How Long To Keep Business Receipts

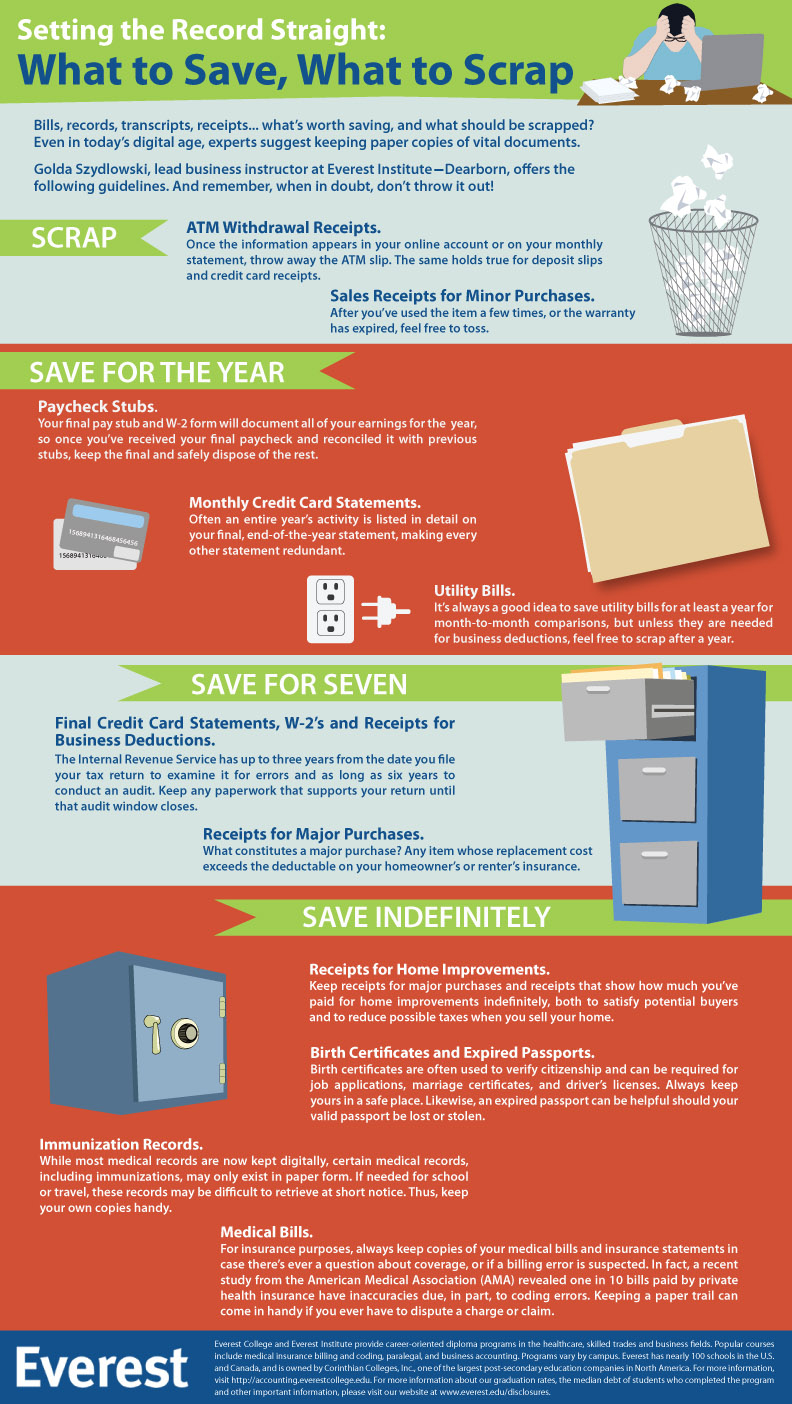

If you filed for a deduction for a bad debt or worthless security the irs suggests you keep your supporting tax records for 7 years.

