Free Promissory Note Template Florida

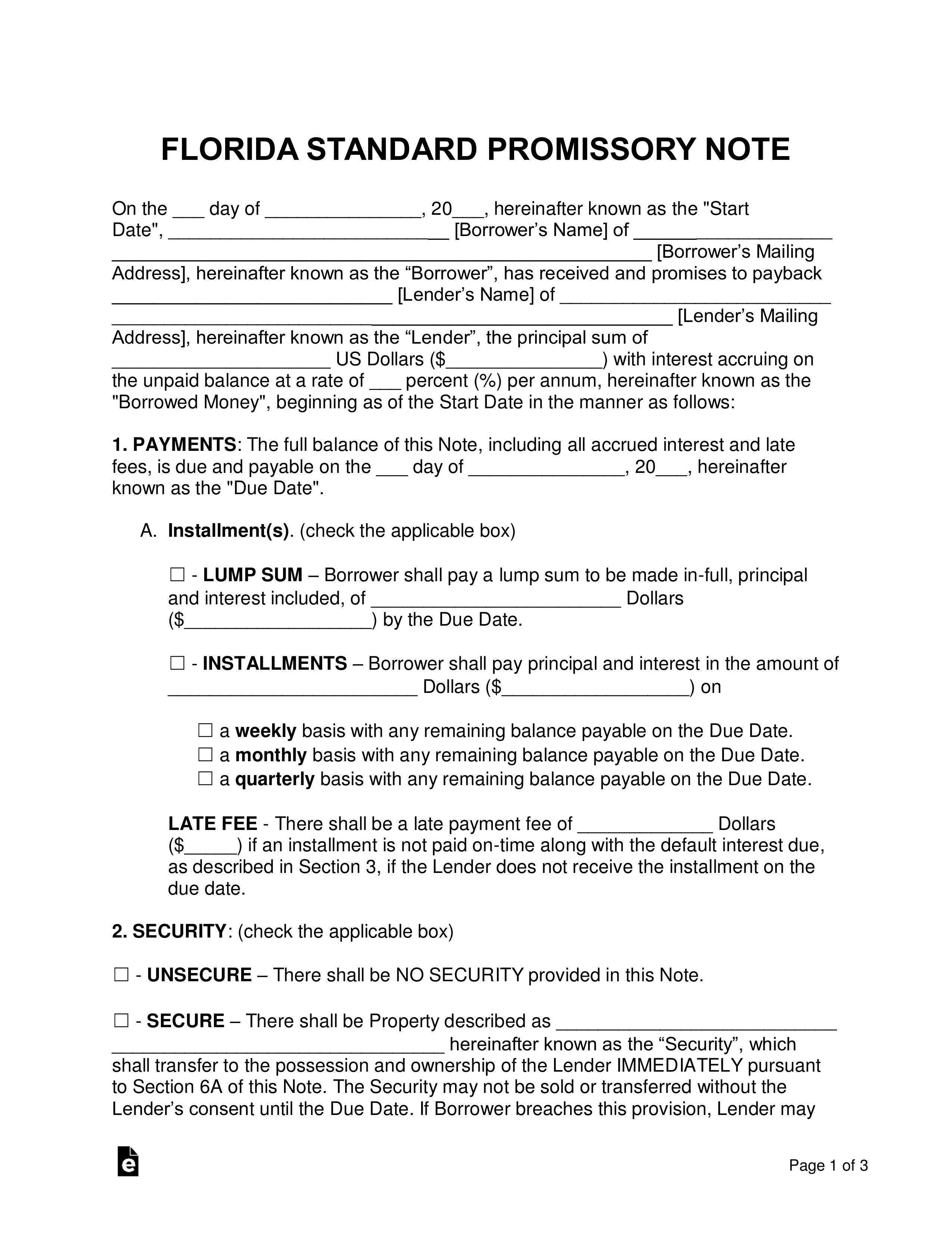

