Donation Template For Taxes

First you need a warm thank you letter but you also must include legally required information so that donors can document that they gave a tax deductible donation to your charity.

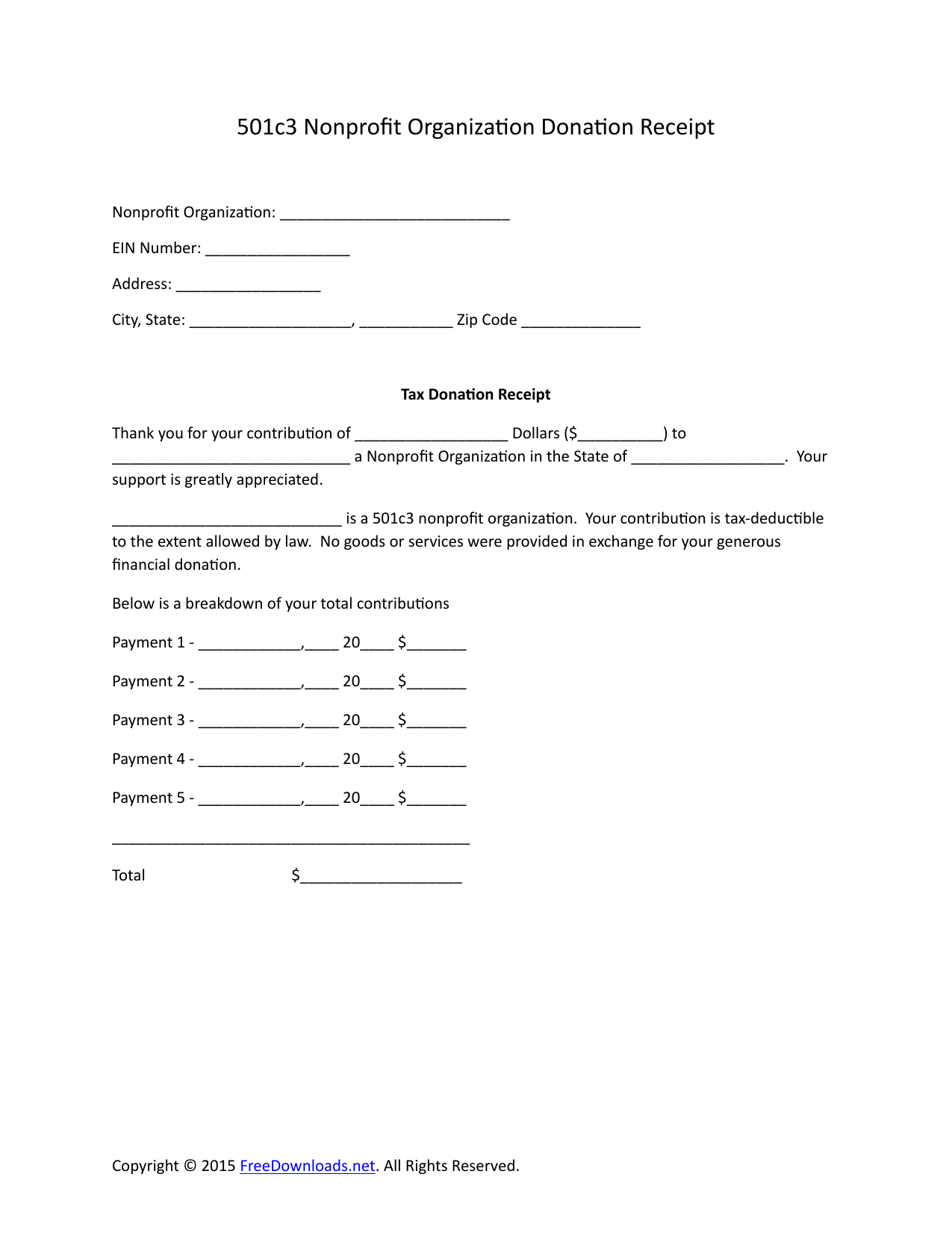

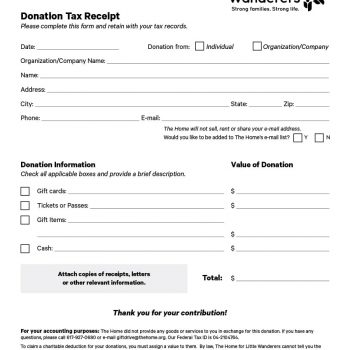

Donation template for taxes. The donor will use this letter as proof of his or her donation to claim a tax deduction. If you are managing a charity organization you must deal with creating tax deductible donation receipts on a regular basis. A tax deductible donation letter is a formal written request for donations from individuals companies or organisations. Organizations using donorbox our powerful and effective donation software can very easily generate 501c3 compliant tax receiptsthis includes both receipts for every individual donation and consolidated receipts of the entire year of donations.

