Resale Certificate Verification

The certificate allows business owners or their representatives to buy or rent property or services tax free when the property or service is resold or re rented.

Resale certificate verification. Reseller permits are generally valid for four years. What is a reseller permit. Enter the eight digit transaction privilege tax license number that you would like to verify. Employer identification number ein is also known as a federal tax identification number and is used to identify a business entity.

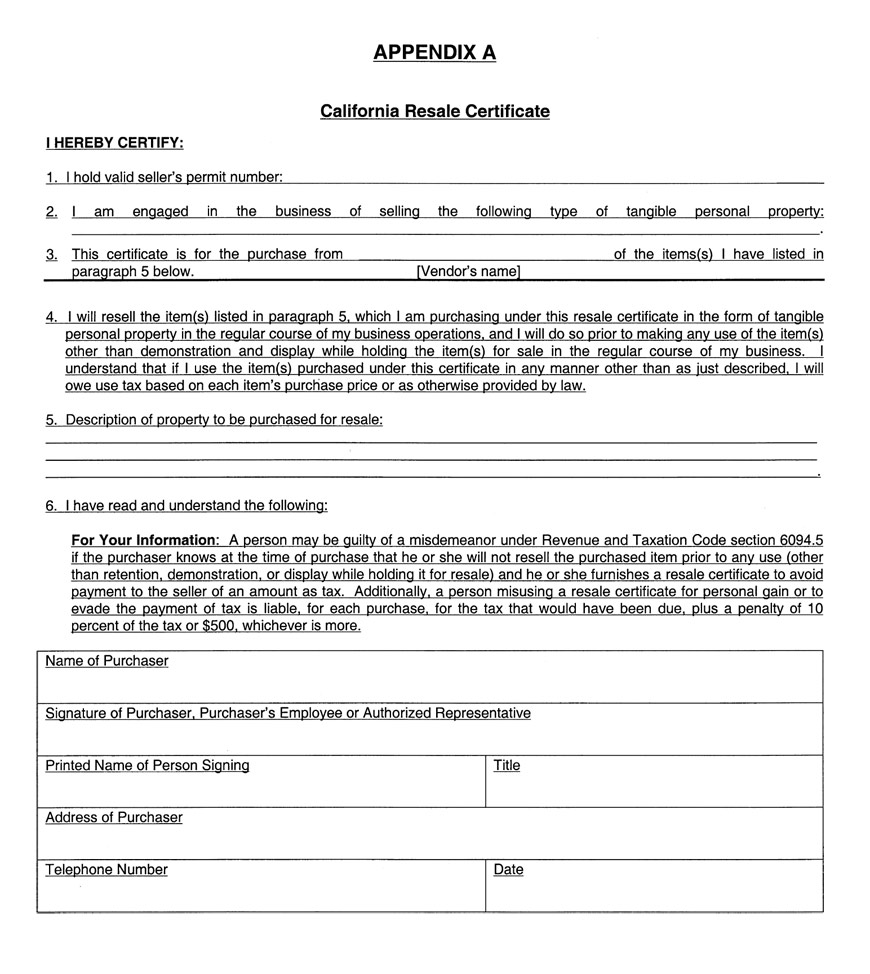

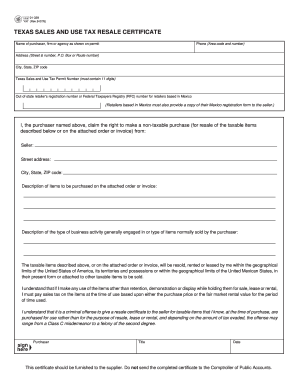

Virginia online verification is not available. I will resell the items listed in paragraph 5 which i am purchasing under this resale certificate in the form of tangible personal property in the regular course of my business operations and i will do so prior to making any. Taxpayer id is an eleven digit number assigned by the texas comptroller. Resale certificates are available through the sales and use tax or communications services tax file and pay webpages.

I understand that it is a criminal offense to give a resale certificate to the seller for taxable items that i know at the time of purchase are purchased for use rather than for the purpose of resale lease or rental and depending on the amount of tax evaded the offense may range from a class c misdemeanor to a felony of the second degree. This includes blanket certificates of resale as well as exemption certificates. Utah allows merchants to accept resale certificates in good faith vermont online verification is not available. This verification does not relieve the vendor of the responsibility of maintaining a copy of the certificate on file.

