Government W2 Forms Printable

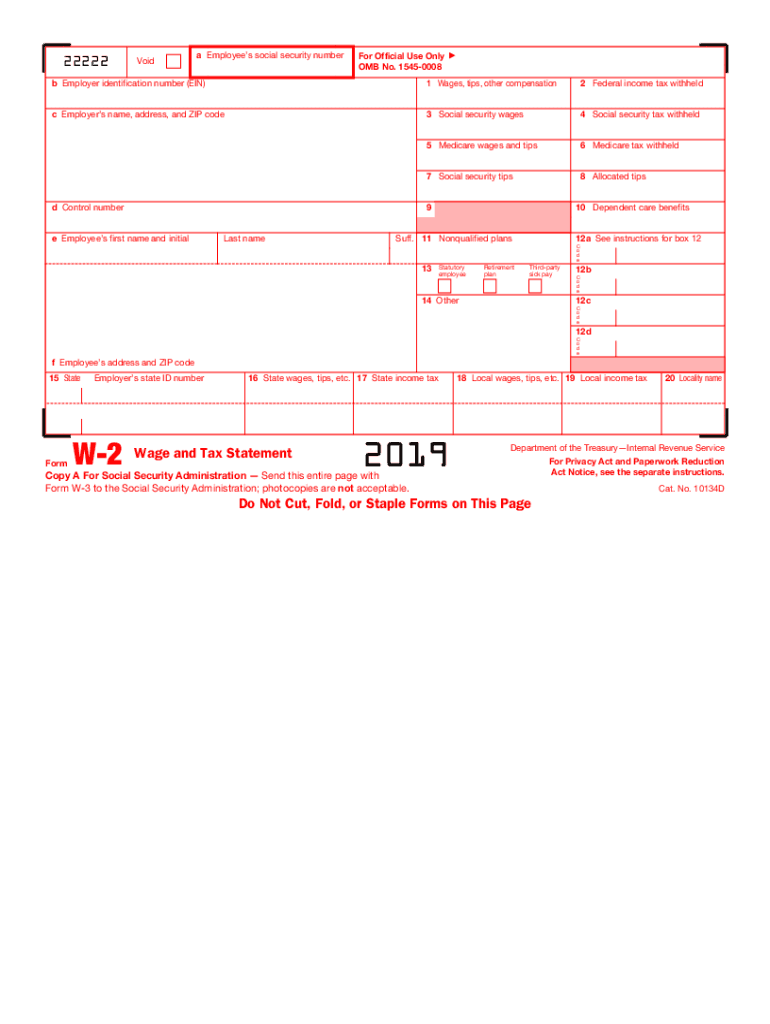

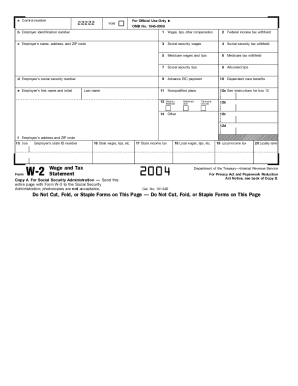

Publication 1141 general rules and specifications for substitute forms w 2 and w 3 laser printed forms.

Government w2 forms printable. It is used as part of the information required to prepare a personal income tax return for employed individualsif anything assuming you are a new employee he. Print and file copy a downloaded from this website with the ssa. Form w 4p withholding certificate for pension or annuity payments. Form w 3 transmittal of wage and tax statements.

