Insurance Cost Comparison Worksheet

Use the health insurance information provided to you by the insurance company to fill in the worksheet.

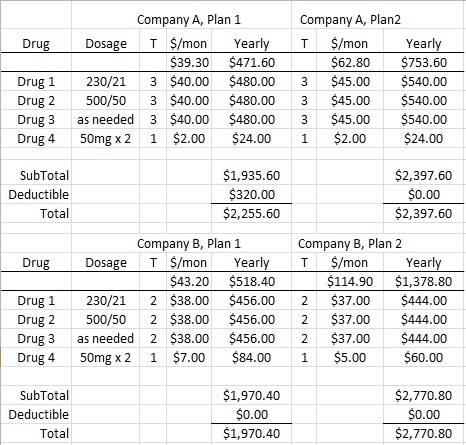

Insurance cost comparison worksheet. Note that amounts that you pay for health insurance are tax deductible we will be adjusting everything to final post tax dollars later on. You have to decide whether the savings on premiums during healthy years and the additional personal savings you can but might not sock away as a result make a low cost. Exact assisted living costs depend on the community and what services you need. Call the insurance company for more information if you cant find the answers in their written papers.

Yes no yes no yes no worksheet continued on next page health plan cost comparison worksheet. My health insurance comparison worksheet this worksheet will help you compare three health insurance options. Along with the co pay co insurance is a cost sharing mechanism designed to encourage consumers to play a role in managing health care costs. Health insurance comparison worksheet.

