Revenue Based Financing Agreement Template

The price will jump back to 9995 shortly.

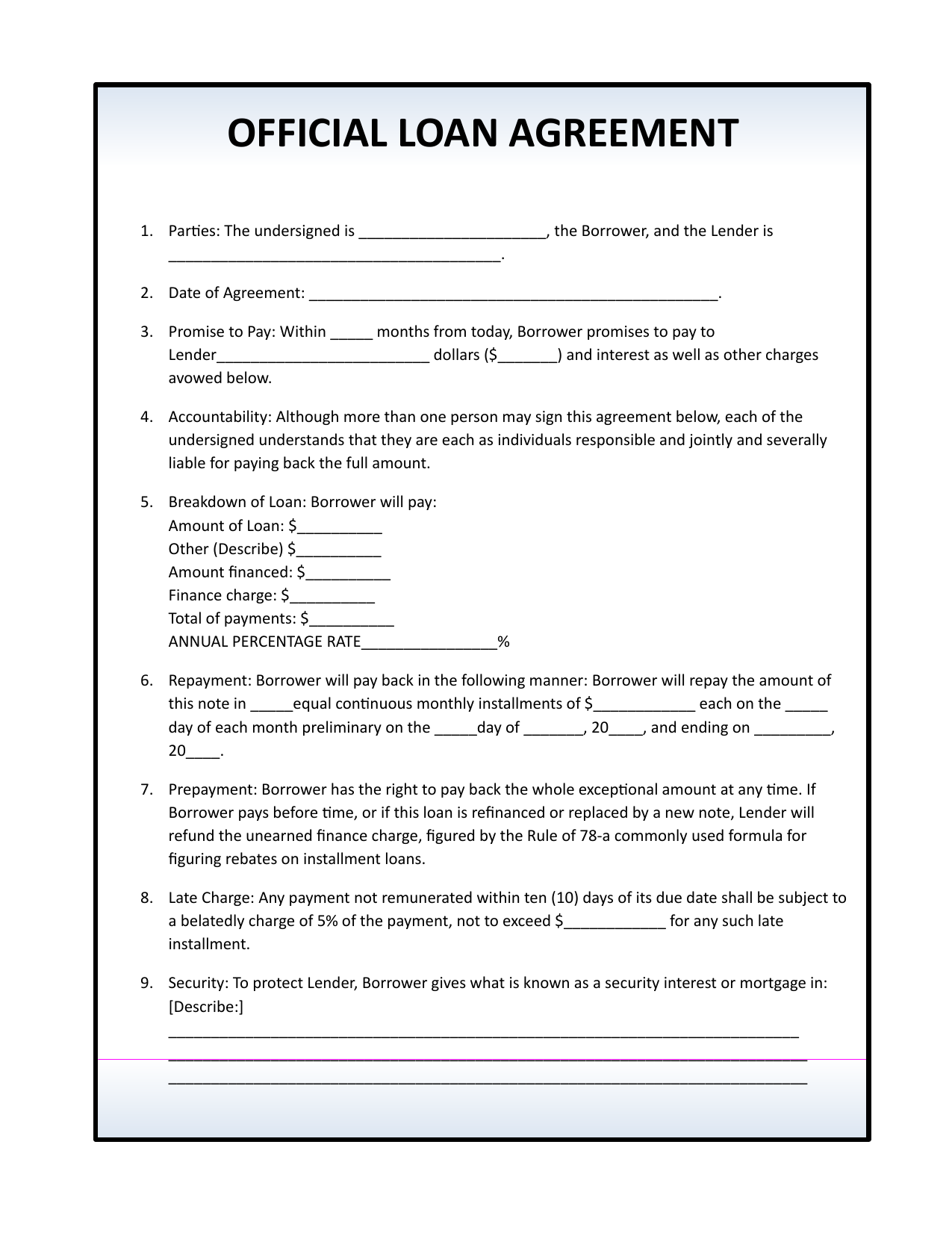

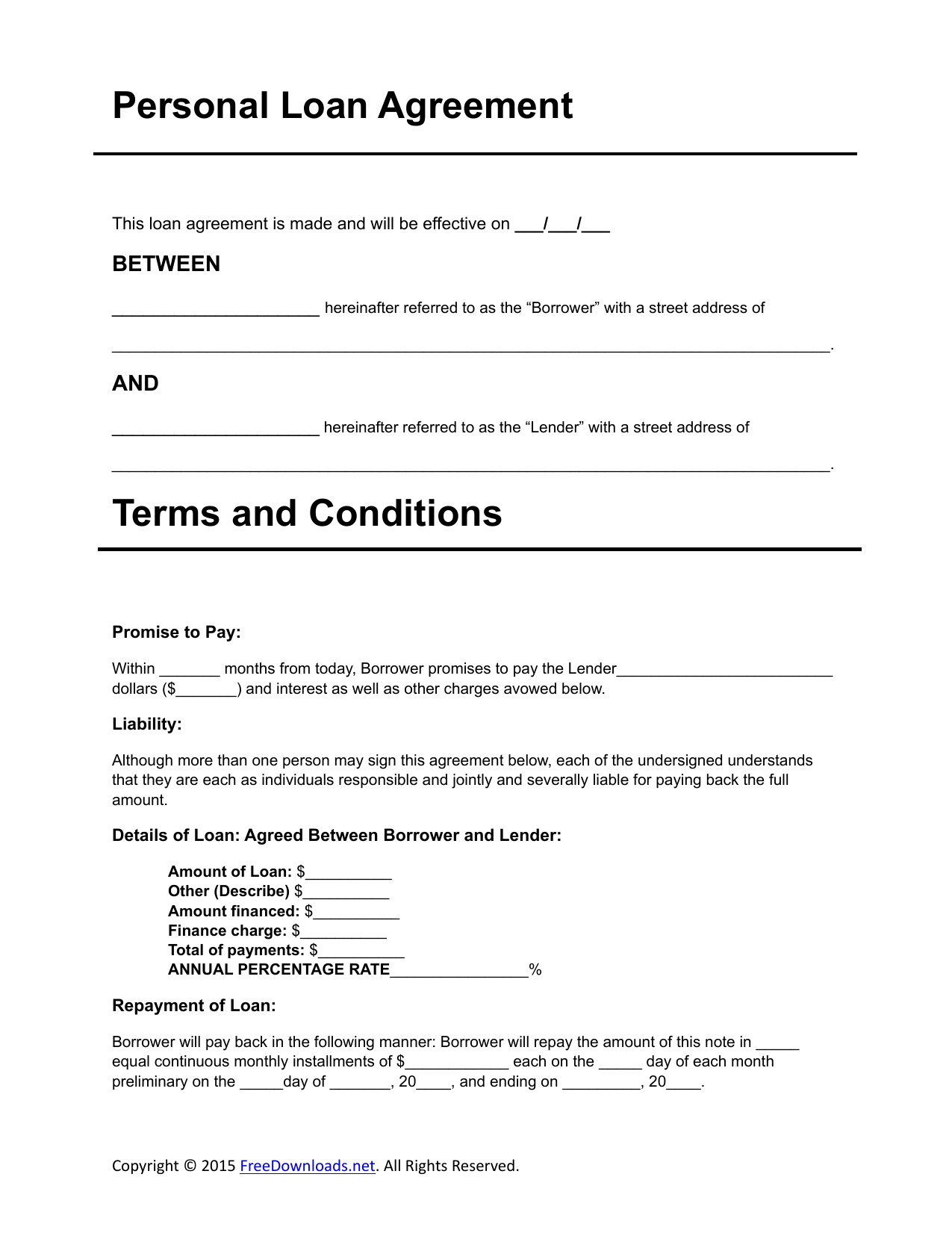

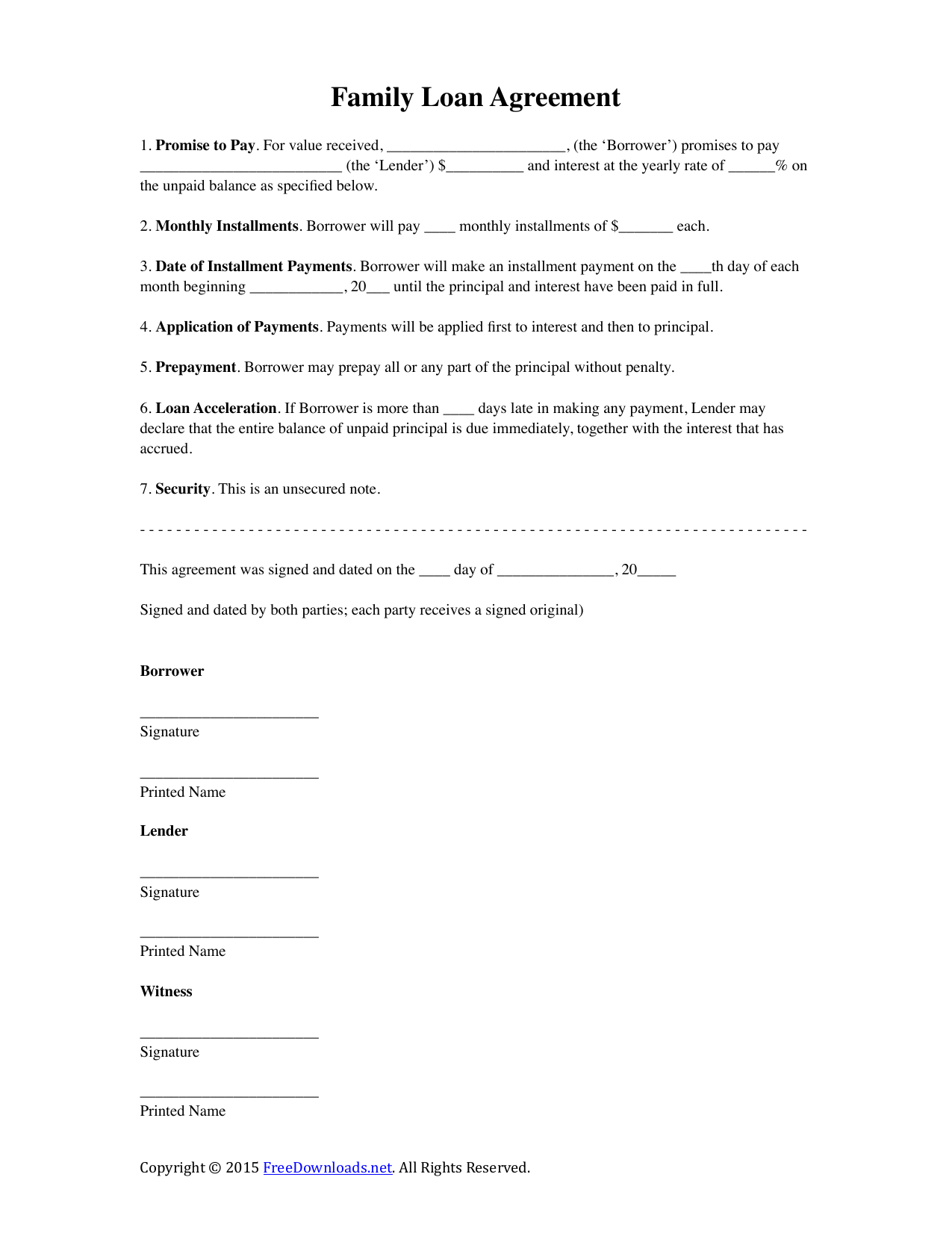

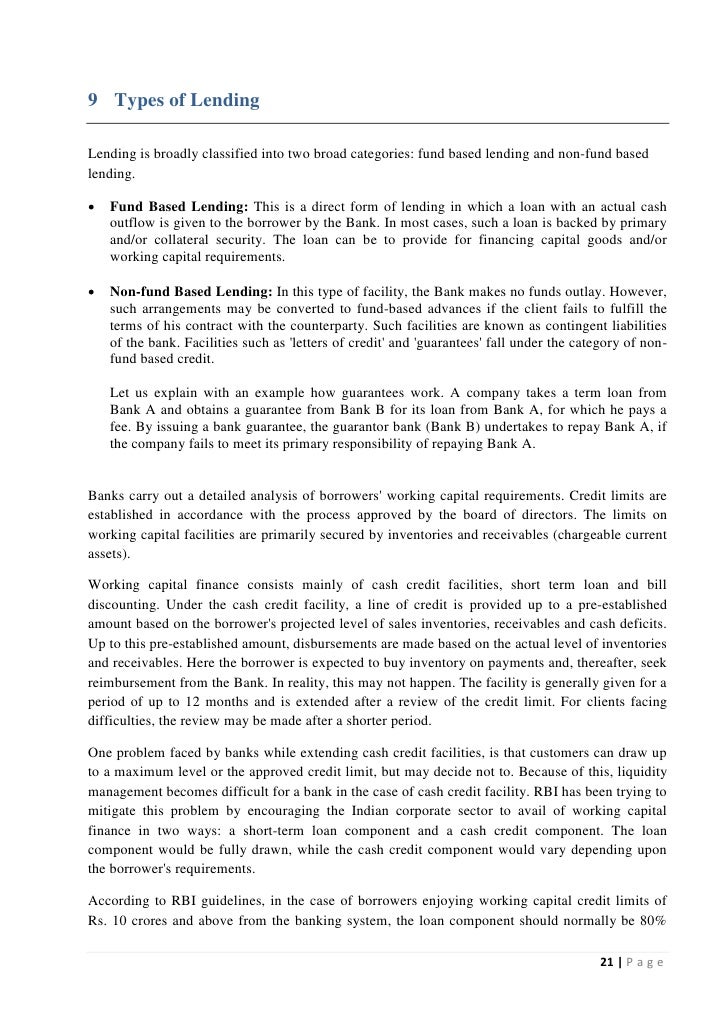

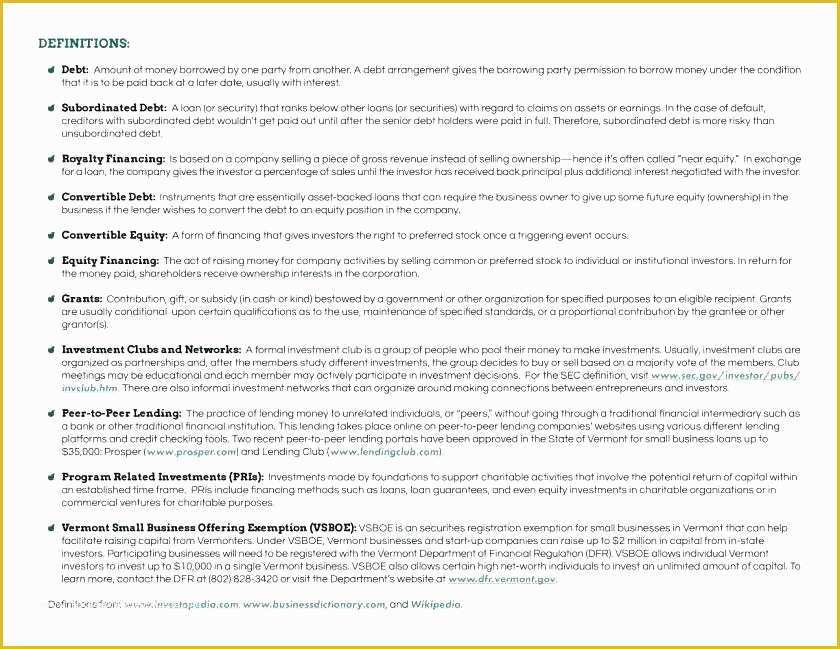

Revenue based financing agreement template. Conditions precedent cps to financial close. Revenue based financing is a type of funding in which a company agrees to share a percentage of future revenue with an investor in exchange for capital up front. The payments fluctuate with the borrowers financial performance going up when revenue is strong and down when it is lower. Other names include revenue share financing royalty financing or a revenue loan.