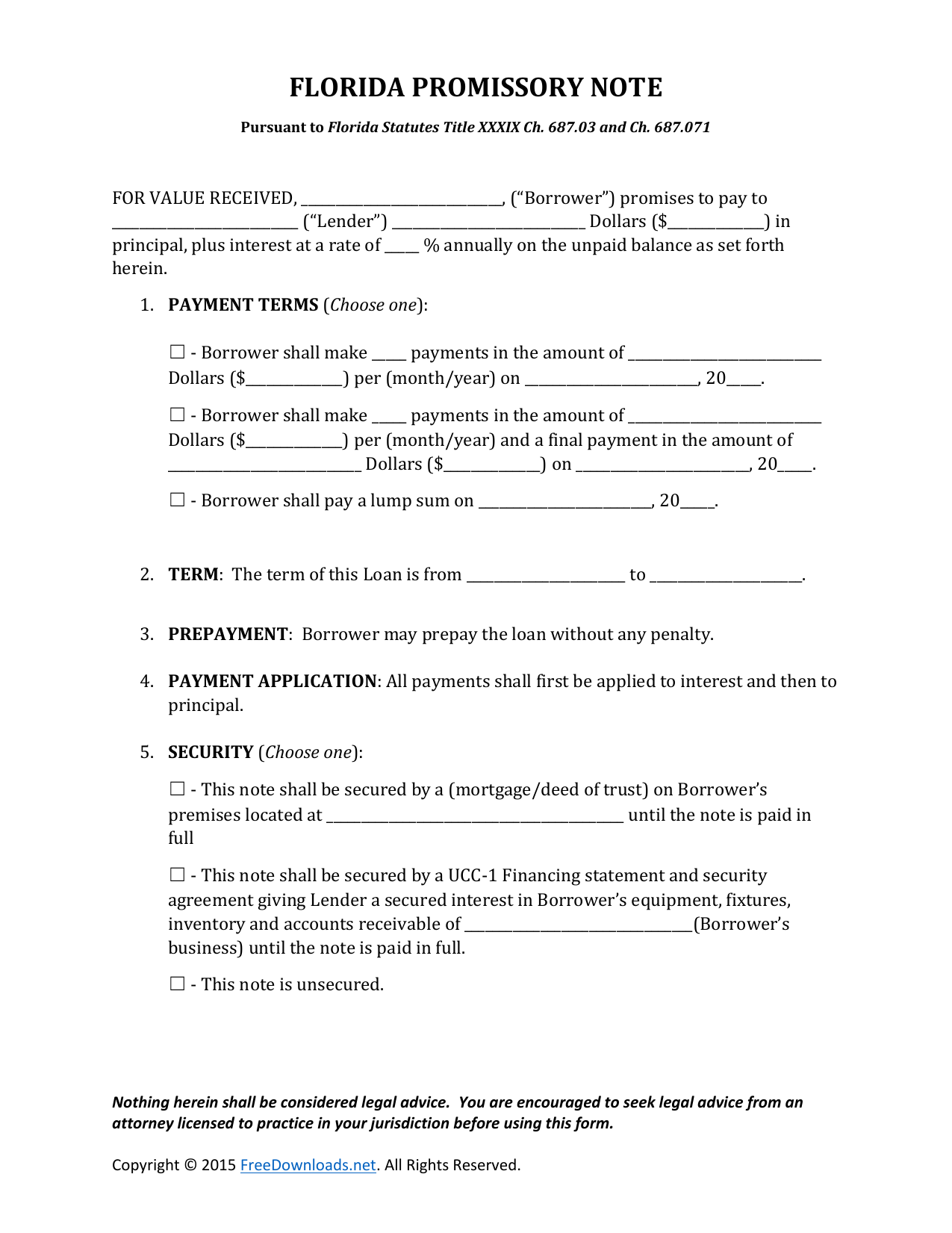

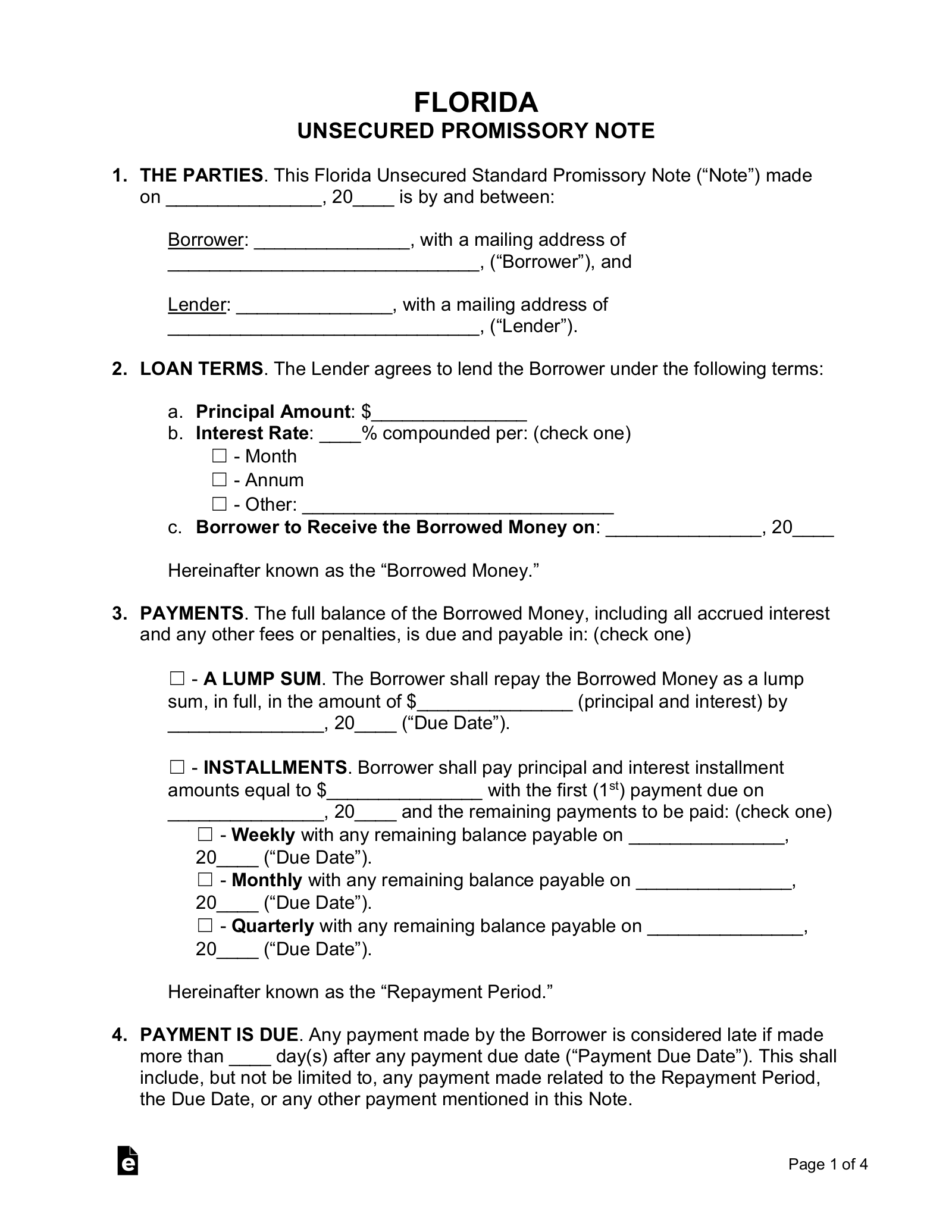

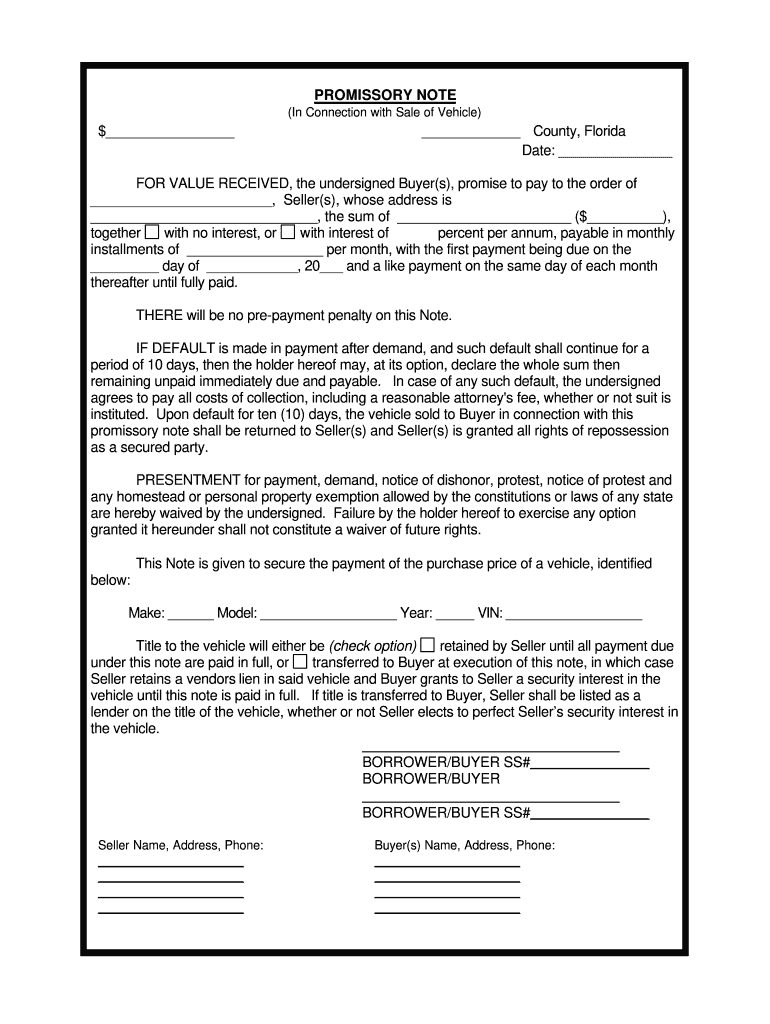

