Home Office Deduction Worksheet

Alternatively teresa could seek reimbursement from her employer.

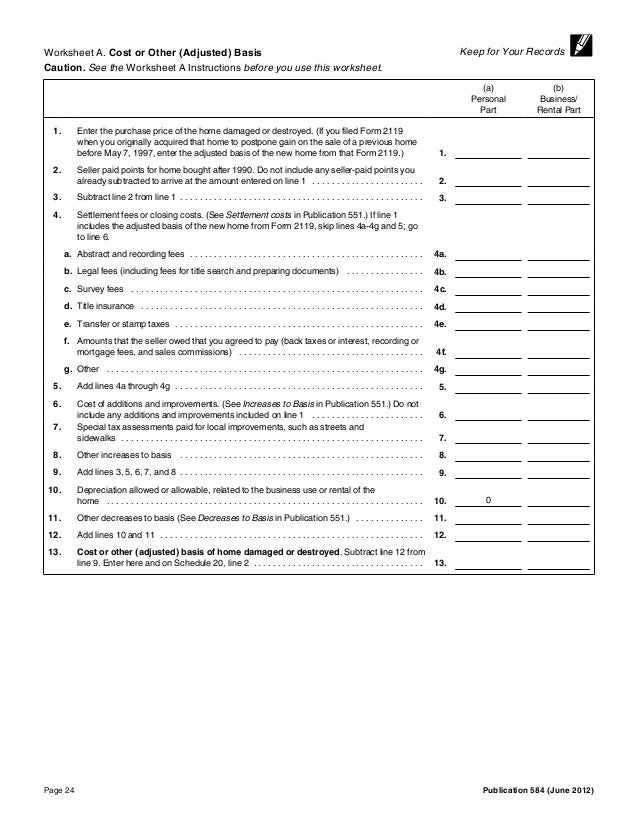

Home office deduction worksheet. When figuring the amount you can deduct for the business use of your home you will use either your actual expenses or a simplified method. Enter the amount from schedule c line 29 plus. Where to report home office expenses use the following worksheets to report home office expenses according to the taxpayers employment status andor business ownership. A fillable pdf what you are viewing now and an online digital form.

