Working Capital Forecast Template

It is a measure of a companys liquidity and its ability to meet short term obligations as well as fund operations of the business.

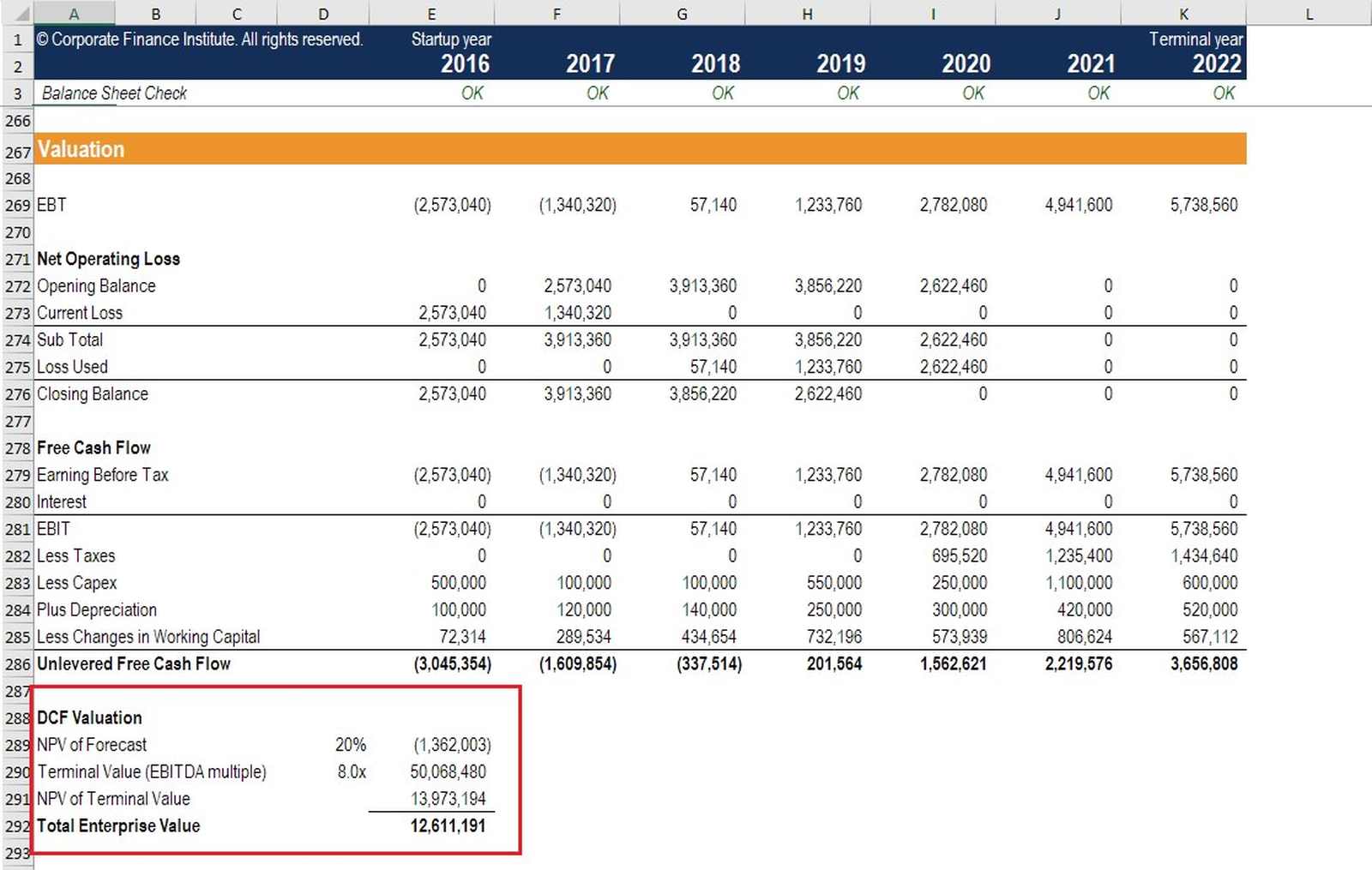

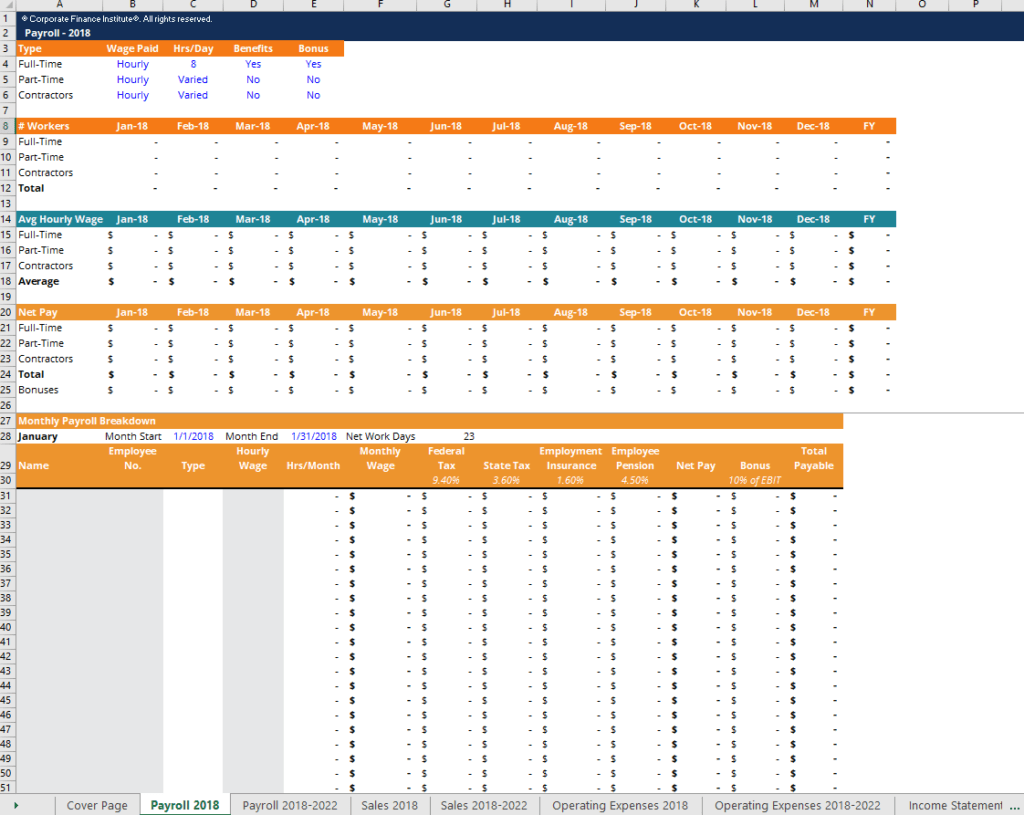

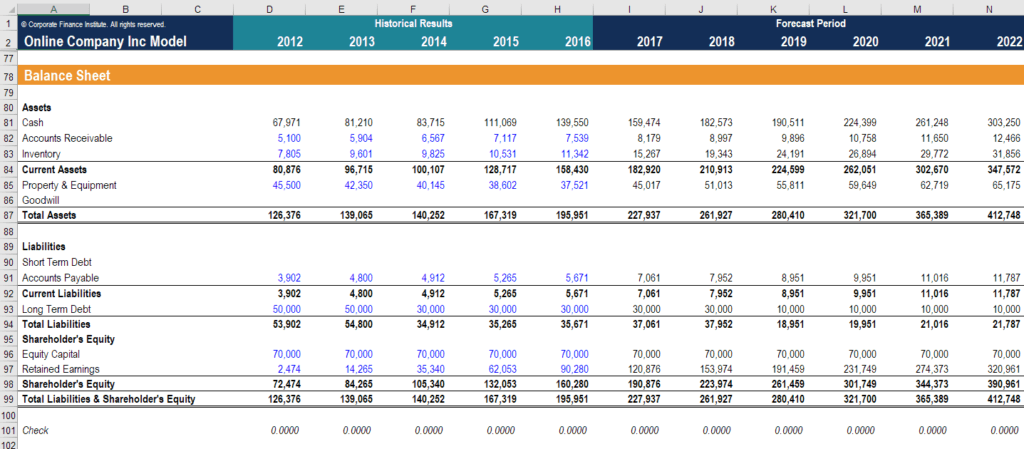