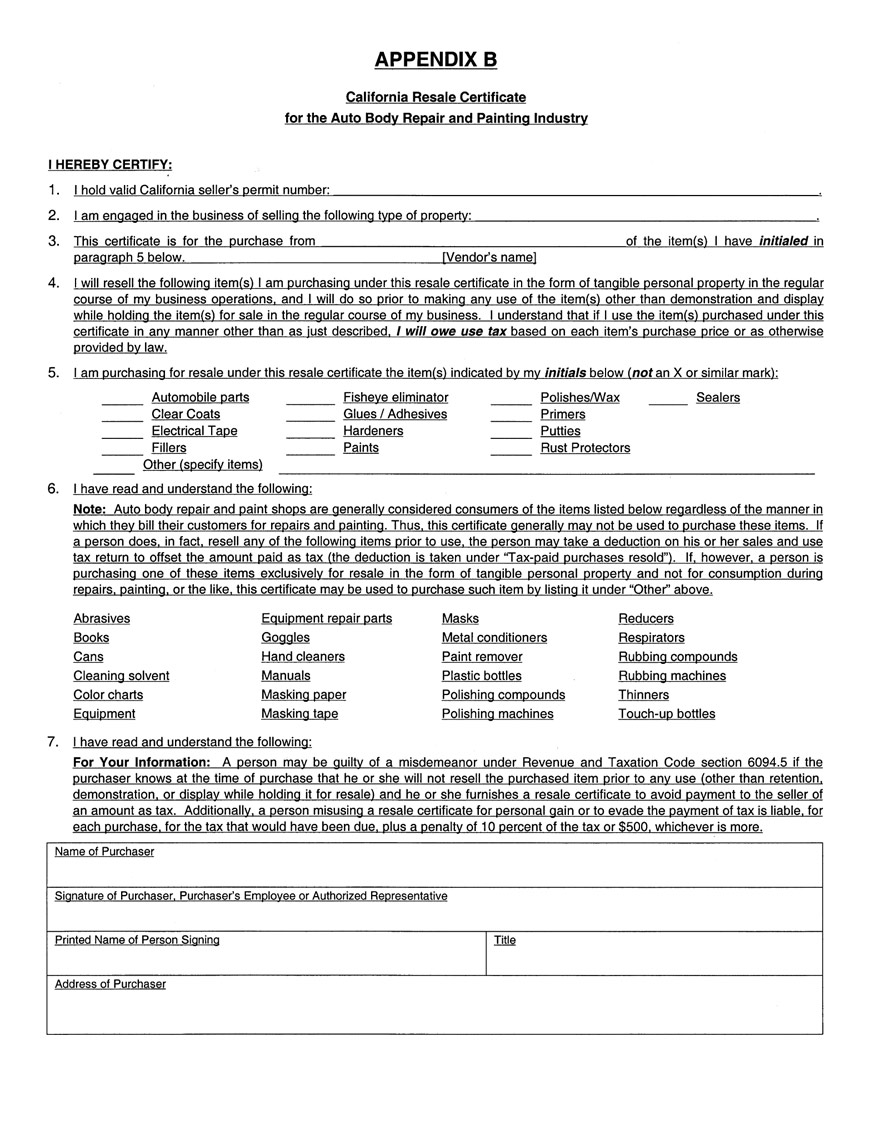

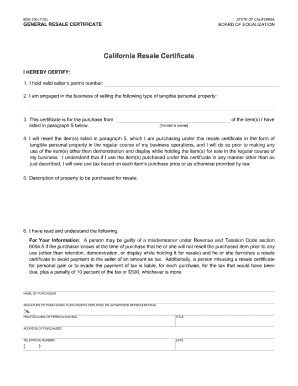

Retailers and wholesalers to purchase items for resale without paying sales tax. Businesses that register with the florida department of revenue to collect sales tax are issued a florida annual resale certificate for sales tax annual resale certificate. California resale certificate. Utah there is no way to verify a resale certificate online.

General resale certificate. The department of revenue recently redesigned the certificates the department issues. Reseller permits are distributed by the state and allow. The taxpayer transparency and fairness act of 2017 which took effect july 1 2017 restructured the state board of equalization and separated its functions among three separate entities to guarantee impartiality equity and efficiency in tax appeals protect civil service employees ensure fair tax collection statewide and uphold the california taxpayers bill of rights.

After entering the number click submit.