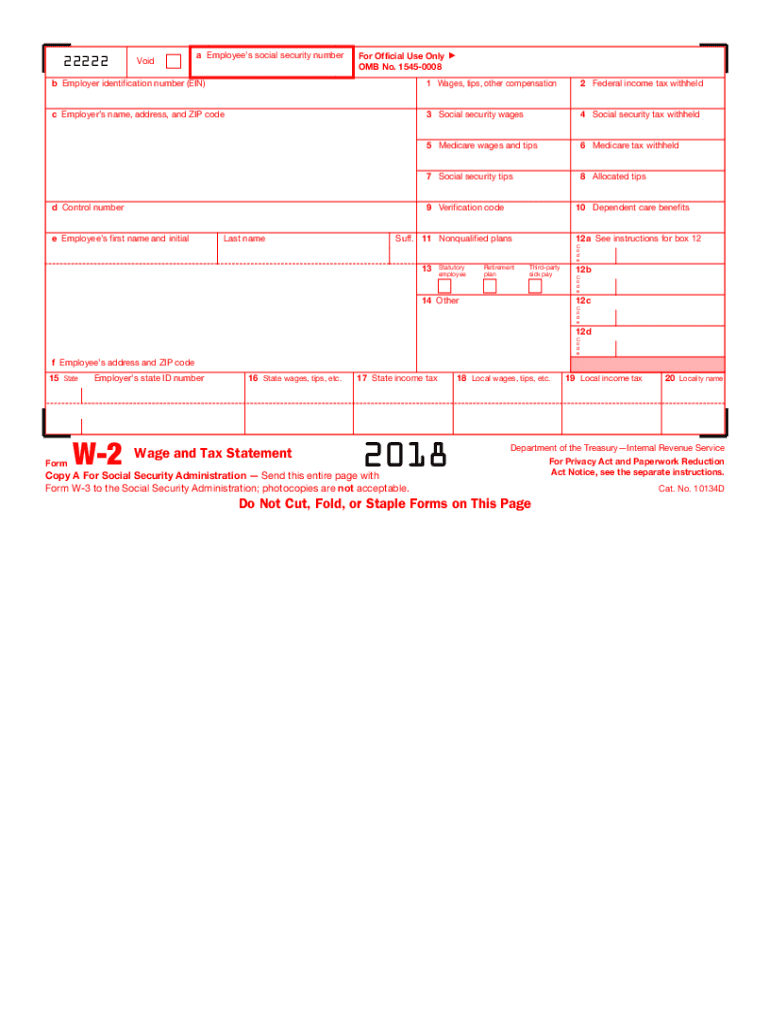

Irs W2 Form 2018 Printable

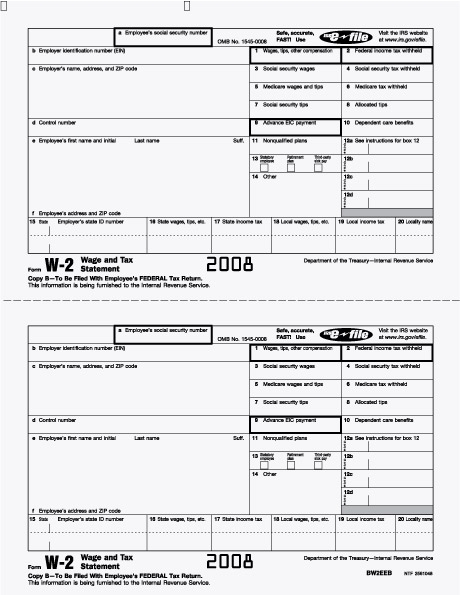

Copy bto be filed with employees federal tax return.