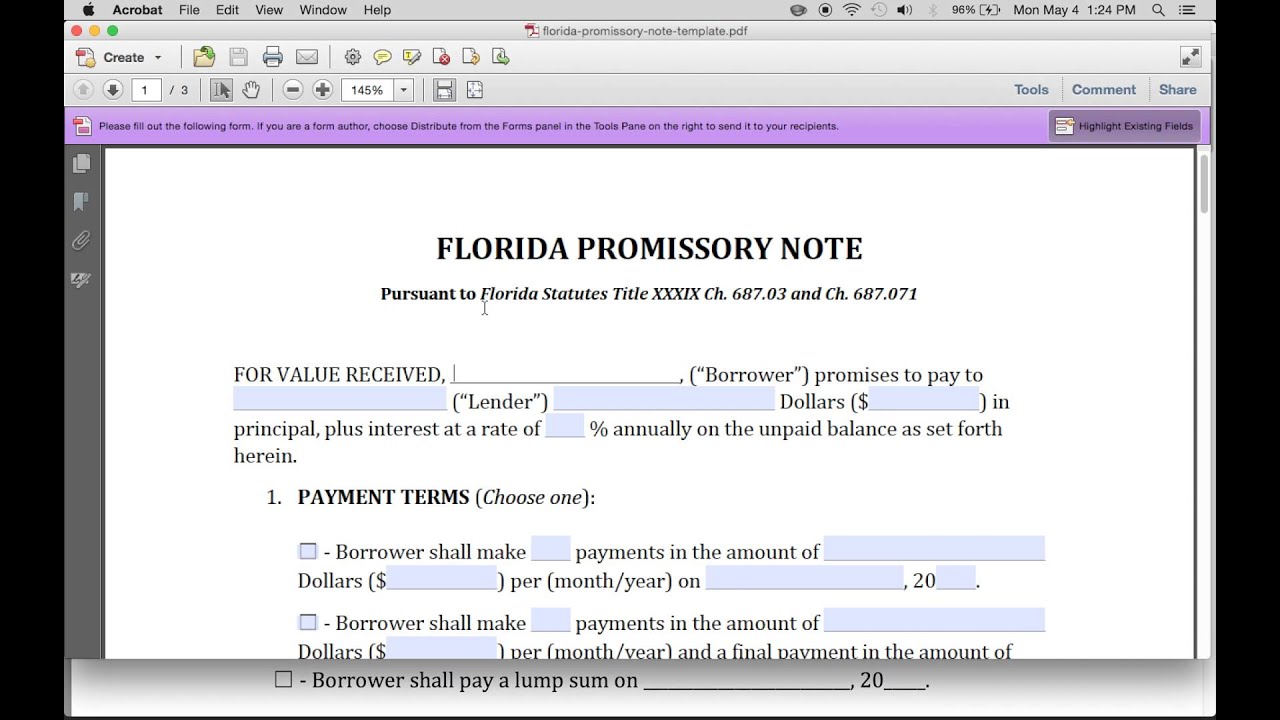

The note is used to identify the specific terms of a loan such as the principal sum interest rates payment method payment schedule etc.

