Printable W4 Form 2020 Pdf

Irs statement on draft 2020 form w 4 internal revenue service.

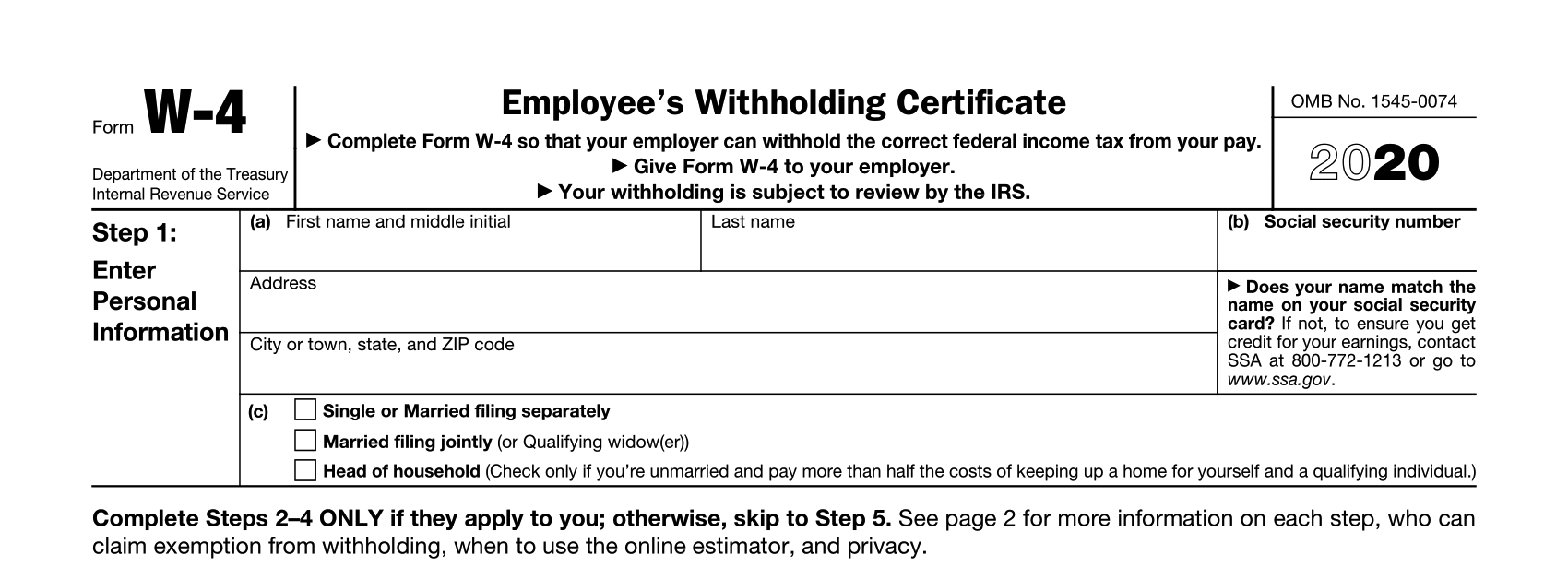

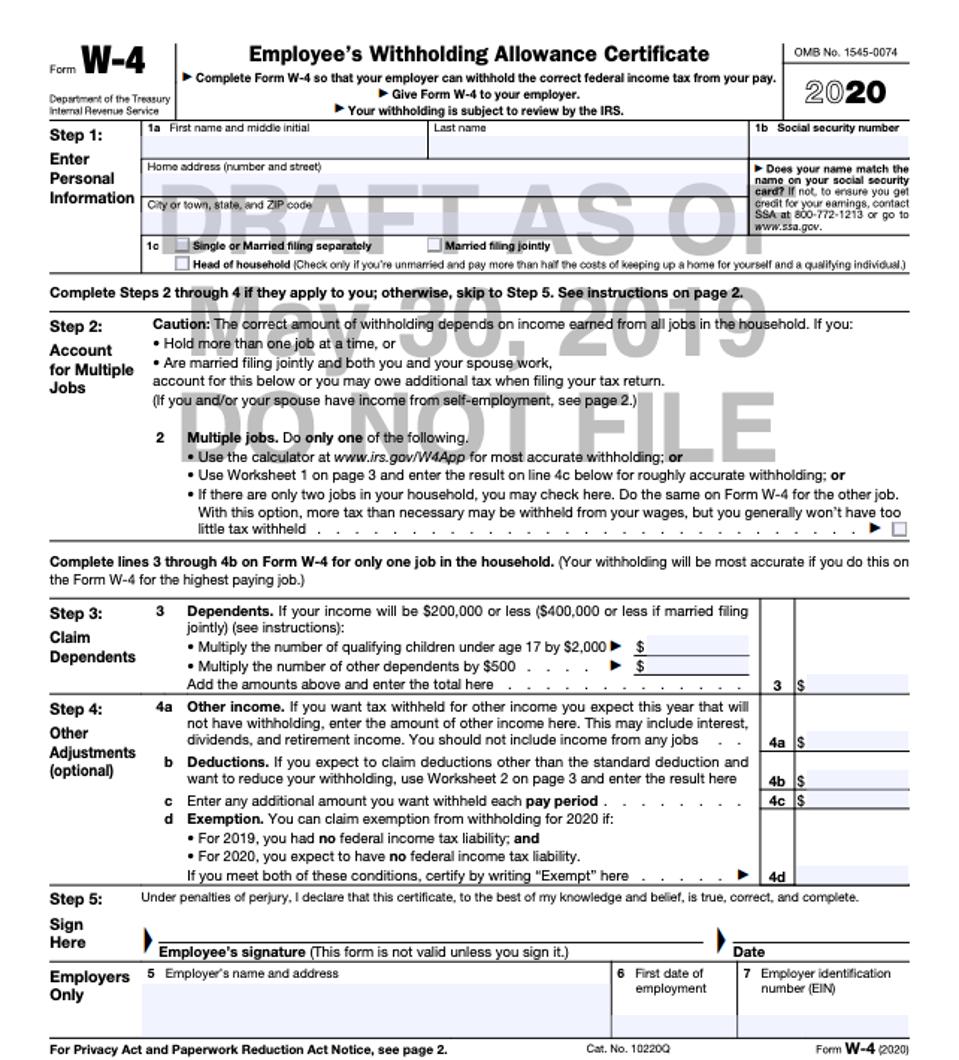

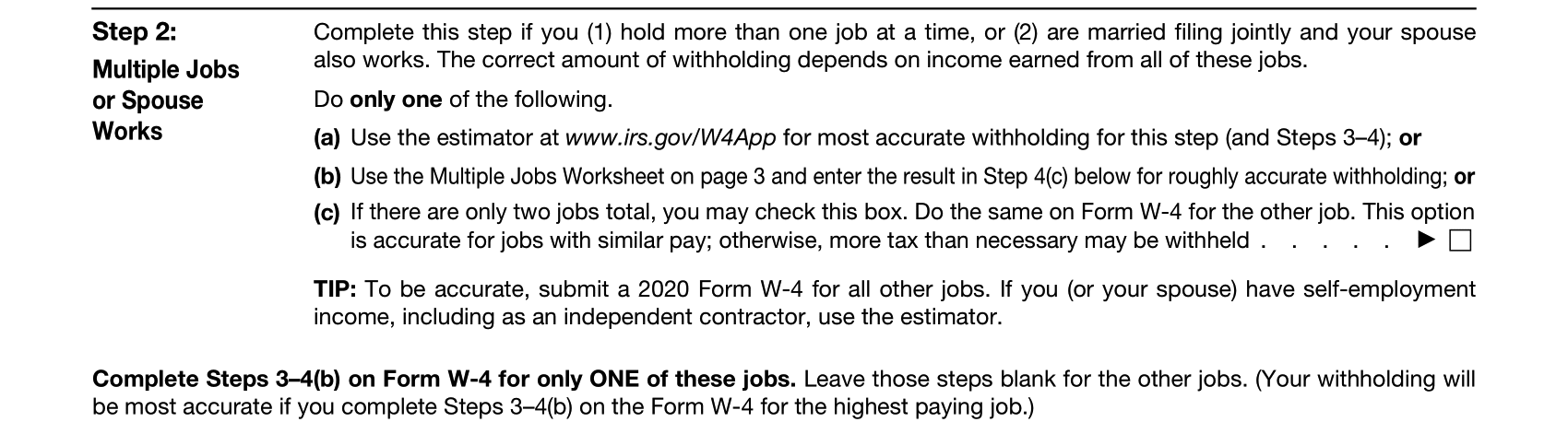

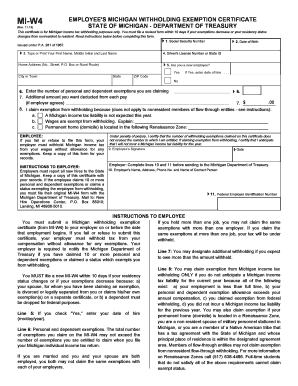

Printable w4 form 2020 pdf. Exemption from withholding. Employees who have submitted a form w 4 in any year before 2020 will not be required to submit a new form merely because of the redesign. Each and every federal government agencies offer all of the paperwork and forms that are needed on their websites. Form w 4 2020 employees withholding certificate department of the treasury internal revenue service complete form w 4 so that your employer can withhold the correct federal income tax from your pay.

