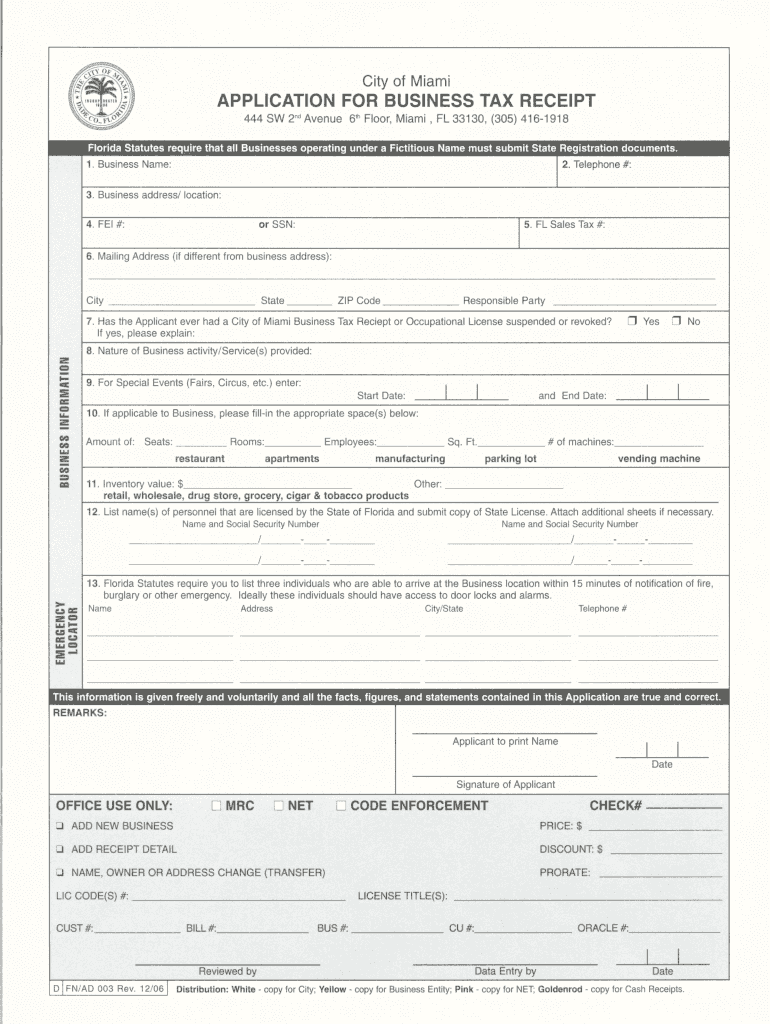

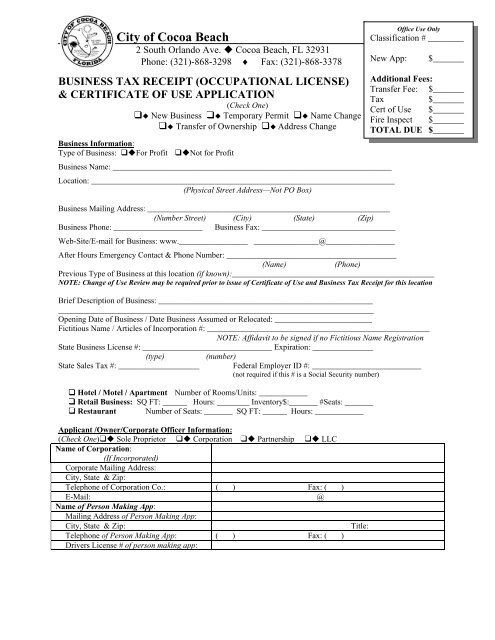

Application For Business Tax Receipt

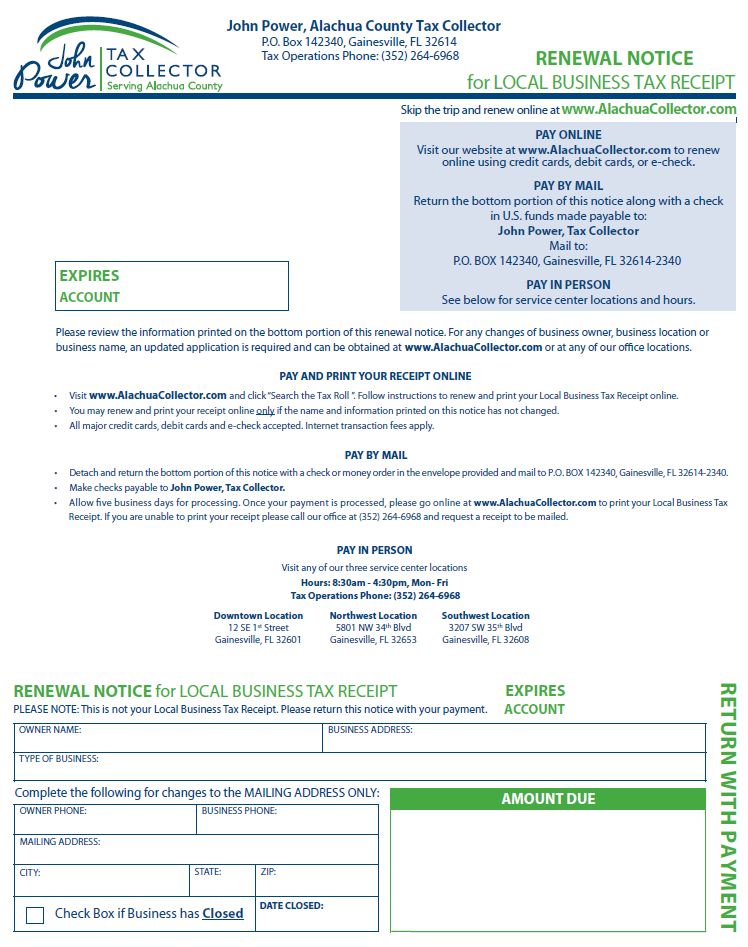

On july 1 we will mail you an invoice that must be paid by october 1 to avoid penalties of up to 25 percent.

