Lending Contract Template

Tidyform provides a large number of free and hand picked simple loan agreement template which can be used for small medium and large sized enterprises.

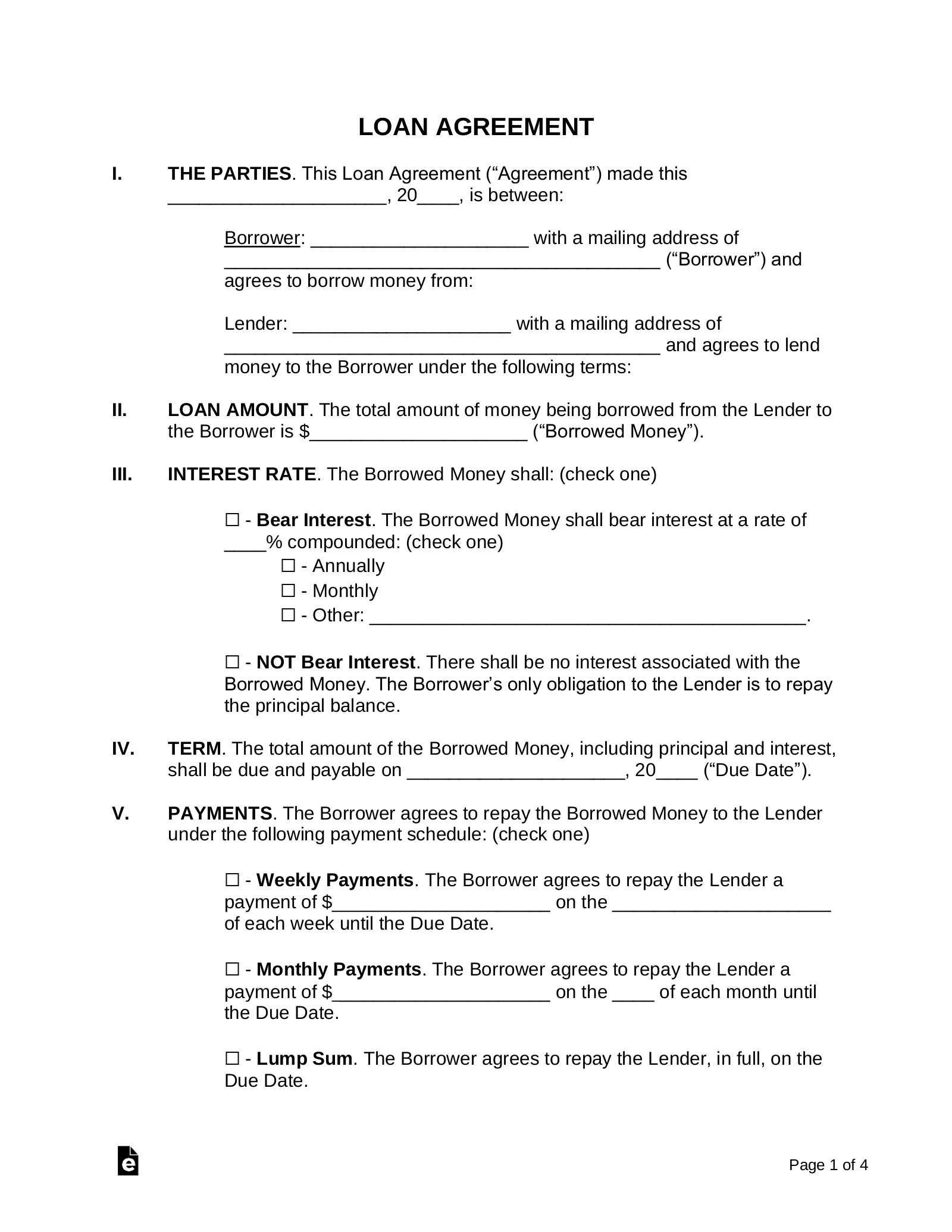

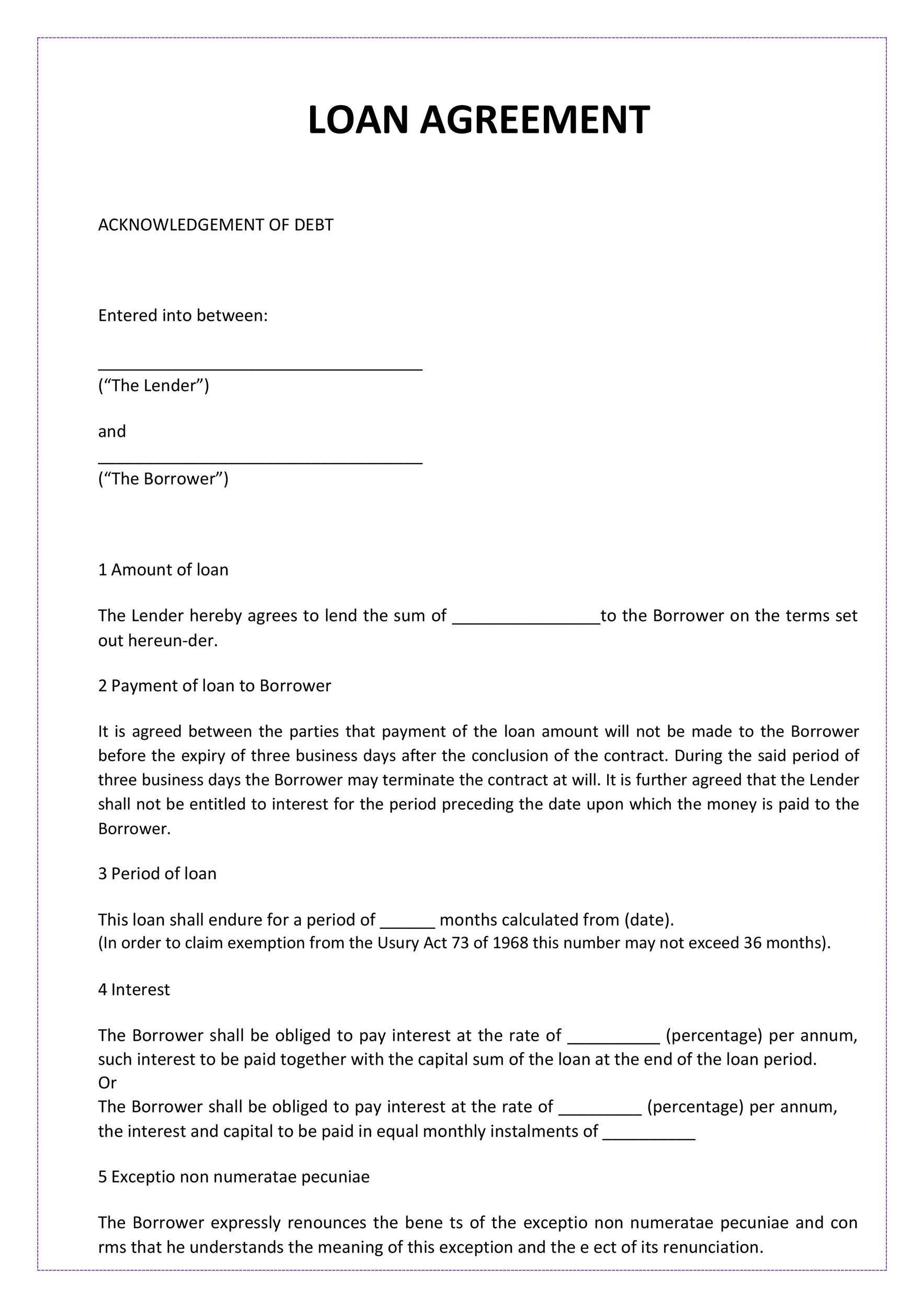

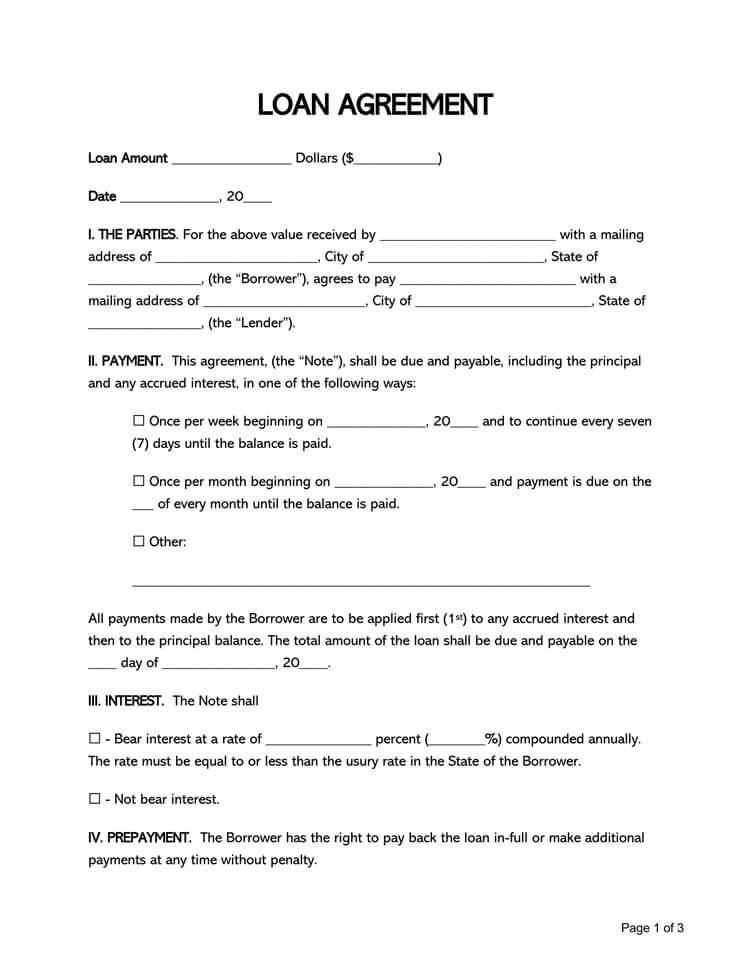