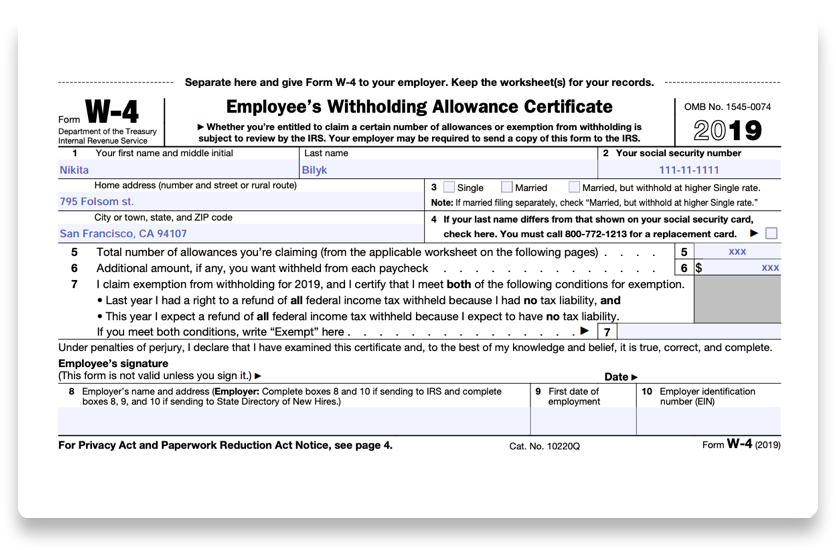

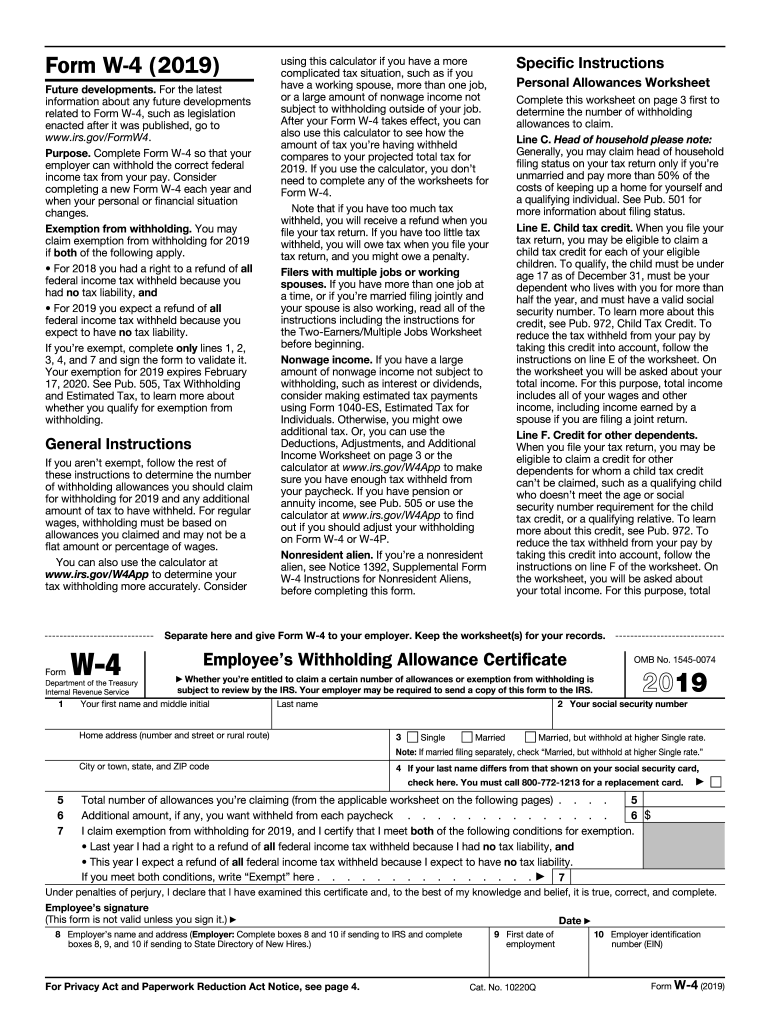

The irs works with the treasury department on form w 4 employees withholding allowance certificate whenever it needs an update. Claim exemption from withholding if you are an iowa resident and both of the following situations apply. 1 for 201 9 you had a right to a refund of all iowa income tax withheld because you had no tax liability and 2 for 2020 you expect. Since the w 4 form is not related to your state income tax whether you live in connecticut or any other state for that matter the w 4 form will remain the same and you will have to complete it.

Although it can be challenging to find them you can view the forms directly on your browser and download them from the irs and uscis website. Enter personal information a. Your withholding is subject to review by the irs. Effect if you dont file a form w4p for 2020.

