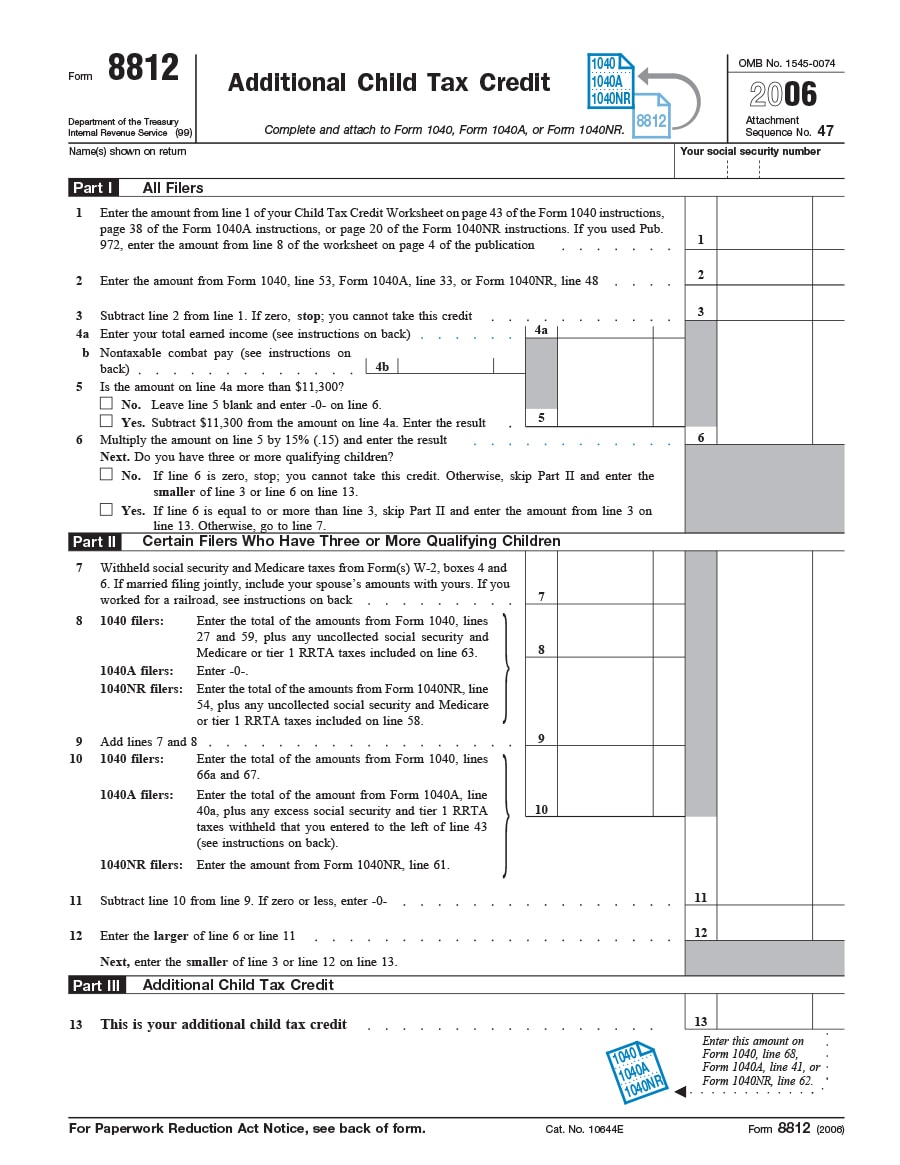

Child Tax Credit Worksheet

Instructions for form 1040 ss us.

