California Special Needs Trust Template

The information below is designed to explain ssi rules so you can understand how distributions will be made from your.

California special needs trust template. This is important as medi cal and ssi rules allow a beneficiary to possess no more than 200000 of countable assets. Oftentimes the parents of a disabled child set up a 3rd party trust for the benefit of their child. Refers to a special needs trust snt established and funded by a person or persons other than the beneficiary. Special needs trust comment.

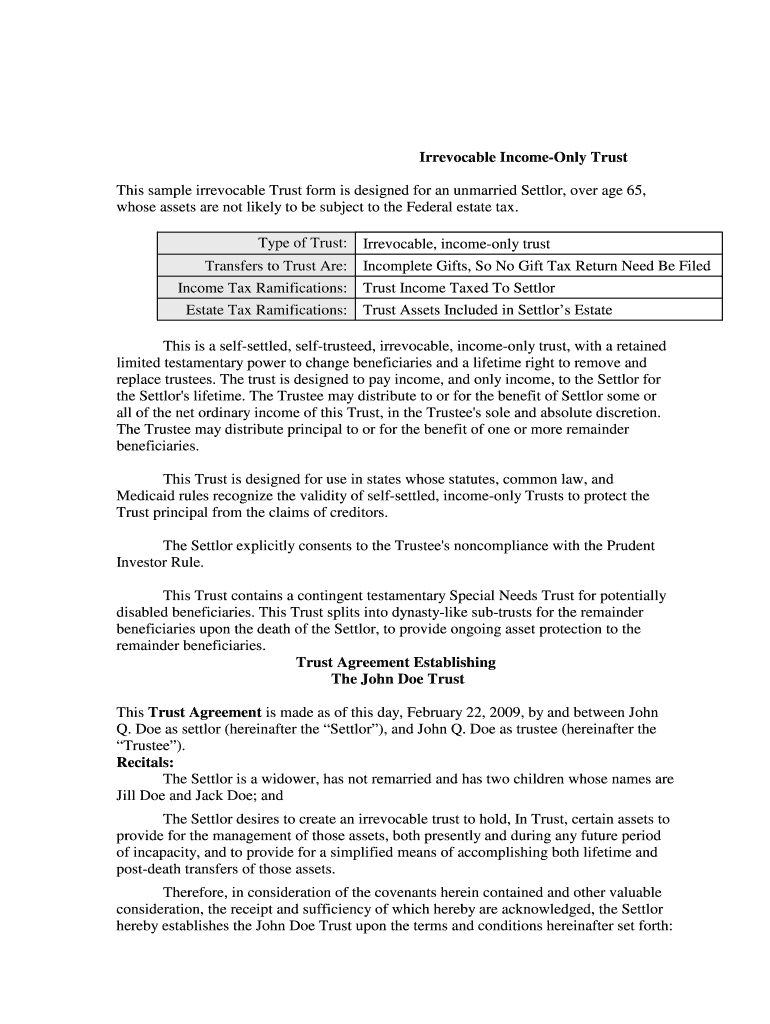

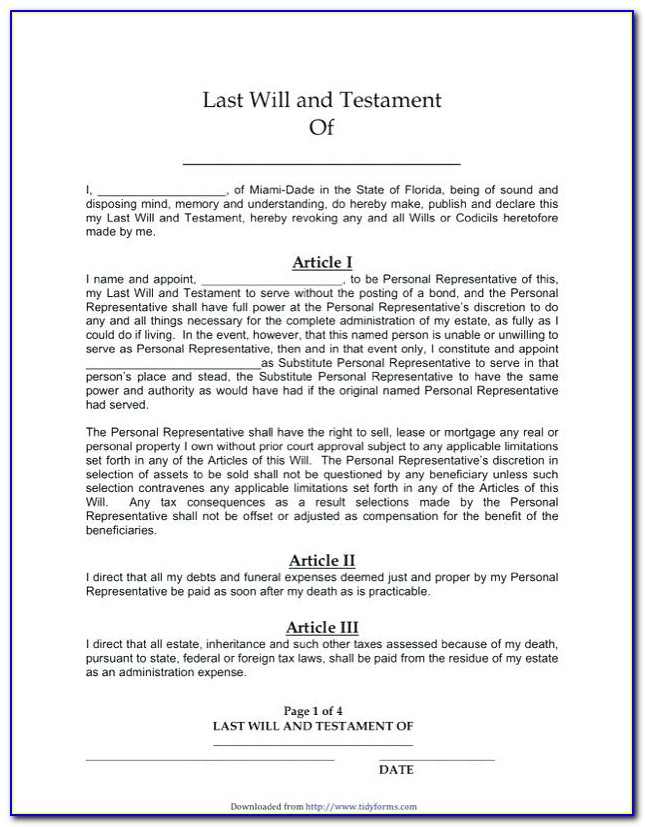

Article i name of trust the trust hereby created may be referred to as the name of beneficiary special needs trust article ii trust funding. There exists living needs such as travel entertainment and outdoor recreation which public benefit programs for the disabled do not. This is an irrevocable inter vivos trust for the benefit of the settlors disabled child. A special needs trust snt allows for a disabled person to maintain his or her eligibility for public assistance benefits despite having assets that would otherwise make the person ineligible for those benefits.