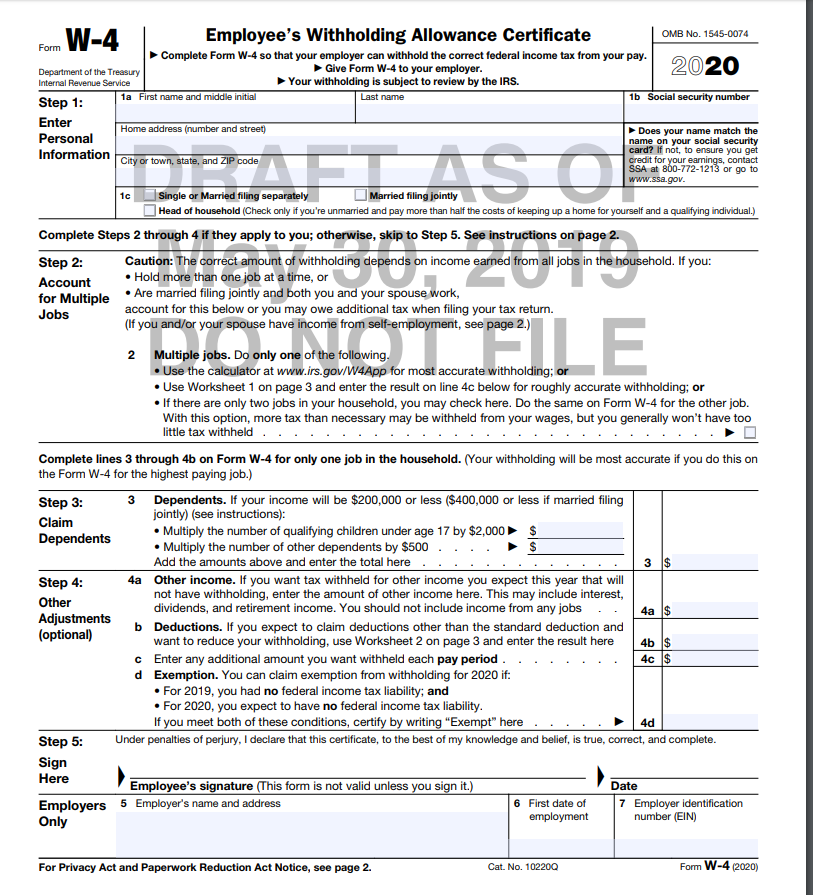

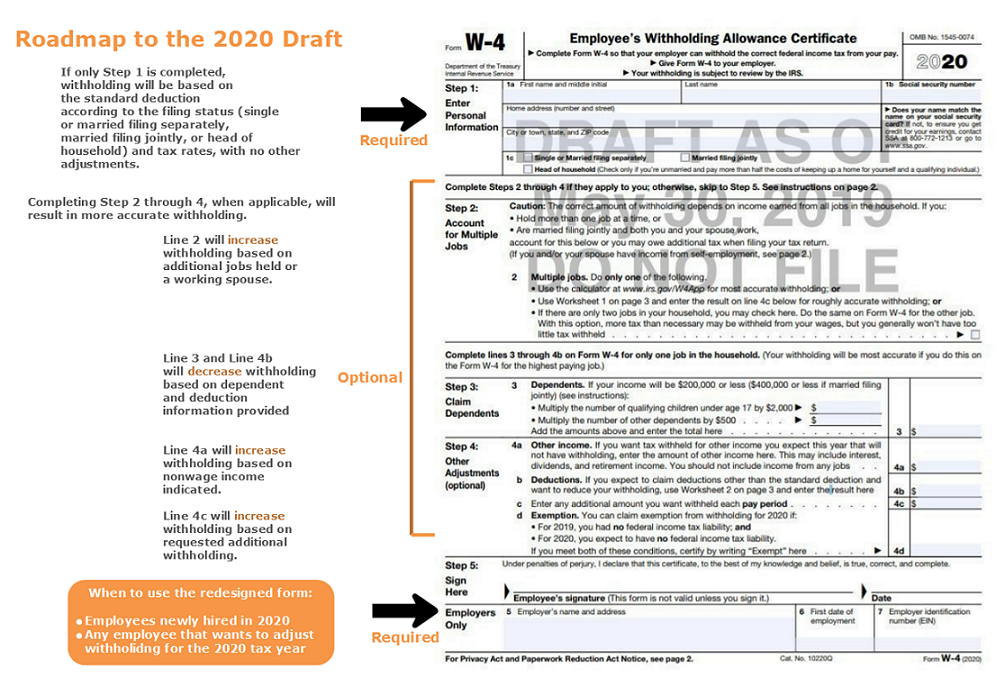

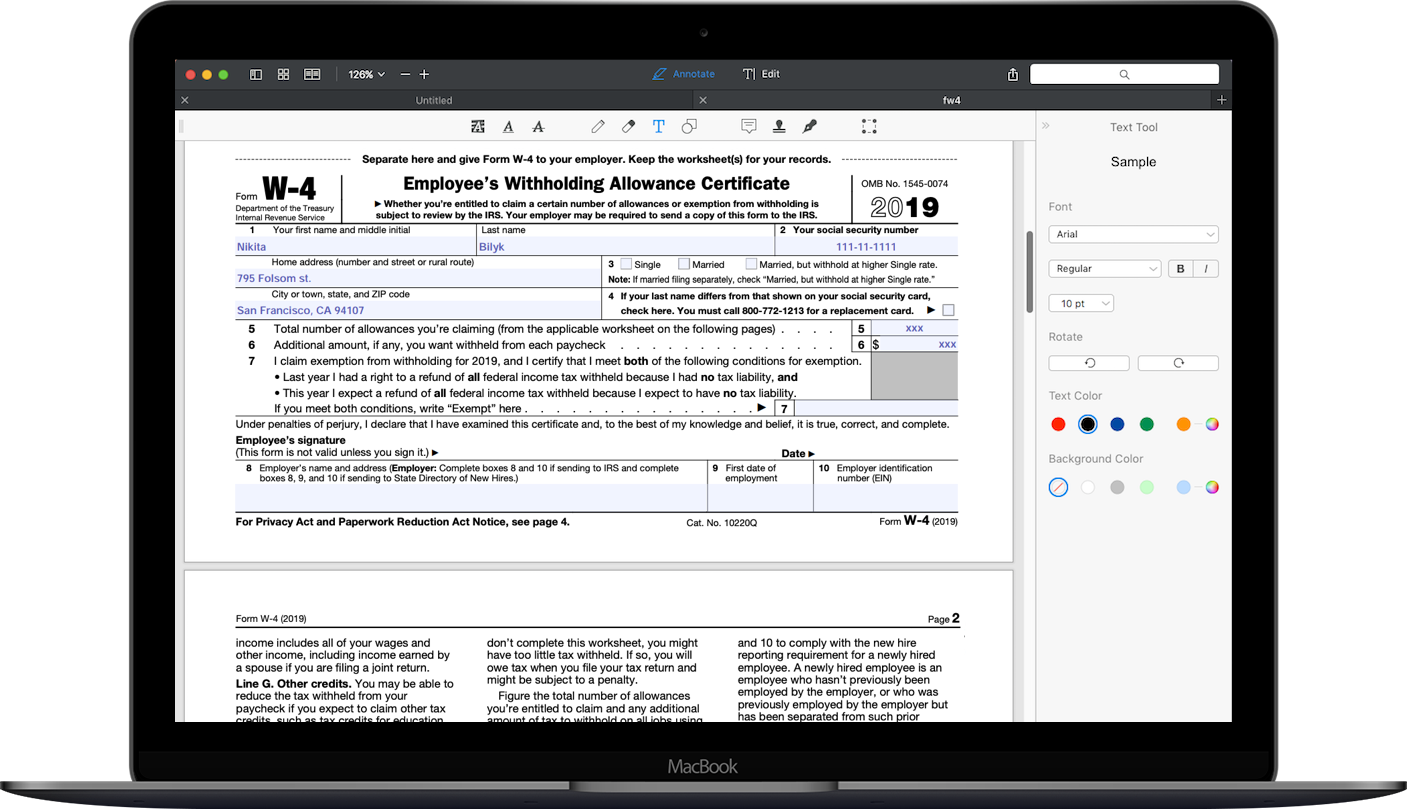

Give form w 4 to your employer. May 31 2019 following feedback from the payroll and tax communities the irs issued an early draft of the 2020 w 4 pdf for public comment. The current version of w 4 can still be used as of december. There is likely going to be a new form for 2020 but it appears to be more detailed and complex as it takes more time than expected and it is something unusual for the irs.

Section references are to the internal revenue code. Follow these instructions to determine the number of withholding allowances you should claim for pension or annuity payment withholding for 2020 and any additional amount of tax to have withheld. Ia w 4 instructions employee withholding allowance certificate. Employers can continue to compute withholding based on the information from the employees most recently submitted form w 4.