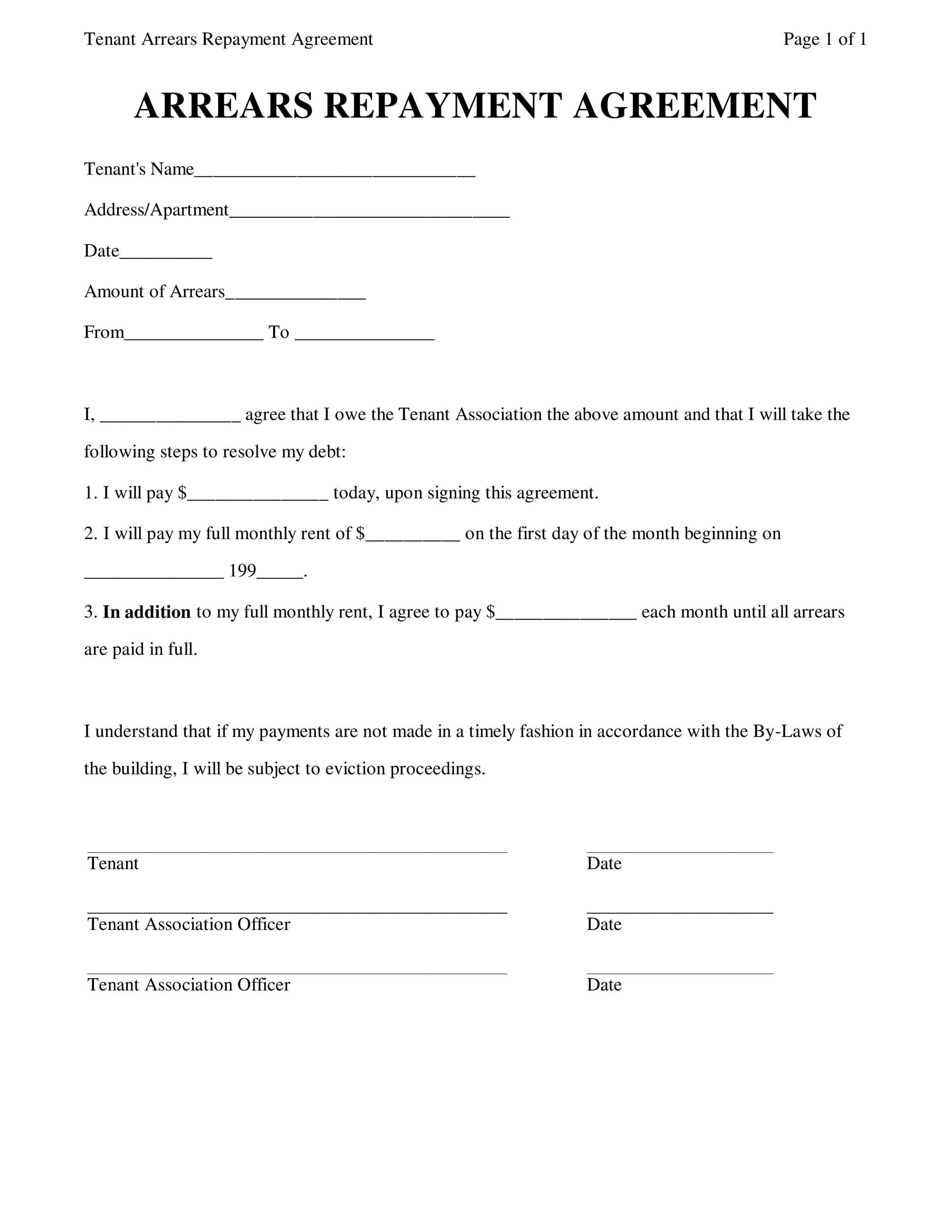

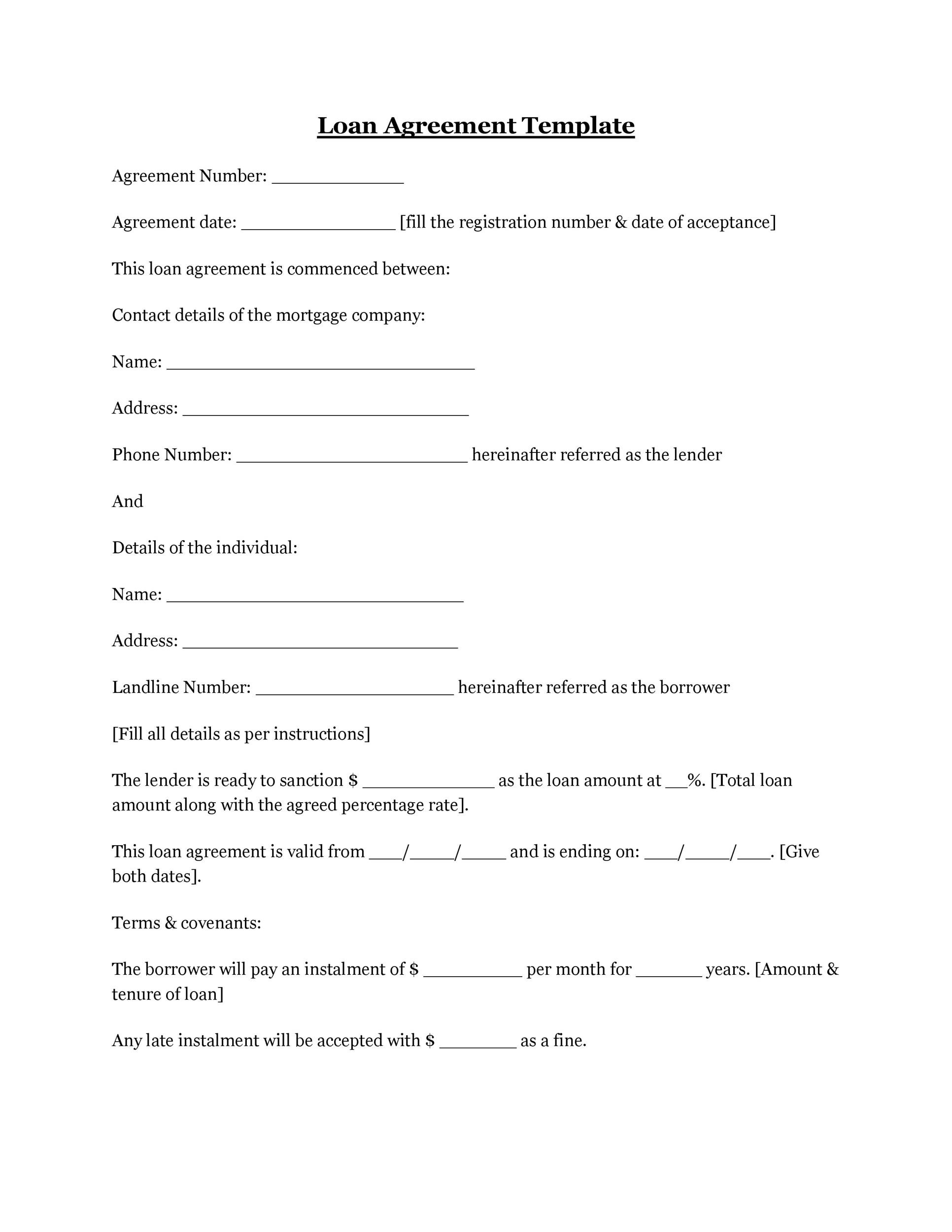

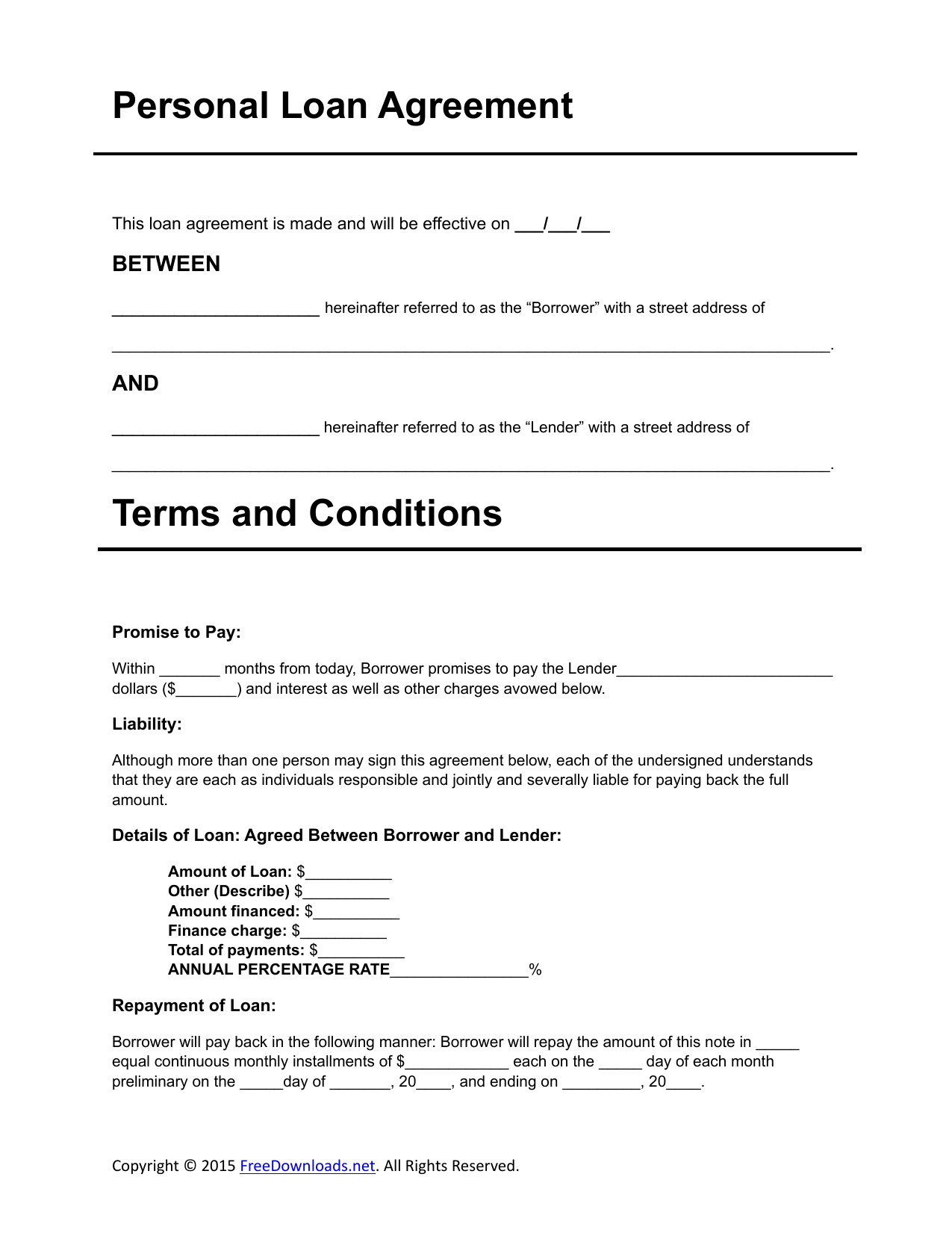

