Donating Clothes Tax Receipt

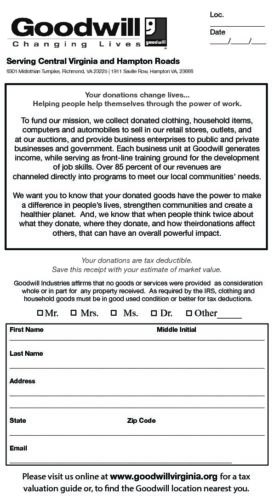

Donors should consult a tax advisor in connection with claiming deductions for charitable donations of property.

Donating clothes tax receipt. The tax receipt is proof that we picked up a non cash donation from you. Please click on the link for the charity you donated to. Only usable clothes should be donated. Donations of goods under 250 do not require a receipt.

Thank you for your support. Other good rules to keep in mind include the following. Donations valued between 500 but under 5000. The donor is responsible for determining the value of their donations and listing them out accordingly.

Many organizations accept clothing donations. This value is determined by you the donor. Hang on to this receipt. How to donate clothes step 1 gather usable clothes.

Yes your donations of clothing and household items are tax deductible. Step 4 save the receipt for tax deductions. Document the condition of high value items. Make an itemized list of donated items.

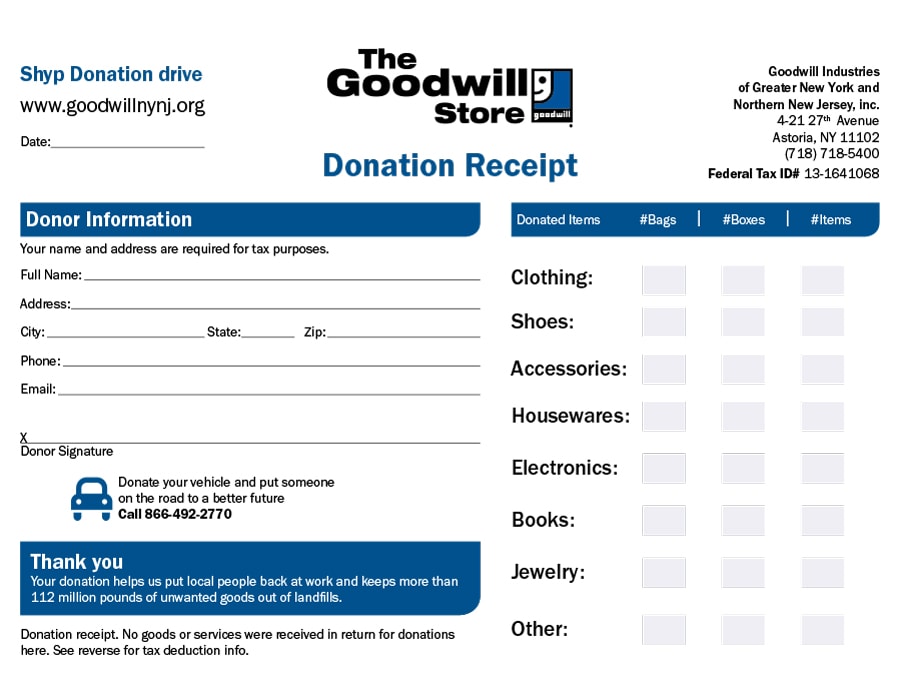

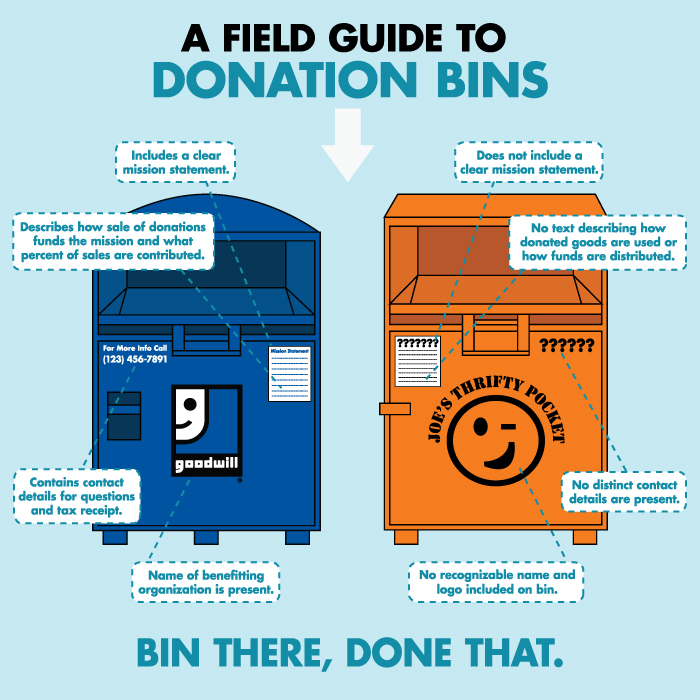

Keep your donation receipts. Step 2 search for a donation center. Step 3 drop off in exchange for a receipt. Donated goods of less than 250 in total value require a receipt with the organizations name the date of the donation and a brief description of the goods unless it is impractical to get a receipt.

