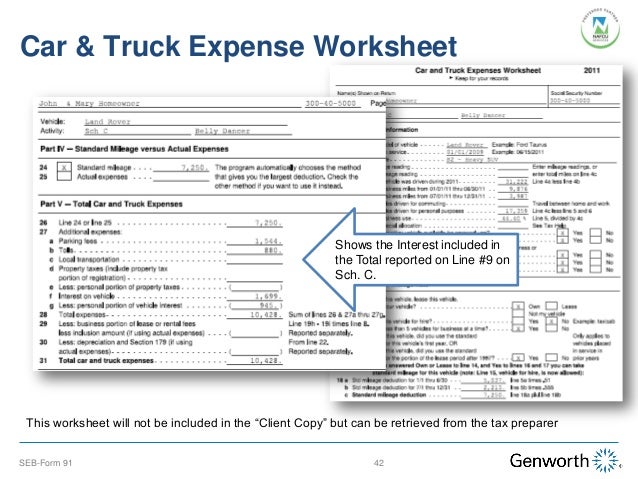

Car Truck Expenses Worksheet Schedule C

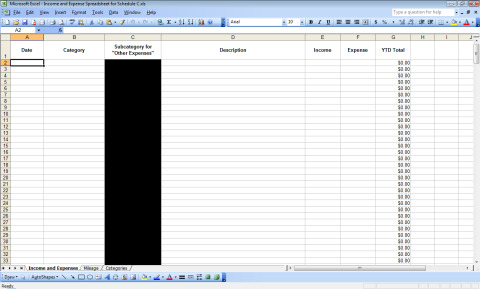

Click the listed property information tab and select your vehicle type from the drop down list.

Car truck expenses worksheet schedule c. As with the standard mileage rate you must divide your expenses between business and personal use. Schedule c car and truck expenses worksheet and 1040nr schedule c 1024 x 791. Medical purposes involve driving to obtain medical care for yourself or for your dependents. Properly tracking your business expenses is very important come tax time especially if youre to get the most out of your tax returns.

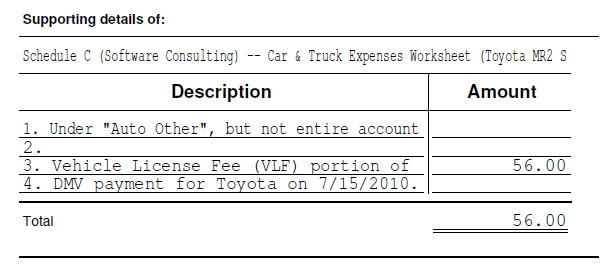

Amt dep allowedallowable 1 is too large. See the possible fixes below. List your vehicle information in the assets section basic information. Best car truck expenses worksheet schedule c prices we hope that by posting this best car truck expenses worksheet schedule c prices we can fulfill your needs of inspiration for designing your homeif you need more ideas to truck reviews news you can check at our collection right below this post.

