Broker Dealer Risk Assessment Template

Overlooked and under tested 3 statement of intent this white paper risk assessment.

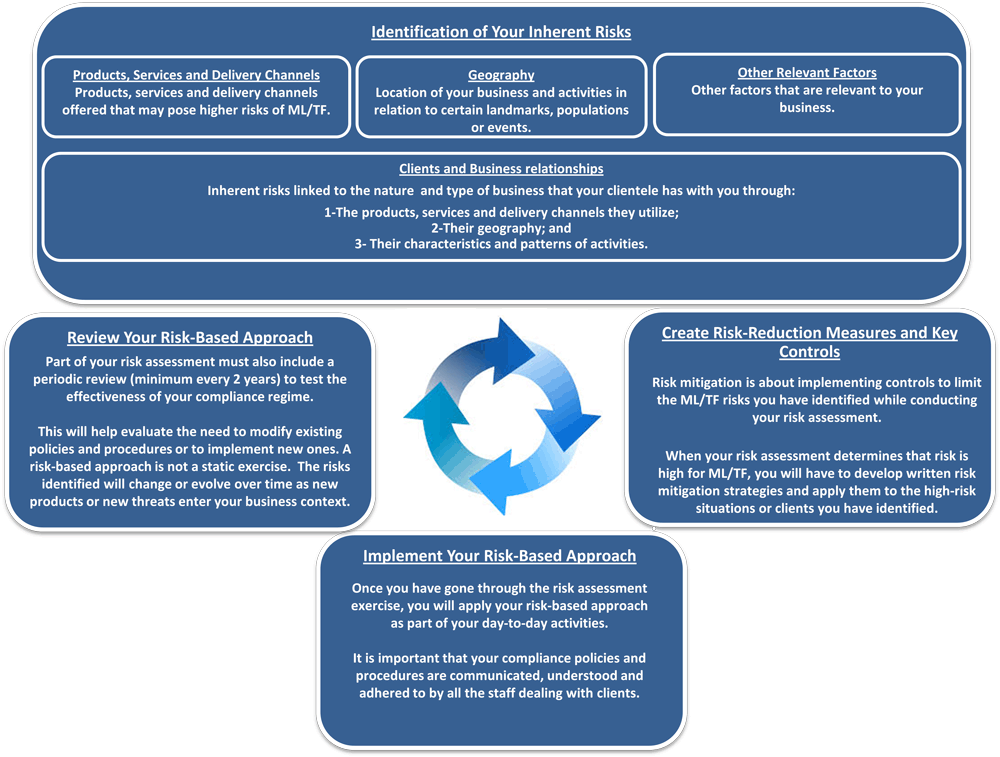

Broker dealer risk assessment template. Sec rule 15c3 5 adopted on november 3 2010 provides that a brokerdealer that provides customers or other persons with access to an exchange or alternative trading system through the use of the brokerdealers market participant identifier must establish risk management controls and supervisory procedures designed to limit the financial. Below are attributes of an effective compliance program. This section covers the following topics. Overlooked and under tested.