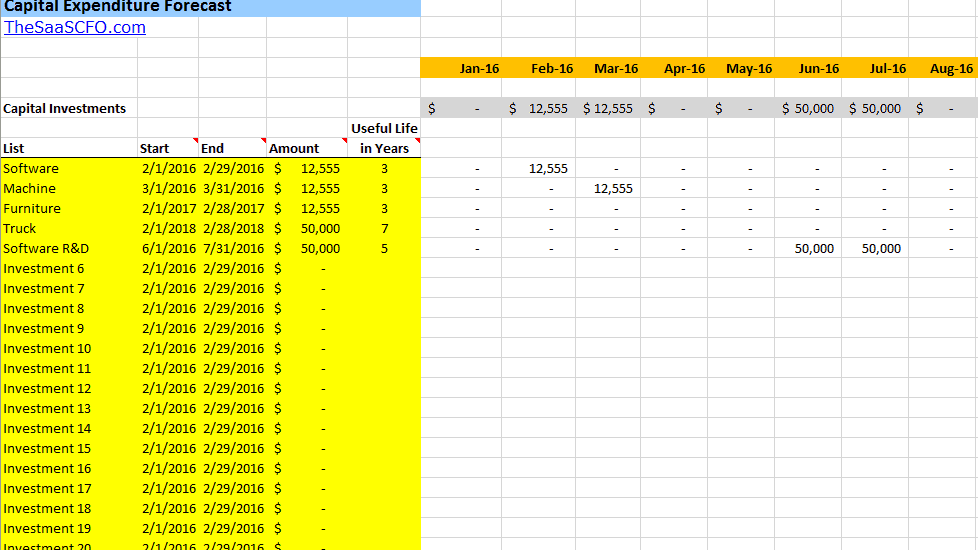

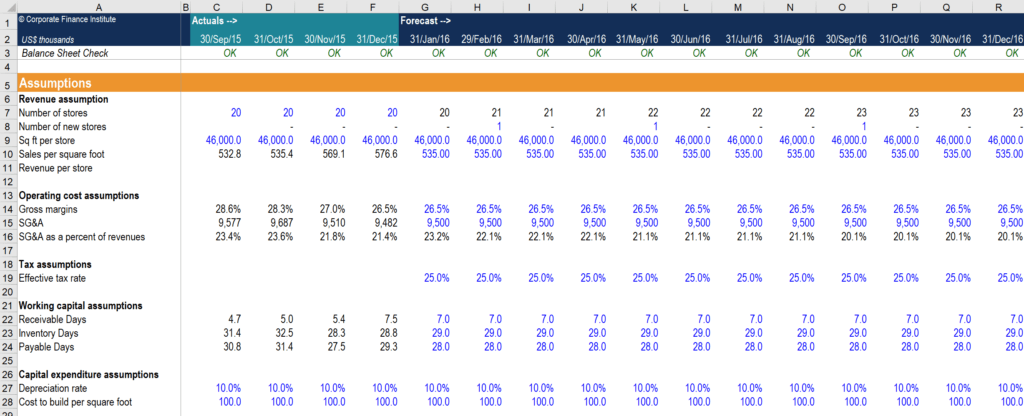

Working capital forecast template. Were now going to forecast the investments account. This article aims to provide readers with an easy to follow step by step guide to forecasting balance sheet items on a financial model in excel including property plant and equipment ppe other non current operating assets and various components of working capital. This is an example of a five year financial projection example template format that you might use when considering how to do a startup financial projections template. This is very simple.

