Tax Deductible Receipt Template

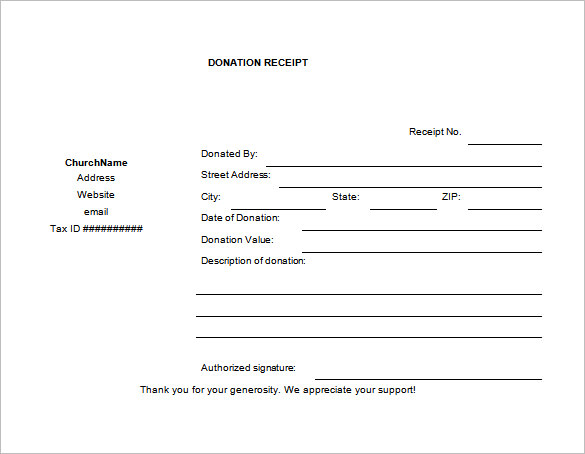

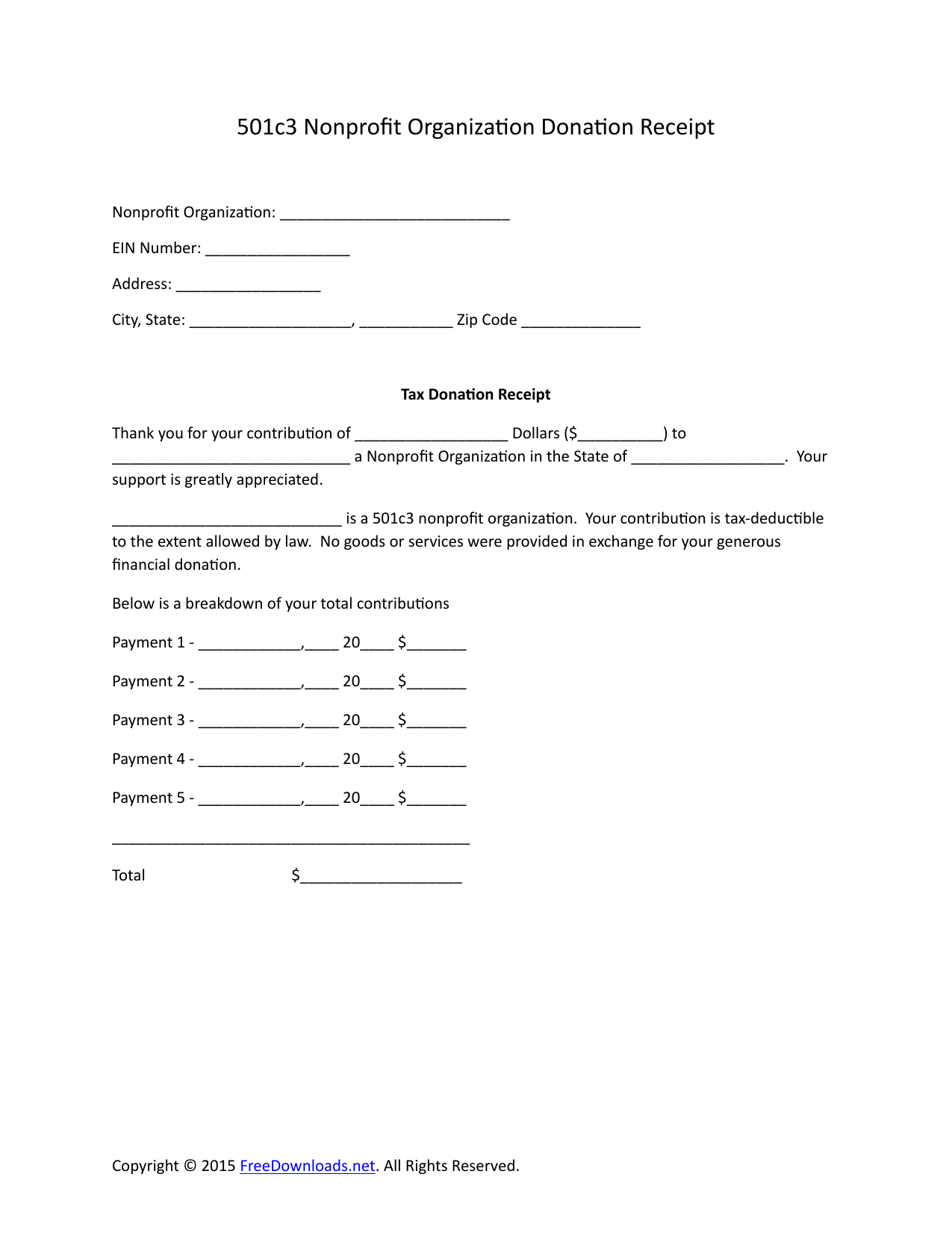

Put your organizations tax id number.

