Capital Expenditure Policy Template

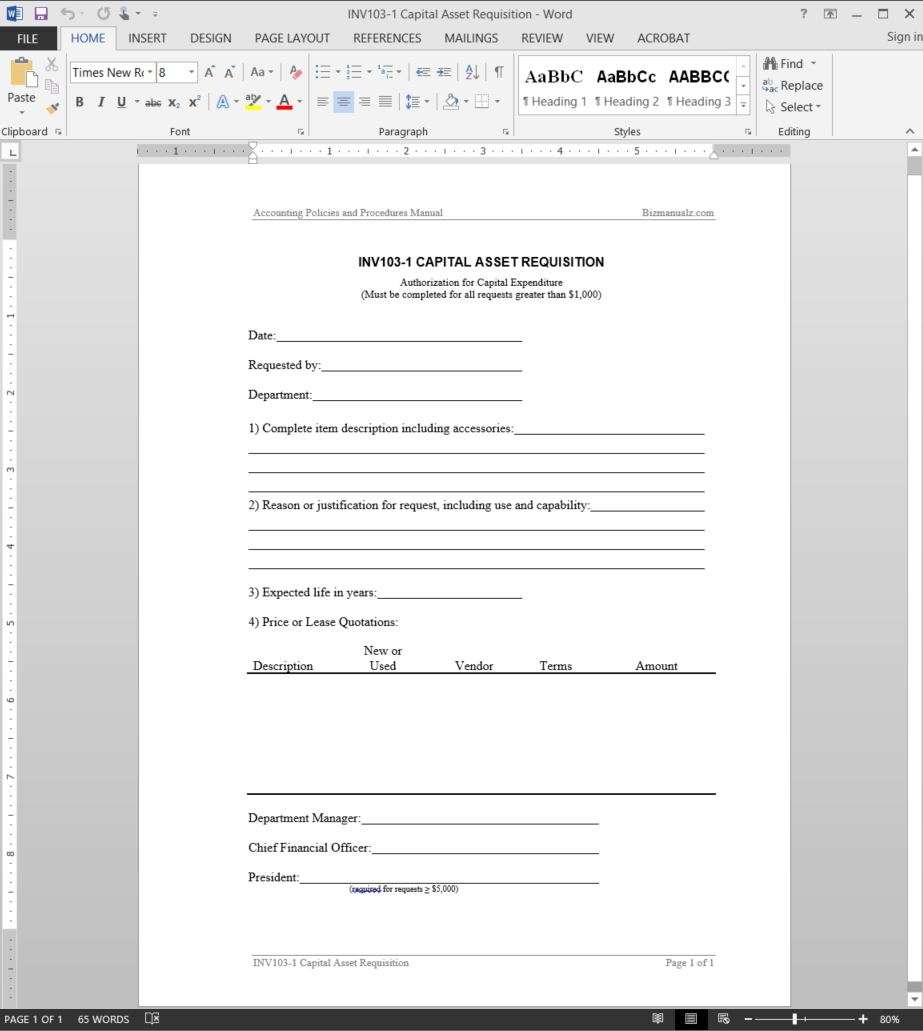

Capital expenditure applies to assets that have a cost of 1000 excluding gst or over.