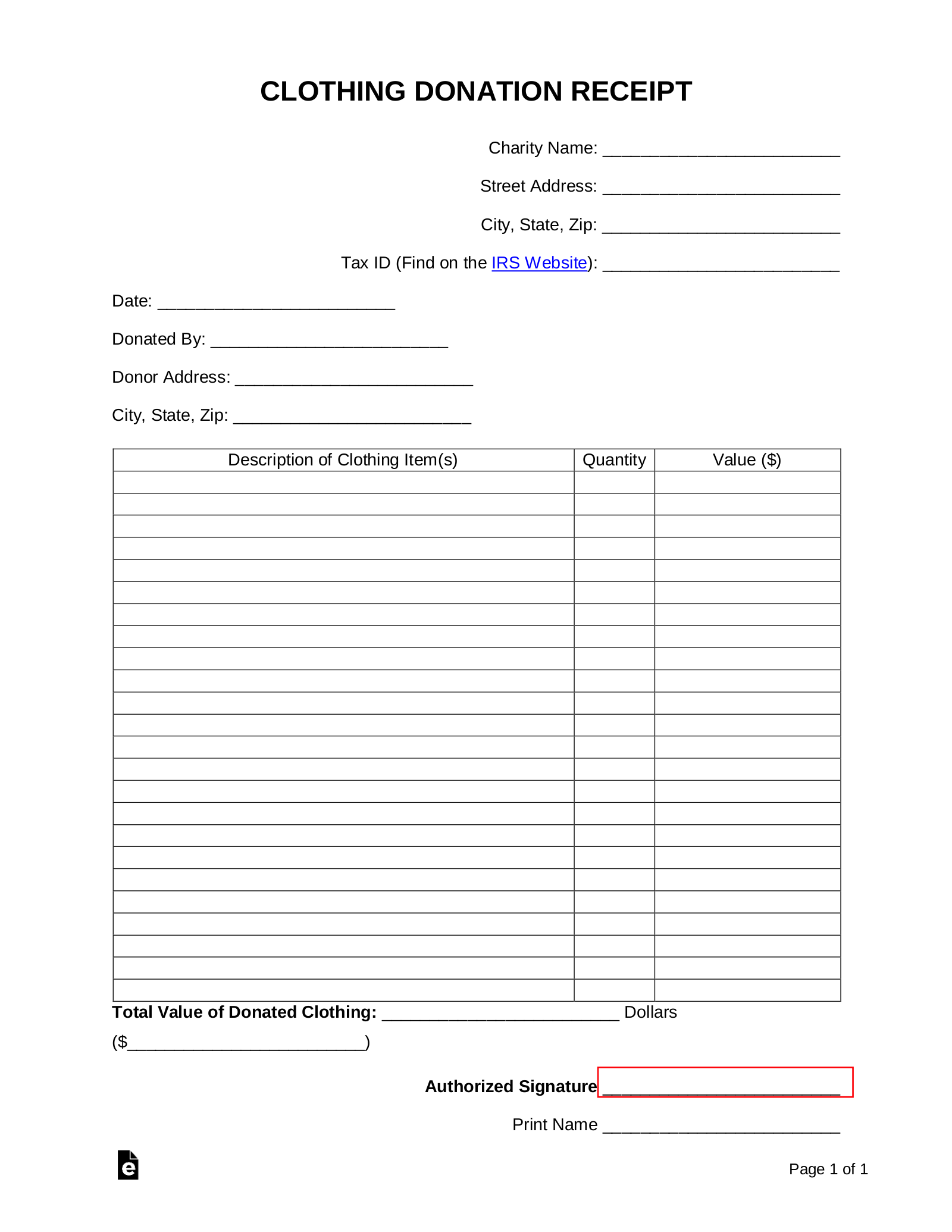

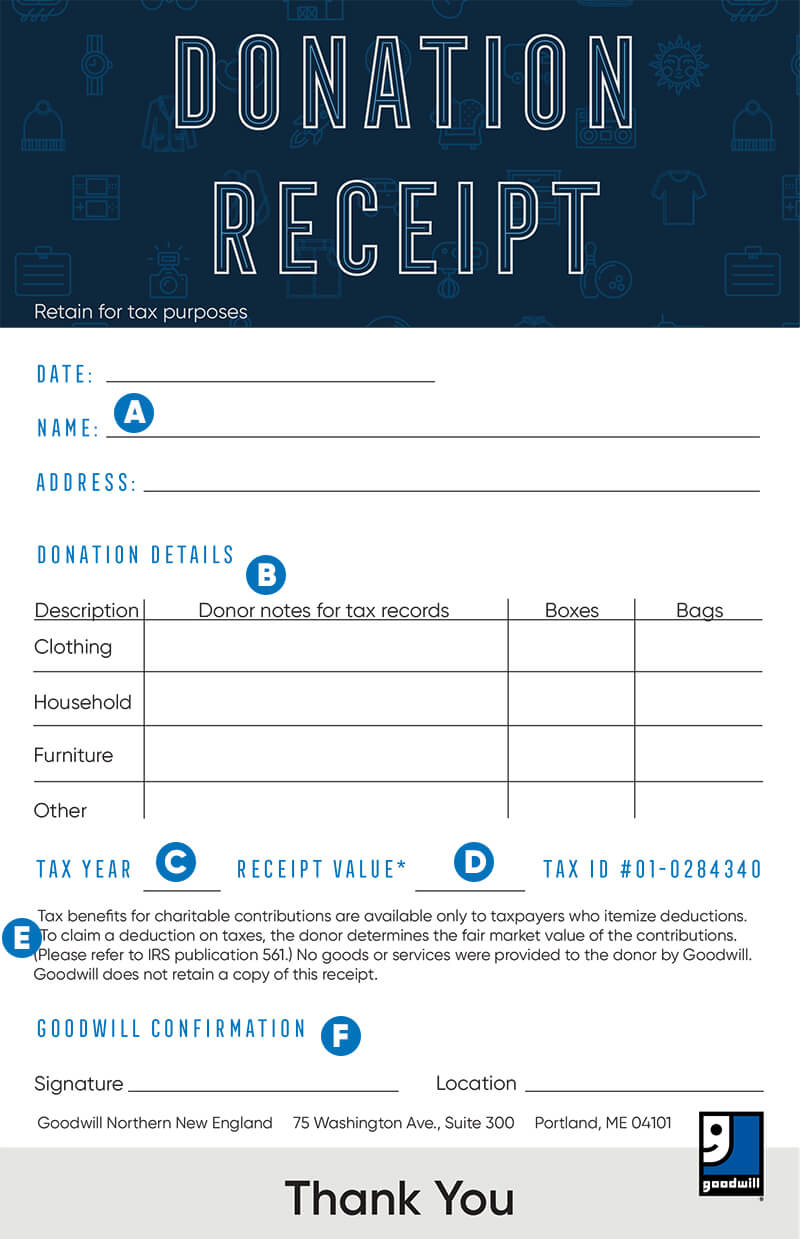

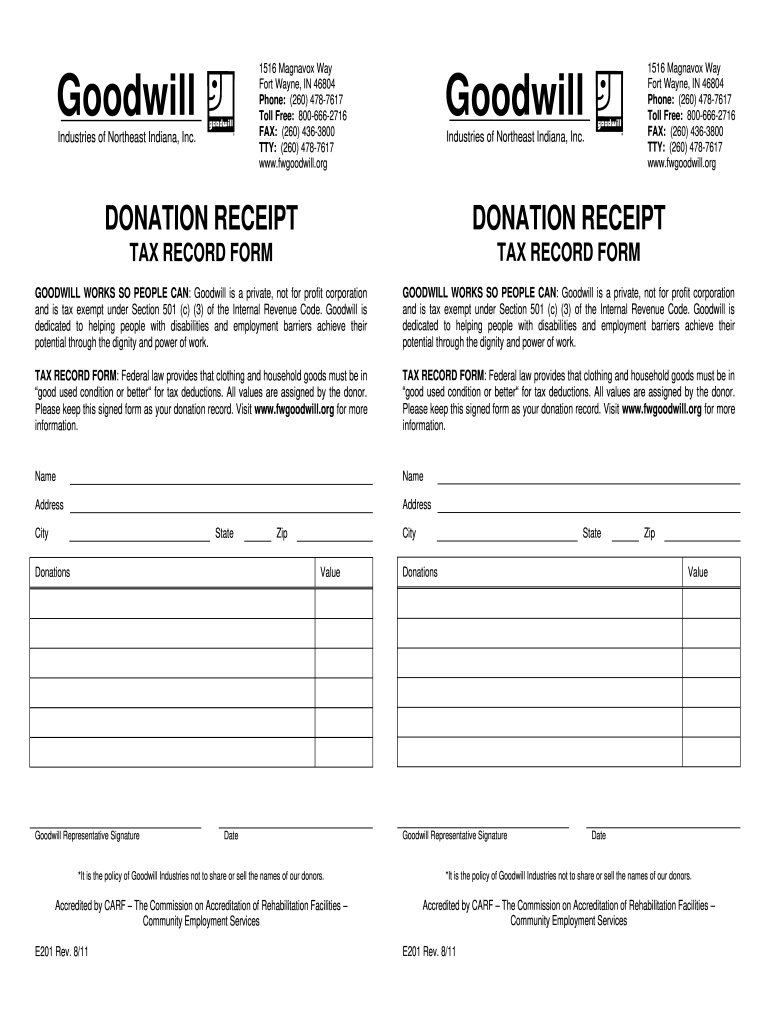

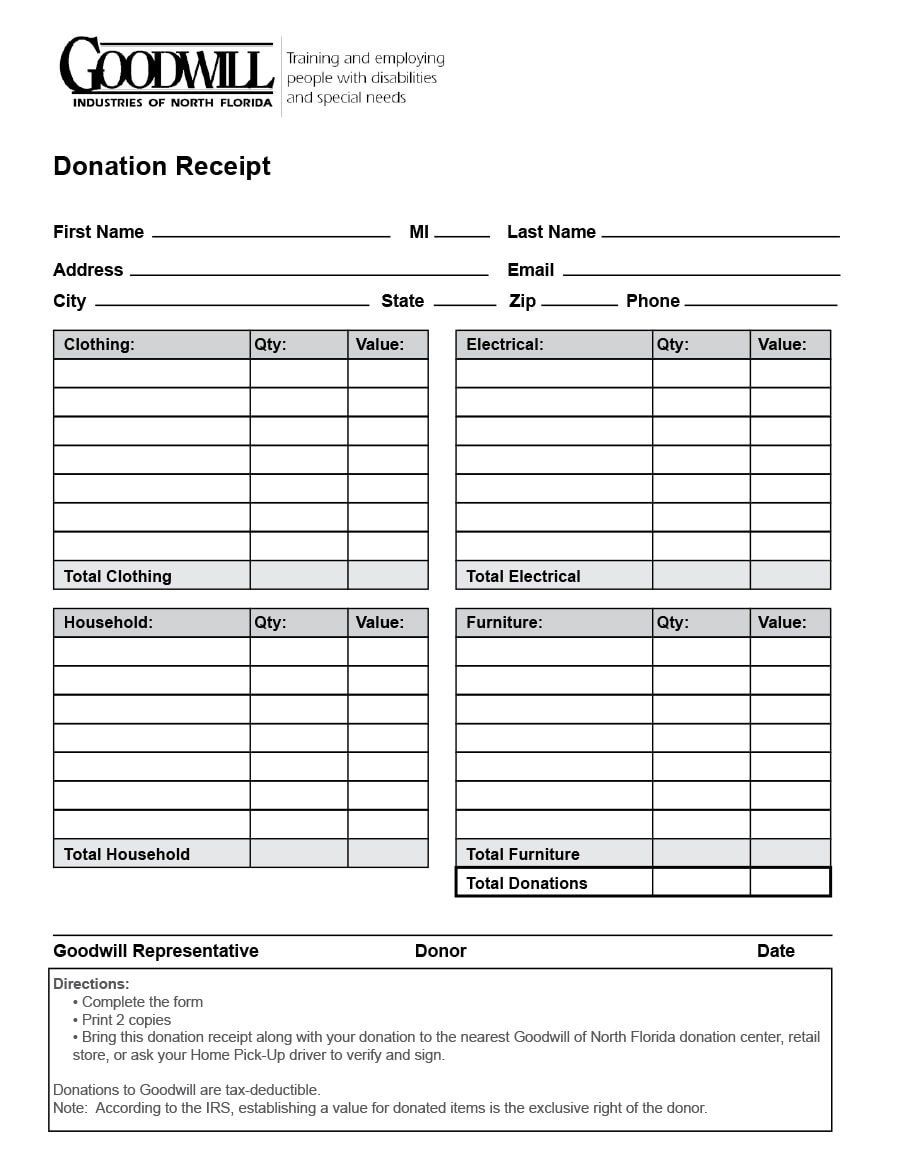

Write in the total fair market value of your donation. When you drop off your donations at goodwill youll receive a receipt from a donation attendant. Internal revenue service requires you to value your donation when filing your return. If the donor claims a deduction for a single item of clothing that exceeds 500 in value the donor must file a qualified appraisal with the irs.

Please refer to irs publication 561 for information determining the value of donated property. Goodwill employees cannot help determine fair market value. Any donations to the salvation army or goodwill between 251 and 500 require a receipt. For more about determining the value of donated goods see irs publication 561.

Goodwill provides a donation value guide to help determine fair market value. Donated goods of more than 250 in total value require a receipt with all of the above. The donor you is responsible for valuing the donated items and its important not to abuse and overvalue items in the event that you are audited. Donate items in good condition only.

How does the tax deduction work. The goodwill donation receipt is used to claim a tax deduction for clothing and household property that are itemized on your taxes. How to calculate clothing donations for taxes keeping track of your donations make sure you donate to a tax exempt organization.