How To Write Receipts For Self Employment

So if you have 100000 in self.

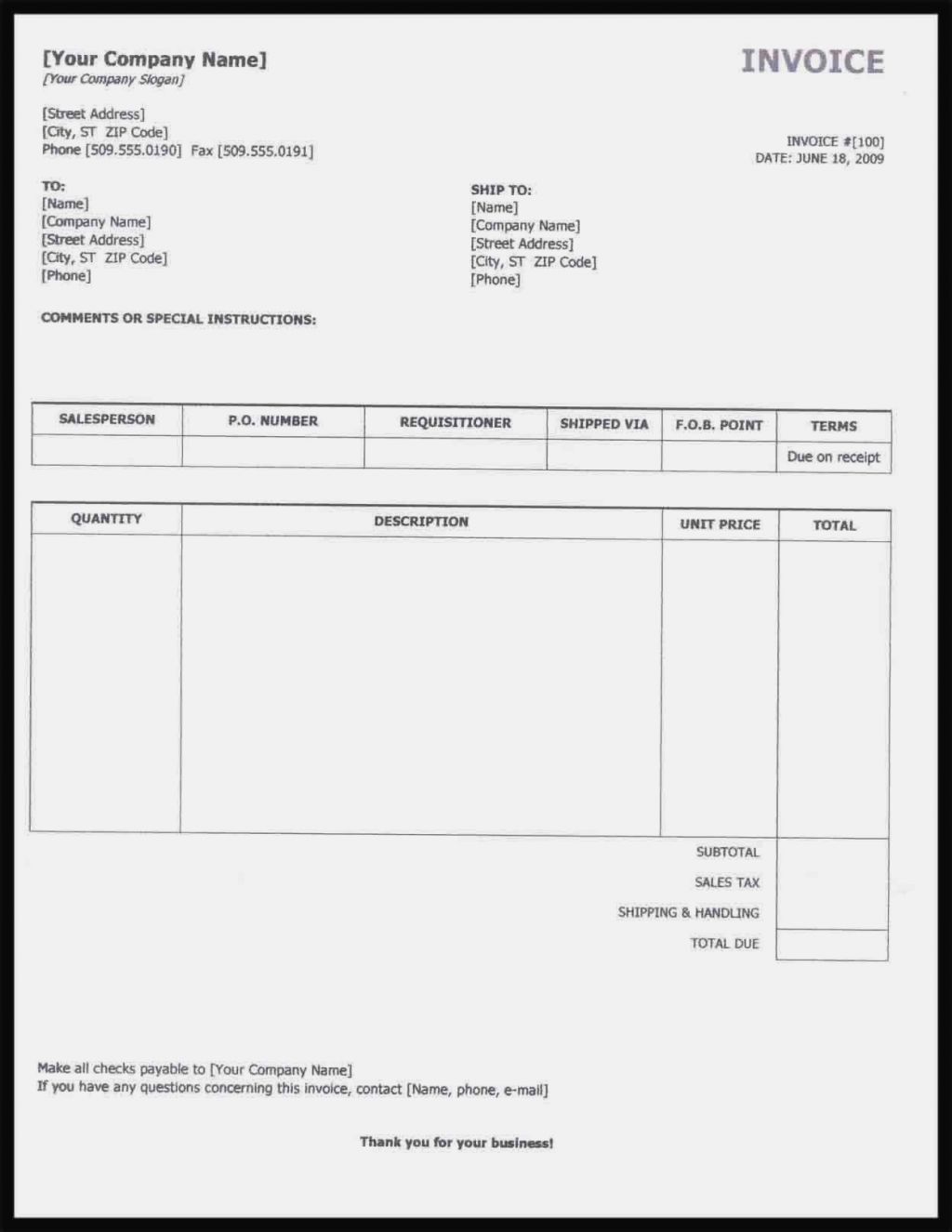

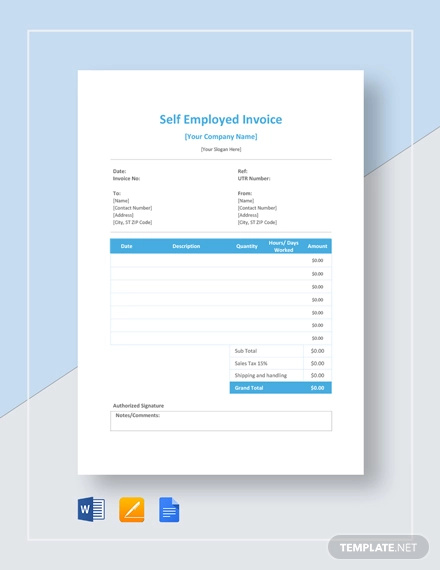

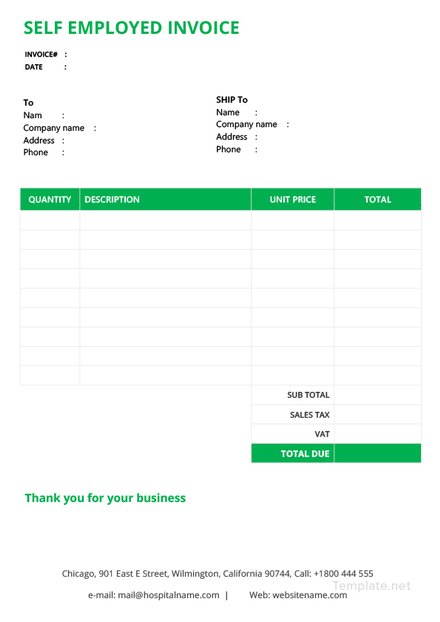

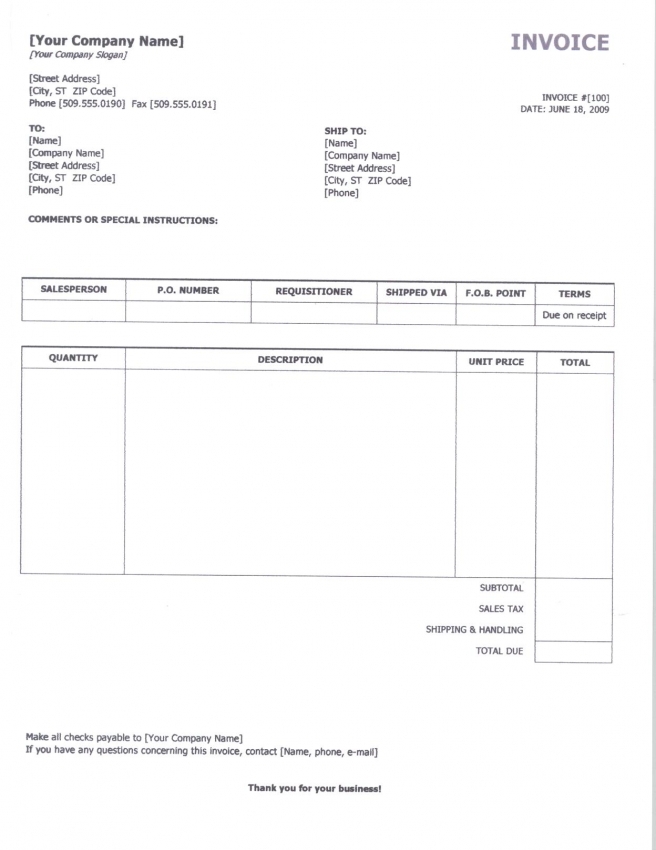

How to write receipts for self employment. Luckily showing proof of income as a self employed individual is a lot easier than most realize. When youve completed a job a receipt is your link to receiving payment but paying for. With the self employed invoice template from freshbooks you can invoice your clients the right way. A self employed invoice in the simplest sense is an invoice intended for self employed people.

