Receipts Required For Business Expenses

Irs requirements for receipts.

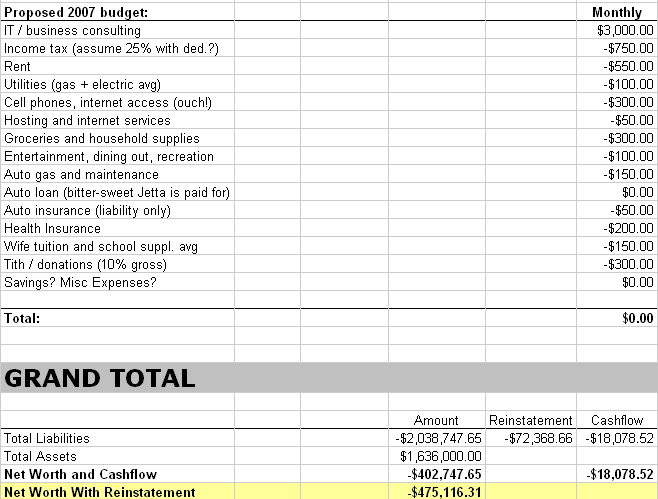

Receipts required for business expenses. All this record keeping is not as hard as it sounds. Section 463 is titled travel entertainment gift and car expenses. However if you have an expense for something that is used partly for business and partly for personal purposes divide the total cost between the. Such as receipts of each individual expense for a business to keep adequate records.

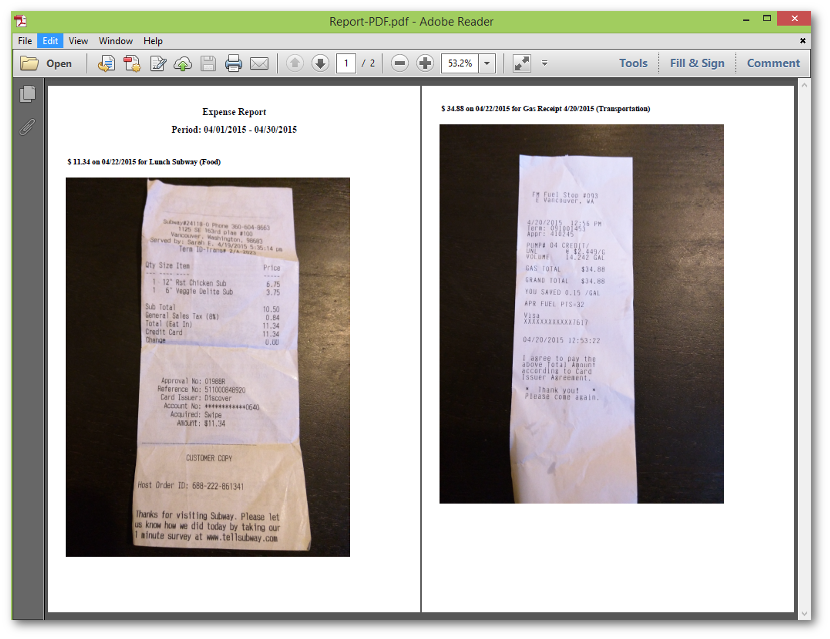

A business needs to keep a log of business expenses along with documentary evidence ie. You should keep supporting documents that show the amounts and sources of your gross receipts. Miscellaneous items including but not limited to. You can elect to deduct or amortize certain business start up costs.

Other miscellaneous items which are eligible for reimbursement only if they are ordinary. Generally you cannot deduct personal living or family expenses. So when it says your expense other than lodging is less than 75 what its really means is your travel entertainment gift and car expenses other than lodging that are less than 75. This may not be the most cost effective method though so always do your research.

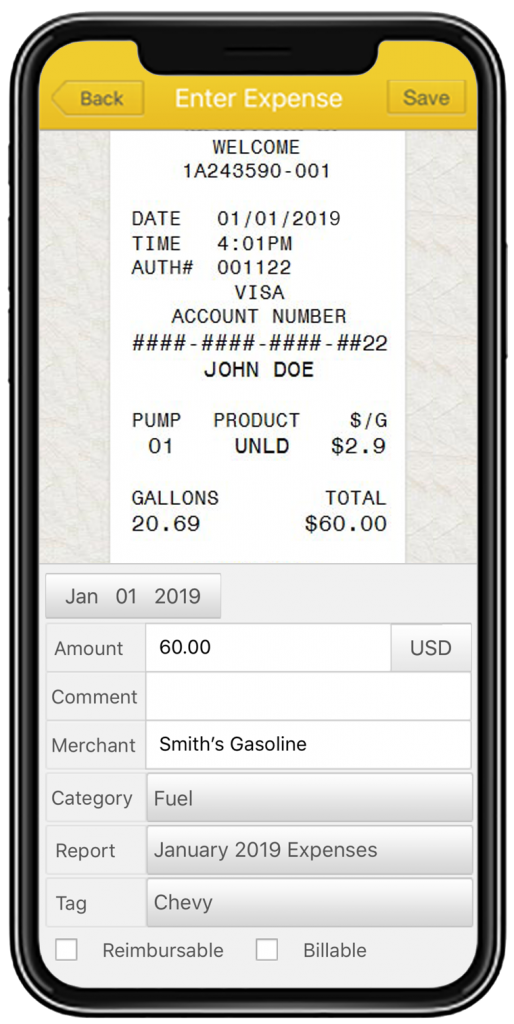

You do need receipts for these expenses even if they are less than 75. Any expense not listed above. Refer to chapters 7 and 8 of publication 535 business expenses. Claiming deductions for things like charitable donations business expenses childcare or tuition payments can lower your tax bill and potentially result in a larger.

He was a flashy guy and tended to pay in cash. Receipts for business expenses under 75. Personal versus business expenses. All of your claimed business expenses on your income tax return need to be supported with original documents such as receipts.

Ground transportation and associated parking costs. You can record the five facts you have to document in a variety of ways. You should keep supporting documents that show the amounts and sources of your gross receipts. Instead you can calculate expenses using a flat rate for mileage.

Gross receipts are the income you receive from your business. In the 1920s the irs disallowed cohans very large travel and entertainment expenses for lack of receipts. Generally you cant make tax claims without receipts. Original receipts required if an expense is 75 or greater.