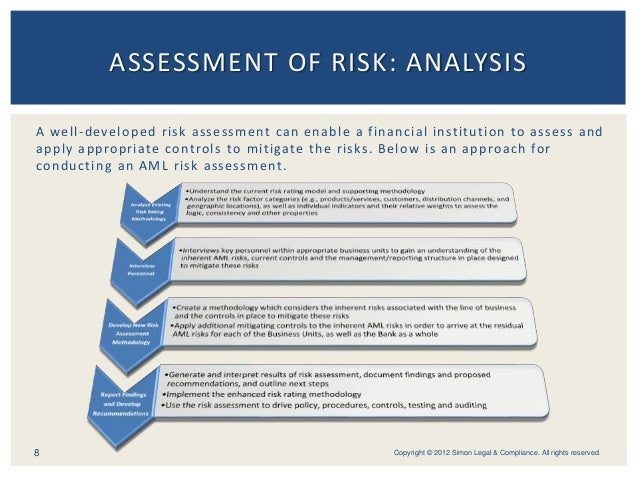

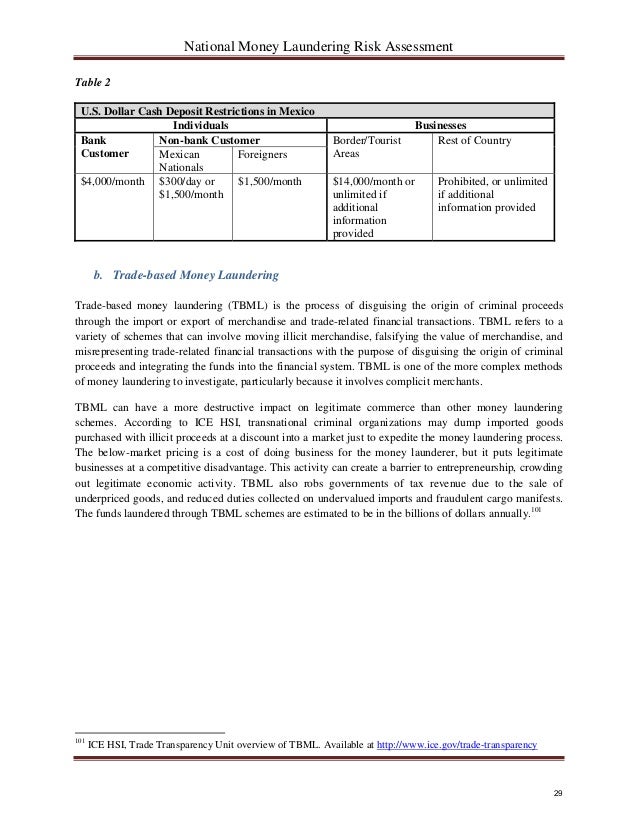

Fraud detection and prevention liquidity risk segregation of customer assets and registered representative investment advisor. The importance of implementing a know your risk assessment kyra within an aml audit for non bank broker dealers will seek to demonstrate the need for a required risk assessment review during the independent annual anti money laundering aml audit. However broker dealers should conduct a risk assessment of the customer who is the subject of the grand jury subpoena as well as review the customers account activity. These questions address risk areas that are applicable to the majority of broker dealers.

Risk management for brokers and intermediaries risk assessment of exchangesclearinghouses brokersintermediaries should consider information available about the risks of trading on a particular exchangeclearinghouse prior to executing trades on such market. The commission may exempt from the filing requirements all brokers or dealers associated with a broker or dealer that has been designated a reporting broker or dealer. We provide managed compliance services to registered funds money managers private fund sponsors broker dealers and cpoctas. Such risks should be monitored on an ongoing basis.

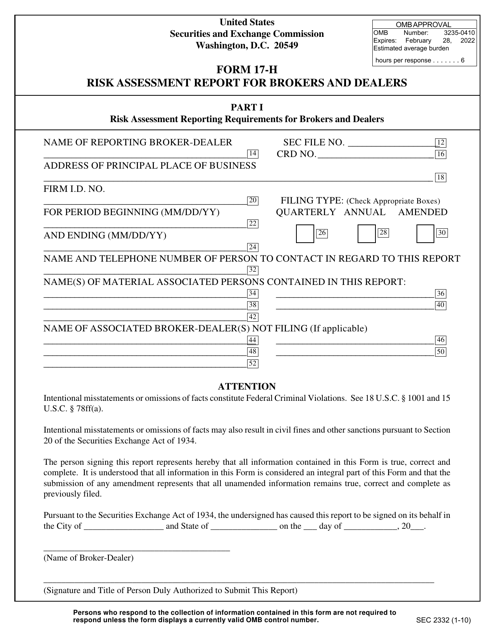

Broker dealer risk assessments in 2010 finra released an updated version of the aml template for small firms new version recommends a risk assessment as a good practice guidance notes that a risk assessment is a useful tool for demonstrating to your firms examiner that the firm used a reasonable. In the event a broker or dealer is associated with one or more other registered brokers or dealers each broker or dealer is required to file a separate form 17 h. Risk policies and management. The risk assessment should be documented and the results of the risk assessment should be used to tailor the aml program.

Finra 2017 risk control assessment. The receipt of a grand jury subpoena does not in itself require the filing of a suspicious activity report sar.