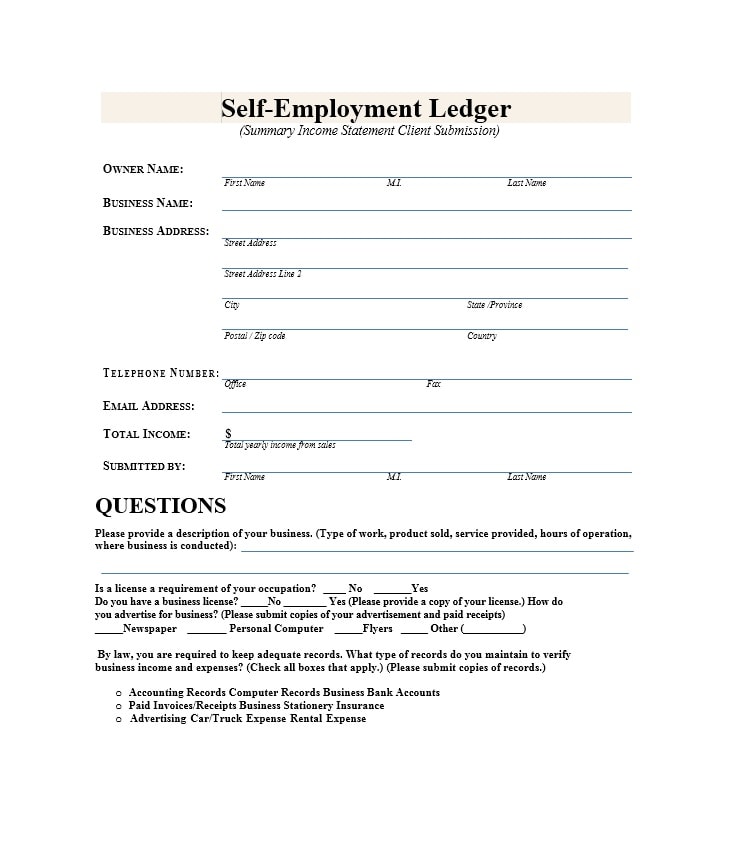

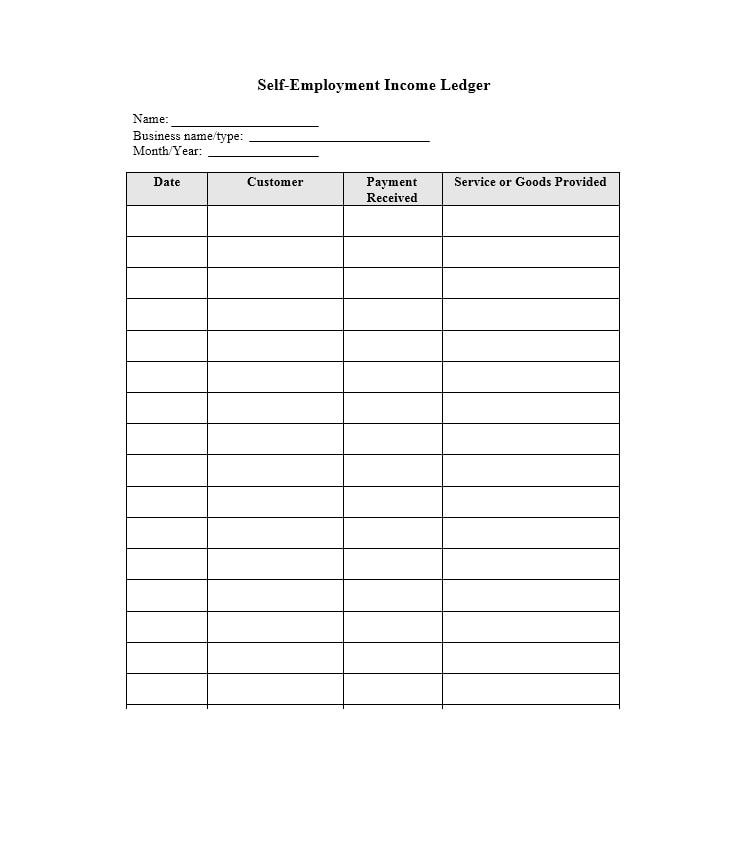

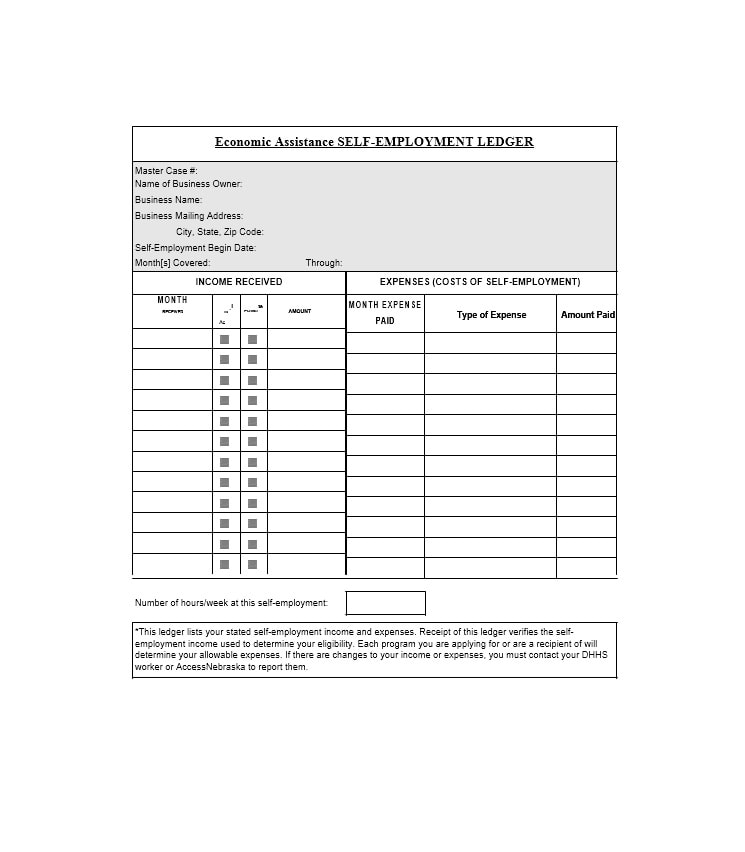

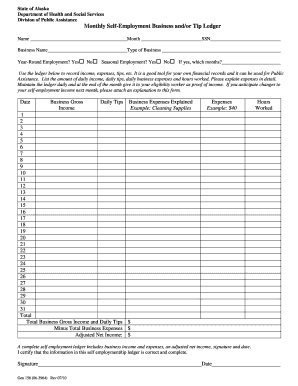

Self employment refers to the status of someone who runs her own business and is therefore her own employer. What is a self employed invoice. For example you can say im a self employed freelance photographer. For further completing the self employment ledger form write down all accepted business expenses monthly expenditure.

