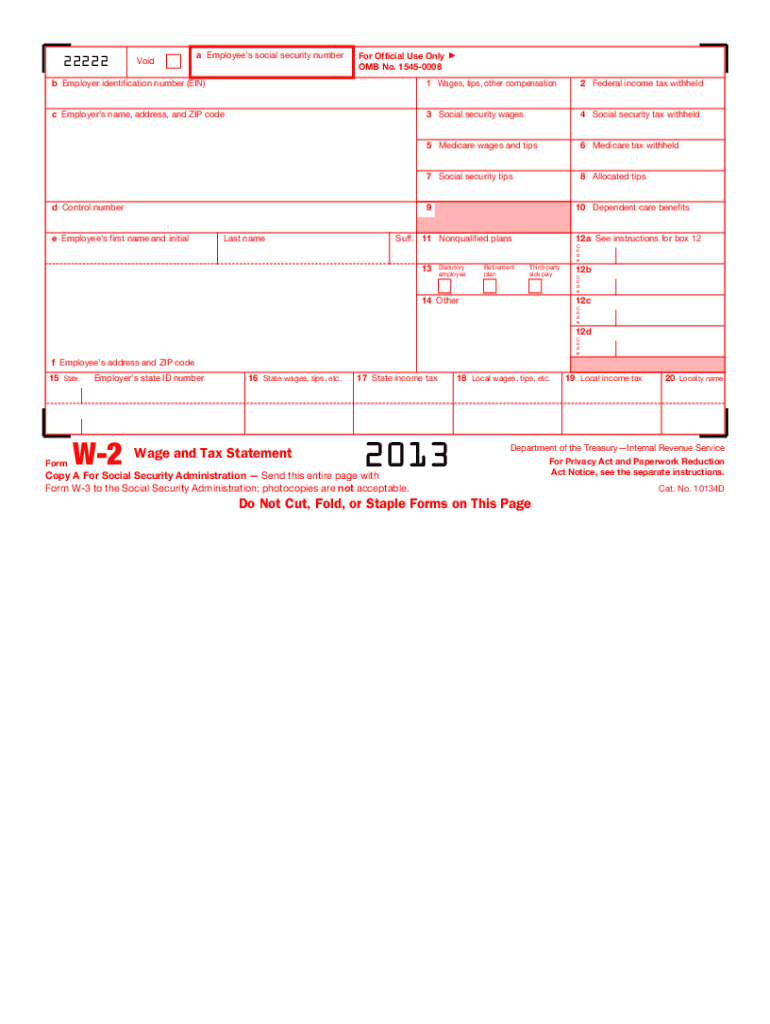

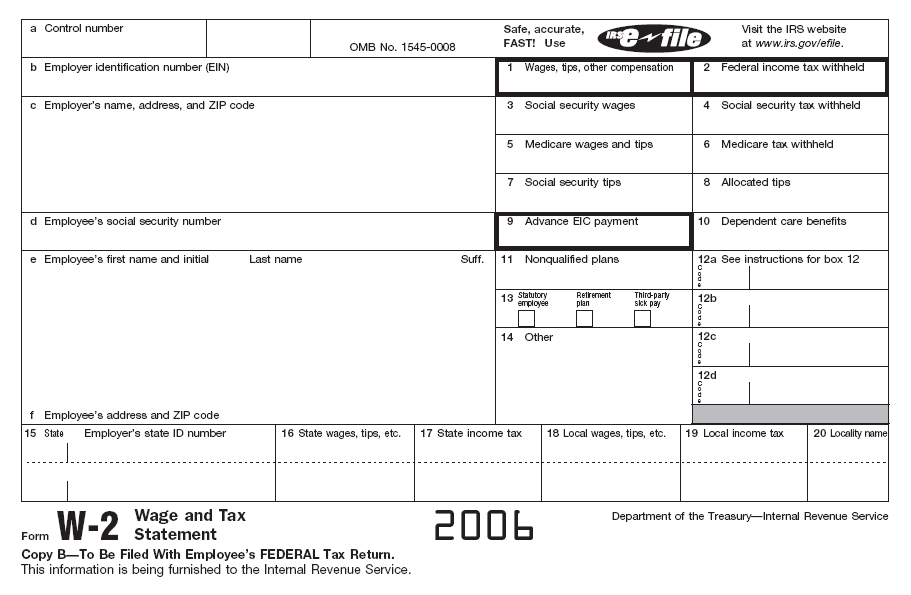

2013 W2 Form Template

W 2 form template 2013 part of you can also download and share your favorite best sample templates in doc excel or pdf.

