Section 199a Deduction Worksheet

The tax adviser and tax section.

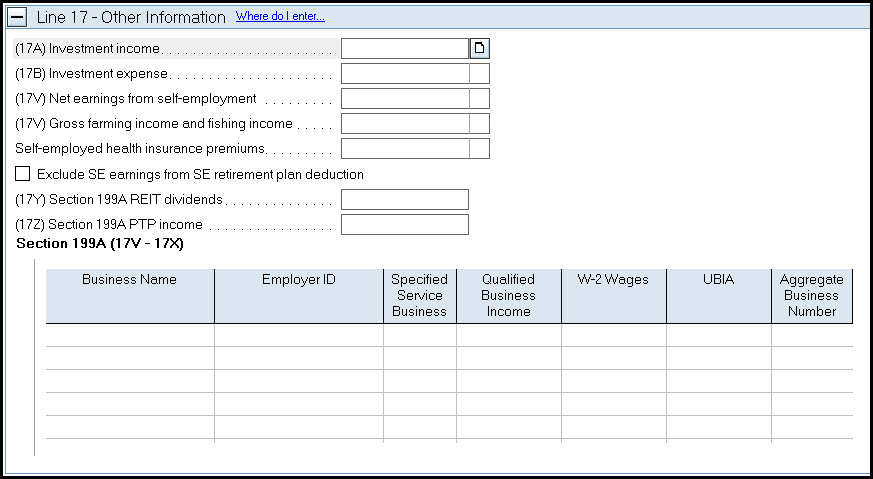

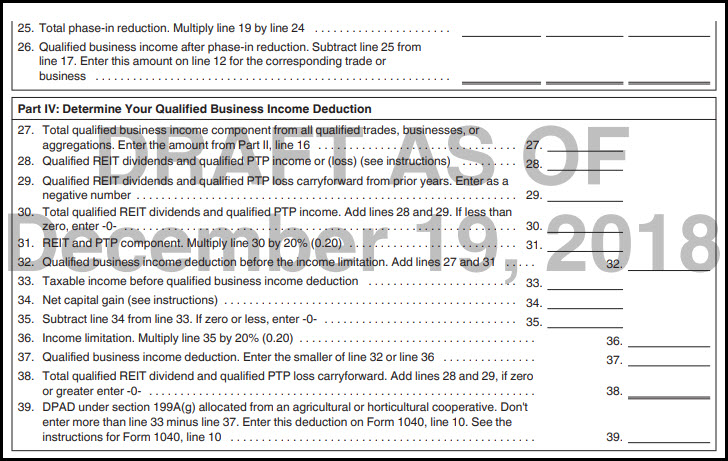

Section 199a deduction worksheet. Final regulations concerning the deduction for qualified business income under section 199a of the internal revenue code. While reit dividends are not considered to be qbi they are included for the section 199a deduction. This component of the section 199a deduction is not limited by w 2 wages or the ubia of qualified property. I do not understand what qbi code v and wages code w and ubia code x is.

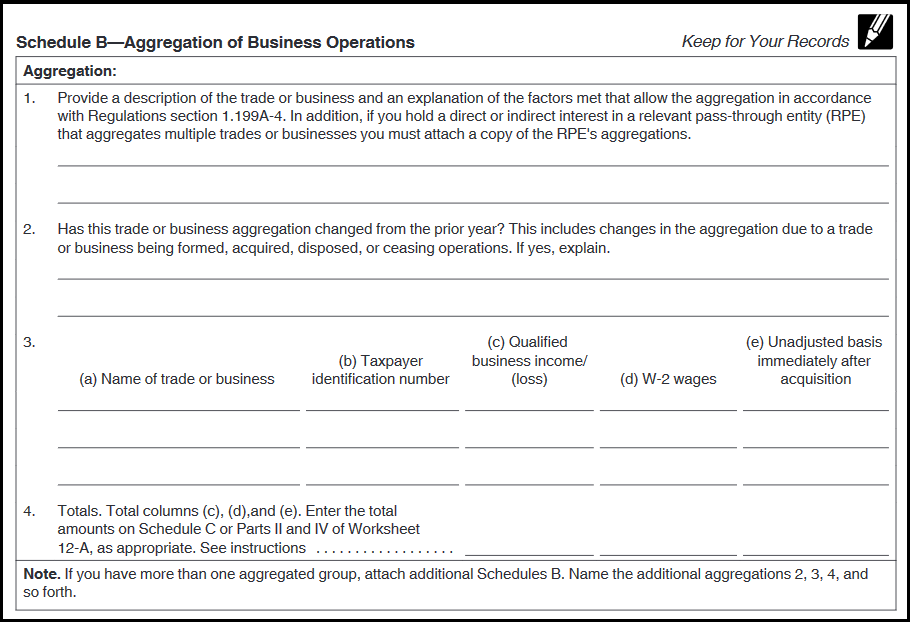

Wow new 20 percent deduction for business income married net capital gains and dividends for definition of qualified business income in the final regs see irs issues final section 199a regulations and defines qbi. Last week the irs released rin 1545 bo71 which they announce as. A specified cooperative that receives a section 199ag deduction as an eligible taxpayer can take the deduction only against patronage gross income and related deductions or can pass on the deduction to its patrons that are eligible taxpayers. 11011 letter addressed to the irs feb.

