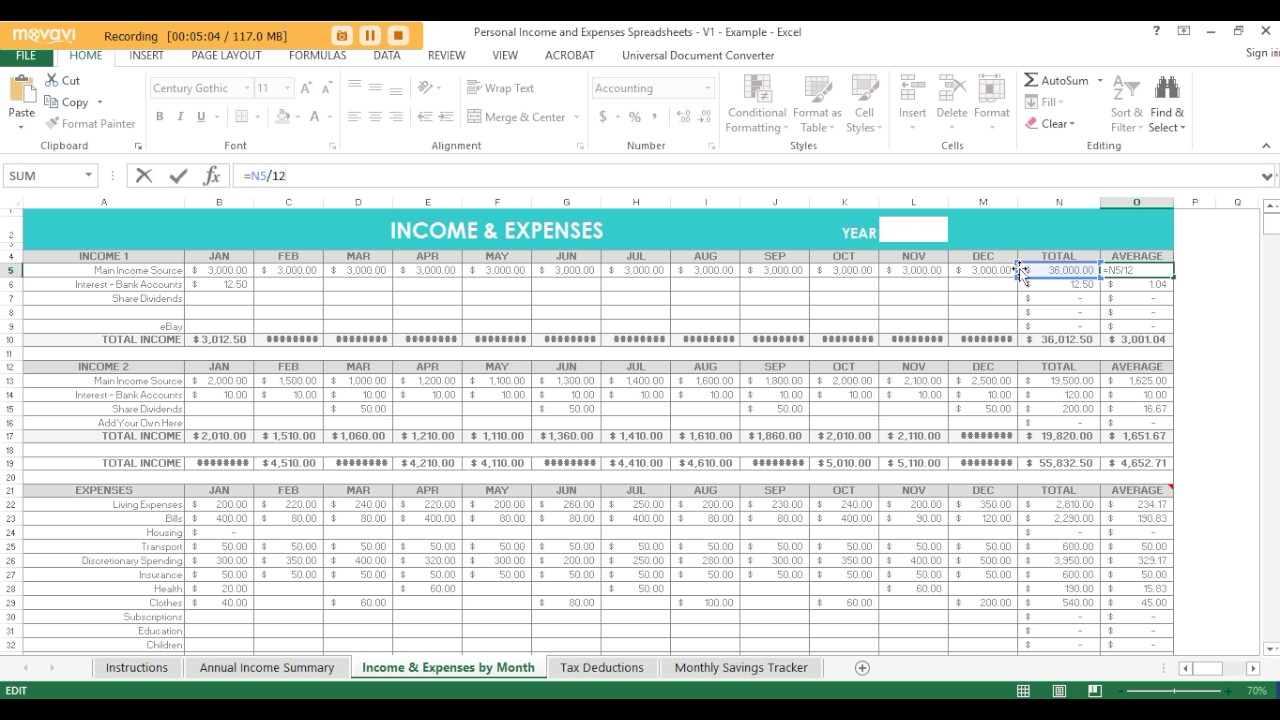

The key to success lies in commitment to a system that makes it more like a daily habit than a chore. The best way to organize receipts keeping track of your receipts is important especially for small business owners and entrepreneurs. Receipt scanning software like the programs available from shoeboxed lets you search for receipts that have been placed into a receipt form digitized by date amount line item or category.