Certificate Of Deposite

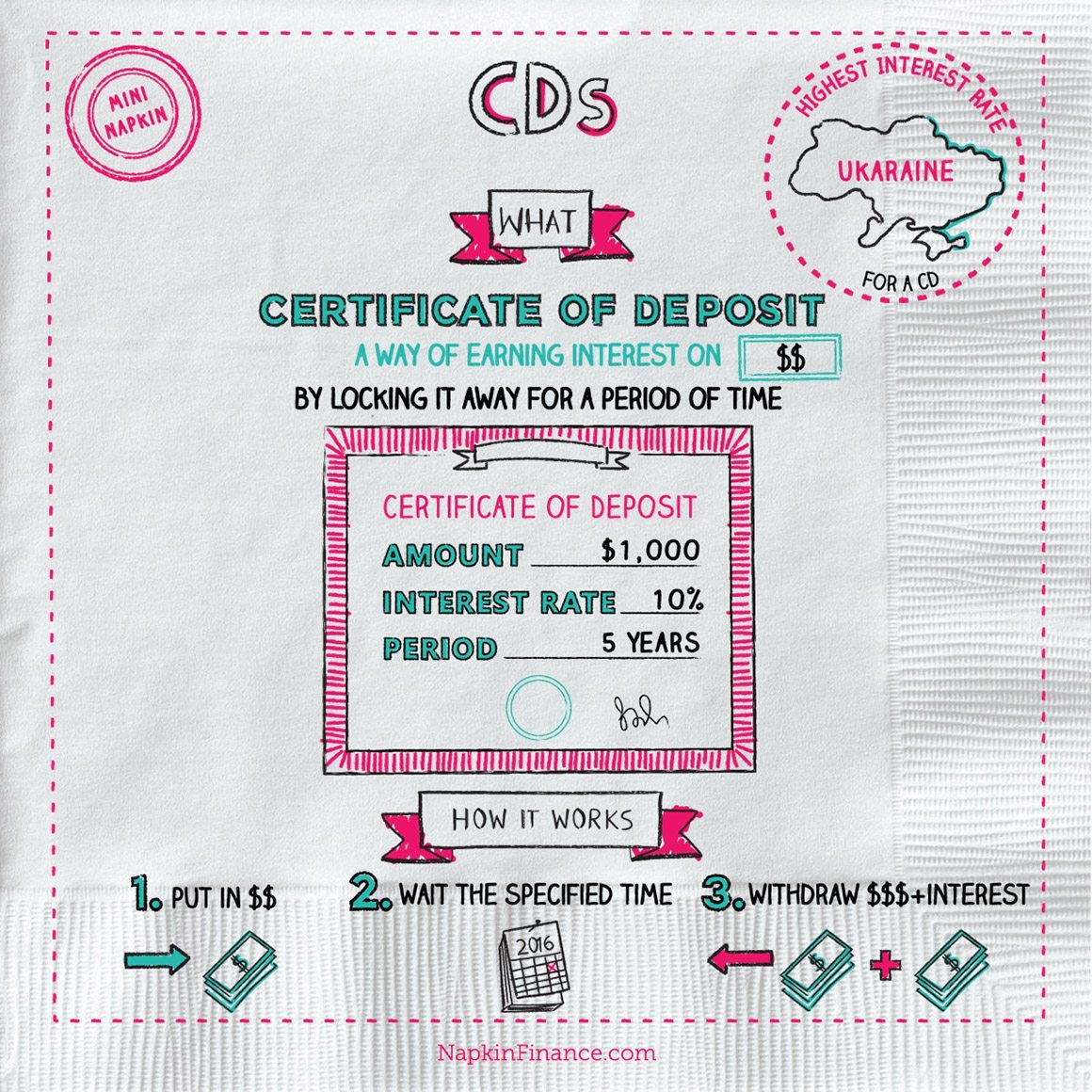

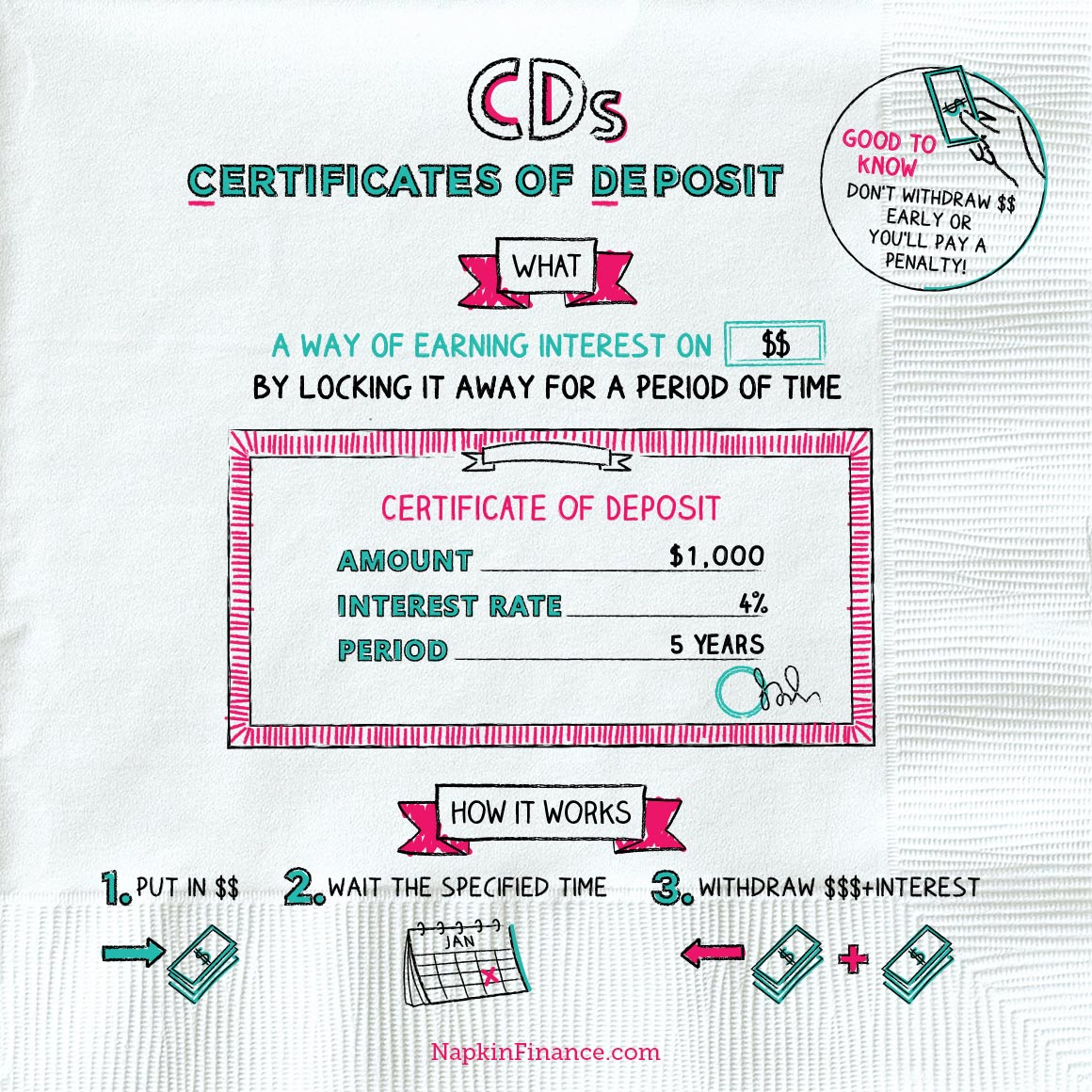

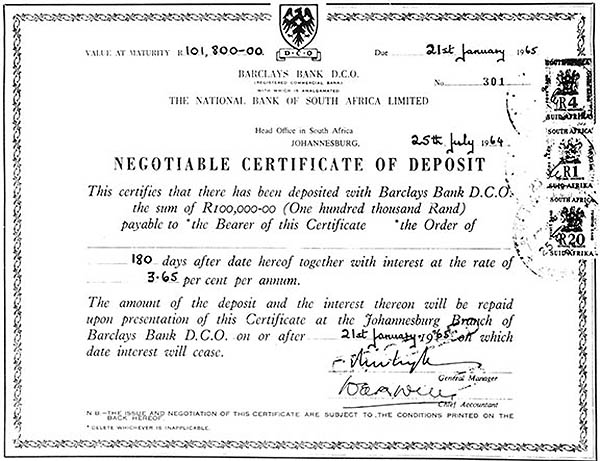

A certificate of deposit or cd is a type of federally insured savings account that has a fixed interest rate and fixed date of withdrawal known as the maturity date.

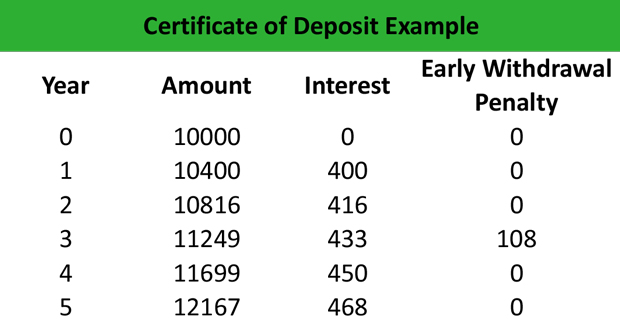

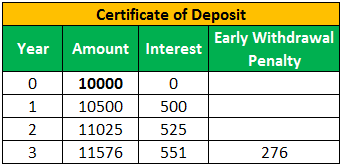

Certificate of deposite. A certificate of deposit cd is a time deposit a financial product commonly sold by banks thrift institutions and credit unions. A certificate of deposit or cd is an account you leave untouched for a set time while it grows interest. You can choose to invest for three months six months one year or five years. A certificate of deposit cd is a product offered by banks and credit unions that offers an interest rate premium in exchange for the customer agreeing to leave a lump sum deposit untouched for a predetermined period of time.

Almost all consumer financial institutions offer them. A certificate of deposit is an agreement to deposit money for a fixed period with a bank that will pay you interest. Cds are similar to savings accounts in that they are insured money in the bank and thus virtually risk free. Cds also typically dont have monthly fees.

Read more about cds. When you cash in or redeem your cd you receive the money you originally invested plus any interest. You choose your term length 3 and how much money to deposit. Along with earning interest the account is fdic insured.

:max_bytes(150000):strip_icc()/cd-basics-how-cds-work-315245-v4-5ba5068946e0fb002558ccde.png)