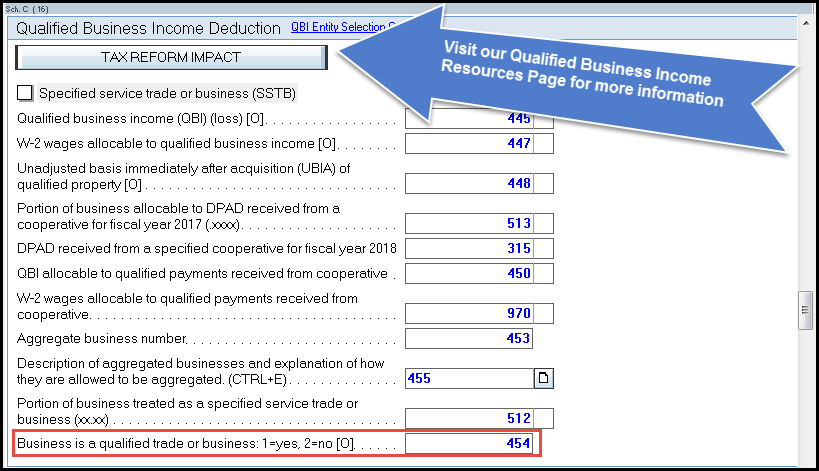

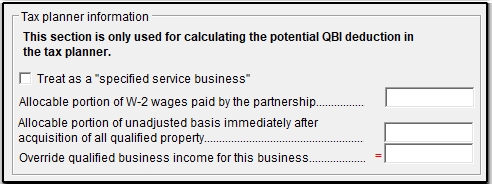

Many owners of sole proprietorships partnerships s corporations and some trusts and estates may be eligible for a qualified business income qbi deduction also called section 199a for tax years beginning after december 31 2017. Aicpa tax executive committee request for immediate guidance regarding irc section 199a deduction for qualified business income of pass through entities pub. Lacerte simplified worksheet section 199a qualif. First is this new for 2018.

