Keeping Receipts Organized

7 tips for keeping receipts organized for tax time scan receipts and keep them at least six years yes the irs can come knocking for documentation and audit you up to six years back in some cases.

Keeping receipts organized. Im talking about those tiny paper receipts we all receive from stores restaurants and gas stations. If your employees ever incur business expenses ask them to turn in an electronic copy of their receipts too. They also fade with time and please dont. Since the cra allows taxpayers to submit scanned documents online theres no downside to scanning your receipts into the computer and keeping image or pdf copies neatly organized on either your hard drive or the cloud.

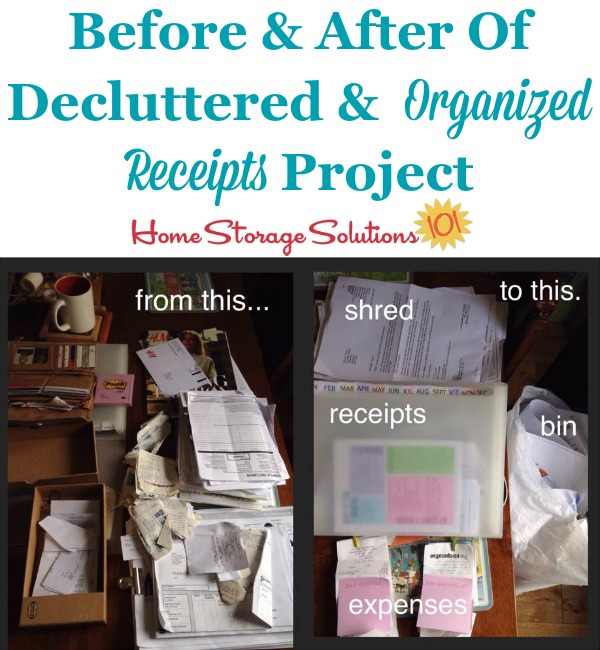

The two most current file folders can sit on top of your desk so that when you collect receipts on your various rounds its easy to pop them into the correct monthly folder. Youre always on the go. Organize receipts inside each folder by date. Keep all your receipts for major purchases tvs computers appliances for warranty dates and to help you resell them later.

Try to keep expenses separated by paying with a business only credit card or bank account when possible and avoid paying in cash. This is especially helpful if youre travelling. Another option is to use a specialized receipt tracking app. One example of keeping business receipts organized is to keep a series of file folders labeled by month and year such as receipts november 2017.

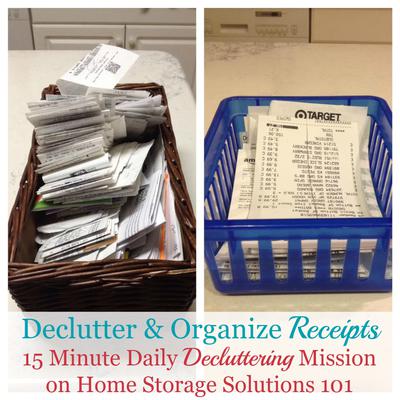

Once you have organized the receipts you already have the trick is to keep all incoming receipts organized. Just send your receipts and shoeboxed will upload them into a personalized online database. Make and affix a label for each category to a section of the expandable folder depending upon your circumstances you may need more than one folder and label the folder for the current year. Now that its january ive decided to finally tackle my receipts and figure out a system that will help me keep them organized and more importantly accounted for.

Another crucial step in organizing your receipts is to stick with the process consistently. Online programs like workful make this process easy for you and your team. Its a good idea to keep a paper copy of each as a backup. Keeping a stack of paper with you the whole way would be a burden.

But as much as i love being organized i just cant get a handle on keeping my receipts organized and it has driven me crazy for years. Ill share how to keep business and personal receipts organized for easy retrieval or for tax and audit purposes. Your workers can submit their receipts and you can approve the expense in seconds. You know the ones that are so tiny they sometimes get lost.