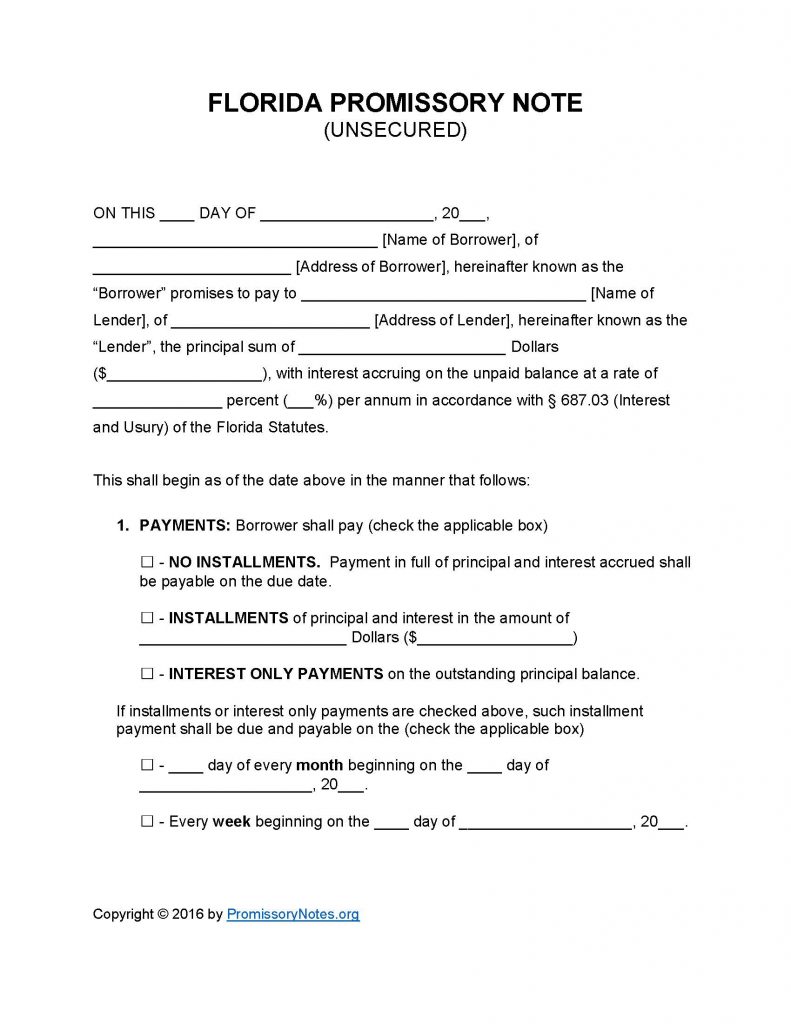

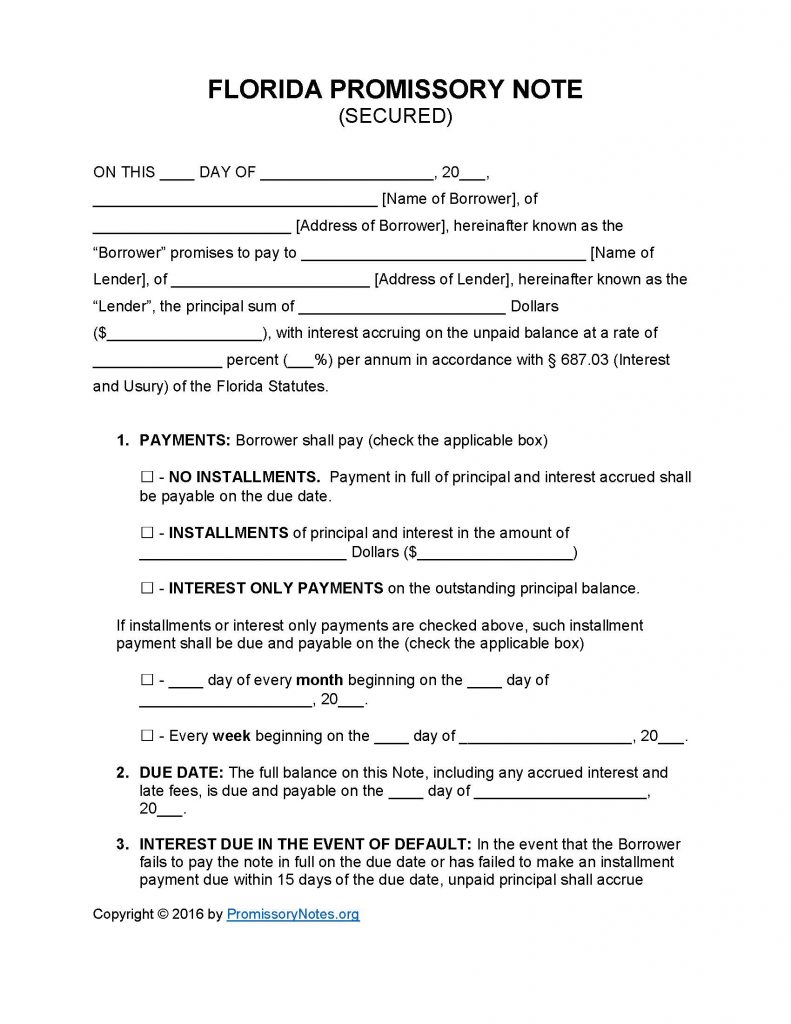

Free promissory note template florida. The free promissory note below is downloadable in microsoft word format. Built into the documents include sections that allow the parties to decide on payment types late fees the final due date and several other options. Florida promissory notes may be secured or unsecured. A promissory note is an important financial document that states the guarantee of payment of a certain sum by borrower to lender.