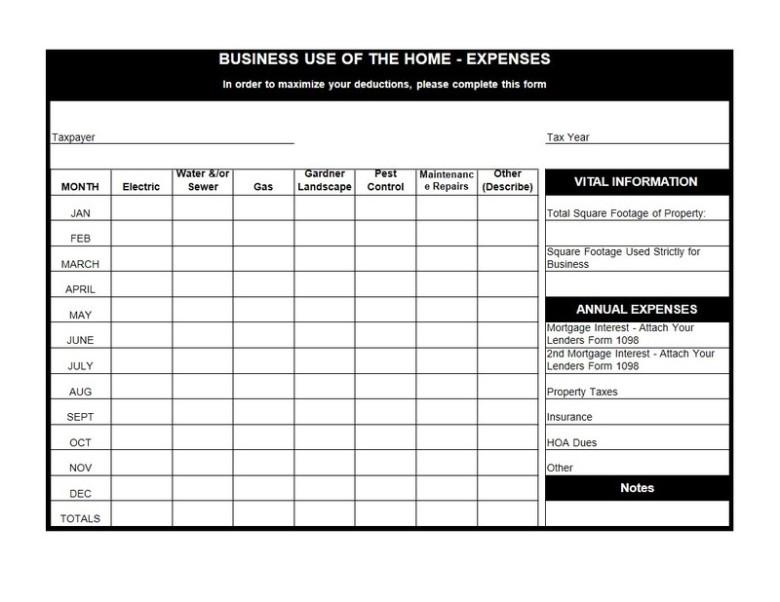

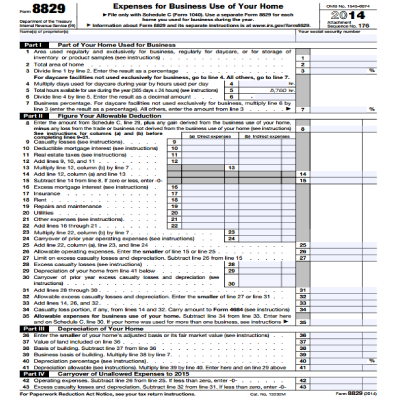

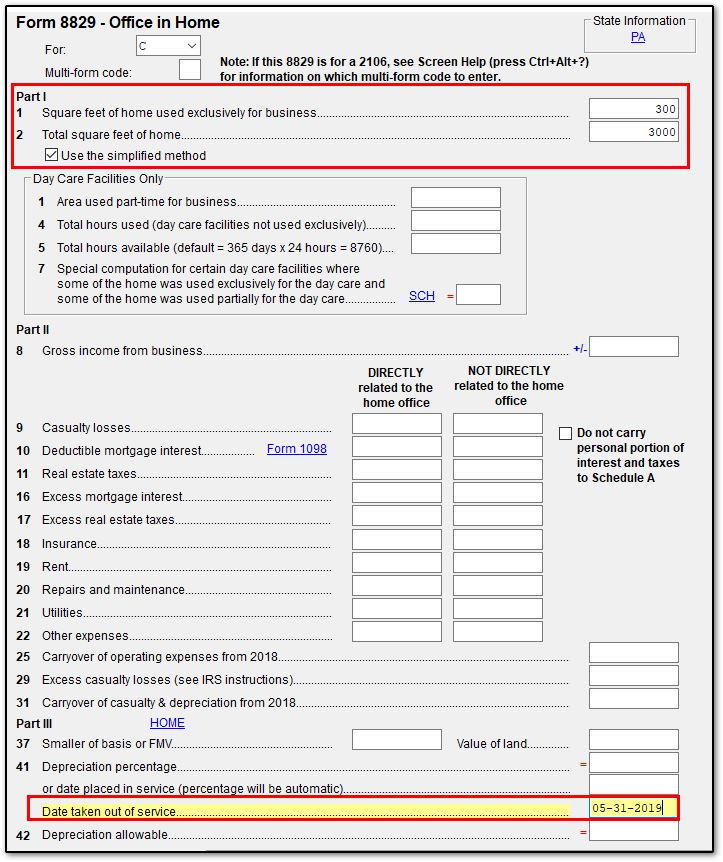

So if you use a whole room or part of a room for conducting your business you need to figure out the percentage of your home devoted to your business activities. See instructions for columns a and b before completing lines 922. Instead you use the worksheet in the schedule c instructions. This six line page with a few sublines for some entries allows you to deduct the square footage of your home office at 5 per square foot up to a maximum 1500.

There are two versions of this worksheet. Home office deduction worksheet please use this worksheet to give us information about your home office for preparation of your tax returns. Generally when using the regular method deductions for a home office are based on the percentage of your home devoted to business use. Home office deduction worksheet.