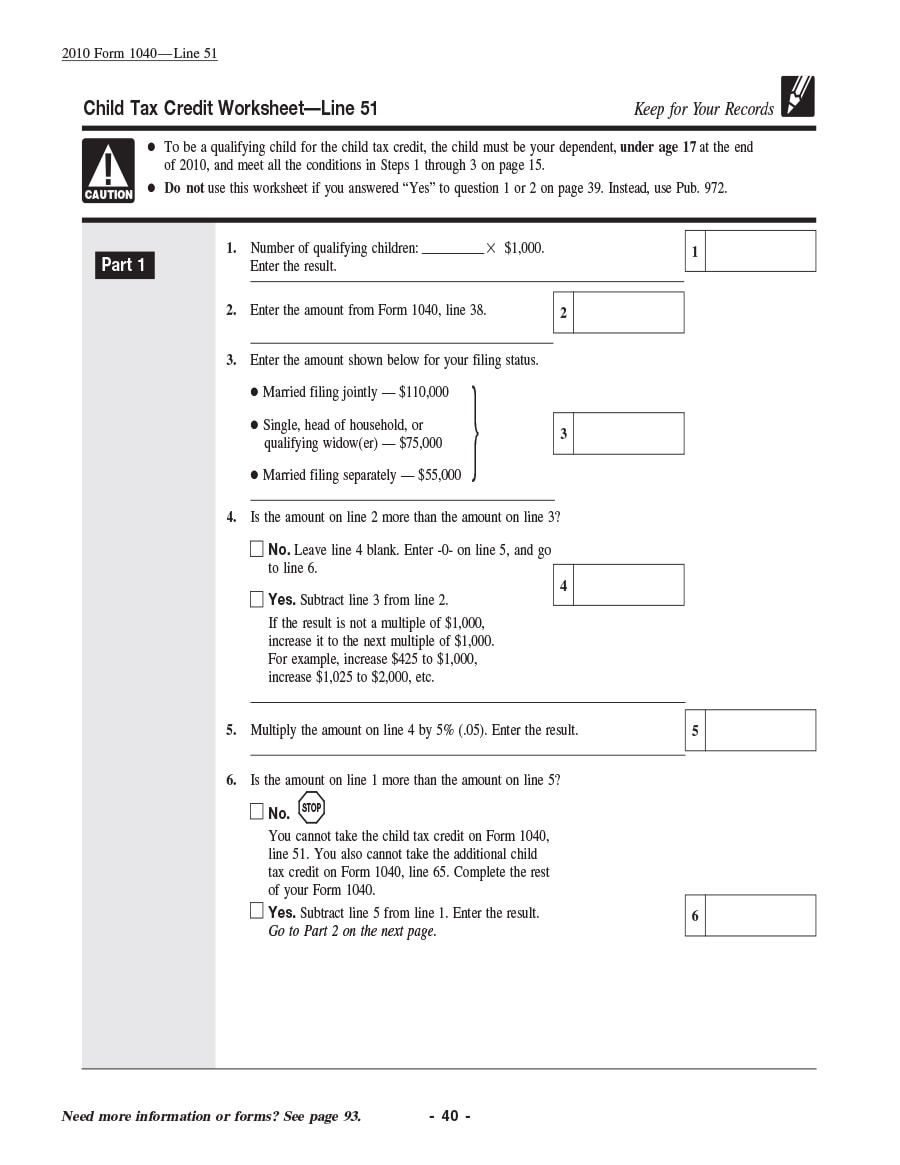

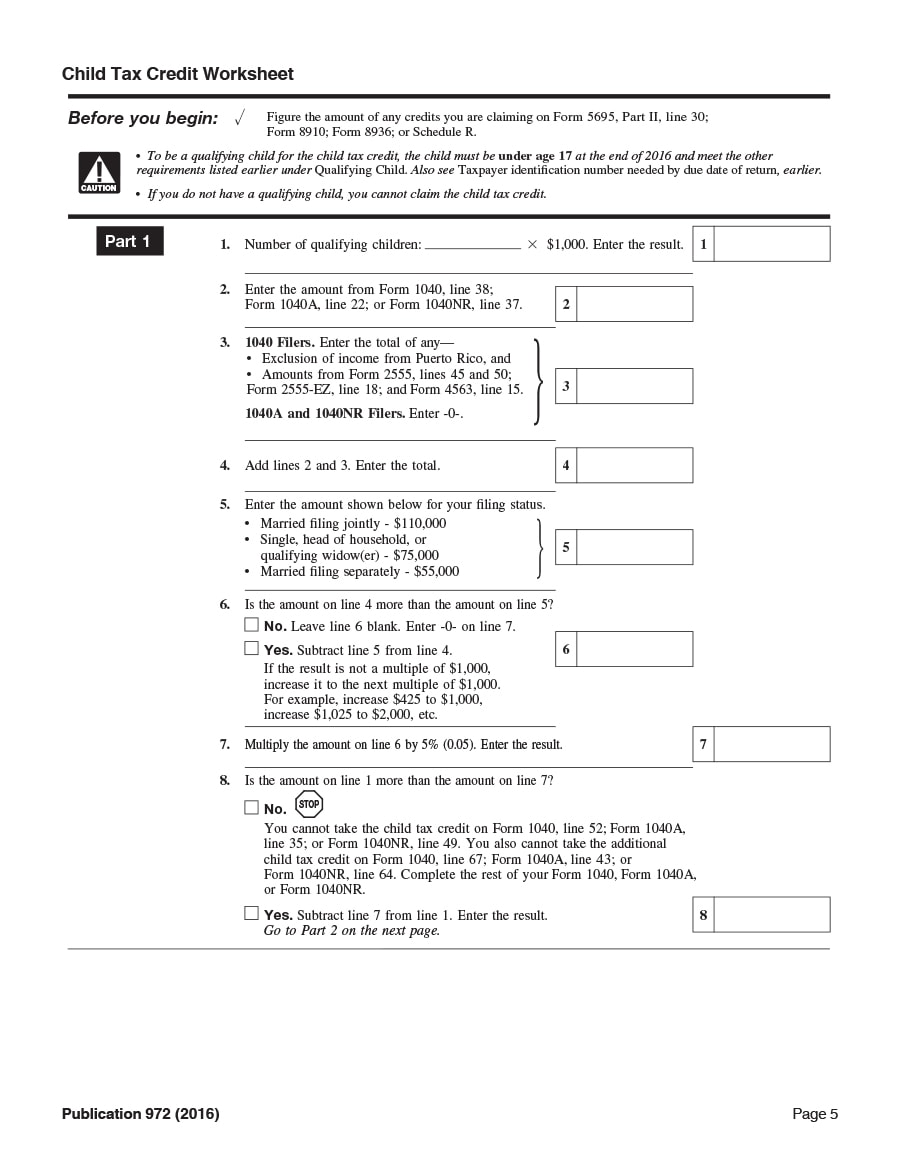

Child tax credit worksheet. Worksheet for calculating how much child tax credit you can claim. 2018 child tax credit and credit for other dependents worksheetline 12a keep for your records 1. If you have young children or other dependents there is a good chance you qualify for the child tax credit. Child tax credit beginning with tax year 2018 you may able to claim the child tax credit if you have a qualifying child under the age of 17 and meet other qualifications.

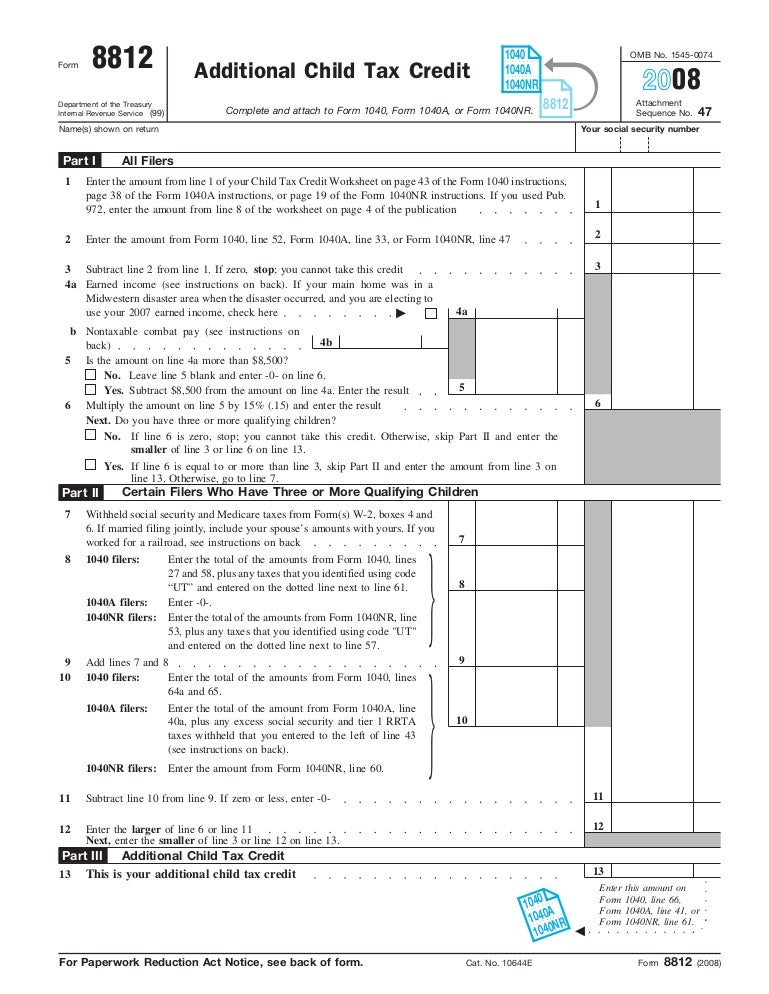

The irs provides a child tax credit worksheet to help calculate the amount of credit available to take on your tax return. Self employment tax return including the additional child tax credit for bona fide residents of puerto rico. Length of residency and 7. To be a qualifying child for the child tax credit the child must be your dependent under age 17 at the end of 2010 and meet all the conditions in steps 1 through 3 on page 15.

This credit reduces your federal income tax bill by up to 2000 per child for the 2019 tax year what you file in early 2020. You andor your child must pass all seven to claim this tax credit. Up to 1400 of the credit can be refundable for each qualifying child as the additional child tax credit. The maximum amount per qualifying child is 2000.

Make sure you checked the box in. To be a qualifying child for the child tax credit the child must be your dependent under age 17 at the end of 2018 and meet all the conditions in steps 1 through 3 under who quali es as your dependent. Subtract line 3 from line 2. Make sure you figured the amount if any of your child tax credit.

Topic page for child tax credit worksheet. If you answered yes on line 9 or line 10 of the child tax credit worksheet in the form 1040 form 1040a or form 1040nr instructions or on line 13 of the child tax credit worksheet in this publication use. Self employment tax return including the additional child tax credit for bona fide residents of puerto rico. 2010 form 1040line 51 child tax credit worksheetline 51 yes.

Information about schedule 8812 form 1040 child tax credit including recent updates related forms and instructions on how to file. The additional child tax credit follow the steps below. In the past two years there have been notable changes to this tax credit.