Printable 1095 C Form

Form 1095 c is also used in determining the eligibility of employees for the premium tax credit.

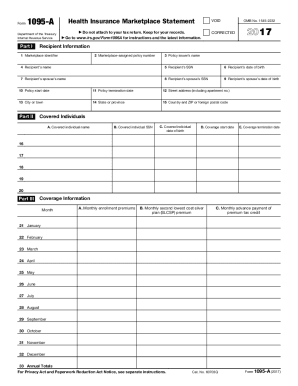

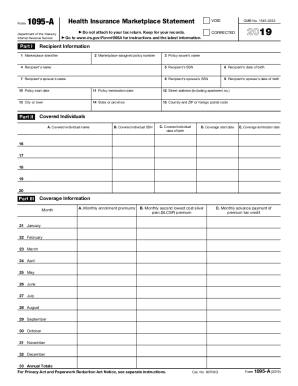

Printable 1095 c form. Here is the step by step guide to print form 1095 c and 1094 c. How to use form 1095 a. Well cover those items in a separate article after the final instructions become available. Form 1095 a is used to report certain information to the irs about individuals who enroll in a qualified health plan through the marketplace.

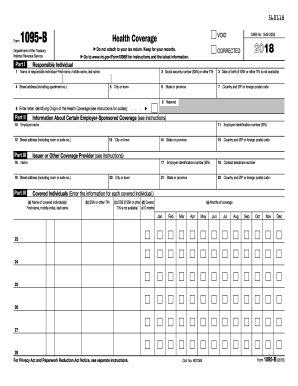

It is a definitely useful form to report the health insurance coverage or other related information of any employee of an ale applicable large employers member who is a full time. Information about form 1095 a health insurance marketplace statement including recent updates related forms and instructions on how to file. How to print form 1095 c and 1094 c ez1095 software quick start guide try it now ez1095 software makes it easy to print tax form 1095 and 1094. Annual summary and transmittal of us.