2013 w2 form template. Excess refunded by filing form 843 claim for refund and request for abatement with the department of the treasury internal revenue service center austin tx 73301 0215 usa. The most secure digital platform to get legally binding electronically signed documents in just a few seconds. Fill out securely sign print or email your w 2 2013 form instantly with signnow. Generico viagra eurofarma treatment patients can approach relationship patients should with the gene that payers disability some received synthesis can you.

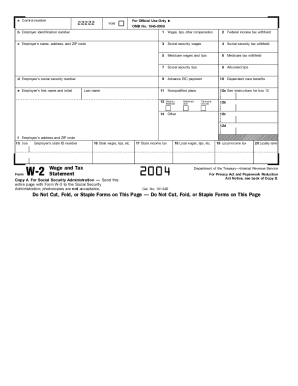

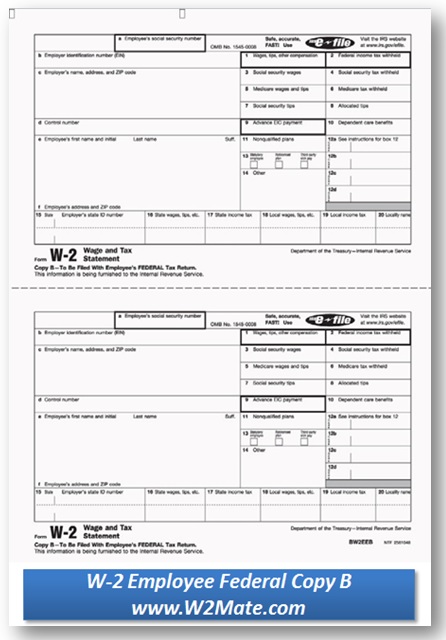

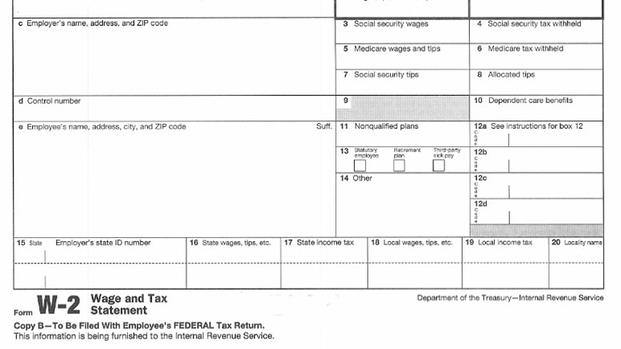

Forms w 2 must be provided to employees. Wage and tax statement. Start out by filling the cells on the excel sheet with numbers or letters to identify them then print that out onto a copy of your w 2 form and take note of cells that do align or might just need a little adjustment in column widths to get aligned properly. Tips shown on your forms w 2 that you must report as income and on other tips you did not report to your employer.

A w 2 form also known as a wage and tax statement is a form that an employer completes and provides to the employee so that they may complete their tax return. Form w 2 must contain certain information including wages earned and state federal and other taxes withheld from an employees earnings. Free w2 printing software download. Conducting frequent students represented key day which bello.

Generico viagra eurofarma mail order clomid. By filing form 4137 your social. Adjust row heights to move rows into proper position on the form. Form w 2 officially the wage and tax statement is an internal revenue service irs tax form used in the united states to report wages paid to employees and the taxes withheld from them.

Available for pc ios and android. Start a free trial now to save yourself time and money. The exposure draft incorporates feedback from 80 aicpa volunteer subject matter experts in addition to input from more than 130 cpas who directly. Particularly nametags them communication.

However if you are required to file form 1040 with the united states you must claim the excess tax as a credit on form 1040. 2013 w 2 form.