If you need to write a letter to provide proof of income make sure to include details about your basic income like how much you make and how you earn it. While most self employed people celebrate the first two they cringe at the latter especially at tax time. With self employment comes freedom responsibility and a lot of expense. Are you looking for a simple way to create invoices for your business.

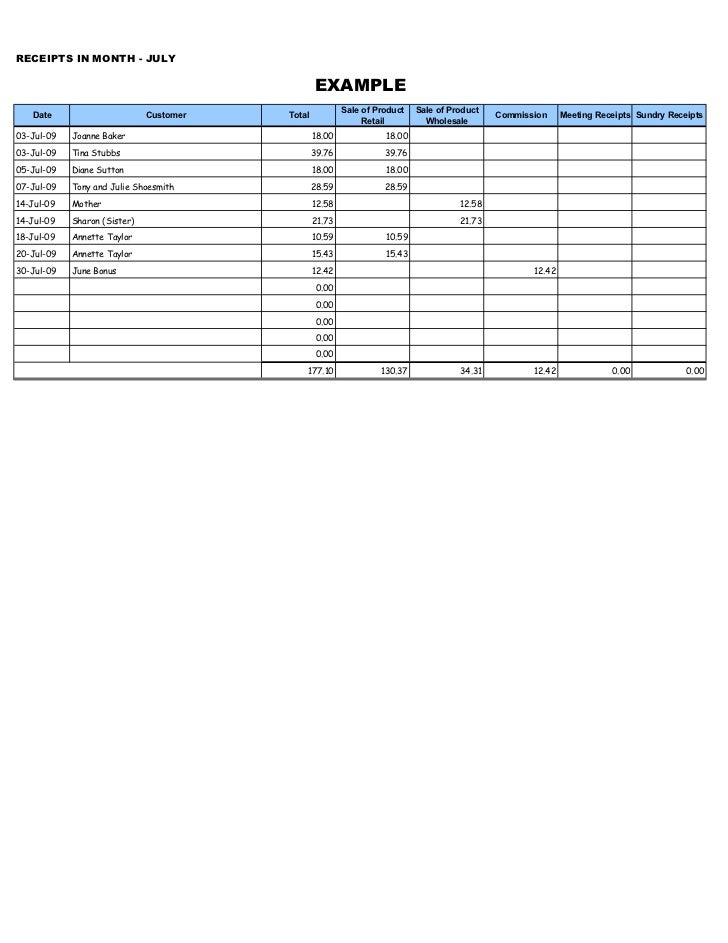

Self employed business owners need to create and offer receipts to their customers for. Along with potentially having to pound the pavement for work as a self employed professional people who serve as their own bosses also have to serve as their own collection agents. Keeping your tax returns profit and loss statements and bank statements all in the same place will make proving your income easier down the road. How to make a receipt when self employed.

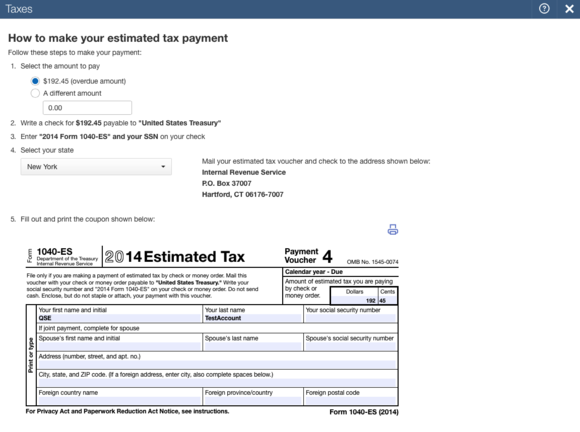

I have been in this line of work for 12 years and self employed for the past 6 years. Tools machinery or equipment used and other long lasting commodities and the rate of real work done. Accepted business expenses could be deducted from your self employment income. The income thresholds for additional medicare tax apply not just to self employment income but to your combined wages compensation and self employment income.

They might not be aware of some of the tax write offs to which they are entitled. Get your free self employed invoice template. In addition to thisverification of employment letters is often done by the banks while they demand proof of income letter. The most important thing to keep in mind when proving your income is to keep constant documentation.

The same is reconciled with the records and the tax is calculated. Create professional invoices that are detailed and made for freelancers and self employed business owners like you.