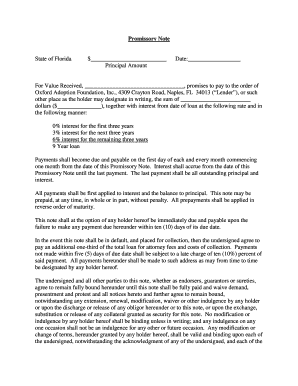

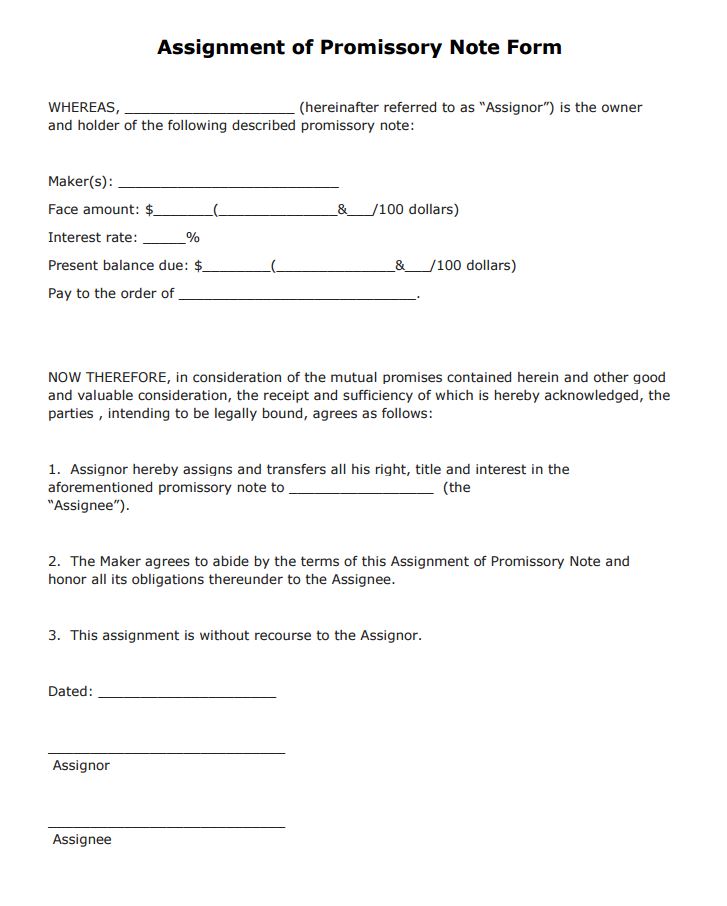

Free promissory note template. However collecting on real property for promissory notes is limited by florida statute 95112b. It is designed for an unsecured loan and it requires that you calculate the amortization repayment schedule interest and payment schedule. Promissory notes are negotiable instruments that are saleable and unconditional and are used in business transactions around the world.