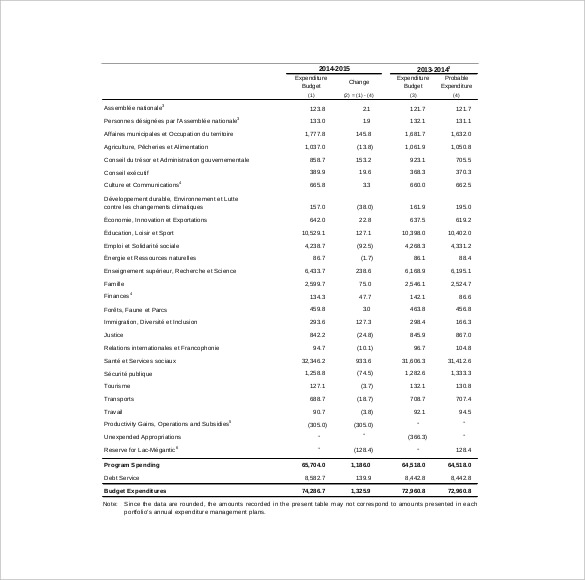

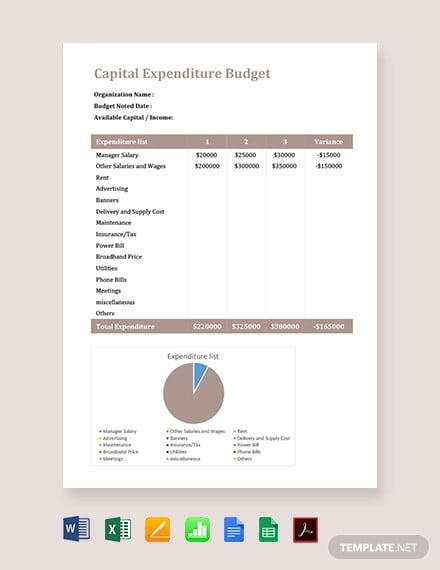

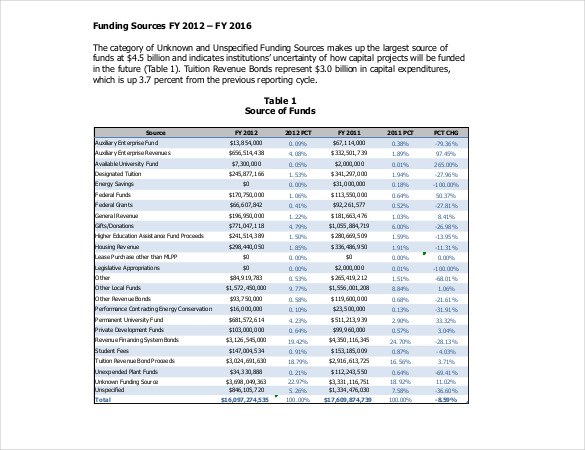

Capital expenditure policy template. Capital expenditure including major project expenditure capital expenditure is expenditure on an asset which will provide a benefit over a number of years such as a computer or workstation. Buildings including subsequent costs that extend the useful life of a building. A capital expenditure budget template is usually used to estimate outgoing expenses and incoming revenues of an organization. Capital expenditure applies to assets that have a cost of 1000 excluding gst or over.