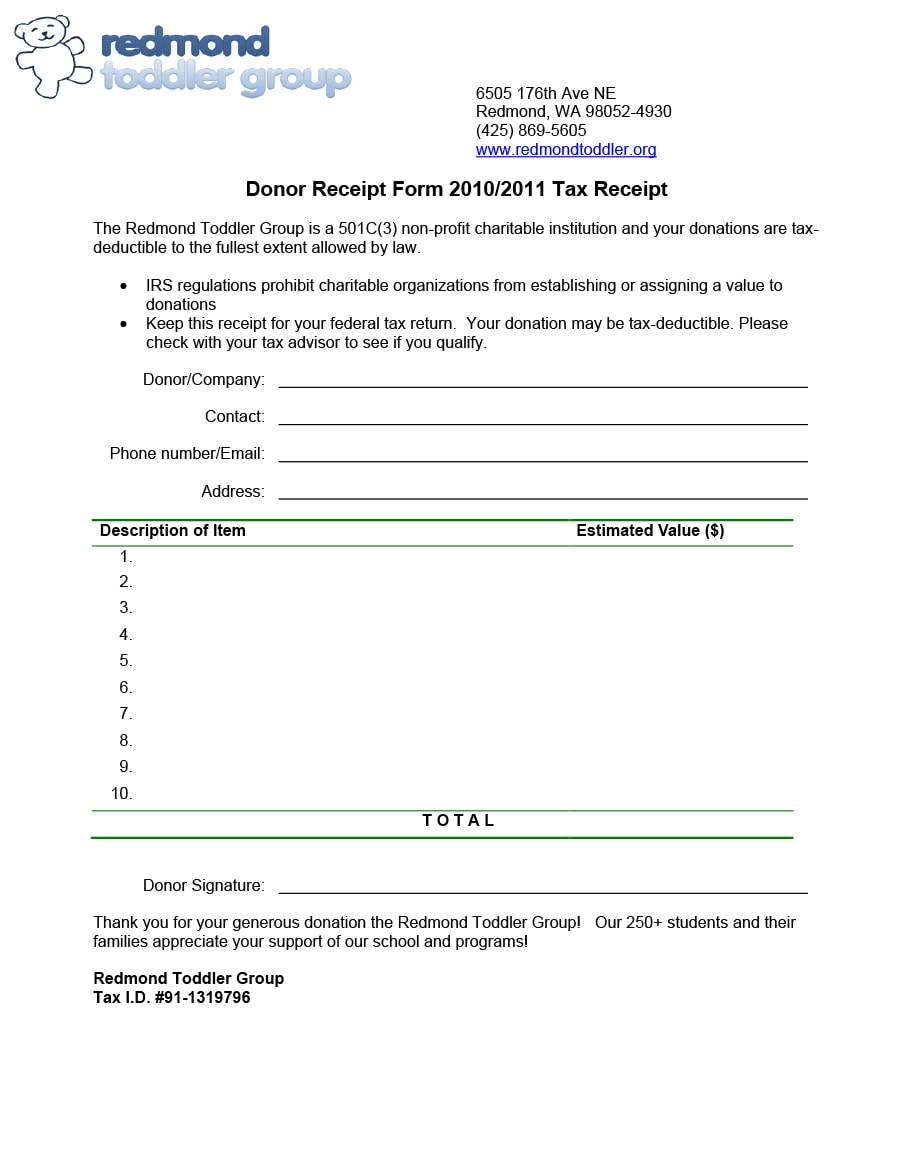

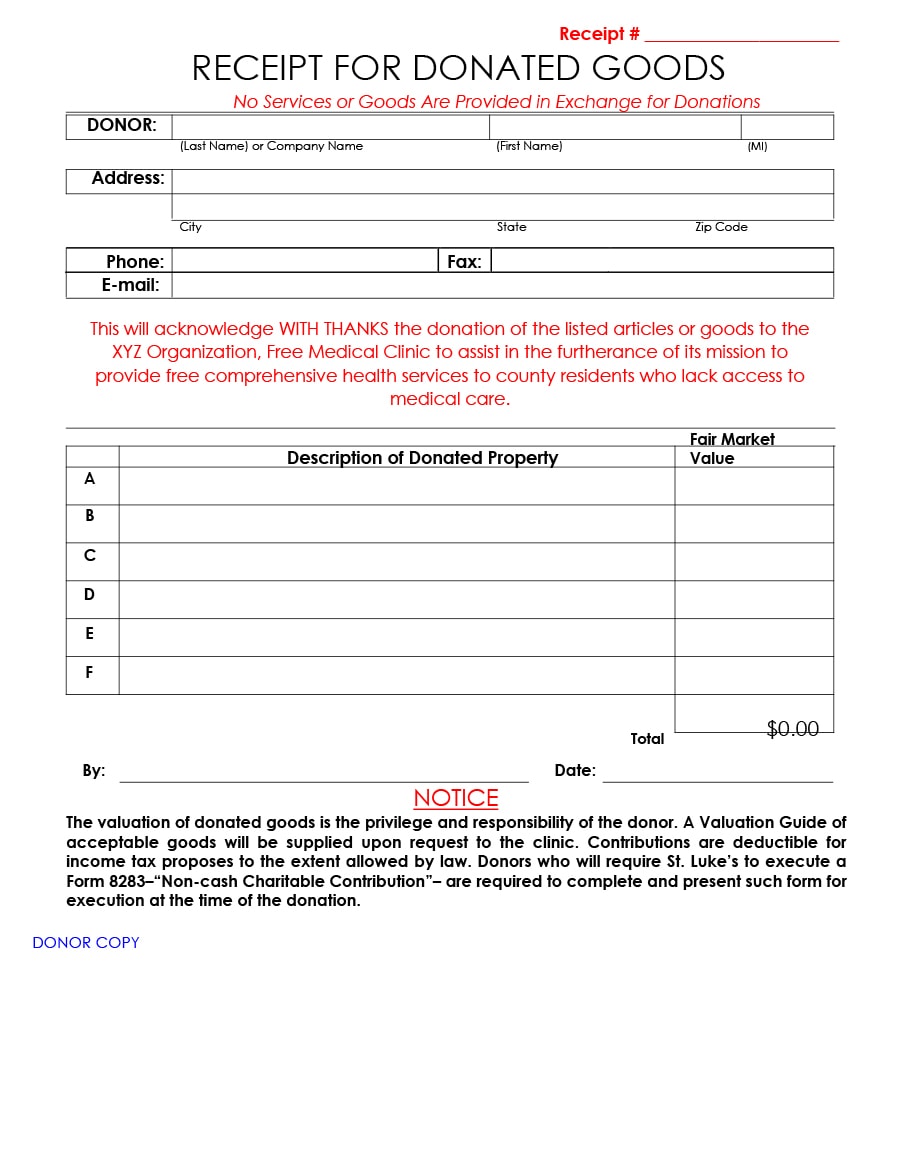

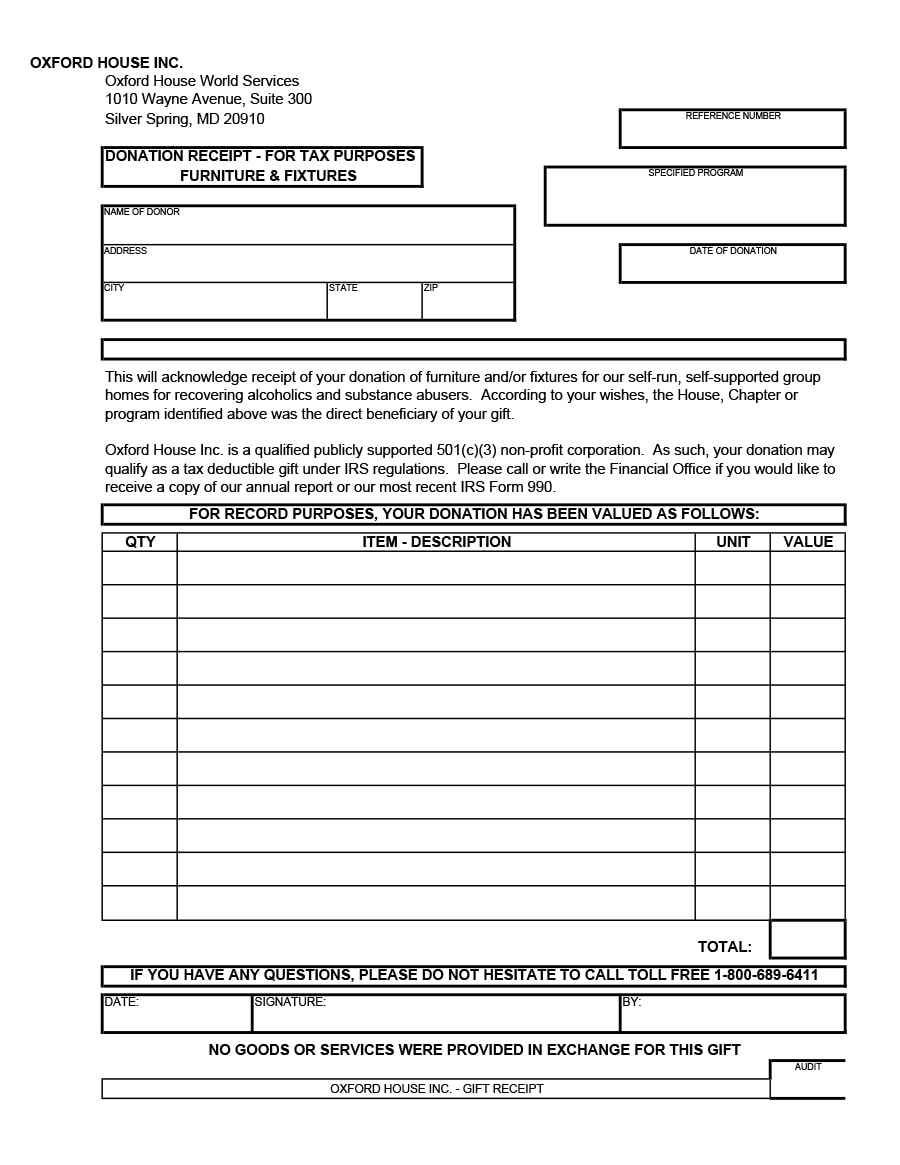

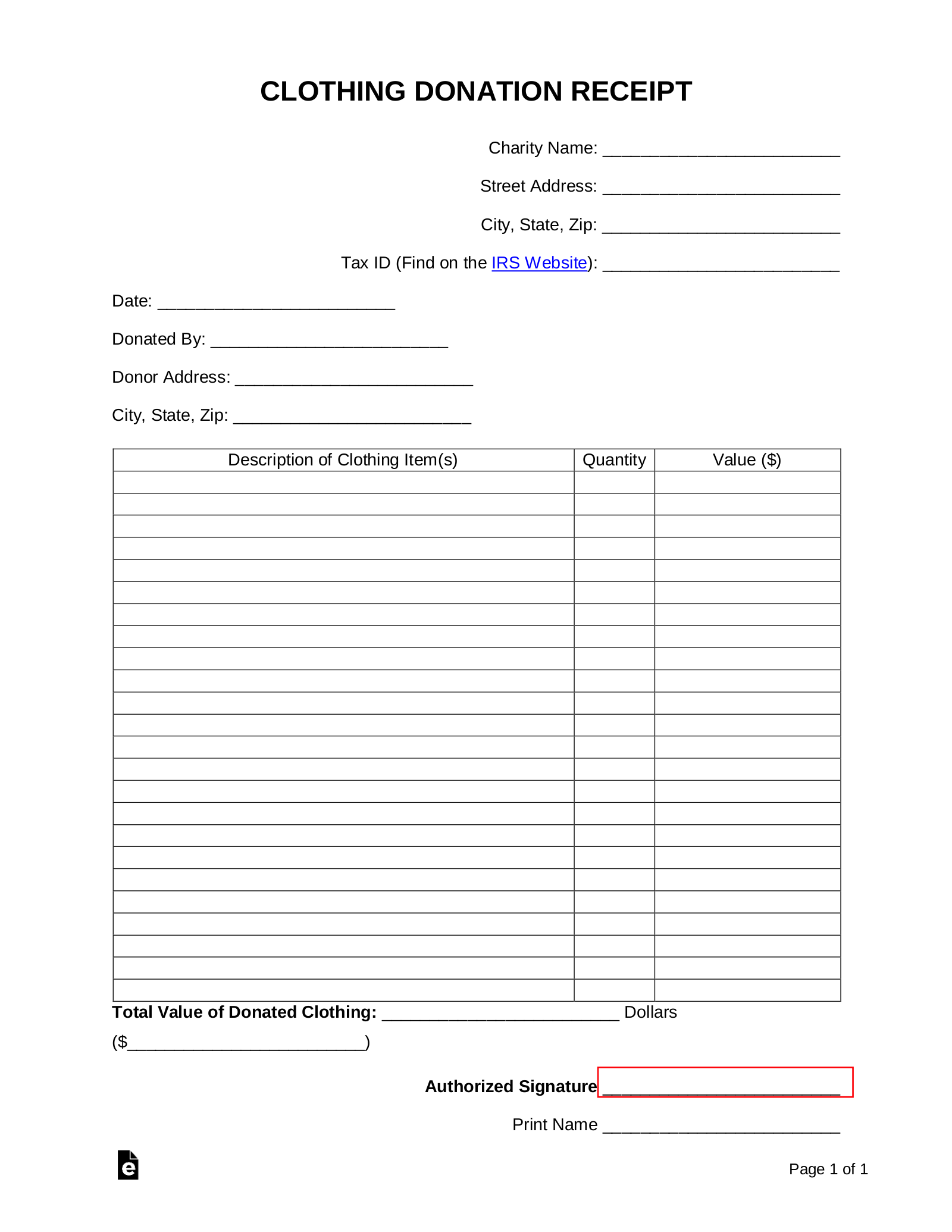

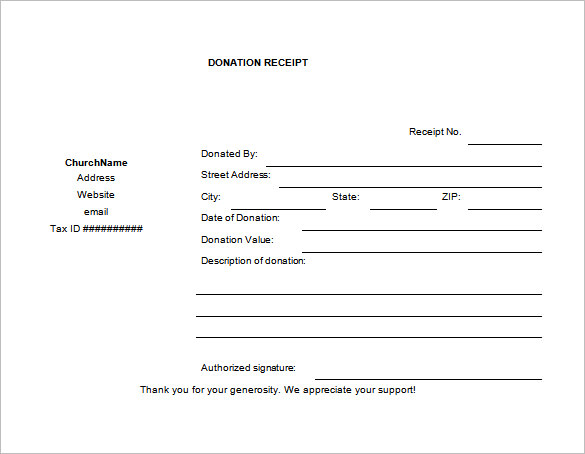

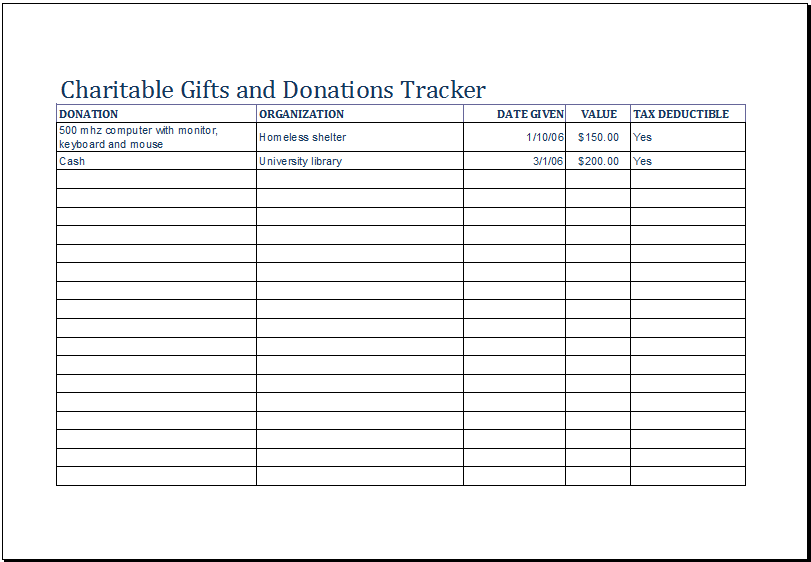

Your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible. The acknowledgment to the donor should include the following. Make sure to save your donation receipt template so