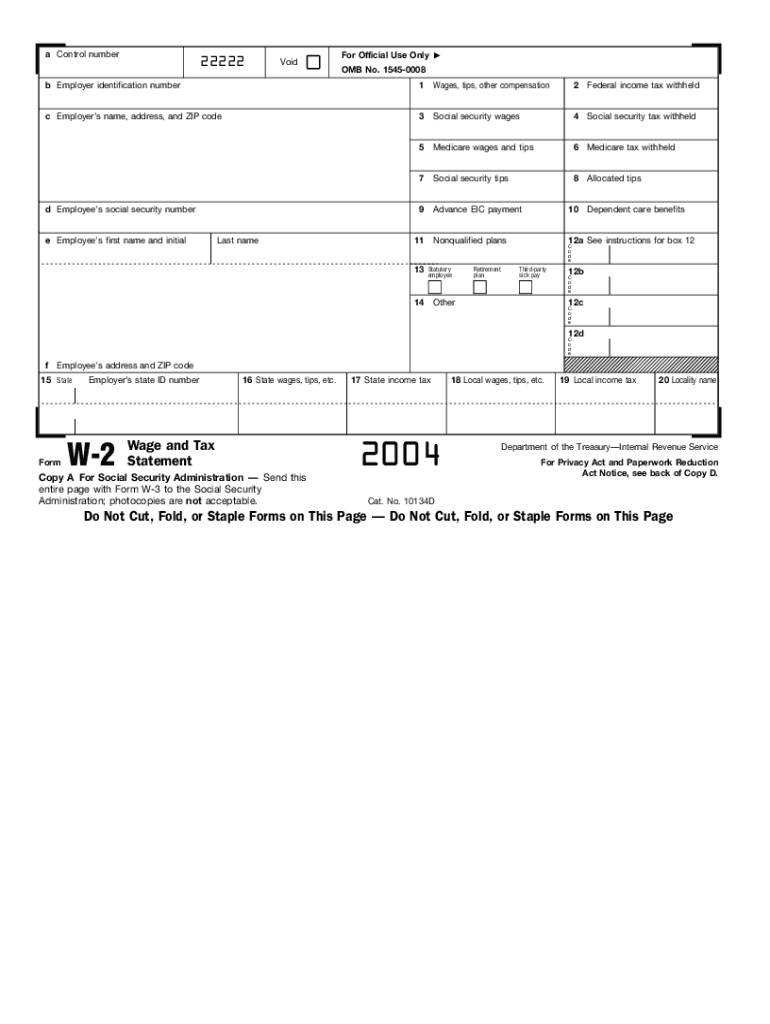

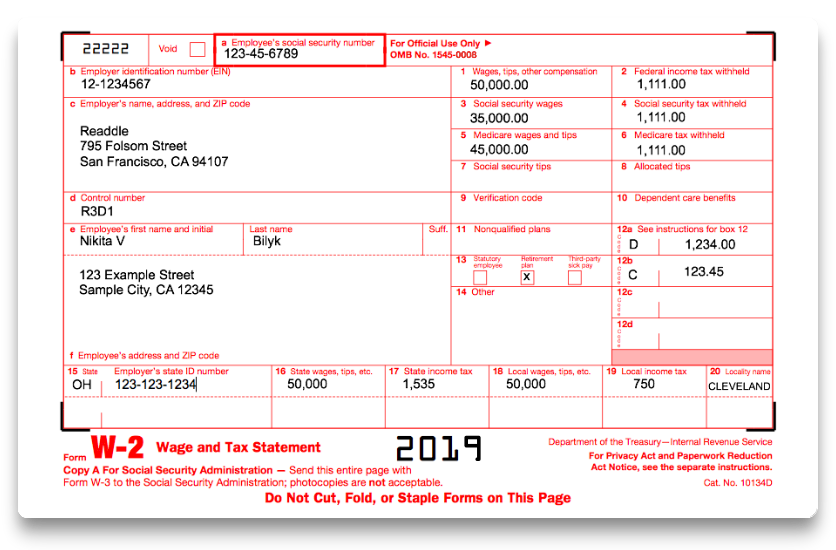

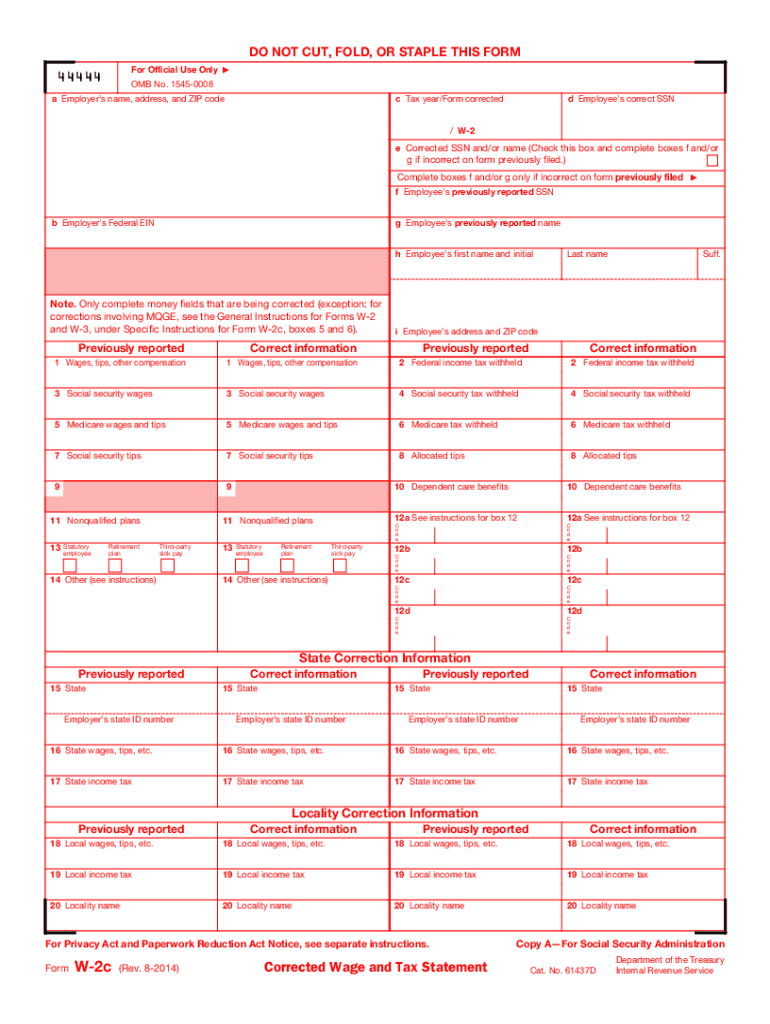

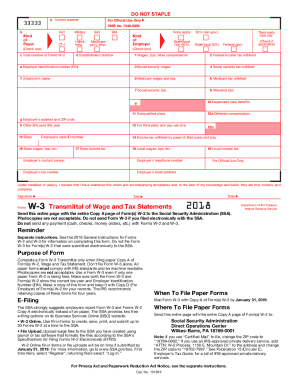

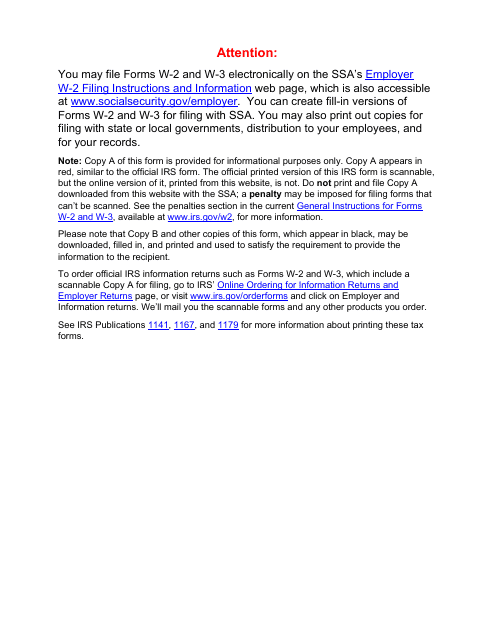

Irs w2 form 2018 printable. This information is being furnished to the internal revenue service. The latest edition of the form was released in january 1 2018 and is available for digital filing. Allow 75 calendar days for us to process your request. Form w 2 is filed by employers to report wages tips and other compensation paid to employees as well as fica and withheld income taxes.

Copy 1for state city or local tax department. Department of the treasury internal revenue service form also known as the wage and tax statement. See the penalties section in the current. Print and file copy a downloaded from this website with the ssa.

May be imposed for filing forms that cant be scanned. Form 4137 social security and medicare tax on unreported tip income form 8027 employers annual information return of tip income and allocated tips form 8850 pre screening notice and certification request for the work opportunity and welfare to work credits. If you cant get your form w 2 from your employer and you previously attached it to your paper tax return you can order a copy of the entire return from the irs for a fee. Information about form w 2 wage and tax statement including recent updates related forms and instructions on how to file.

Department of the treasuryinternal revenue service. Wage and tax statement. Complete and mail form 4506 request for copy of tax return along with the required fee.

:max_bytes(150000):strip_icc()/Screenshot2018-12-0623.28.52-5c09f72d46e0fb000195b16b.png)