Cpa Certification Ny

Applications with education from outside the us.

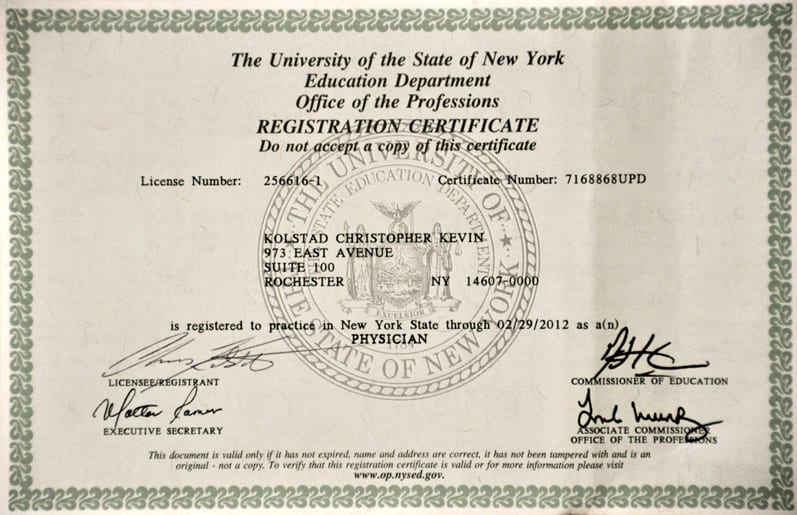

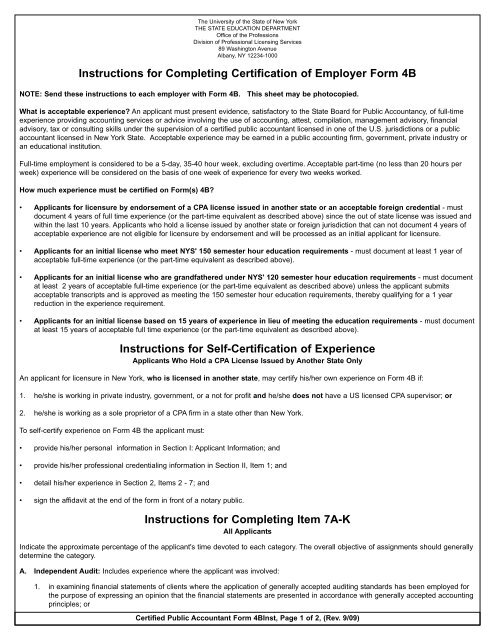

Cpa certification ny. The information below is meant to serve as an easy reference guide for some of the commonly asked questions regarding becoming a cpa in new york state. Cpe requirements in new york state. And applications that do not contain sufficient detail usually require a lengthier review process. Refer to this step by step process on how to renew your professional license.

Request information from new york colleges and universities offering programs in accounting. You must begin to meet your cpe requirements for the calendar year beginning january 1 2016. Single source national database of licensed cpas and cpa firms. It is not meant to replace the guidelines set forth by the new york state education department and is not the final authority in answering questions about the cpa licensure process.

For example if you earned your cpa license on june 1 2012 your initial registration period ends on may 31 2015. Due to the volume and complexity of review certified public accountant applications take time to process after all documentation has been submitted. The state of new york requires 150 semester hours as well as 1 year of work experience in order to obtain your cpa license. You will receive a new license within 4 6 weeks.

Determine a cpa or cpa firms credentials without having to search each of the 55 boards of accountancy website individually. Coursework completed as part of a chartered accountant or similar program is considered professional training and is therefore not accepted toward the education requirements for the us. This certificate program is designed for students who have earned baccalaureate degrees in disciplines other than accounting and would like to transition to a career in. However you may sit for the cpa exam upon completion of your bachelors degree and 120 semester hours.

If you have 15 years of public accounting experience you must. Contact the new york state education department to review your.