Conditional Receipt Life Insurance

When you select a life insurance policy you will fill out an application for coverage.

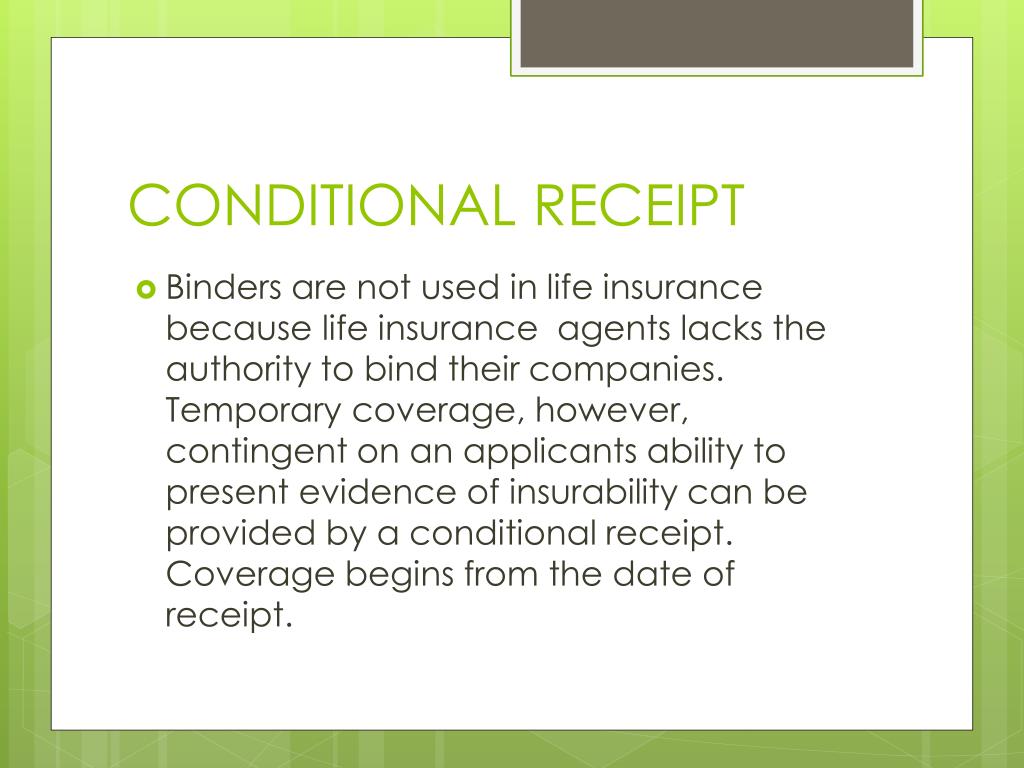

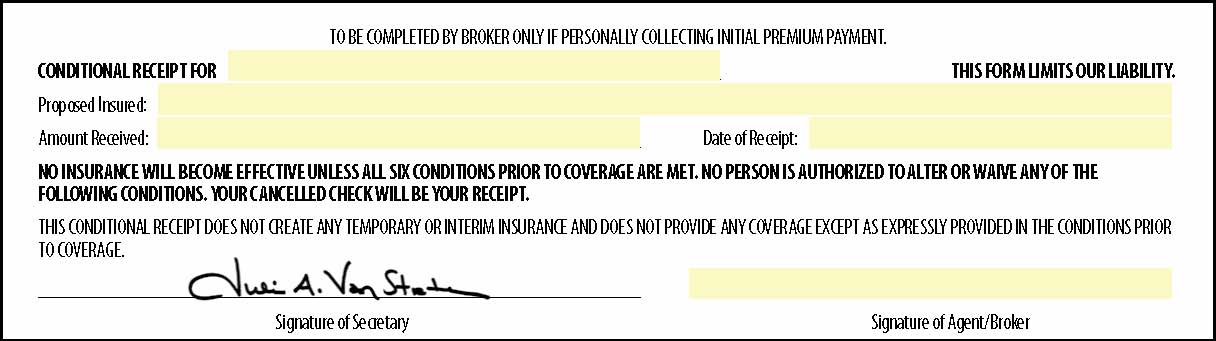

Conditional receipt life insurance. What is conditional coverage for life insurance. A conditional receipt gives an insurance company a window of time in which they can ultimately issue or refuse to approve the policy. For an example see the link to new york state law found under references below. The conditional receipt is the most common form of receipt but it is not a full receipt.

