Charitable Donation Valuation Worksheet

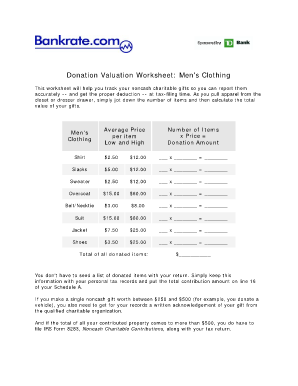

Internal revenue service irs requires donors to value their items.

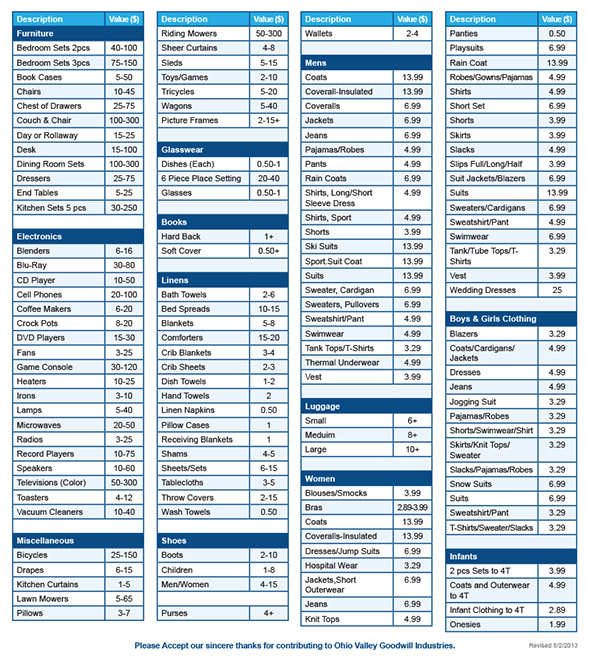

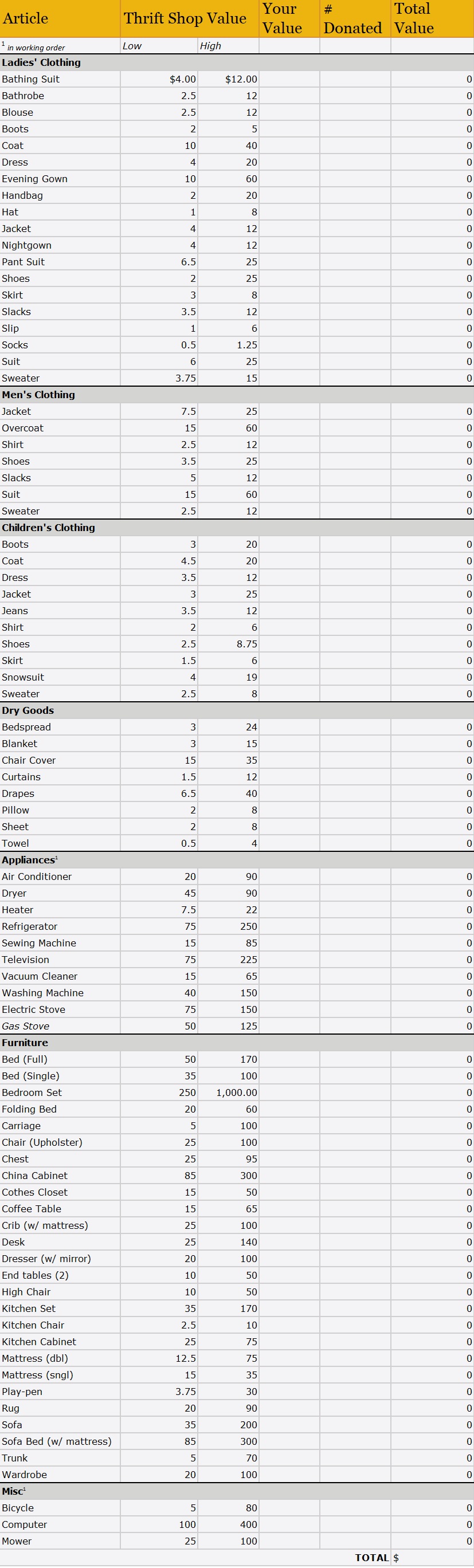

Charitable donation valuation worksheet. Valuation guide for goodwill donors the us. Keep for your records 1. Free charitable donation receipt our charitable donation receipt automatically calculates the fair market value of commonly donated items. Total of all donated items entity to whom donated.

Subtract line 2 from line 1. Dont complete the rest of this worksheet. Please choose a value within this range that reflects your items relative age and quality. My our best guess of value non cash charitable contributions donations worksheet.

