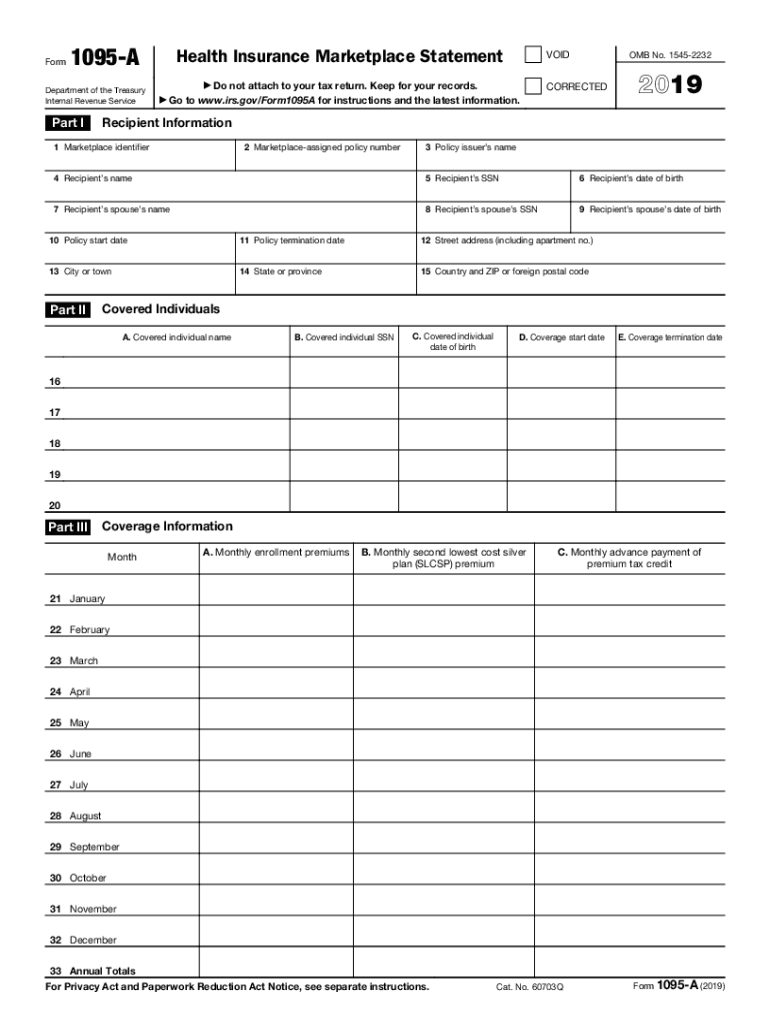

1095 A Form Printable

You may have more than one if your household enrolled in more than one marketplace health plan or if you reported a life change during the year.

