Schedule D Tax Worksheet Error

A form 1040 taxpayers regular tax calculation using the worksheet is potentially impacted if.

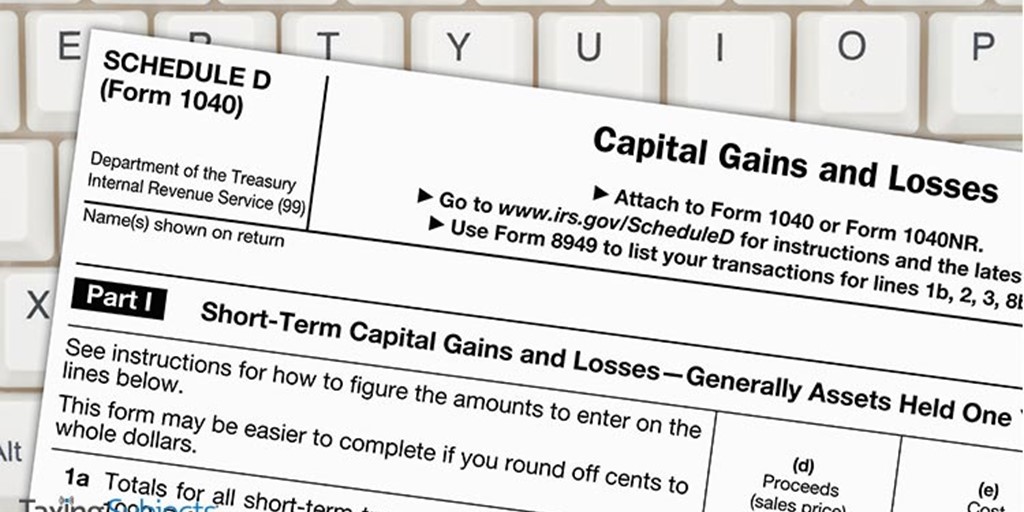

Schedule d tax worksheet error. Line 18 of the original schedule d tax worksheet line 18 a of the corrected schedule d tax worksheet is not more than 157500 315000 if married filing jointly or a qualifying widower. The net is a change in line 45 tax on all taxable income for me this results in a reduction of almost 1400. Page last reviewed or updated. Potentially impacted taxpayers can recalculate their regular tax using the new worksheet to see if it changes.

A form 1040 taxpayers regular tax calculation using the worksheet is potentially impacted if. Irs sent 1800 refund in october with interest. And line 18 of the original schedule d tax worksheet line 18a of the corrected schedule d tax worksheet is not more than 157500 or 315000 if married filing jointly or as a qualifying widower. Line 15 of the schedule d tax worksheet is not more than line 14 of the schedule d tax worksheet those lines were not impacted.

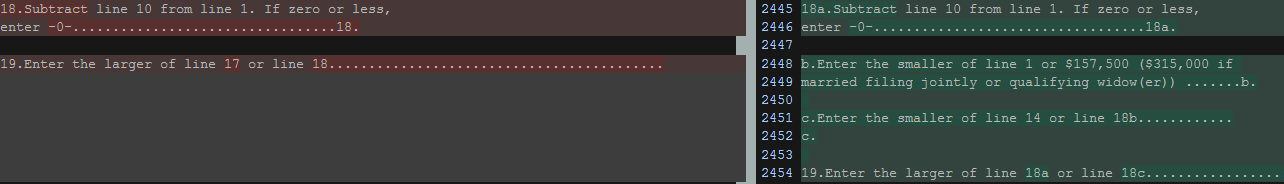

Line 18 of the original schedule d tax worksheet line 18 a of the corrected schedule d tax worksheet is not more than 157500 315000 if married filing jointly or a qualifying widower. The irs added lines 18 a b and c to the original schedule d tax worksheet. Form 1041 schedule d lines 18a and 19 in column 2 are both more than zero. The irs corrected the schedule d tax worksheet in the instructions for schedule d form 1040 us.

Potentially impacted taxpayers may recalculate their regular tax using the new worksheet to see if it changes. 2014 schedule d tax worksheet form 1040 schedule d instructions page d 15 2013 schedule d tax worksheet form 1040 schedule d instructions page d 14 2012 schedule d tax worksheet form 1040 schedule d instructions page d 13. We corrected the schedule d tax worksheet in the instructions for schedule d form 1040 by renumbering line 18 as line 18a adding new lines 18b and 18c and updating the text on line 19 to reflect those changes. Client with a large amount of 1250 unrecaptured gain filed prior to irs may corrected worksheet.

If you filed an amended return because you opted to recalculate your regular tax using the new worksheet to see if it changed the irs is currently processing those amended returns. So we sent in 1040 x for the additonal 500 and is was approved within 4 weeks.