It is designed to provide the maximum benefits to the child without threatening eligibility for medicaid or other public programs. Schomer is a graduate of boston university school of law and is a frequent lecturer on estate planning and elder law issues having appeared on local and national television discussing the importance of estate planning. Sample special needs trust. A special needs trust snt sometimes called a supplemental needs trust is a legal arrangement in which a person or organization like a bank manages assets for a person with a disability.

So the trust you make for yourself or the trust that a lawyer makes for you will look different and may provide different solutions to your familys circumstances. Faqs about special needs trusts q. Special needs trust guidelines the essential purpose of a special needs trust is to improve the quality of an individuals life without disqualifying them from eligibility to receive public benefits. Family trust to be held in trust for the benefit of name of beneficiary together with any other assets received by the trustee.

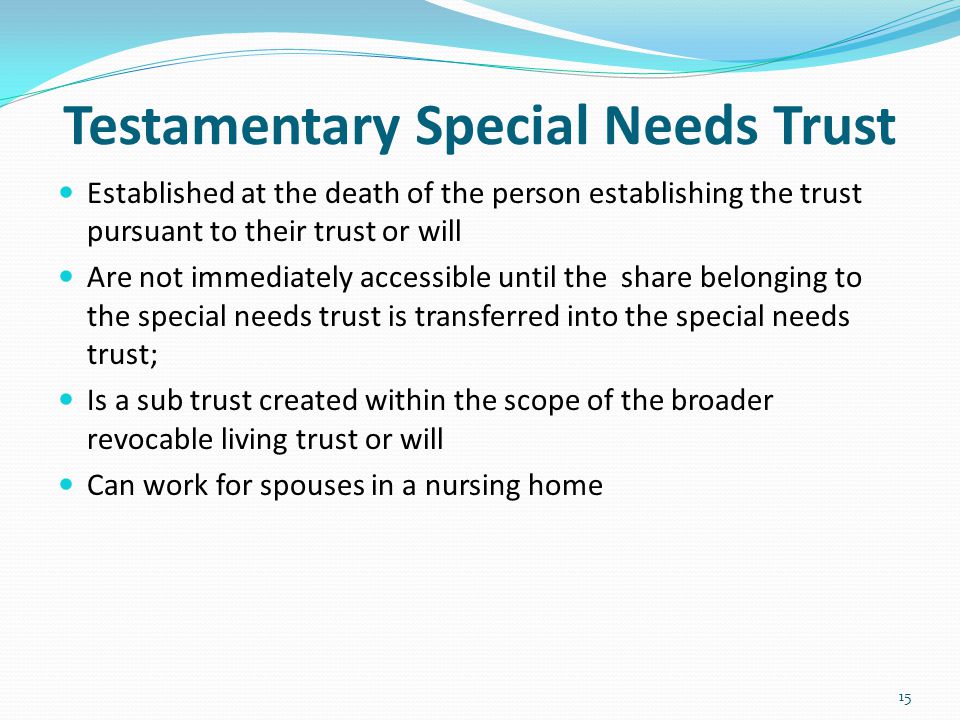

There are two types of snts. Trust funds special needs trust funds. 21 it is grantors primary concern in drafting this special needs trust that it continue in existence as a supplemental and emergency fund to public assistance for the beneficiary throughout her life. What is a special needs trust.

%2C445%2C291%2C400%2C400%2Carial%2C12%2C4%2C0%2C0%2C5_SCLZZZZZZZ_.jpg)