Cash Flow Template For Startup Business

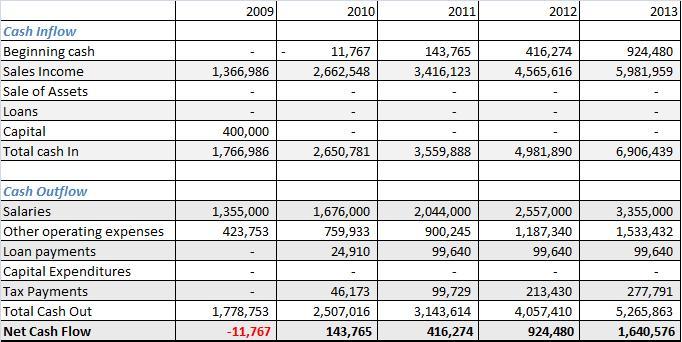

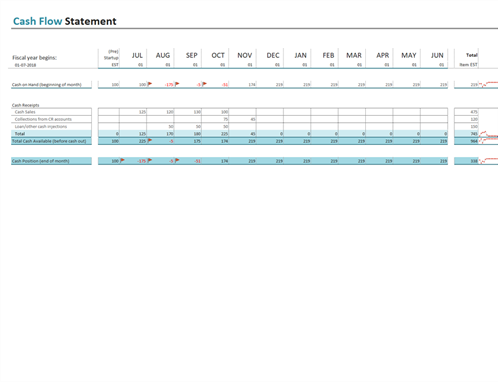

A cash flow forecast is an estimation of the money you expect your business to bring in and pay out over a period time.

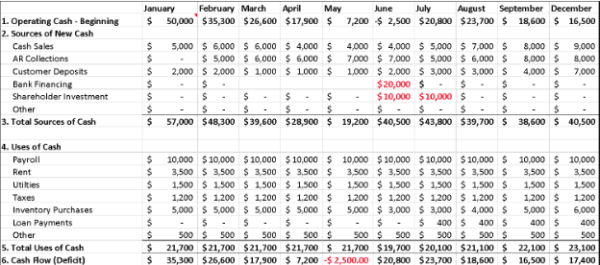

Cash flow template for startup business. Cash flow from operating activities represents cash from the day to day trading operations of the business. Understanding cash flow statements example. What is a cash flow statement. This template can help you predict whether your business will have enough cash to meet its obligations.

Using this template will help you plan your cash flows for a two year period. Accordingly as a startup company owner you have to know the ins and the outs of cash flow statements. It reflects all of your revenue sources like sales or other payments from customers compared to your expenses like supplier payments premises rental and tax payments. The cash flow statement looks complicated but is in fact relatively straightforward to analyze.

This section starts with the net income of the business from the income statement and then adjusts this for non cash flow items such as depreciation and cash used to provide working capital. Startup businesses by their nature tend to experience cash flow problems. The cash flow helps you to see how and when cash will enter and leave your business. Think of the cash flow as the story of the money that enters and then leaves your bank account on a monthly basis.

If your startup company has to account for vat or sale tax the entries on the profit and loss must exclude this tax. Projected cash balances below the minimum amount you specify are displayed in red. Download this financial projections excel template to calculate your startup expenses payroll costs sales forecast cash flow income statement balance sheet break even analysis financial ratios cost of goods sold amortization and depreciation for your small business. The profit and loss report is for 12 months and all the entries are included on the report automatically.

How to forecast your startup or businesss cash flow. Alongside the balance sheet and the income statement the cash flow statement cfs is the third of the holy trinity of mandatory business forms. A cash flow forecast is an estimate of the money you expect your business to bring in and pay out over a period of time we require a 12 month forecast. It is a measure of all the incoming and outgoing cash activity of the business and is usually estimated at a monthly level.

By way of example the cash flow statement of apple inc. Small business cash flow projection. You can also see a chart of your projected monthly balances. It should reflect all of your likely revenue sources like sales or other payments from customers and compare these against your likely business expenses like supplier payments.

As the business seeks to expand additional cash is needed to fund the growth in working capital and investment this problem is further compounded by the lack of available finance facilities for a startup operation. Cash flow forecast template for excel.