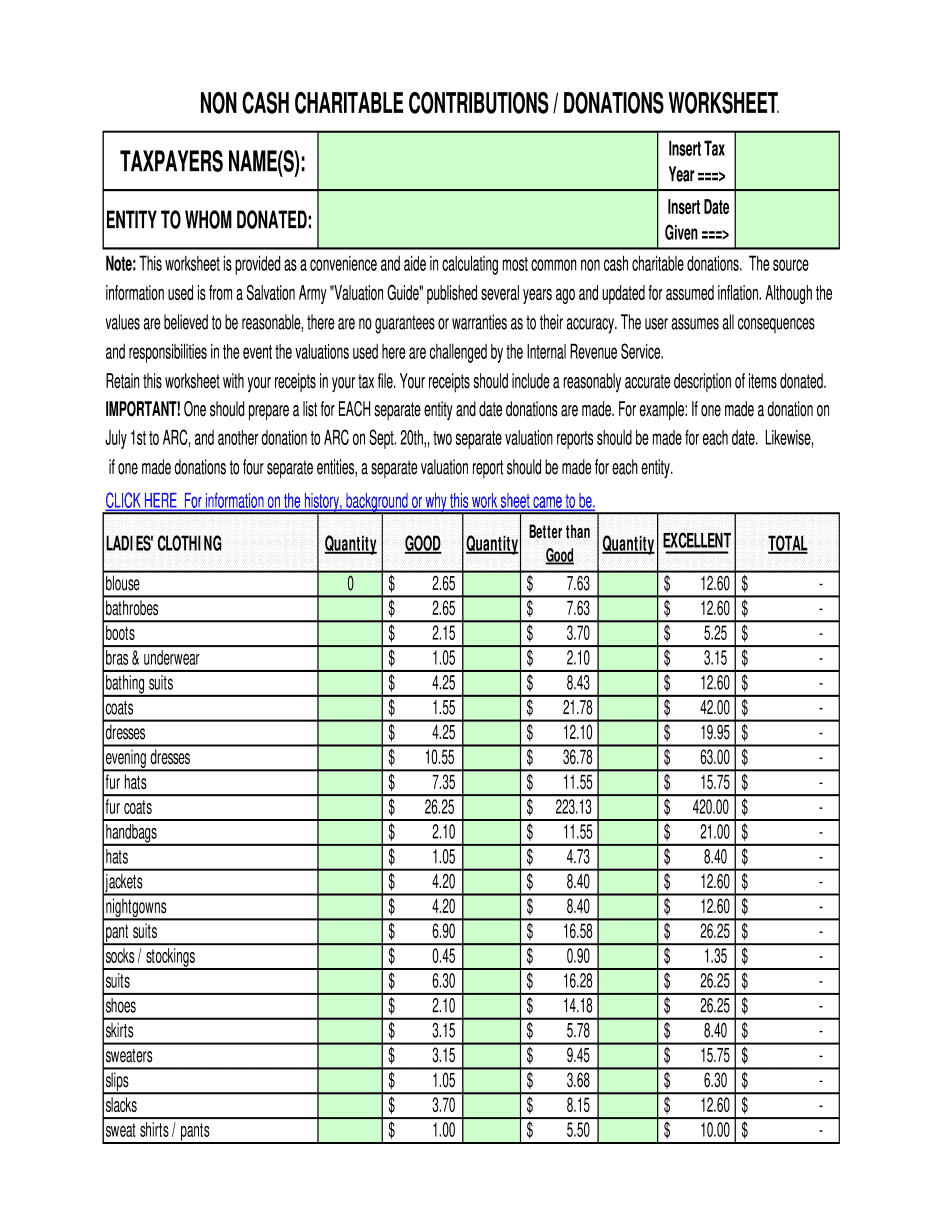

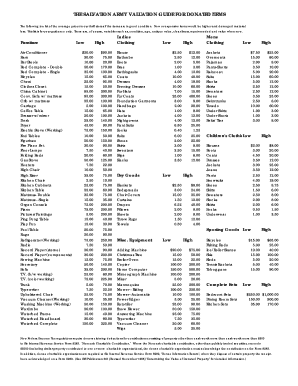

Use this donation calculator to find calculate as well as document the value of non cash donations. Enter fair market value of the donated food. The source information used is from a salvation army valuation guide published several years ago and updated for assumed inflation. You can page through the list and just print out the pages you need for the items you are.

Set your own value. You can look up clothing household goods furniture and appliances. Assume the following items are in good condition and remember. This worksheet is provided as a convenience and aide in calculating most common non cash charitable donations.

If you donated clothing or household goods to goodwill or the salvation army this year find out the tax donation value of the items for your tax deductions. Most also work with google docs and open office. If the result is zero or less stop here. This worksheet is provided as a convenience and aid in calculating most common non cash charitable donations.

All practical spreadsheets work with microsoft excel. The donation value guide below helps you determine the approximate tax deductible value of some of the more commonly donated items. Return from charitable donation spreadsheets to practical spreadsheets home page. The salvation army does not set a valuation on your donation.

Anderson financial services. What is your original cost based on reciepts or your best estimate of the items donated. Although the retain this worksheet with your receipts in your tax file. Enter basis of the donated food.

Your charitable contribution deduction for food is the amount on line 1. To help guide you goodwill industries international has compiled a list providing price ranges for items commonly sold in goodwill stores. It includes low and high estimates. Charitable item donation record using the worksheet the donation worksheet lists a variety of items that are typically donated to charity.

See separate worksheet instructions. Insert tax year insert date given enter items not provided for in the above categories.