Genworth Self Employed Worksheet

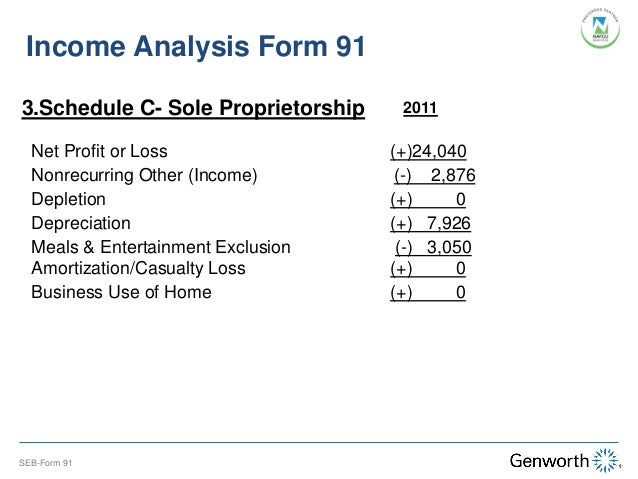

Allowable addbacks include depreciation depletion and other noncash expenses as identified on previous pages.

Genworth self employed worksheet. Irs 1form 1040 line 7 section 53041 d1 review w 2 document page 2 line 1 validate with business returns and irs form 1125 e compensation of ofcers as applicable subtotal of w 2 income from self employment. Recurring capital gains from self employment 5 schedule e supplemental income and loss note. At genworth mortgage insurance our business is about getting people in homes and keeping them there. Genworth mortgage insurance new mi site welcome to your premier mortgage insurance website experience.

Keep your career on the right track our income analysis tools are designed to help you evaluate qualifying income quickly and easily. Genworth self employed worksheet self employed borrower tools collection of downloadable calculators and reference guides to help you with calculating and analyzing the average monthly income of self employed borrowers. Together with our lender partners we help make the dream of homeownership a reality for families across the us. W 2 income from self employment reported on irs forms 1040 and 1120 or 1120s name of business.

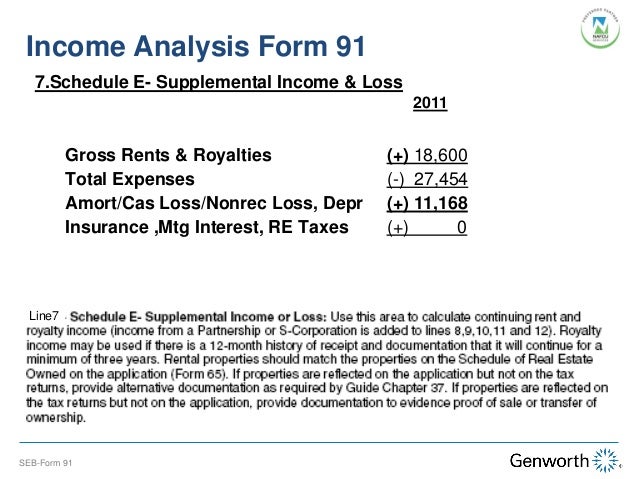

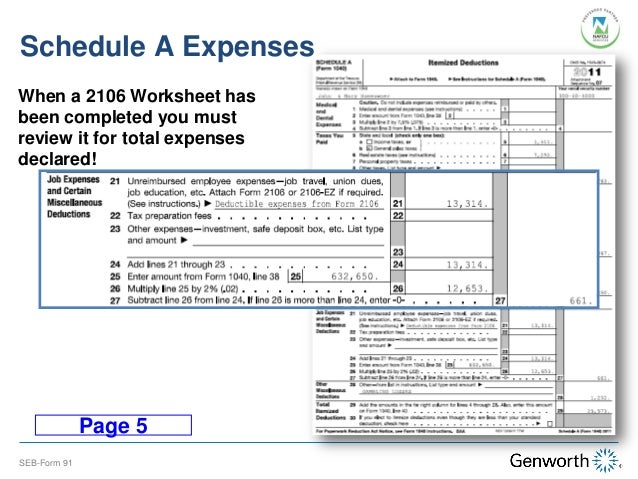

Self employed business types irs form 1040 personal tax return profit and loss statement income analysis forms sole proprietor schedule c adjustments to income non reoccurring income depreciation amortization depletion meals and entertainment genworth resources agenda seb basics 2. Use our pdf worksheets to total numbers by hand or let our excel calculators do the work for you. A typical profit and loss statement has a format similar to irs form 1040 schedule c. Royalties received line 4 b.

Total expenses line 20. Selfemployed borrowers business only to support its determination of the stability or continuance of the borrowers income. A lender may use fannie mae rental income worksheets form 1037 or form 1038 or a comparable form to calculate individual rental income loss reported on schedule e. Determining a self employed borrowers income isnt always straightforward.