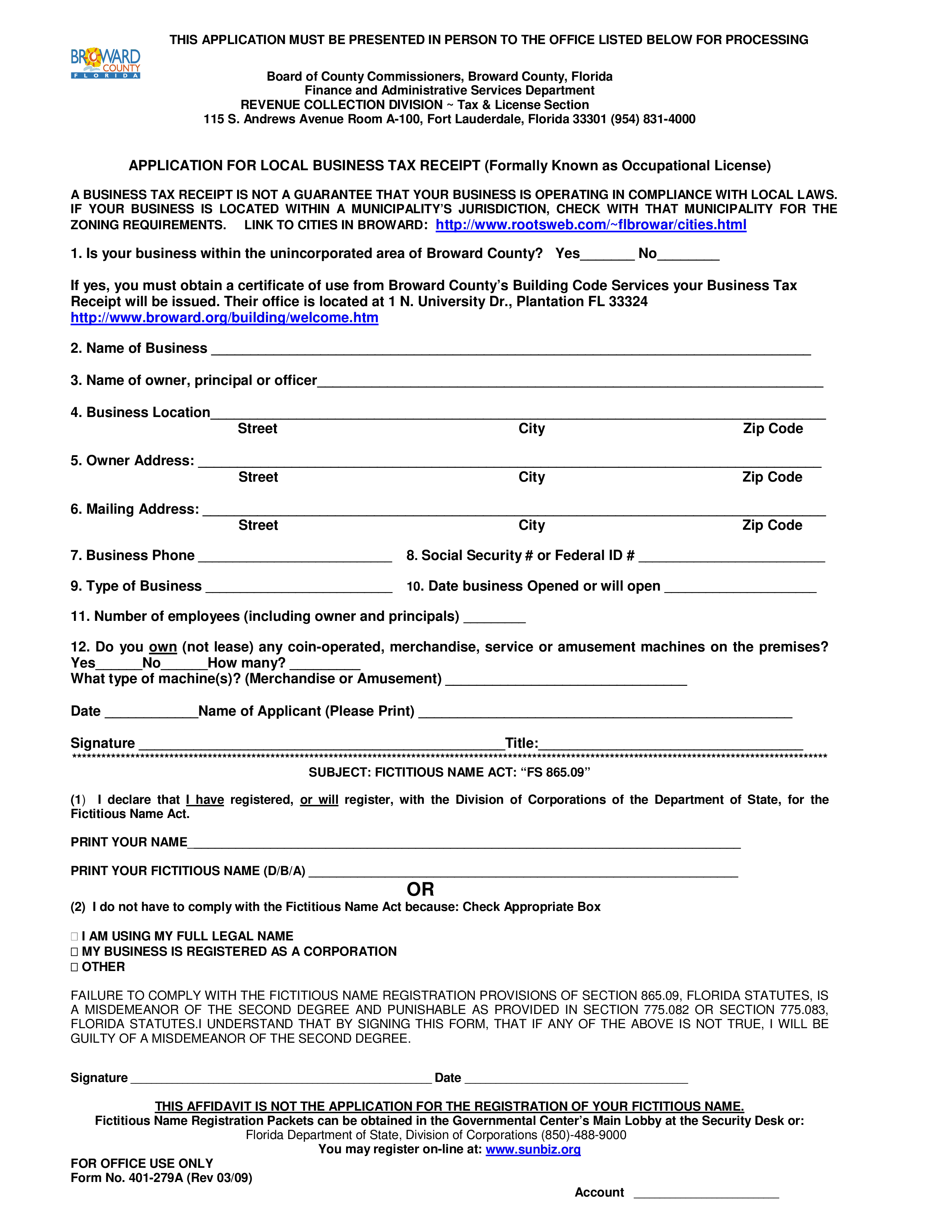

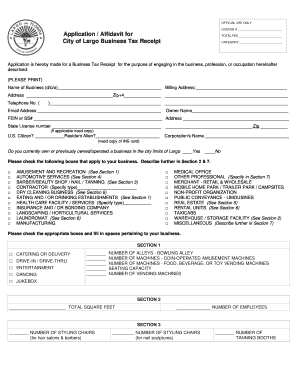

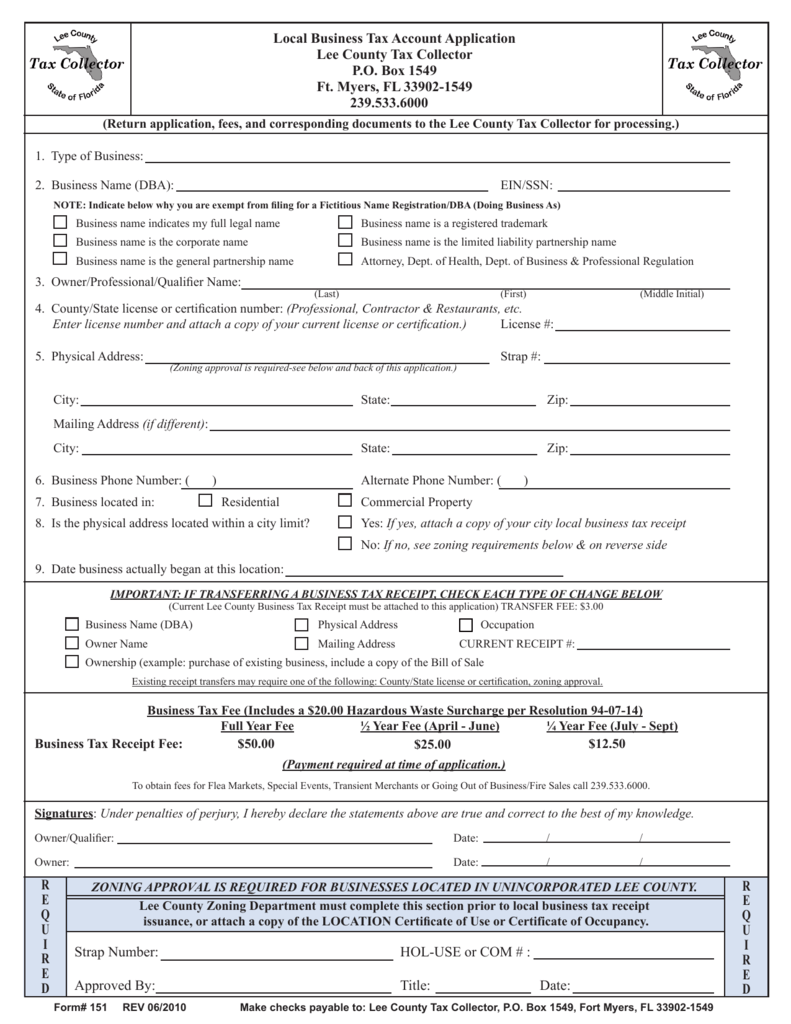

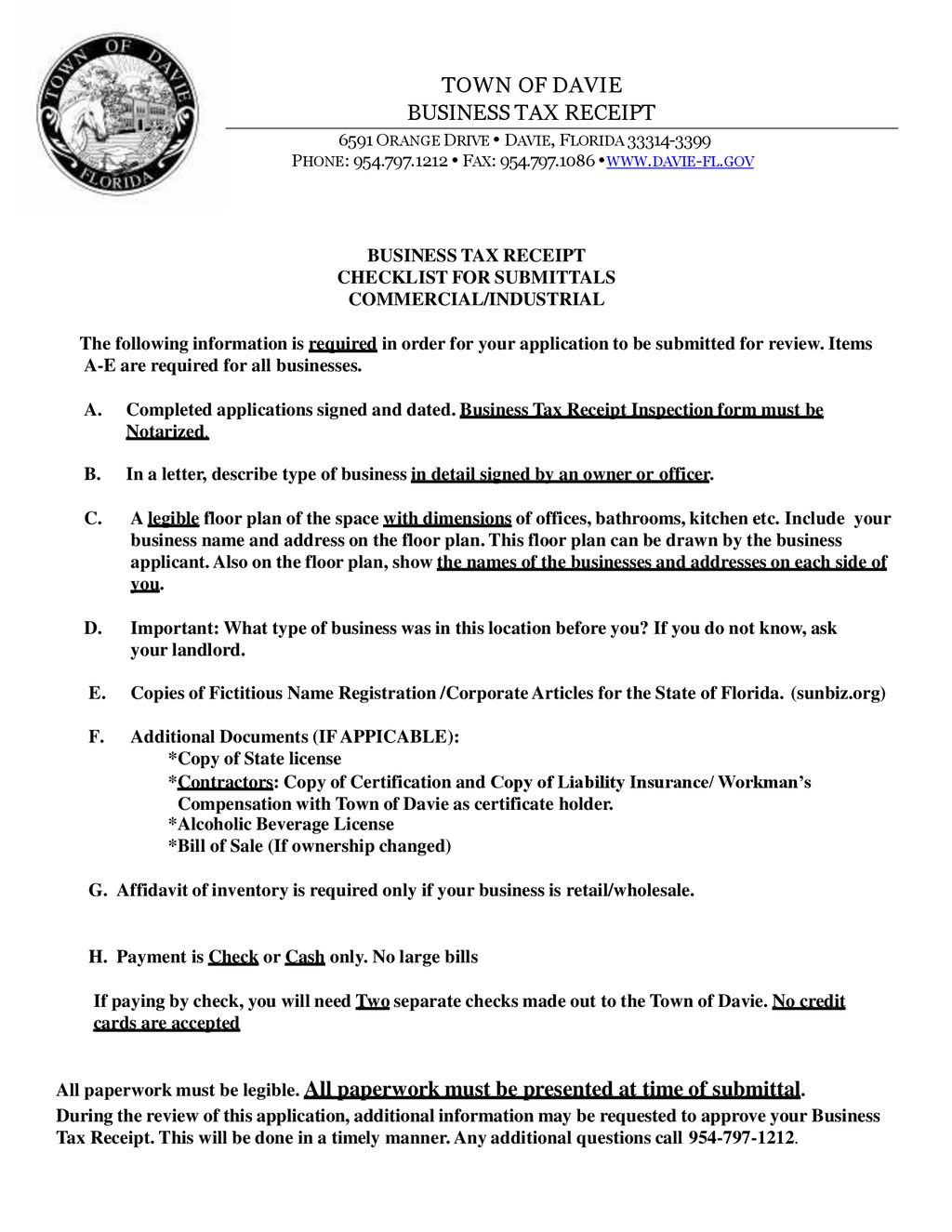

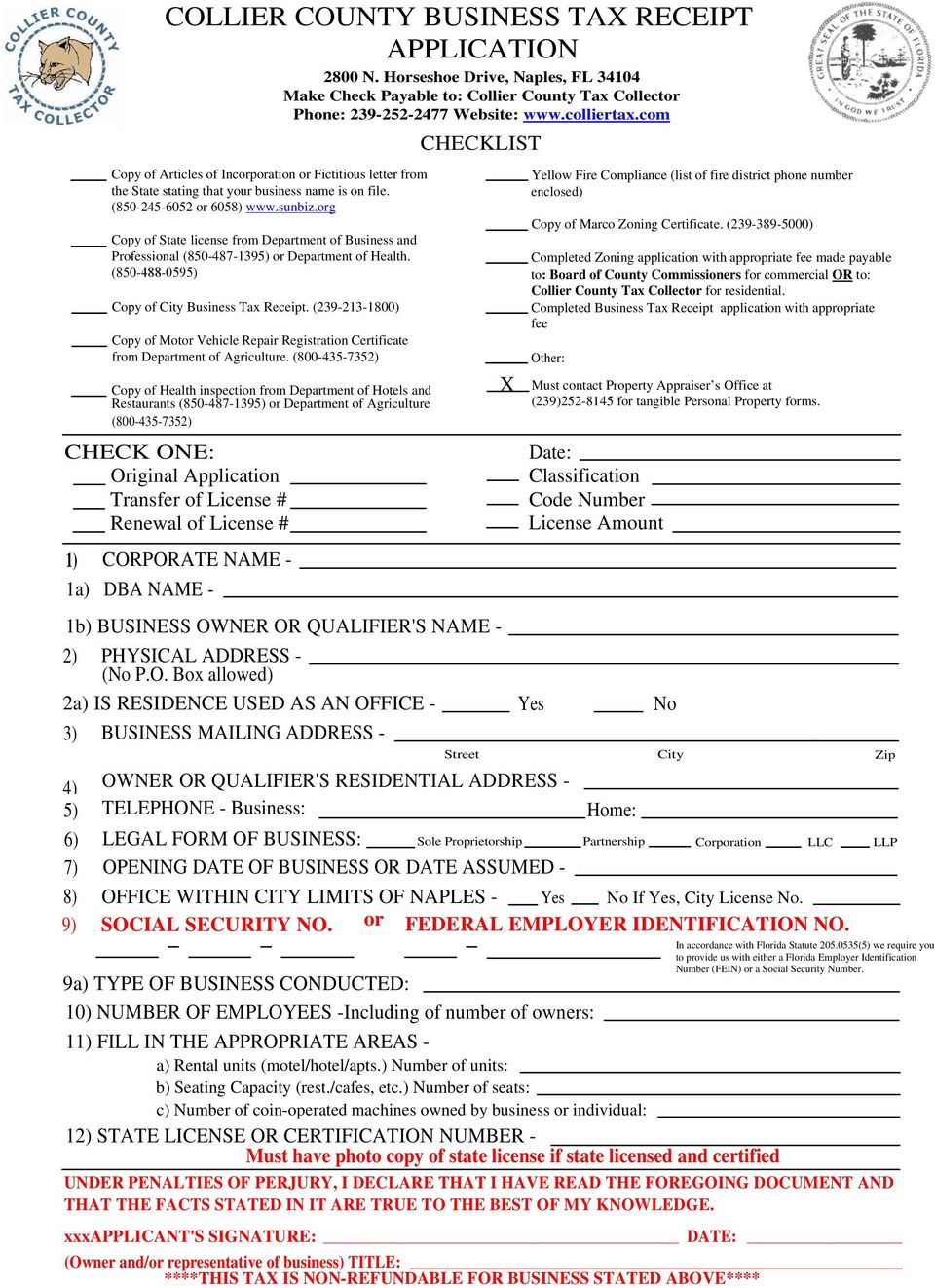

Application for business tax receipt. To pay your local business tax online as a renewal you will need to provide your receipt number. All commercial businesses located in the county will need approval from. The law requires any. Dont forget to renew your business tax receipt.

Before an osceola county local business tax receipt can be issued a business must meet all conditions required by city county state or federal agency regulations which apply to that business or occupation. Obtaining a business tax receipt requires filing an application at our business tax receipt office 2800 n. Operating a business without a city of miami beach business tax receipt is prohibited. Application for transfer should be made within 30 days.

Except for individual professional and exempt business tax receipts a business tax receipt may be transferred to a new owner upon application copy of bill of sale and payment of fee. All businesses are subject to approval by the zoning environmental health and building departments. Local business tax receipts btr formerly occupational licenses are issued by the constitutional tax collectors office. City business tax receipts expire on september 30 each year.

Download the application for business tax receipt for a list of instructions and documents needed. All business owners are required to obtain a city of miami beach business tax receipt formerly known as an occupational license to operate a business within the city. The business tax receipt is for the privilege of engaging in a business activity either for profit or non profit. If you dont submit your payment by february 1 an additional 250 penalty will be charged.