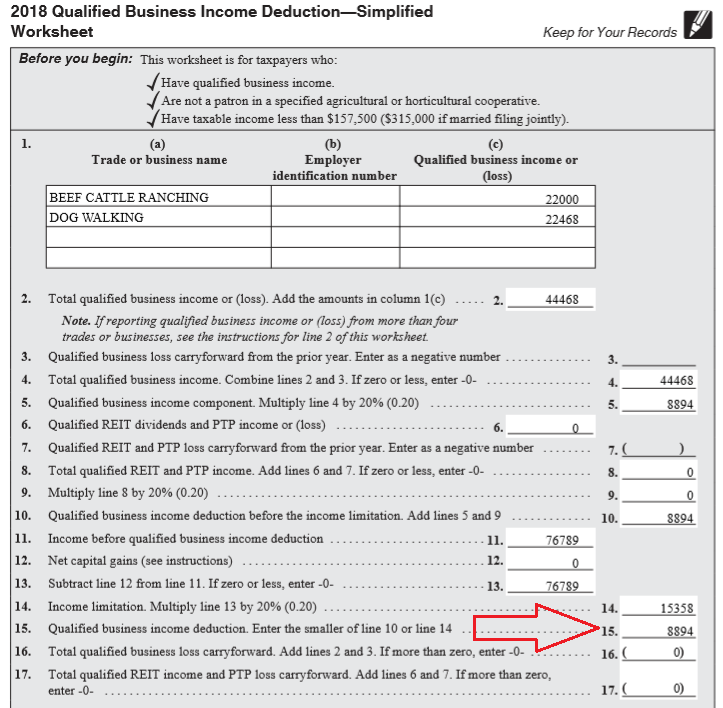

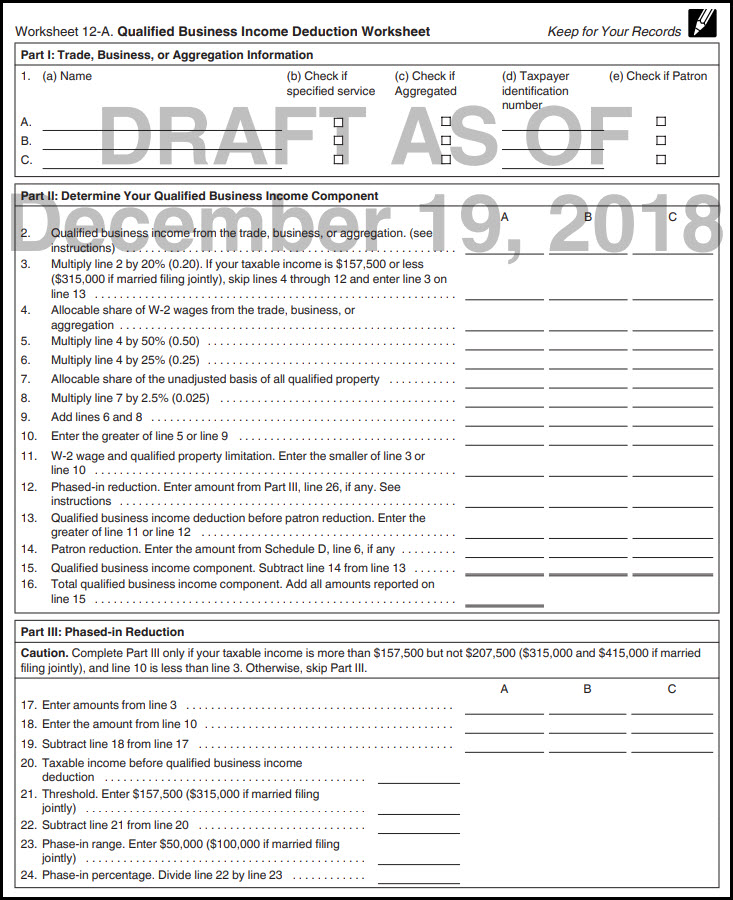

The section 199a deduction formula looks at your taxable income. Helpful 199a deduction articles single taxable income for definition of qualified business income see tax reform. Qualified business income deduction 199a worksheet. A section 199ag deduction that cant be used in the year it is received is lost.

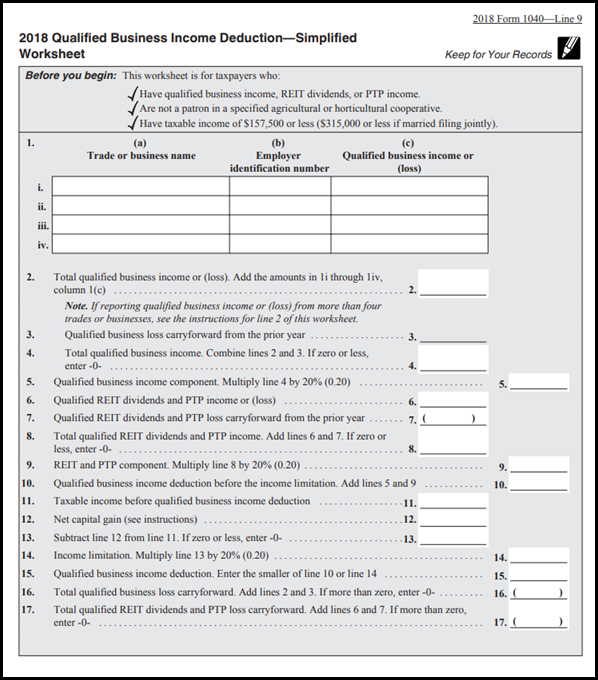

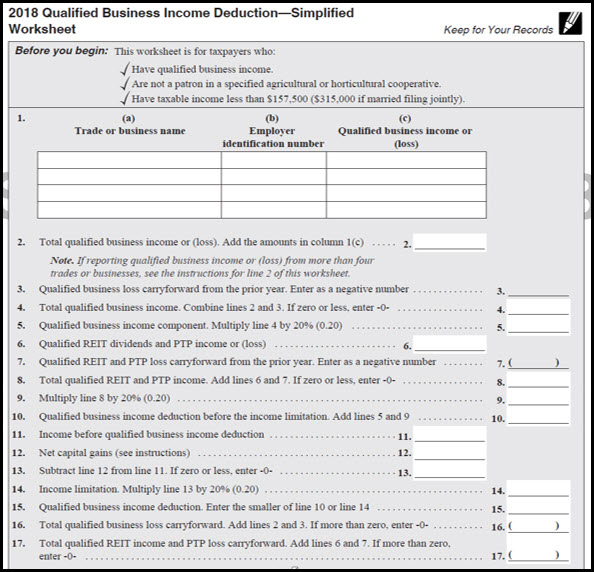

The actual calculation of the deduction was done in 2018 on one of two 2 worksheets depending on the income of the taxpayer. Lacerte simplified worksheet section 199a qualified business income deduction. The tax cuts and jobs act adds a new deduction for non corporate taxpayers for qualified business income. Subscribe to rss.

The tax cuts and jobs act created a deduction for certain pass through business income which is known as the qualified business income deduction qbid or section 199a deduction.