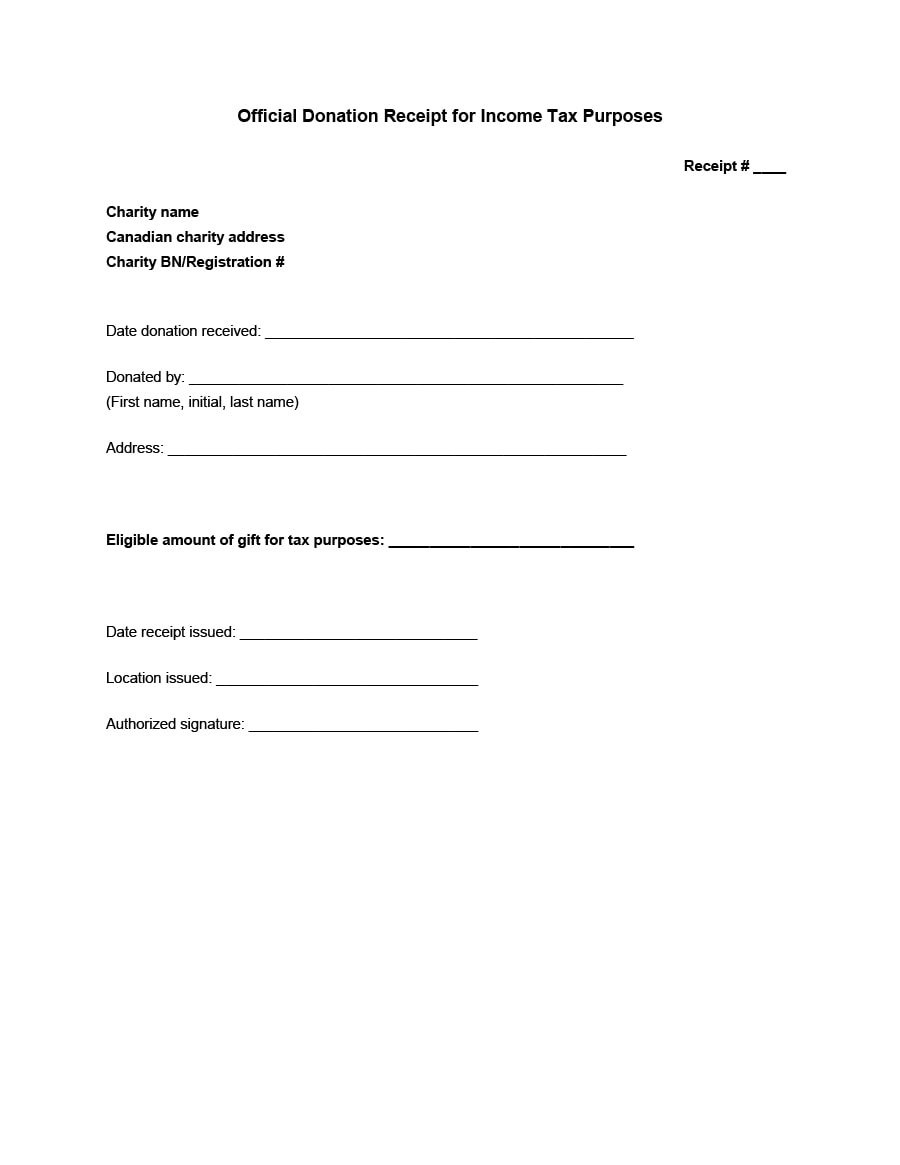

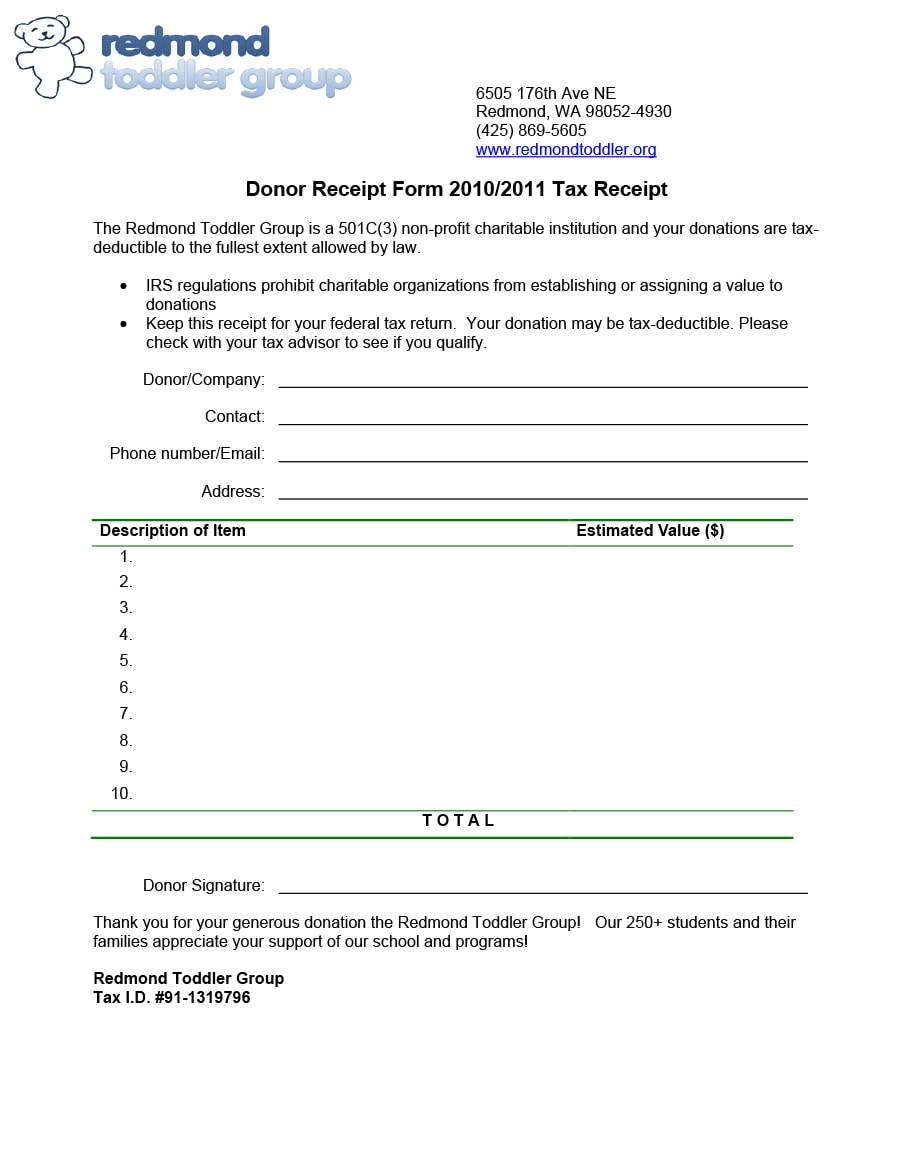

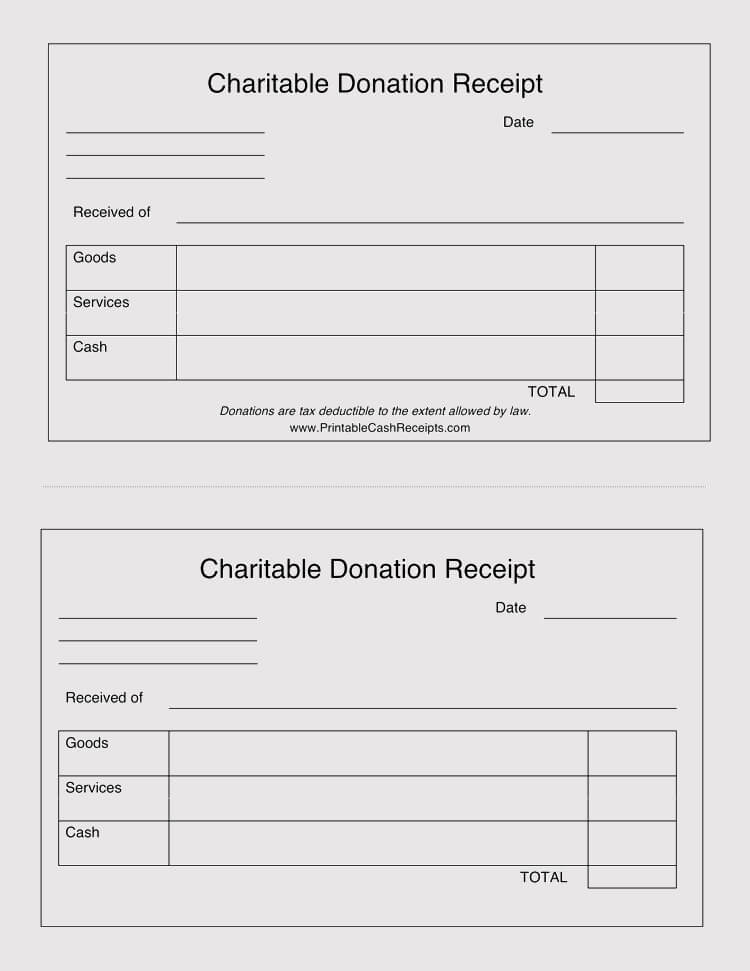

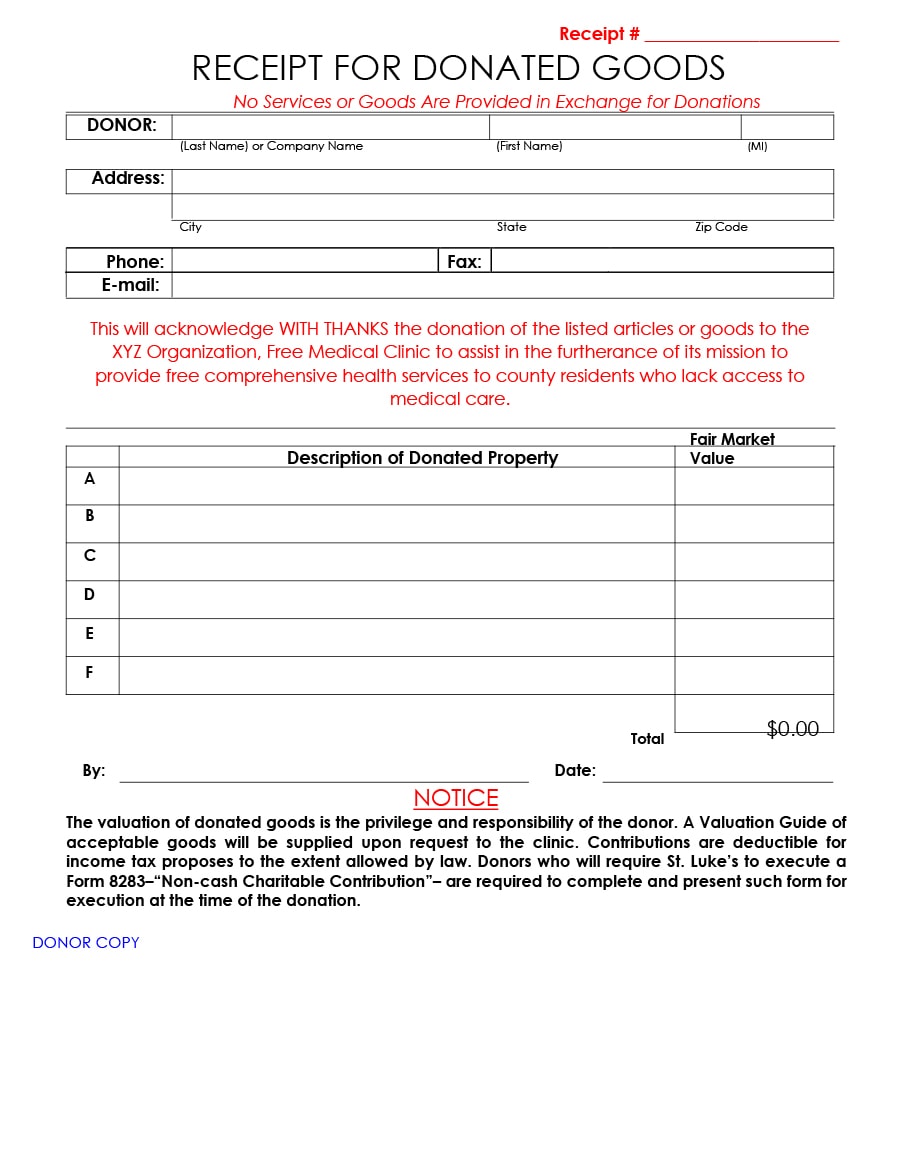

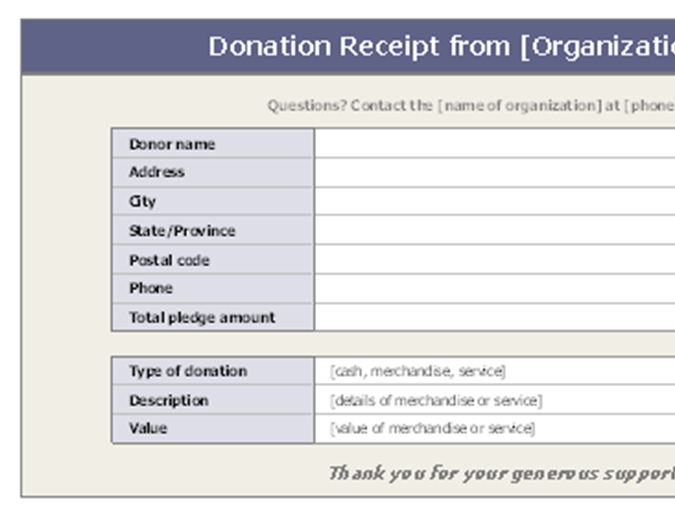

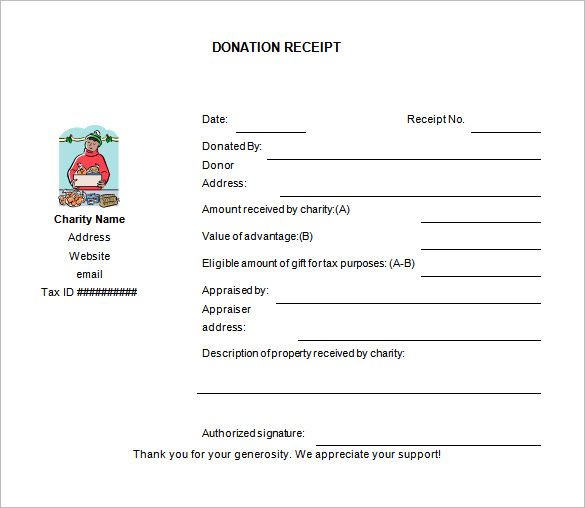

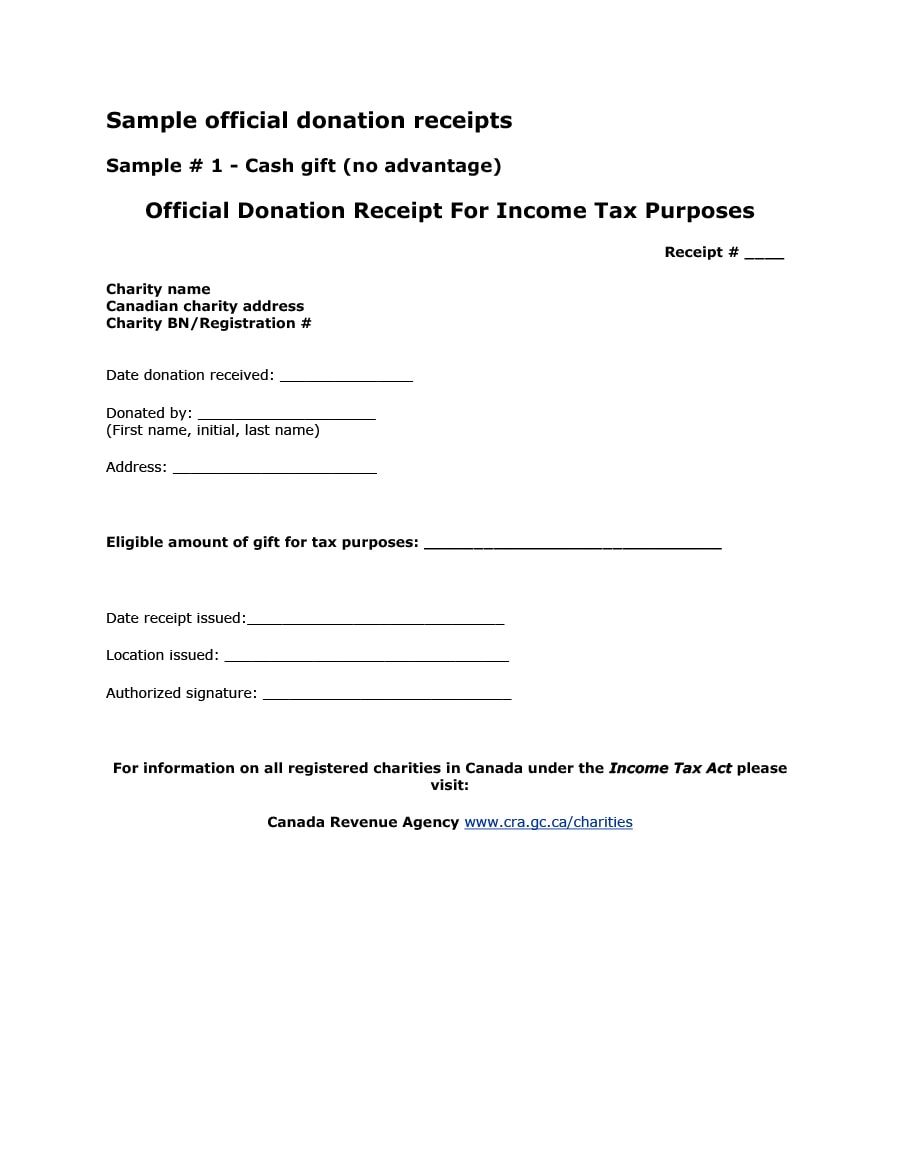

Tax deductible receipt template. Take a look at the template. Simply download the template to your computer. A donation receipt is the document that certifies that a donation has been made to some charity or an organization and is offered to the donor on part