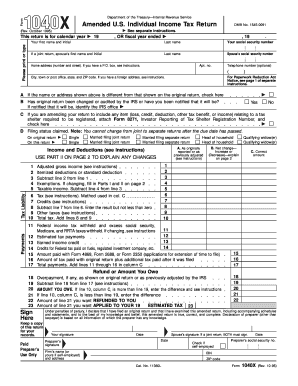

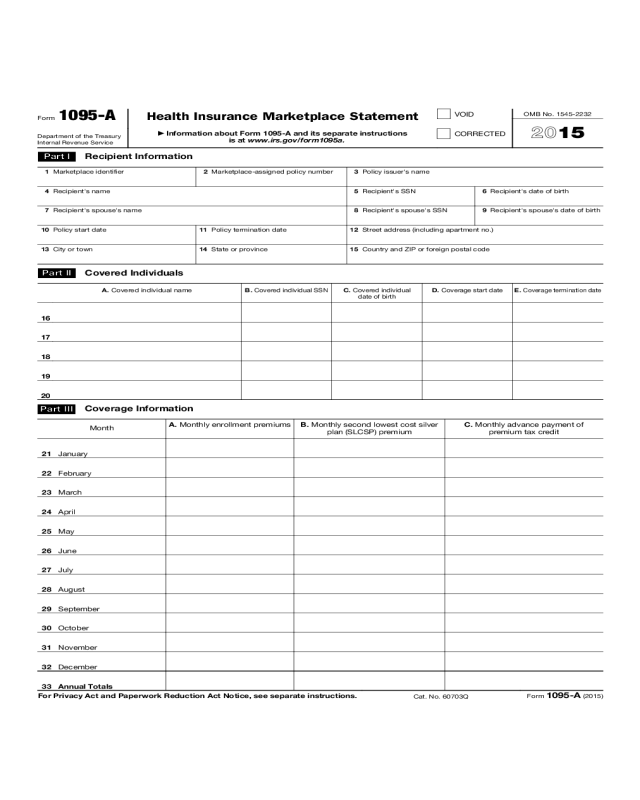

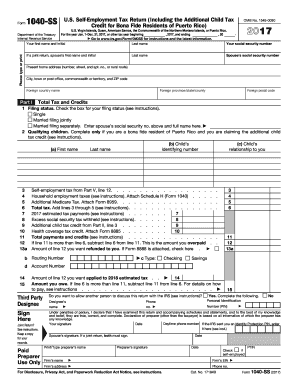

1095 a form printable. Ale members must report that information for all twelve months of the calendar year for each employee. Form 1095 a is provided here for informational purposes only. You are receiving this form 1095 c because your employer is an applicable large employer subject to the employer shared responsibility provision in the affordable care act. The top left and print to print a copy for your records.

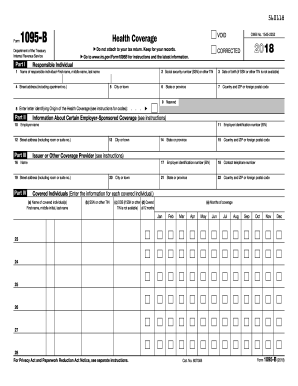

If you or another family member received employer sponsored coverage that coverage may be reported on a form 1095 c part iii rather than a form 1095 b. Form 1095 a is used to report certain information to the irs about individuals who enroll in a qualified health plan through the marketplace. For more information see. Form 1095 a rather than a form 1095 b.

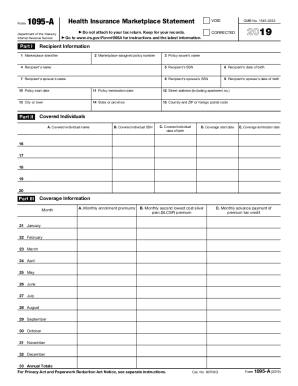

Irs forms 1094 and 1095 irs form 1094 b transmittal of health coverage information returns is a form used by the irs to obtain information about individuals that have health coverage meeting the standards of. As the form is to be completed by the marketplaces individuals cannot complete and use form 1095 a available on irsgov. Health insurance marketplaces use form 1095 a to report information on enrollments in a qualified health plan in the individual market through the marketplace. About form 1095 a health insurance marketplace statement internal revenue service.

Health insurance marketplaces furnish form 1095 a to. You or a household member started or ended coverage mid month. But if the marketplace assigned policy number in box 2 is the same among the forms use the most recent one. Typically it is sent to individuals who had marketplace coverage to allow them to.

Form 1095 c is filed and furnished to any employee of an applicable large employers ale member who is a full time employee for one or more months of the calendar. In this case your form 1095 a will show only the premium for the parts of the month coverage was provided. This form 1095 c includes information about the health insurance coverage offered to you by your employer. This form must be sent by the employer not by the irs and it is complementary to other health insurance forms 1095 a and 1095 b.

Form 1095 a is an irs form for individuals who enroll in a qualified health plan qhp through the health insurance marketplace. Irs form 1095 c employer provided health insurance offer and coverage is a form used by the employers that have fifty or more full time employees to send the required information about enrollment in health coverage and health coverage offers for these employees.