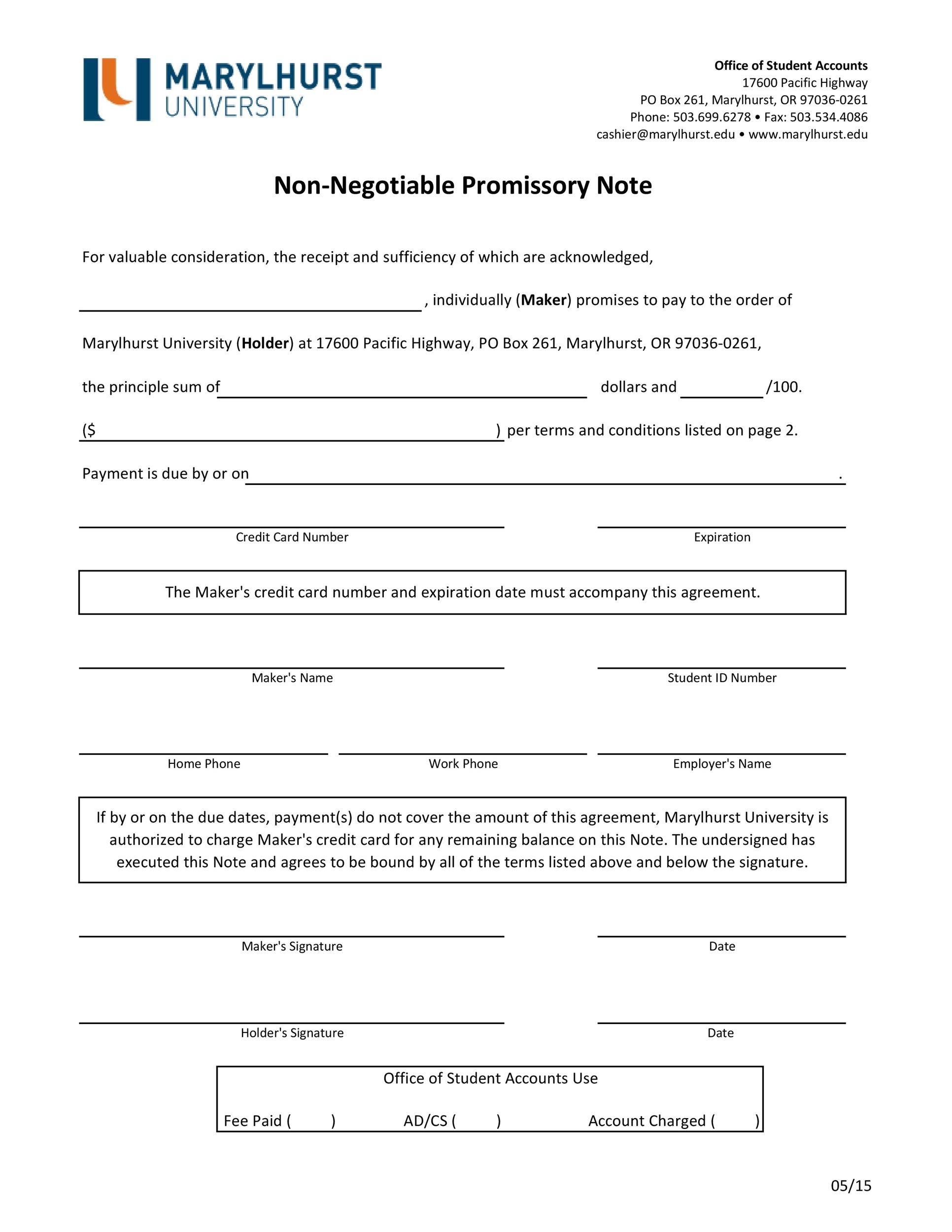

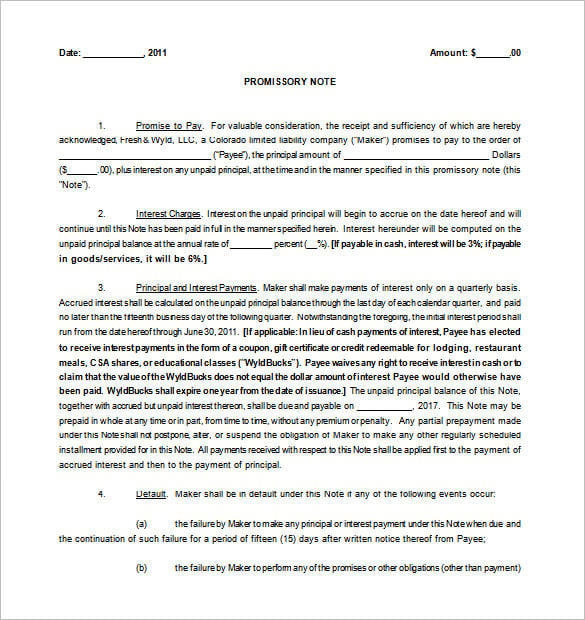

Click the image to zoom in and read specific clauses of the promissory note in more detail. The florida promissory note templates are a set of documents utilized by two 2 parties and are designed to ad structure and security to a loan transaction. Download free printable promissory note templates that may be written in fillable adobe pdf pdf ms word doc and rich text format rtf. Download this florida promissory note form which represents a promise by one person to pay back money loaned to them by another person over an agreed upon period of time and at an agreed upon rate of interest.