you can make use of the same template for all your donations. The receipt shows that a charitable contribution was made to your organization by the individual or business.

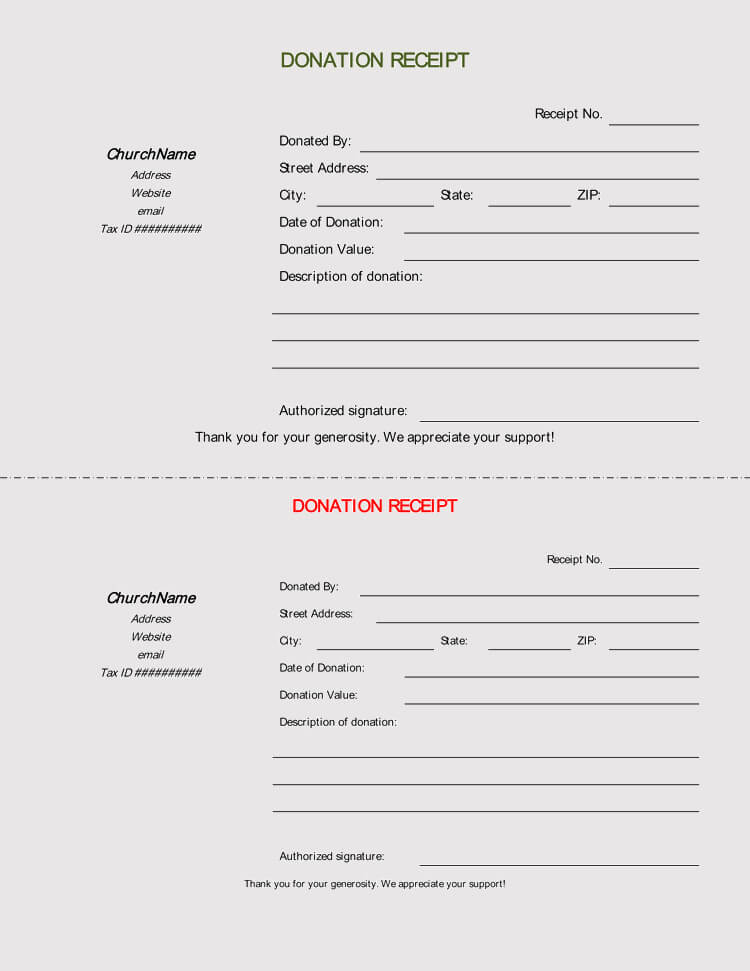

The templates that we provide are basic ones. The receipt template is a microsoft word document so that you can customize it and make it work for your organization. The donation receipt template is very easy to use. The irs requires public charities also known as 501c3 organizations to send a formal acknowledgment letter for any donation of more than 250.

Also make a copy and file all the donation receipts which you have given out to keep track of all the donations and for tax purposes as well. We provide you with a tax deductible donation receipt template to help you create tax deductible donation receipts quickly and easily. When creating a formal or service letter presentation design and layout is vital to earning a good initial impression. We have prepared examples of tax donation receipts that a 501c3 organization should provide to its donors.

This letter provides the potential donor with information about the requesting organisation and details about the project for which a donation is being soughtin order to receive maximum donations you need to make sure that the letter looks professional and polite. Again the irs requires that a tax exempt organization send a formal acknowledgment letter for any donation that is more than 250. Variety of church donation letter for tax purposes template that will flawlessly match your demands. The templates were designed with word and excel which makes the templates easy to customize with your own organizational details logo and more.