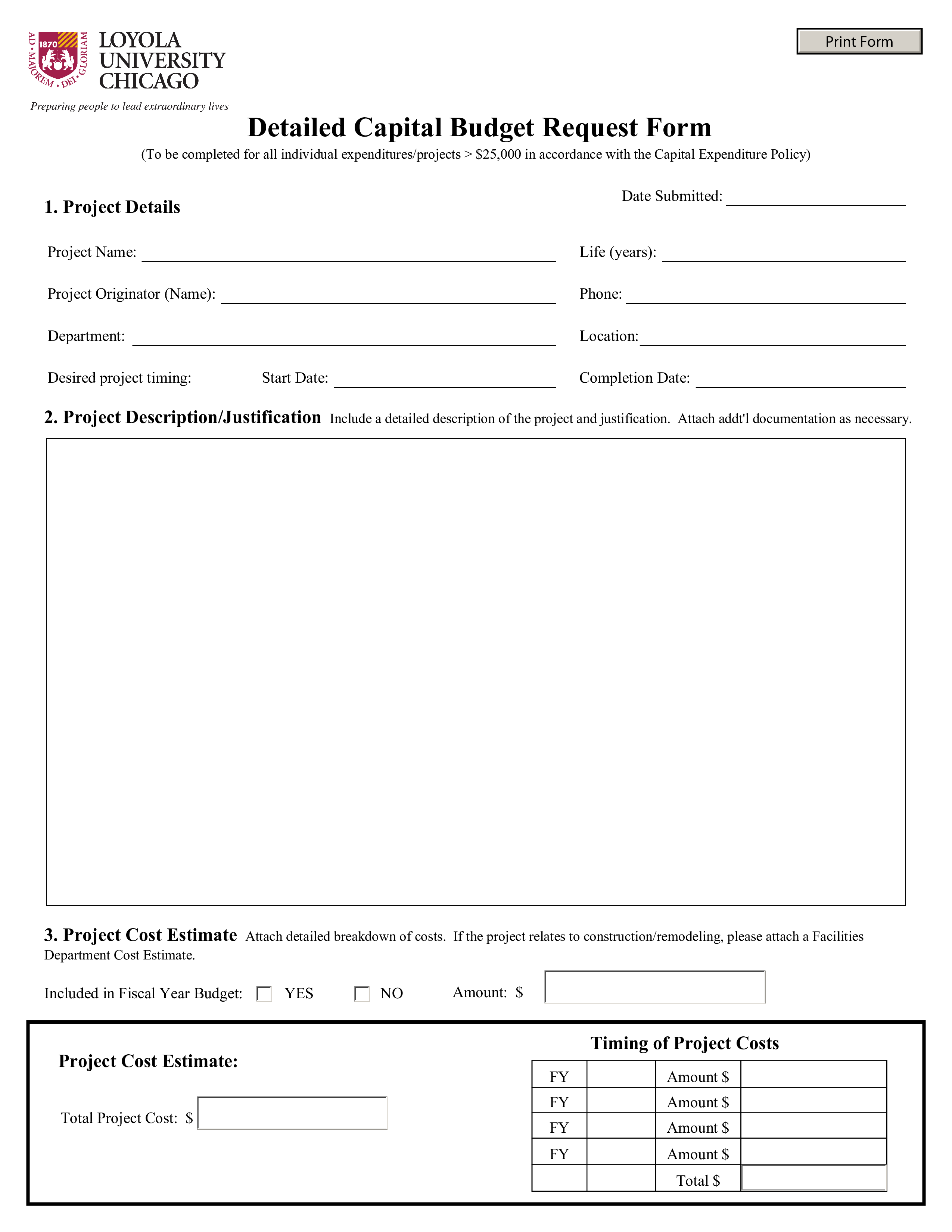

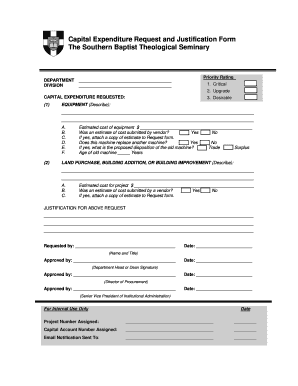

50 body of policy 51 capital expenditure capital expenditure is expenditure on an asset which will provide a benefit over a number of years such as a computer or workstation. 7 capital expenditure budget templates docs pdf excel a weekly budget template caters for the spending that is incurred on fixed assets. Considered a capital expenditure. The capital expenditure policy establishes a framework for the approval and control of all capital expenditure incurred to undertake research and manage research activities through which dmtc ltd dmtc will receive an enduring benefit.

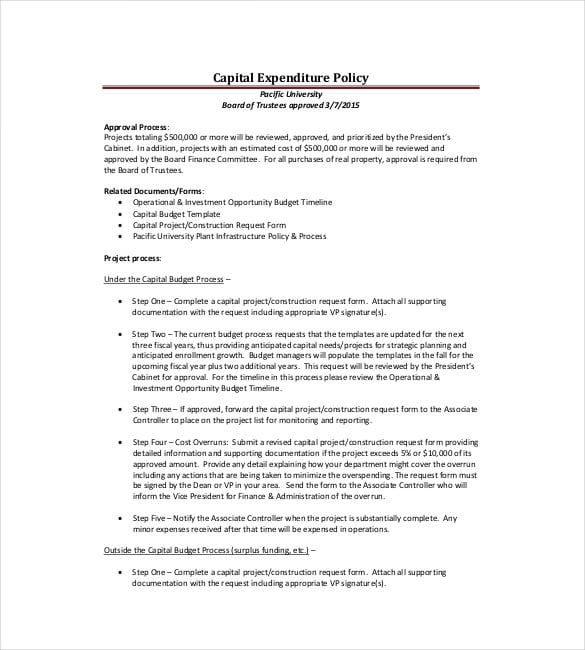

This policy provides guidelines for prioritizing and approving capital expenditures in the current fiscal year and through the capital budget process for the next three years. The total costs will be depreciated over the life of the asset. To provide guidelines under which capital expenditures will be approved and prioritized for the current fiscal year capital budget and five year capital plan. To ensure that capital expenditures are properly monitored and tracked.

It is different from current expenditure budget which considers only expenses on items that the business expects to stay with for a single financial year. The capital expenditure policy is designed to ensure. Examples of capital expenditures are as follows. Remember an expenditure budget is part of the monthly and financial budget template that companies use for budgeting and it often records the costs required to run the business on a daily basis.

A capital expenditure refers to the expenditure of funds for an asset that is expected to provide utility to a business for more than one reporting period. Fixed assets with a value of less than 2000 are expensed in the period acquired.