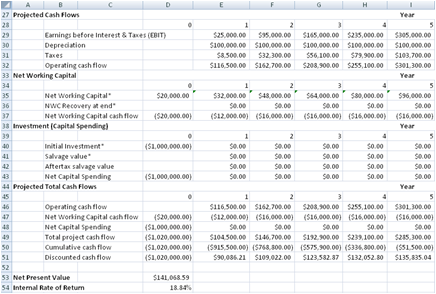

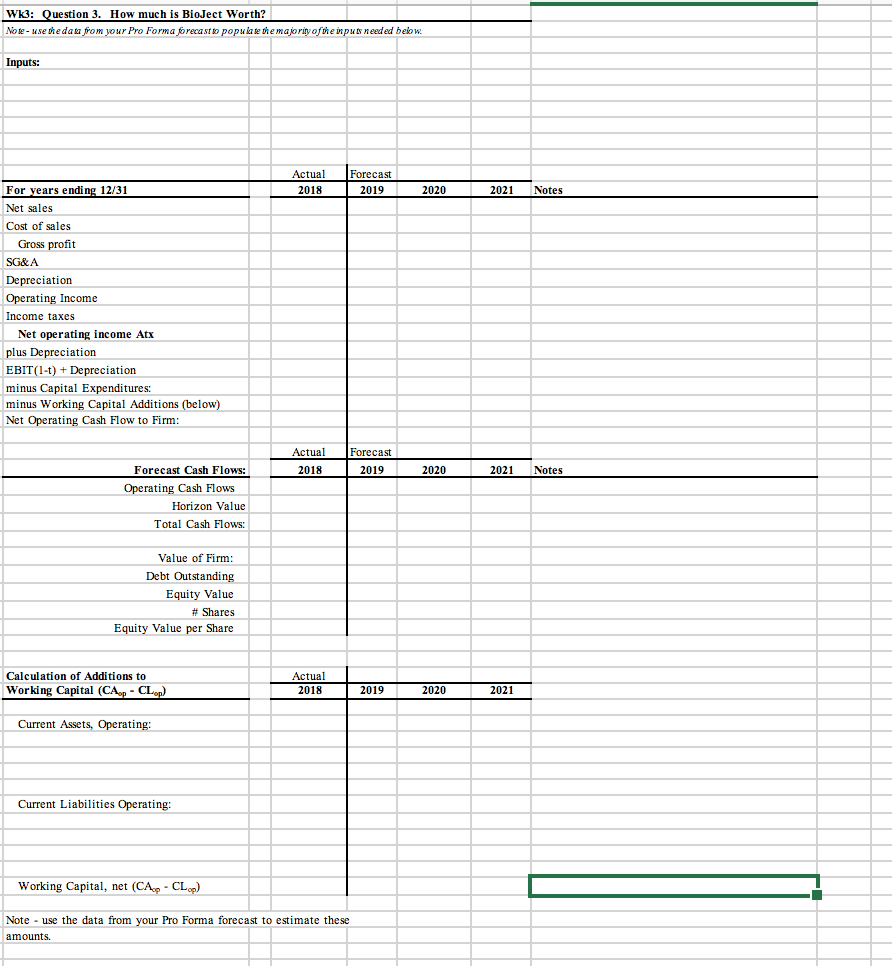

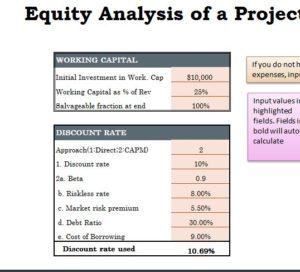

Forecasting working capital requirements. The reason is that the total current assets requirements should be forecasted in estimating the working capital requirementsworking capital forecasting is based on the overall financial requirements and financial policies of the concern. It is a financial measure which calculates whether a company has enough. Net working capital nwc is the difference between a companys current assets net of cash and current liabilities net of debt on its balance sheet.

The financial projections template cash flow statement refers to changes in working capital as part of the cash flow from operating activities but what is working capital what does it mean and how does it affect cash flow. We will forecast the arrevenue ratio at 10 based on historical figures. Forecast all the accounts except for investments. This working capital template allows you to calculate working capital using the following formula.

Working capital can be positive or negative and is used for managing cash flow. In this four step guide article we forecast. The ideal position is to. Working capital current assets current liabilities working capital is the difference between a companys current assets and current liabilities.

The working capital formula is current assets minus current liabilities. You can easily calculate working capital in the template provided. One term often referred to by investors and lenders is working capital. As the revenue figure is normally to hand or the first to be forecast the simplest way to do this is to calculate the working capital requirement as a percentage of revenue.

You need to provide the two inputs of current assets and current liabilities. Let us now do the same working capital example in excel. Were going to have to dig a little to find out a little more about what is in this account. In a normal business costs are incurred on purchases of inventory wages.

At any point in time a business needs to be able to estimate its working capital requirement. We make no warranty or representation as to financial projection model template accuracy and we are covered by our terms and conditions which you are deemed to have read.