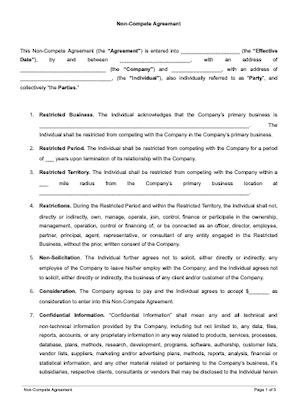

Revenue based financing or royalty based financing rbf is a type of financial capital provided to small or growing businesses in which investors inject capital into a business in return for a fixed percentage of ongoing gross revenues with payment increases and decreases based on business revenues typically measured as either daily revenue or monthly revenue. It is somewhere between equity and debt. The loan payments are tied to monthly revenue going up for strong revenue months and down for low revenue months. Provide you with a sample rrc agreement you can use to save thousands in legal fees.

A form of revenue based financing lender loans funds to a business and receives payments based on a percentage of their ongoing gross revenue loan proceeds are used for long term growth capital borrowers payment amounts vary over time increasing or decreasing according to business revenue. Revenue based financing rbf is a loan in which repayments are based on a percentage of the borrowers monthly revenue rather than a fixed amount. This is a form of revenue based financing. This structure is common in financing oil and gas exploration and movies but is an emerging form of financing for startups and small businesses.

The regular price is 9995 but today its only 7995. Revenue based financing also known as royalty based financing is a method of raising capital for a business from investors who receive a percentage of the enterprises ongoing gross revenues in exchange for the money they invested. Get your copy of how dealmakers close investors today. 25 of borrowers gross revenues from all sources minus permittable offsets outlined below delivered to village capital in quarterly repayments.

Sample revenue share agreement amount of financing. In a revenue based financing investment investors receive a regular share. Direct agreements between the lenders and epc contractor land owner operator offtaker and concession giver. 25 000 as part of a 50000 total raise.