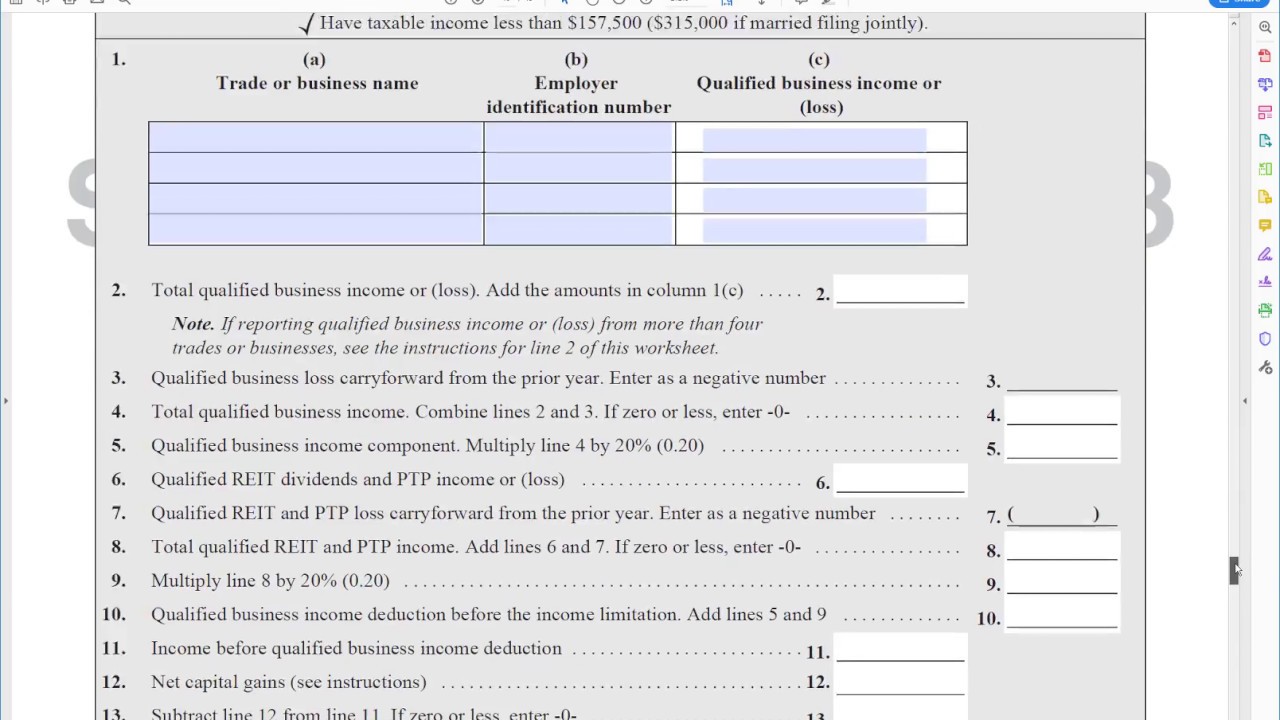

Figure your allowable deduction. As a statutory employee. Schedule c form 8829 worksheet. After you determine that you meet the tests under qualify ing for a deduction you can begin to figure how much you can deduct.

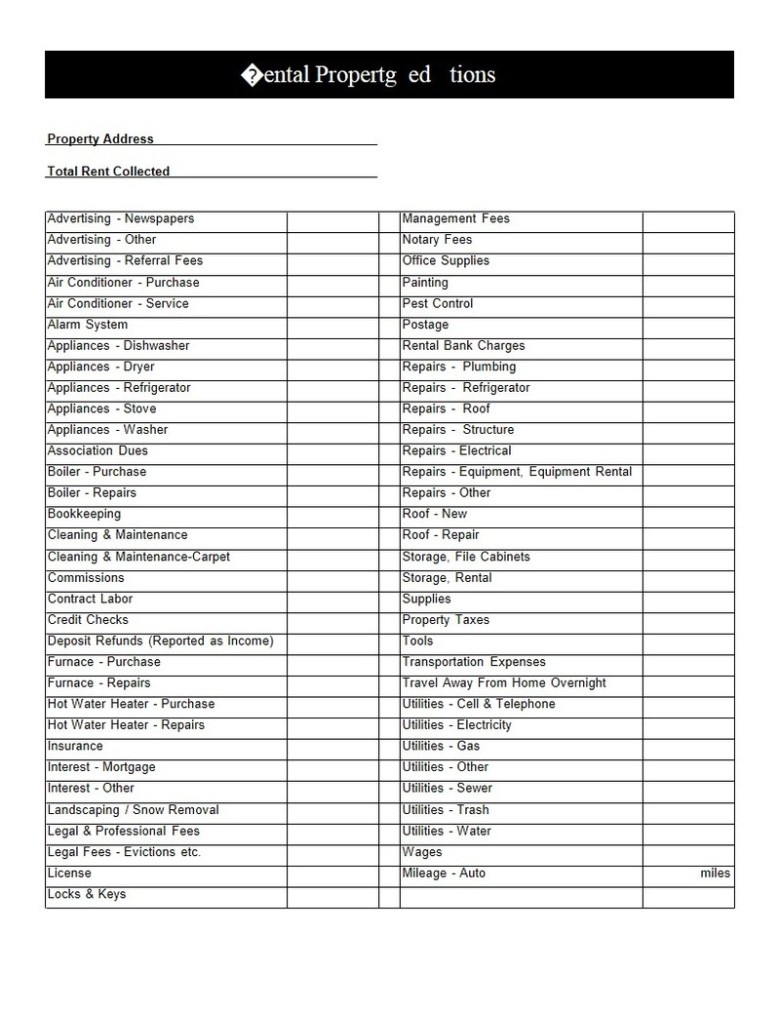

You cannot deduct more than 10000 5000 if married filing separate of your total state and local taxes as an itemized deduction on schedule a including real estate taxesthe amount that you can enter on the worksheet to figure the deduction for business use of your home line 7 may not be the full amount of real estate taxes you paid. Examples include your utility bills mortgage interest or rent insurance hoa real estate taxes repairs pest control trash removal security and maintenance. Deduction for home office use of a portion of a residence allowed only if that portion is exclusively used on a regular basis for business purposes same allowable square footage of home use for business not to exceed 300 square feet. Indirect expenses are required for keeping up and running your entire home.

Teresas home office deduction of 1880 after the 2 of agi threshold would reduce her federal income tax by 1880 x 25 470. Any loss from the trade or business not derived from the business use of your home see instructions 8. Electing to use the simplified method. If her employer reimbursed teresa 2880 for the business use of her home that 2880 would be tax free.

Requirements to claim the home office deduction. As an employee.