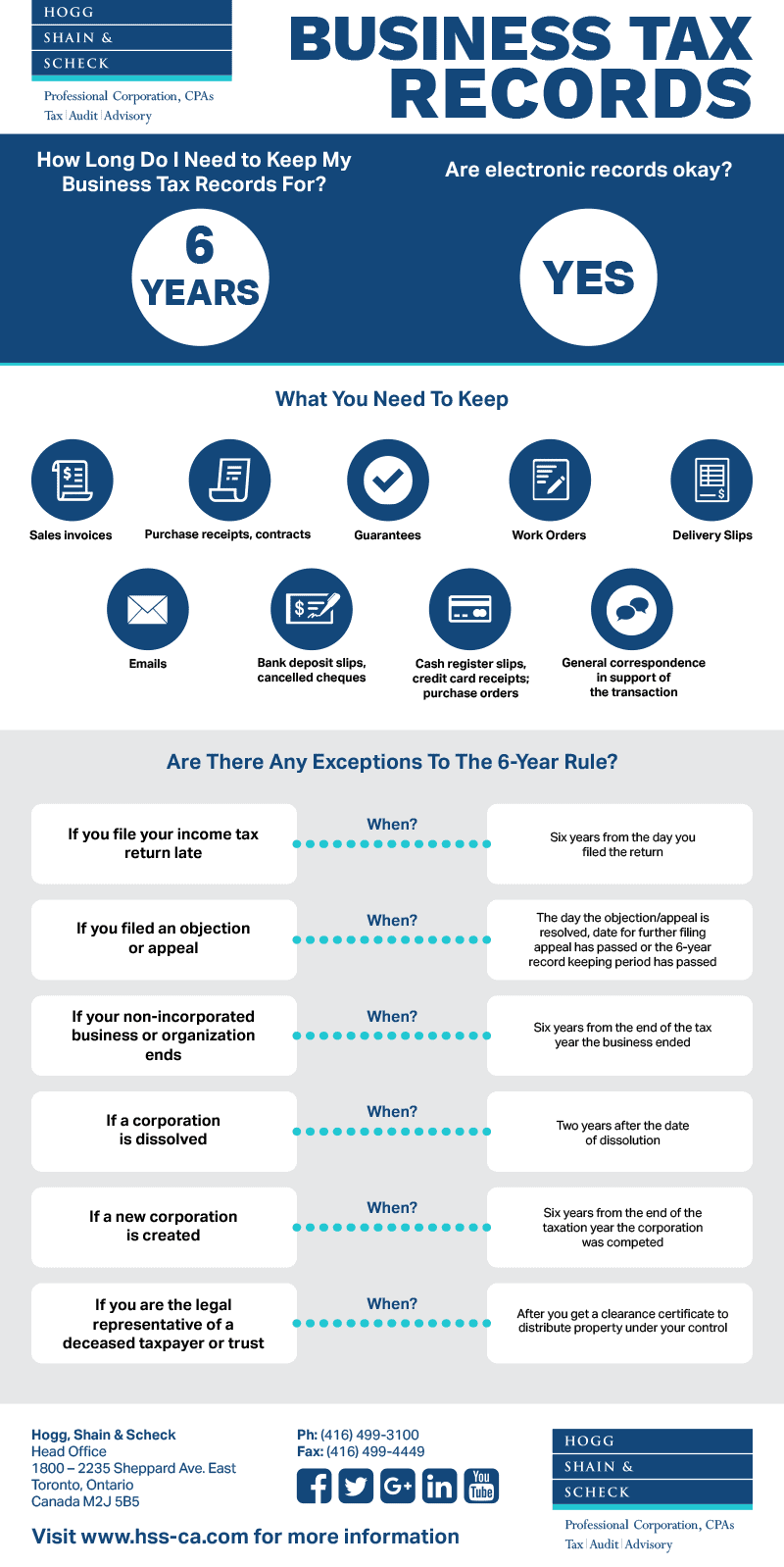

How long to keep business receipts. Typically the irs can come after your business for failing to report income for up to 6 years after your filing if the amount is greater than 25 of your businesss gross income. Keep records for 7 years if you file a claim for a loss from worthless securities or bad debt deduction. Gross receipts are the income you receive from your business. In most cases the irs can audit you for three years after a filing but that time period extends to six years if the irs suspects you made a substantial error on your return.

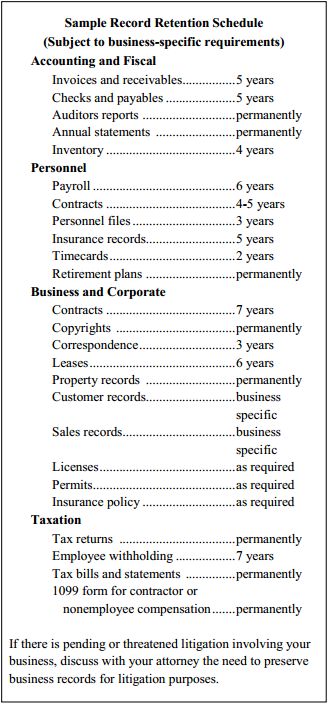

Otherwise though most personal expenses arent even short term keepers. You should keep supporting documents that show the amounts and sources of your gross receipts. Keep records for 3 years from the date you filed your original return or 2 years from the date you paid the tax whichever is later if you file a claim for credit or refund after you file your return. Keeping business records takes time and space but the benefits are worth the sacrifices.

Atm receipts and deposit slips after theyve been reconciled with your bank statement monthly and quarterly bank statements if year end statements are received keep for three years material that supports tax returns should be saved for three years. Stick to the irs recommendation of six years. Its more important to be prepared than have extra filing space. That deadline extends to six years if it believes you underreported income by 25 percent or more.

Keep your business receipts for at least three years in case you need to show proof of purchases or sales. If you omitted income from your return keep records for six years. Having peace of mind as a business owner is invaluable. In some cases the government may look further back into your records.

Keep receipts or credit card statements that prove charitable donations expenses and other deductions for at least three years. If you have self employment income keep them for seven years. Most supporting documents need to be kept for at least three years. Employment tax records must be kept for at least four years.

You should keep them in an orderly fashion and in a safe place. The irs may audit six years worth of financial information for businesses suspected of fraud or tax underpayment. Thats why you should always keep your business records. Business tax returns and supporting records must be kept until the irs can no longer audit your return.

The following are some of the types of records you should keep.