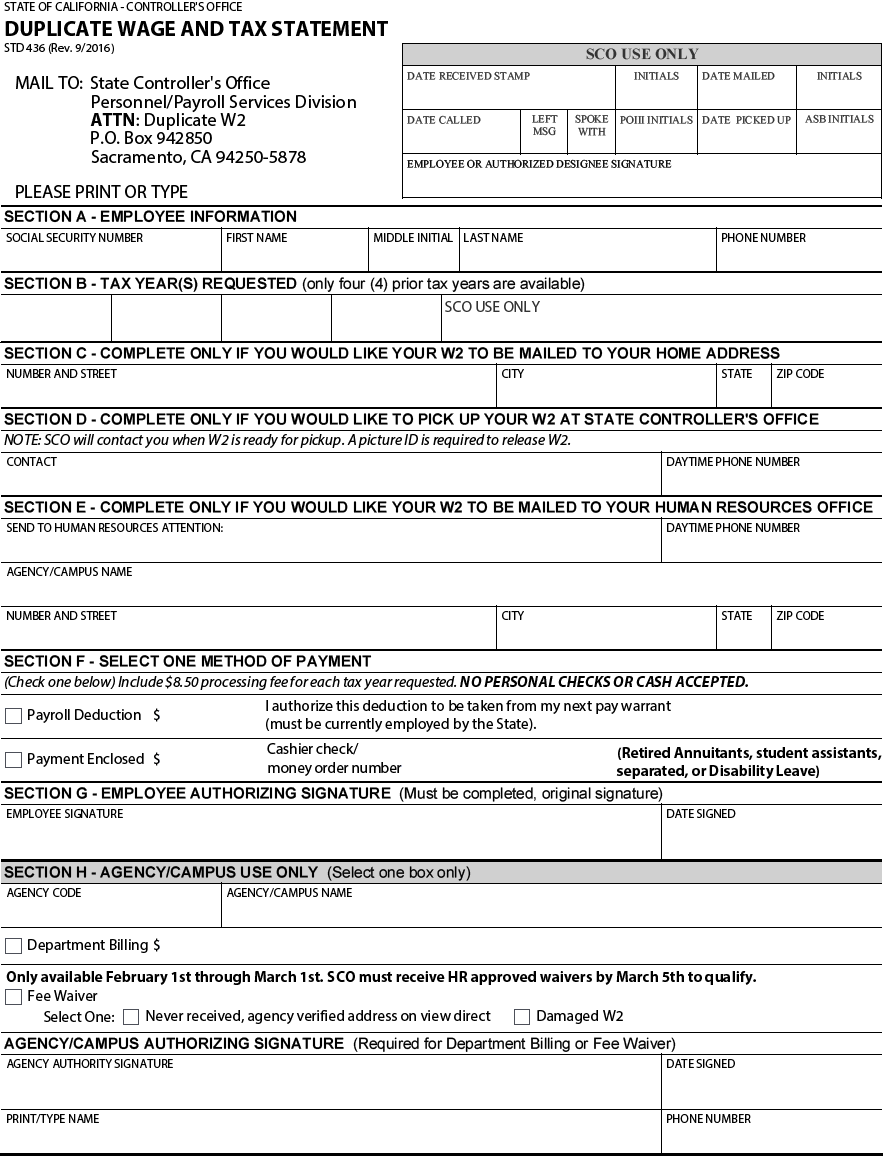

Copy a of this form is provided for informational purposes only. Click the name of the agency that publishes the form youre looking for. For tax year 2018 you will no longer use form 1040a or form 1040ez but instead will use the redesigned form 1040. Purpose of form complete form w 4 so that your employer can withhold the correct federal income tax from your pay.

Every employer engaged in a trade or business who pays remuneration including noncash payments of 600 or more for the year all amounts if any income social security or medicare tax was withheld for services performed by an employee must file a form w 2 for each employee even if the employee is related to the employer from whom. Copy a appears in red similar to the official irs form. Form 940 employers annual federal unemployment tax return. Where to file paper w 2w 2cs.