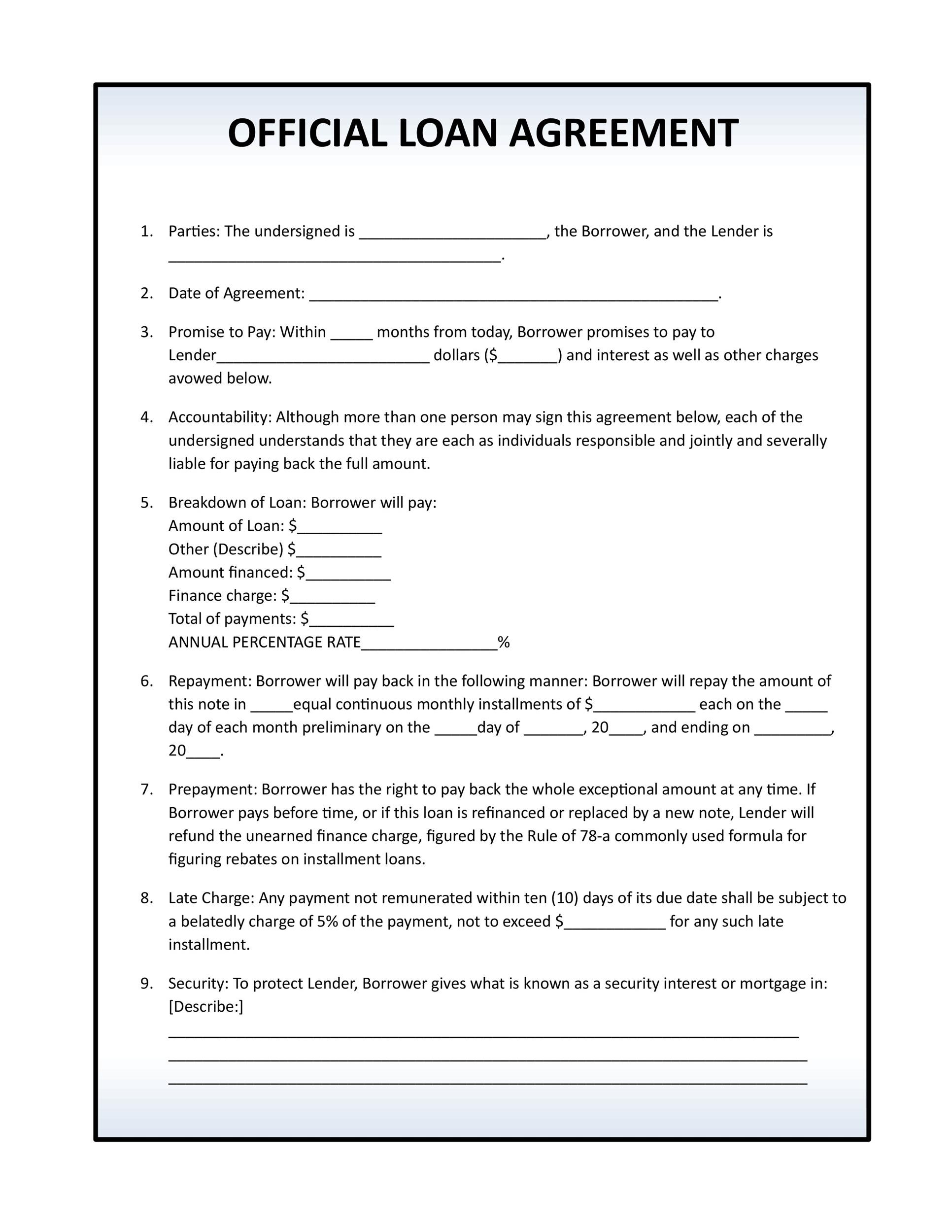

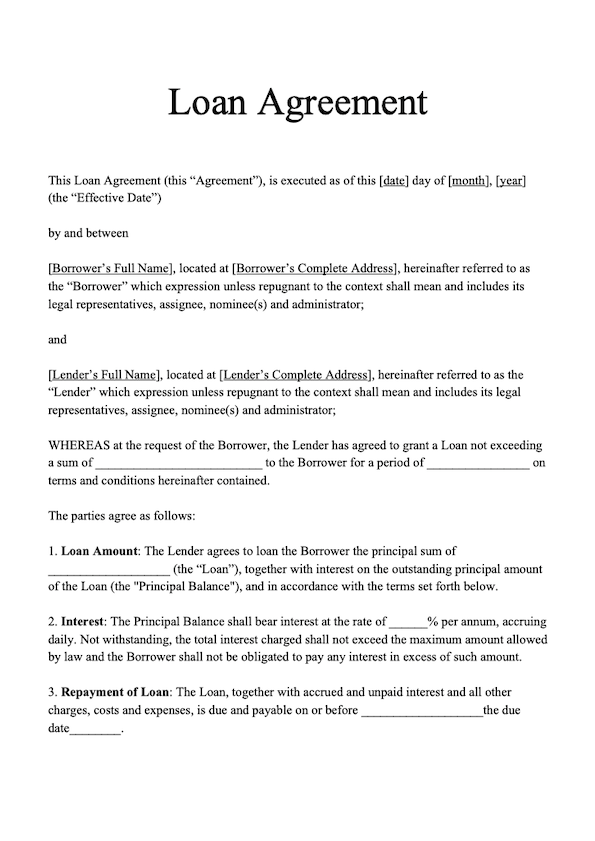

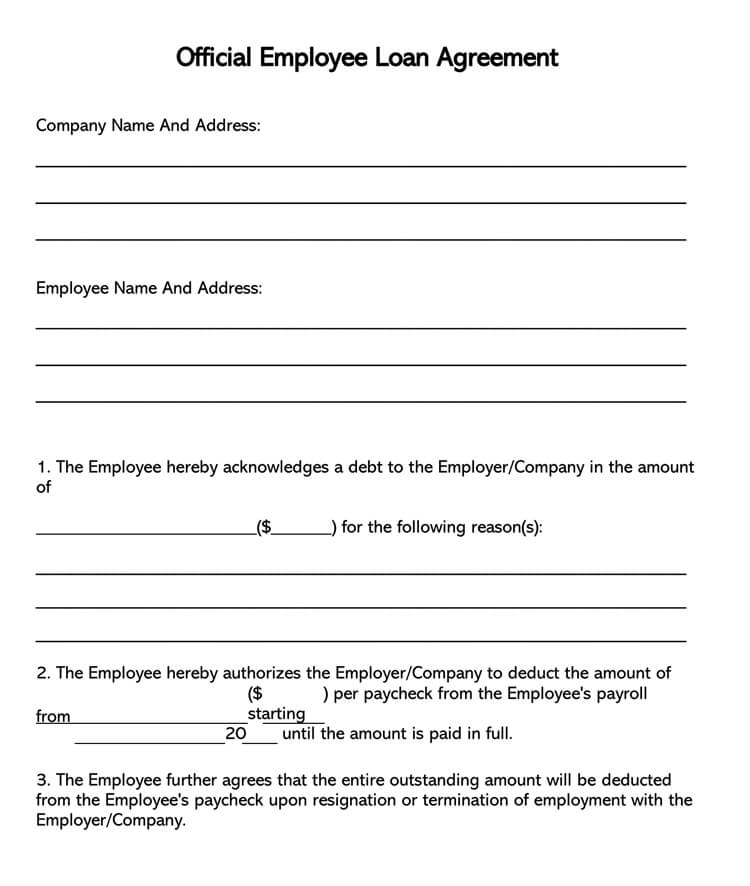

Lending contract template. You can find practical colorful files in word excel powerpoint and pdf formats. The drafting of this document is a careful task. It must include information important to the loan and its repayment. As a lender this document is very useful as it legally enforces the borrower to repay the loan.