of the charity. Print out one donation receipt as needed or print out several hundred at a time.

Once the amount for any donation reaches 250 or more a receipt is required. Name of the organization. Gifts of 2 or more. It allows you to have all the information of your organization pre written once you download it.

With this tax deductible donation receipt template you can. Amount of cash contribution. Gift types and conditions. Under this rule a person may make ten 10 trips to donate clothes and claim it as a tax deduction without proof or a receipt.

The written acknowledgment required to substantiate a charitable contribution of 250 or more must contain the following information. Property we value at more than 5000. For example add a logo change the fonts change the color of the fonts add a picture add signature lines. Its important to remember that without a written acknowledgment the donor cannot claim the tax deduction.

Your non profit organization can customize and use this receipt template to acknowledge patrons donations that may be tax deductible. Insert your organization address with contact details including email and website. Shares valued at 5000 or less. The receipt shows that a charitable contribution was made to your organization by the individual or business.

A donation receipt template can help you generate an expert receipt in a few minutes. Gift types requirements and valuation rules. Is it a gift or contribution. A tax donation receipt template is available for download and can be easily filled to meet regulatory requirements.

Description but not value of non cash contribution. If you run a charity which often receives donations you have to be ready with your bunch of donation receipts. The receipt can take a variety of written forms letters formal receipts postcard computer generated forms etc. Tax deductible donation receipts we have prepared examples of tax donation receipts that a 501c3 organization should provide to its donors.

Best practices for creating a 501c3 tax compliant donation receipt. Decide on the areas that you would like to change. Property purchased during the 12 months before making the gift. 10 donation receipt templates doc pdf.