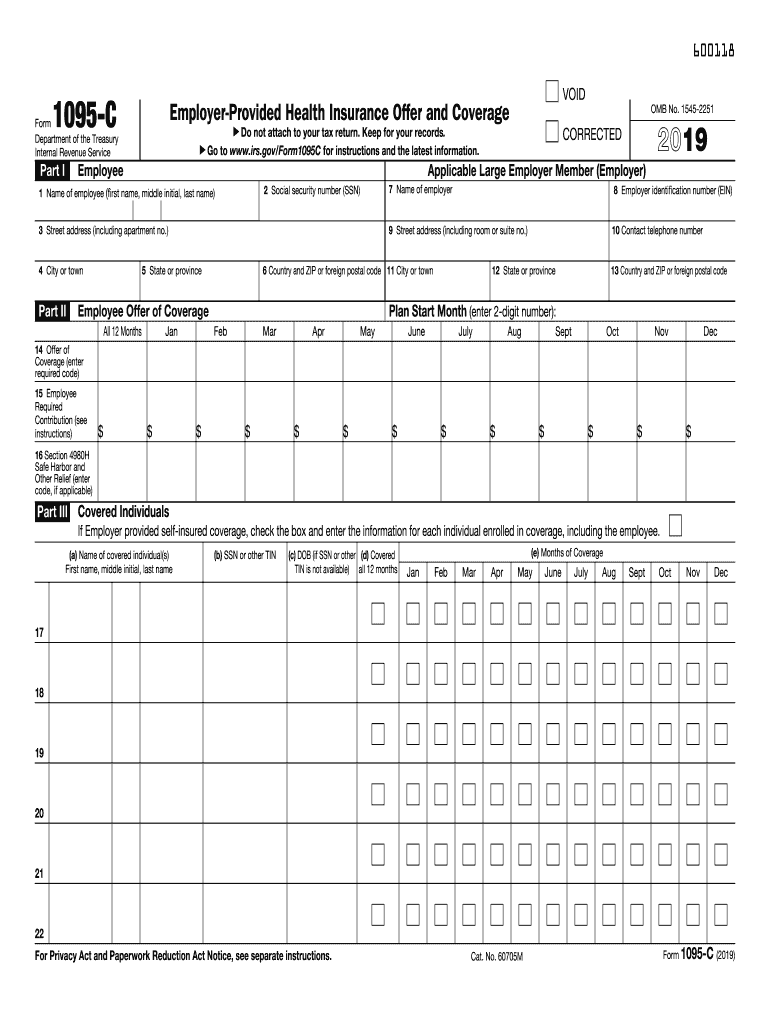

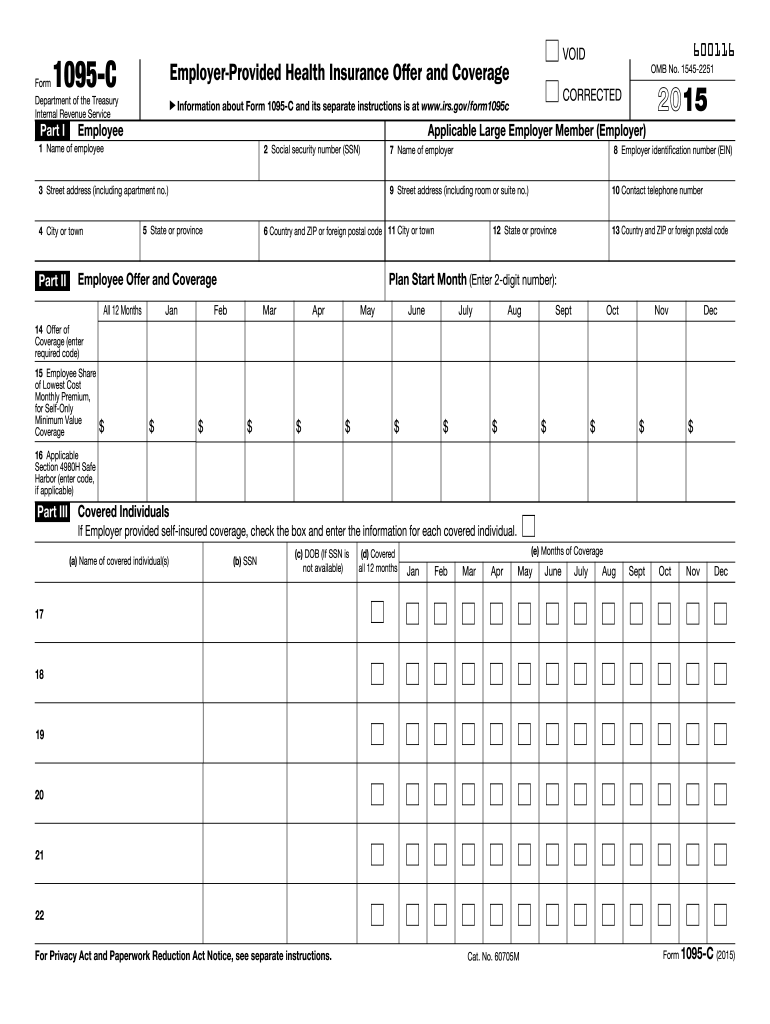

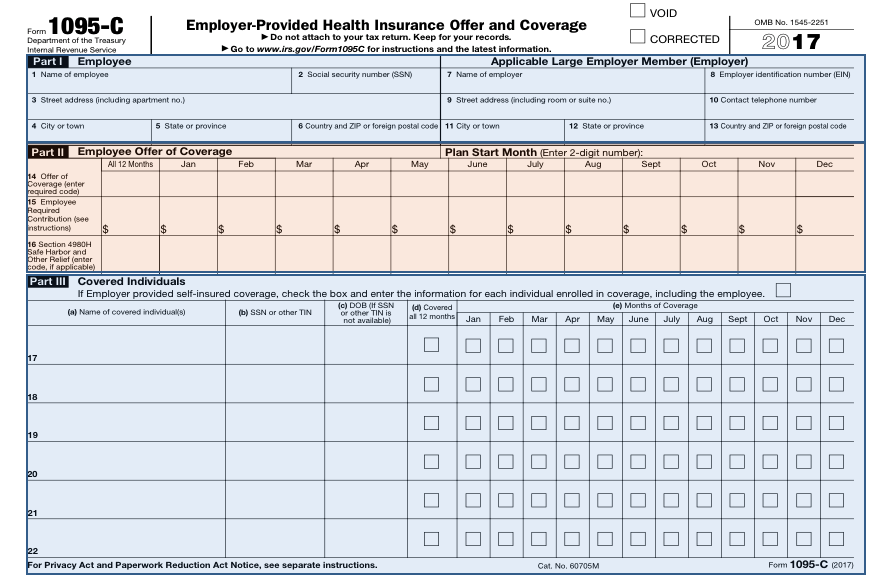

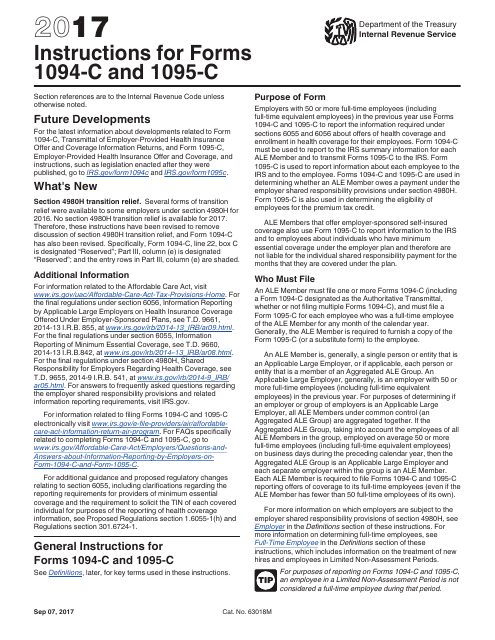

Health coverage 2019 12092019 form 1095 c. The irs has released final forms 1094 c and 1095 c c forms and final instructions for the c forms for the 2017 tax year. Form 1095 c is so called employer provided health insurance offer and coverage which updated in tax year 2016. Fillable printable form 1095c what is a form 1095c.

Employer provided health insurance offer and coverage 2019 12092019 form 1096. Final forms 10941095 b but not the instructions have also been released. In this case your form 1095 a will show only the premium for the parts of the month coverage was provided. Forms 1094 c and 1095 c are used in determining whether an ale member owes a payment under the employer shared responsibility provisions under section 4980h.

If anyone in your household had a marketplace plan in 2019 you should get form 1095 a health insurance marketplace statement by mail no later than mid february. Form 1095 c is used by applicable large employers as defined in section 4980hc2 to verify employer sponsored health coverage and to administer the shared employer responsibility provisions of section 4980h. Information returns info copy only. Form 1095 c is used to report information about each employee to the irs and to the employee.

Form 1095 c is used to report information about each employee to the irs and to the employee. Forms 1094 c and 1095 c are used in determining whether an ale member owes a payment under the employer shared responsibility provisions under section 4980h. If your employer is not an applicable large employer it is not required to furnish you a form 1095 c providing information about the health coverage it offered. Form 1095 c also is used in determining the eligibility of employees for the premium tax credit.