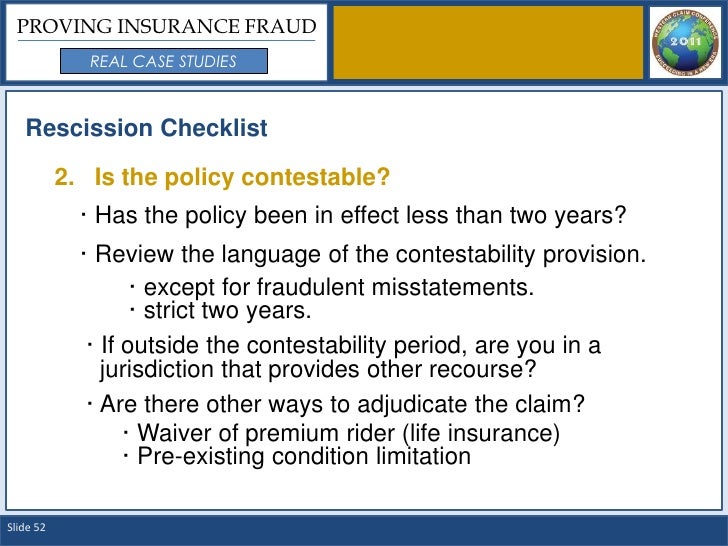

This receipt means that the person can only be insured if he or she meets the standards of insurability and is given approval by the insurance company. 1 insurability and 2 approval. Such receipts bind the insurance company if the risk is approved as applied for subject to any other conditions stated on the receipt. Not only is it important to get yourself a life insurance agent who understands the importance of conditional receipt but also it reminds me that as you put your insurance in force with a life insurance company it is important to have one with stability that is able to pay the claims when you actually need them paid.

In most cases when you leave your insurance agents office he or she will give you a document notifying you that you currently have conditional coverage life. The conditional receipt contains two subcategories as well. A conditional receipt is a document given to someone who applies for an insurance contract and has provided the initial premium payment. Conditional receipt of a life insurance policy the sudden death of a loved one is hard to deal with.

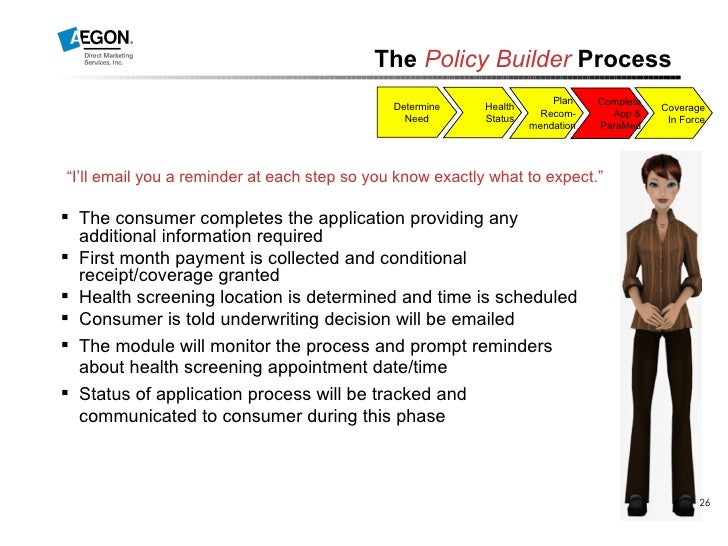

This receipt is given to policy owners when they pay a premium at time of application. Policy delivery and receipt once the underwriting process is complete and you have been approved the life insurance policy will be issued by the insurance company. This can only be compounded by your loved one not having a life insurance policy. The coverage is not effective until the policy is delivered and the initial premium has been paid.

/insurance-e1a1b77a7bf440c9a8d5b15dc162ad6a.jpg)