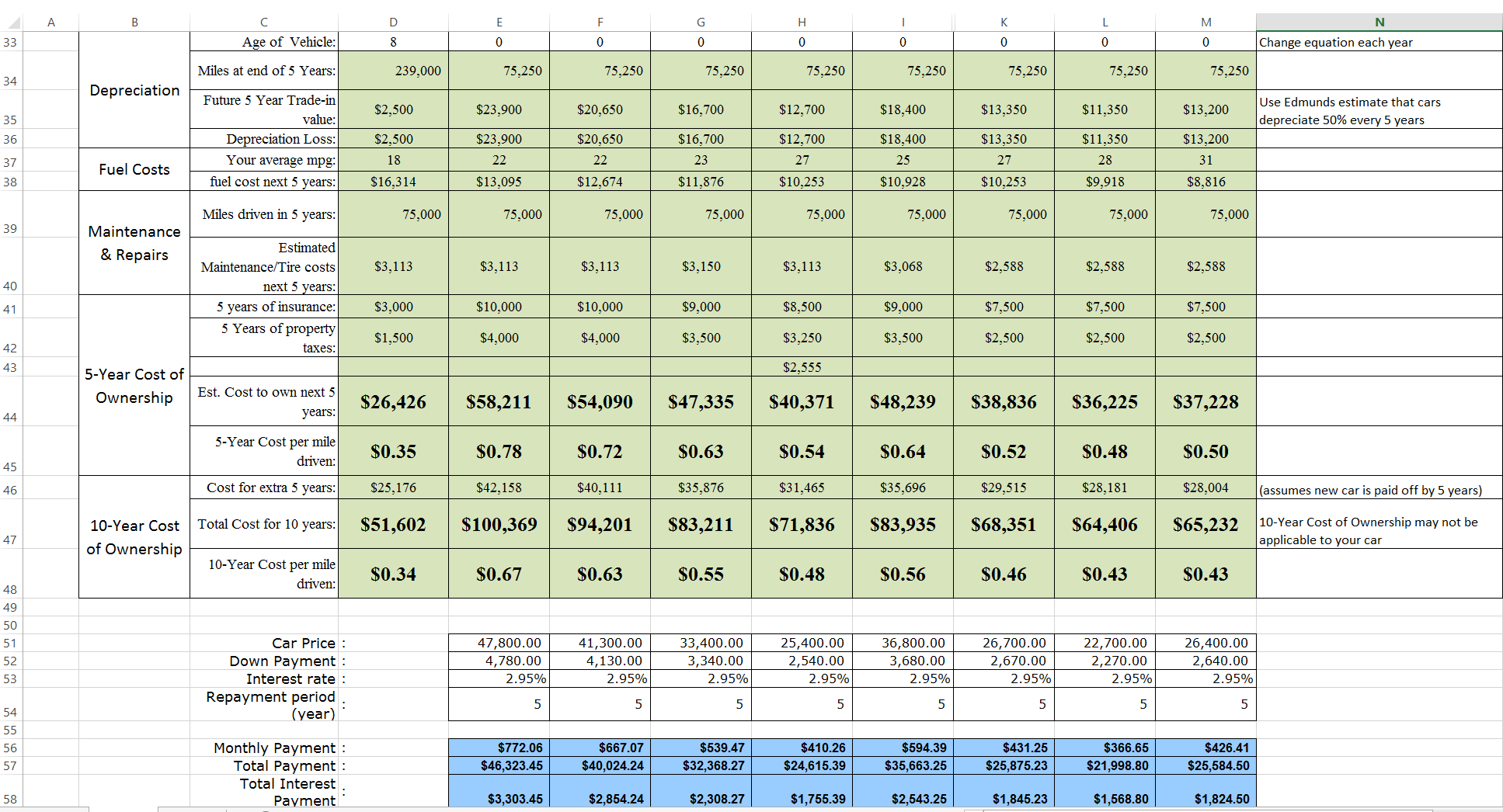

For example if costco sells a package of 25 pens for 450 and walmart sells a package of 5 pens for 125 you can enter the price as the unit price. Out of pocket oop maximum the oop maximum is the most we have to pay in one year for health care expenses not including our premiums. Best for you this worksheet will help you compare options. Shopping for auto insurance companypolicy comparison worksheet use this worksheet to help you gather information about insurance companies and the homeowners insurance policies they sell.

Cost comparison worksheet use the worksheet below to determine how much you or your parent is already spending each month while living at home. Buy the lowest premium insurance you can find that protects you from spending levels that could significantly damage your savings your life and your lifestyle. 45025 for costco and 1255 for walmart. Annual physical exam copays andor co insurance annual routine pediatric care copays andor co insurance annual immunizations3 copays andor co insurance major medical do you have a copy of the plans provider list.

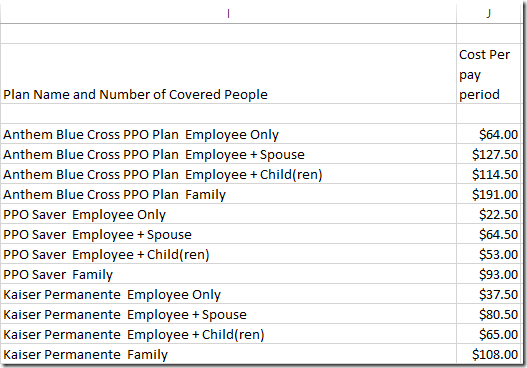

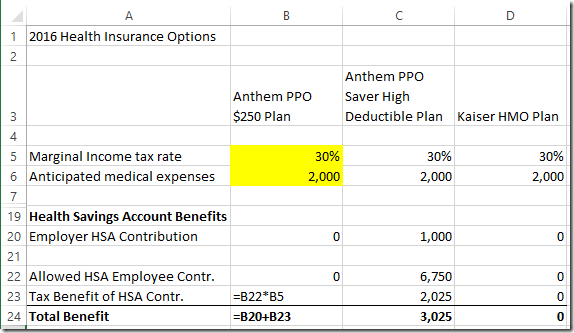

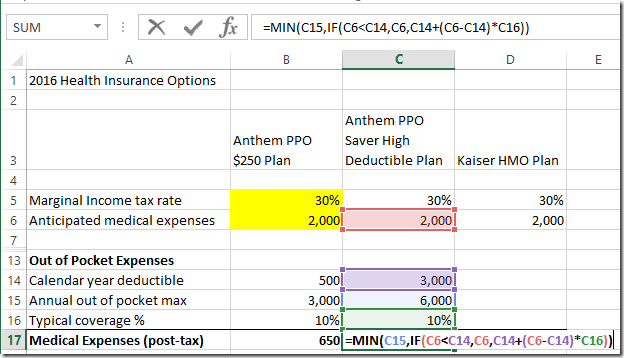

Building a spreadsheet can help someone compare the costs and benefits of each of the plans under a variety of different assumptions about tax rate and healthcare expenditure. Use the information provided by each insurance company to fill in the worksheet. For a more accurate cost comparison you may want to list the unit price. How much each plan costs usually these are quoted per pay period ie.

Hsas are tax free employee savings accounts to cover deductibles and other out of pocket medical costs. Section1 health insurance planpolicy costs example option 1 option 2 option 3 company name. High deductible plans are often tied to health savings accounts or hsas.