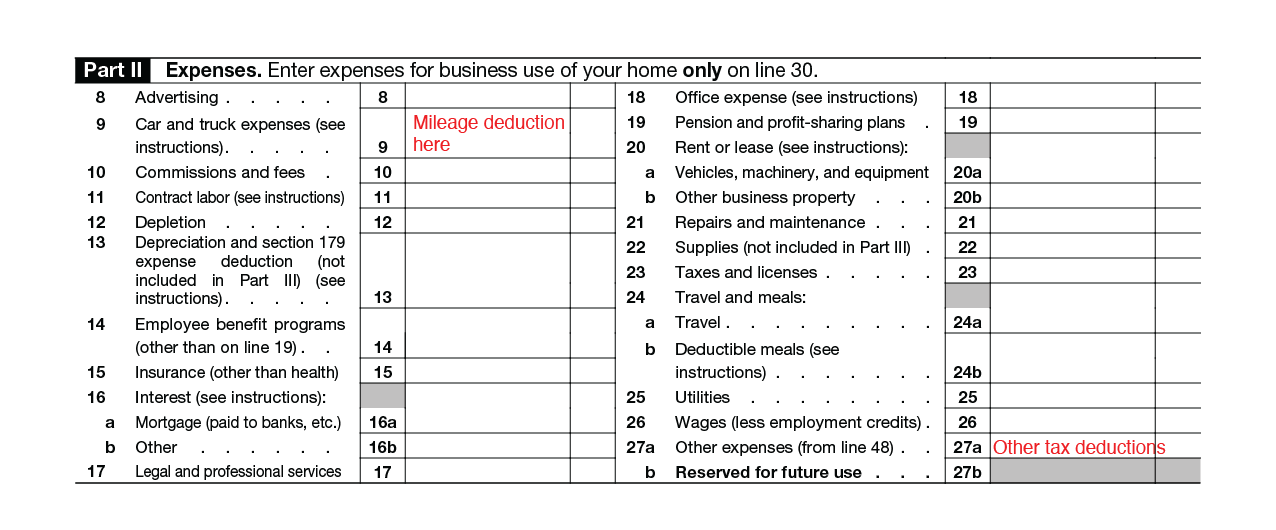

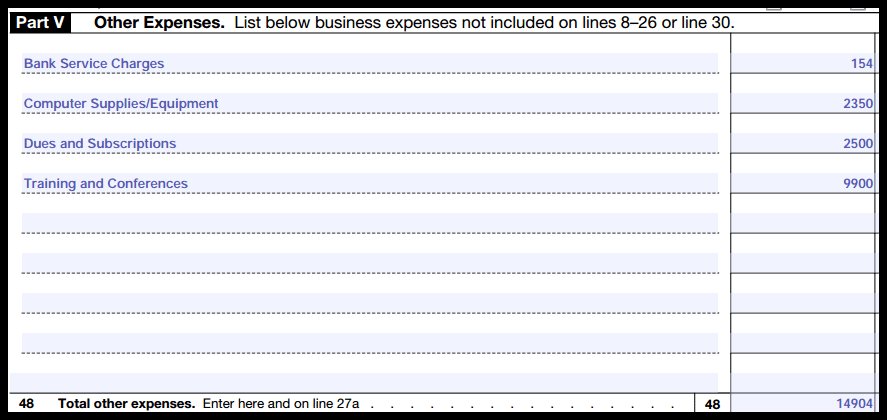

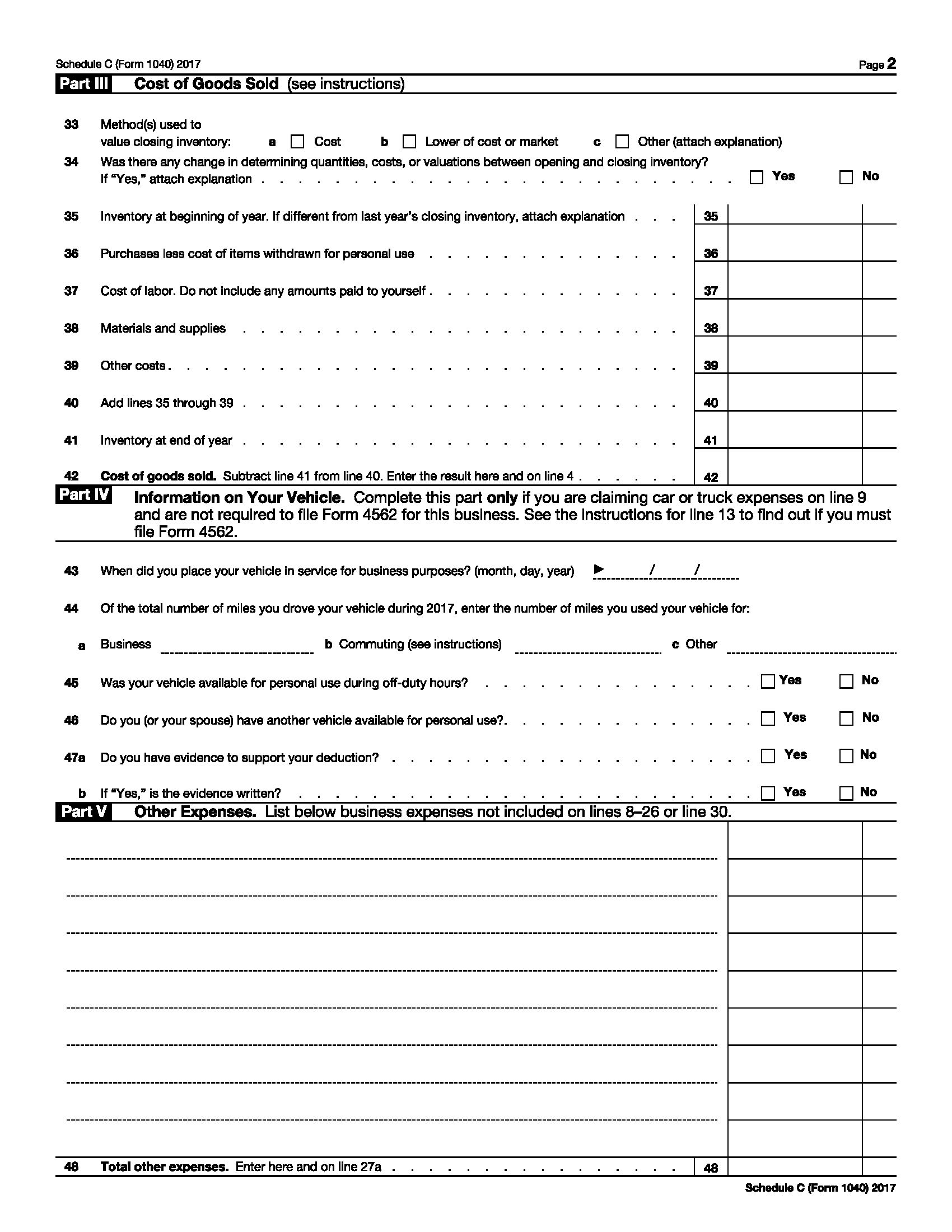

After determining the part of your gross income from the business use of your home subtract from that amount the total expenses shown on schedule c line 28 plus any losses shown on form 8949 and included on schedule d or form 4797 that are allocable to the business in which you use your home but that are not allocable to the business use of the home. You can deduct expenses for the business use of your vehicle. For claiming actual vehicle expenses you can include. Schedule c form 1040 or 1040 sr profit or loss from business sole proprietorship pdf or.

The law requires that you substantiate your expenses by adequate records or by sufficient evidence to support your own statement. To use the actual car expenses go to the depreciation section of the schedule c. The deduction for business use of a vehicle is taken on schedule c if youre self employed on schedule f if youre a farmer or as an itemized deduction as part of your unreimbursed business expenses on form 2106 if youre an employee. Actual expense method for the actual expense method you must track the actual expenses paid to use your vehicle for business.

Deduct your self employed car expenses on. Now here is the primary picture. If you have any other details regarding this question please feel free to post them in the comment section. Take a look at the following guide to schedule c deductions and you may find that youre missing out on some key tax deductions for self employed freelancers and small business owners.

Sch c wks car amp.

/GettyImages-510502763-5796ded05f9b58461f833d13.jpg)