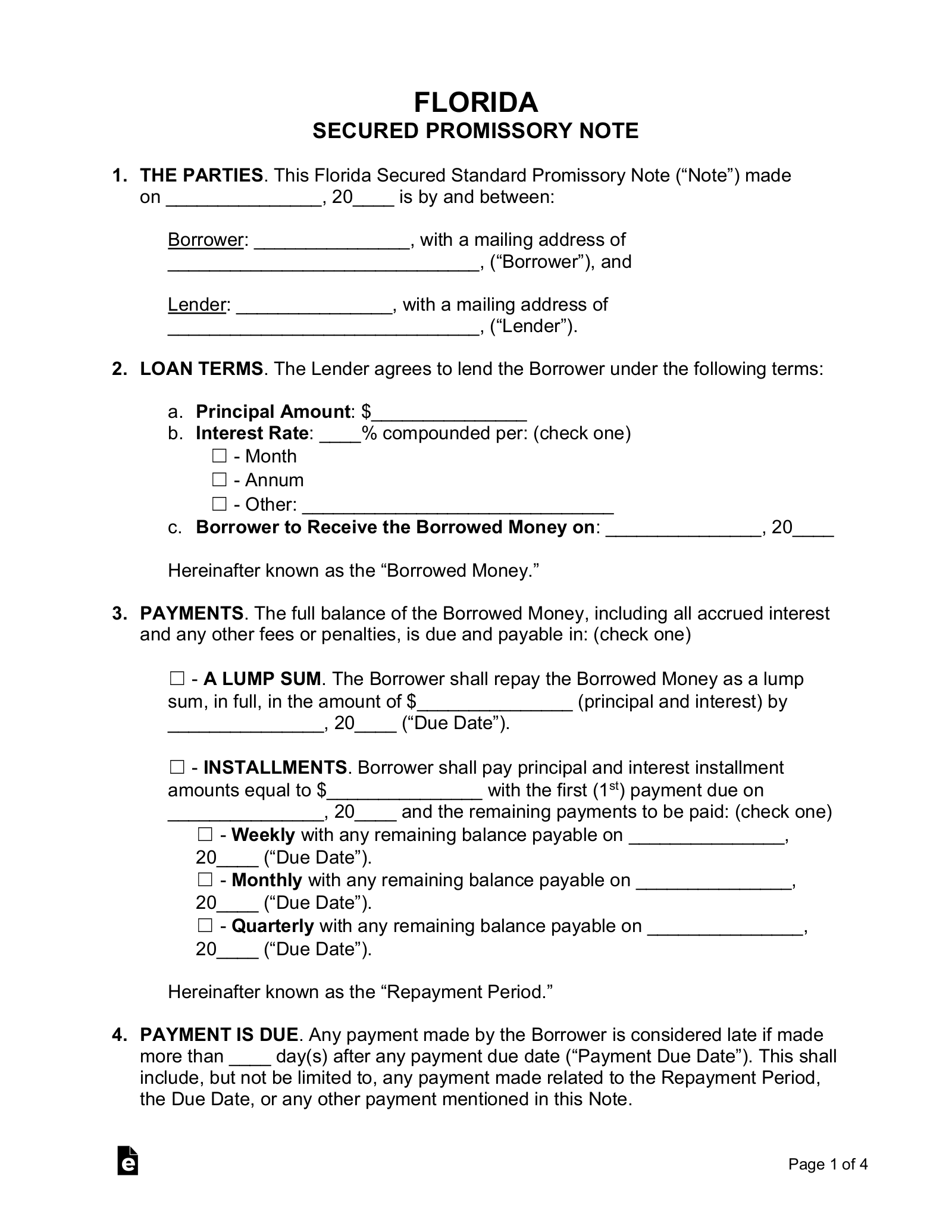

Free promissory note template example pdf word download a blank ms word version of this promissory note or view a completed pdf sample to see what the final draft should look like. The parties may also decide whether or not they want to secure the money with collateral as well as the specific terms of repayment. The florida secured promissory note template is a written contract that is entered into by a lender and a borrower. The florida secured promissory note is an agreement that binds two individuals into a contract to help ensure a loaned balance is reimbursed to the lenderthe lender and borrower will need to come to an agreement on things such as the full balance the final due date of the balance payment types late fees and other topics.

Secured notes differ from unsecured ones in that they are secure due. The note is a written statement by the borrower to promise to pay back the funds within a specific time frame and interest rate. A secured promissory note means that the borrower promises that if they default on the loan the lender is entitled to a piece of collateral mentioned and described in the promissory note.