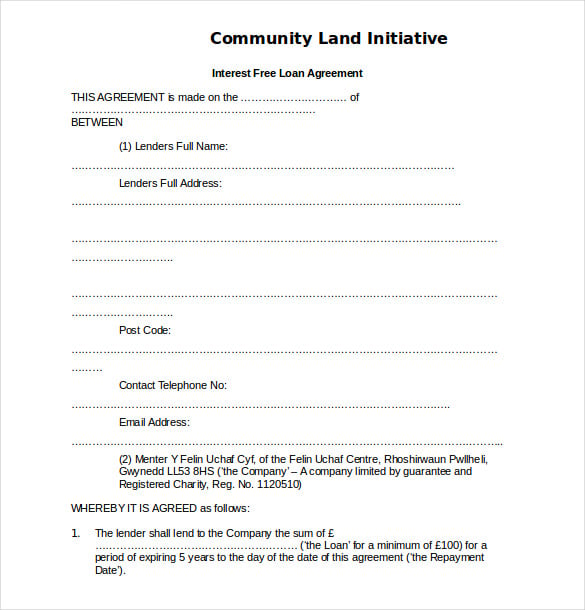

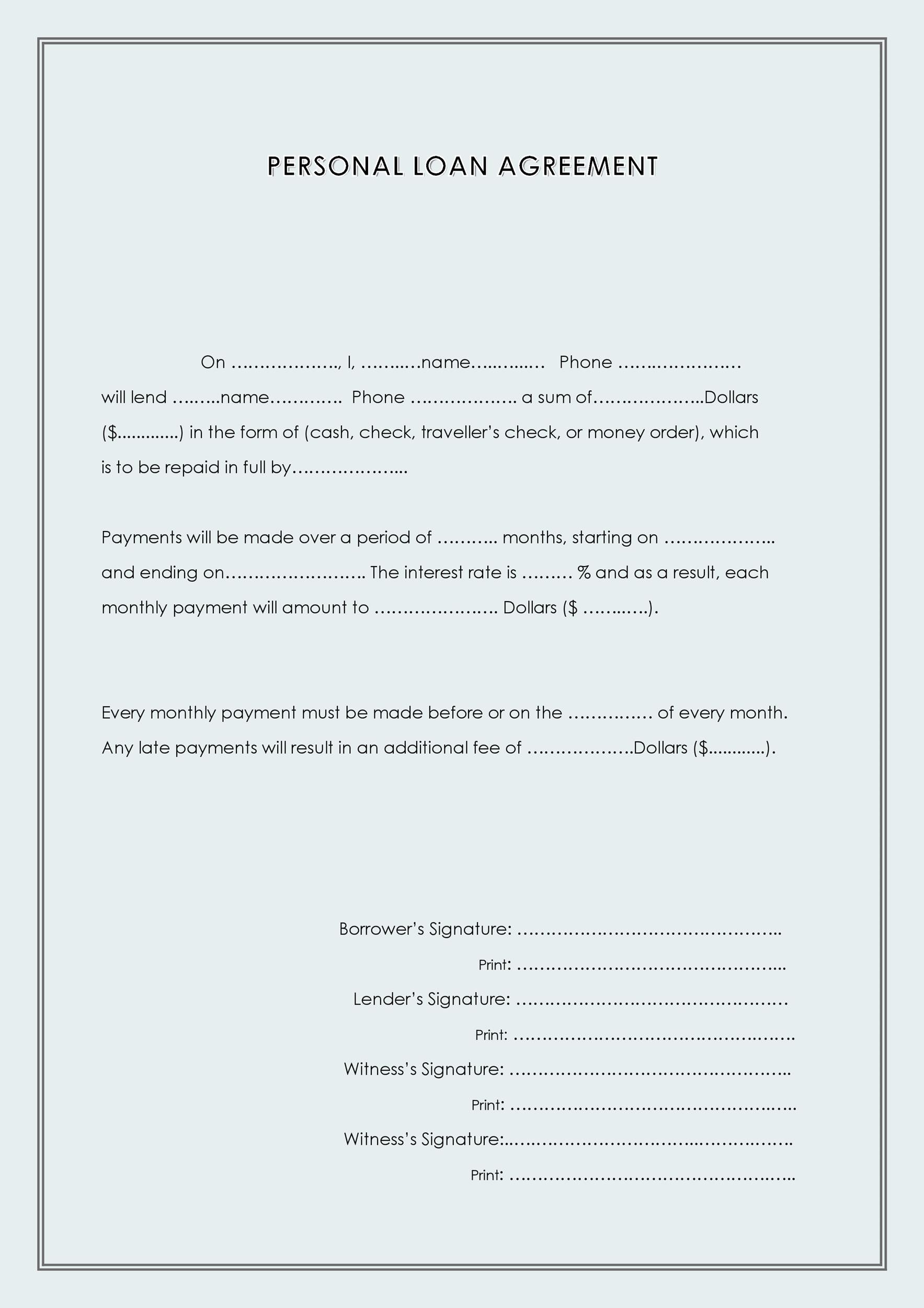

You may heard about loan agreements before a loan is an agreement of borrowing money from the lender and then repay him after a specified time. A loan agreement is a document between a borrower and lender that details a loan repayment schedule. The borrower promises to pay back the loan in line with a repayment schedule regular payments or a lump sum. It is simple to use and it only takes a few minutes to make a loan contract.

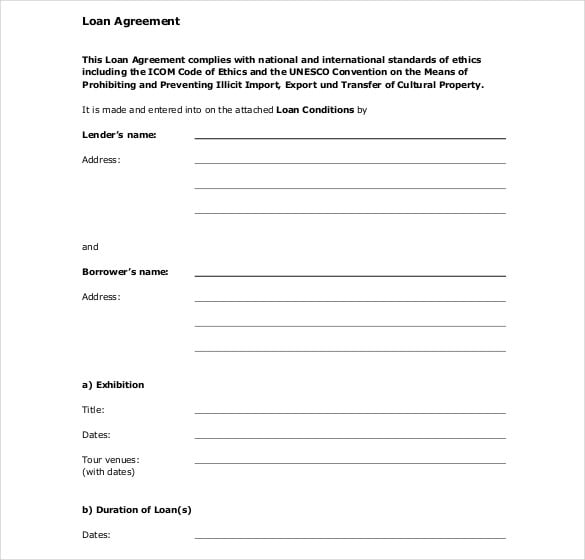

The loan agreement may be in writing or in oral the writing loan agreement is fully legal and it binds the borrower in the terms and conditions of loans. Our loan agreement form can be used to create a legally binding agreement suitable for any state. Download these 9 free sample loan agreement templates to assist you in preparing your own loan agreement. This loan does have higher interest rate than other loans.

Its primary function is to serve as written evidence of the amount of a debt and the terms under which it will be repaid including the rate of interest if any. This kind of lending is confirmed by signatures on a contract. Lawdepots loan agreement can be used for business loans student loans real estate purchase loans personal loans between friends and family down payments and more. A loan agreement form is a contract between two parties where the borrower promises to repay a loan to the lender.

A loan contract template is a tool that can help you draft a legal loan document. A loan agreement is a written agreement between a lender and borrower. A personal loan is an unsecured loan where the borrower does not need to give any security or asset to guarantee repayment of the loan. Even though it is easy to make a document youll need to gather a bit of information to make the process go faster.