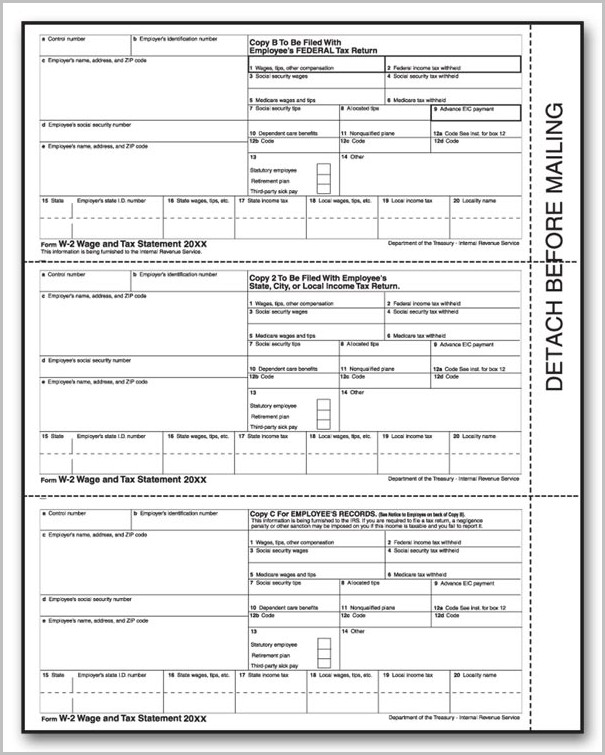

If too much is withheld you will generally be due a refund. You must print these blank paper w 2 forms using black ink. Many people will only need to file form 1040 and no schedules. Us individual income tax return.

You may print government accepted black and white laser w 2 copy a and w 3 forms on plain paper there is no need to buy preprinted red w 2 copy a or w 3 forms. Postal service or a private carrier such as fedex or ups. Annual income tax return filed by citizens or residents of the united states. Form w 4 employees withholding certificate.

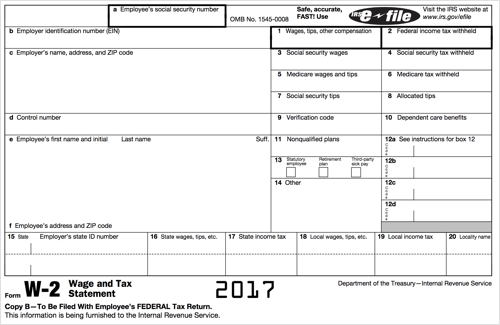

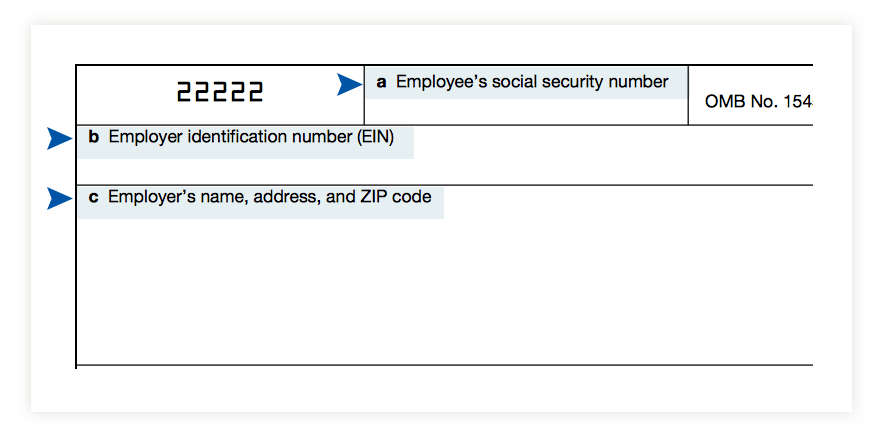

Complete a new form w 4 when. The official printed version of this irs form is scannable but the online version of it printed from this website is not. Form w 2 wage and tax statement. A w 2 form is issued to all employees at the end of a calendar year which summarizes all of an employees earnings and related income tax deductions made throughout the year.

If too little is withheld you will generally owe tax when you file your tax return and may owe a penalty. The irs requires the use of perforated paper for any employee copy w 2 that is printed on plain paper. Select the appropriate mailing address depending on the type of w 2 and the carrier you choose eg us. Form w 2ccorrected wage and tax statement.

Form w 2 must contain certain information including wages earned and state federal and other taxes withheld from an employees earnings. A w 2 form also known as a wage and tax statement is a form that an employer completes and provides to the employee so that they may complete their tax return.