How Much Tax Receipt For Donating Car

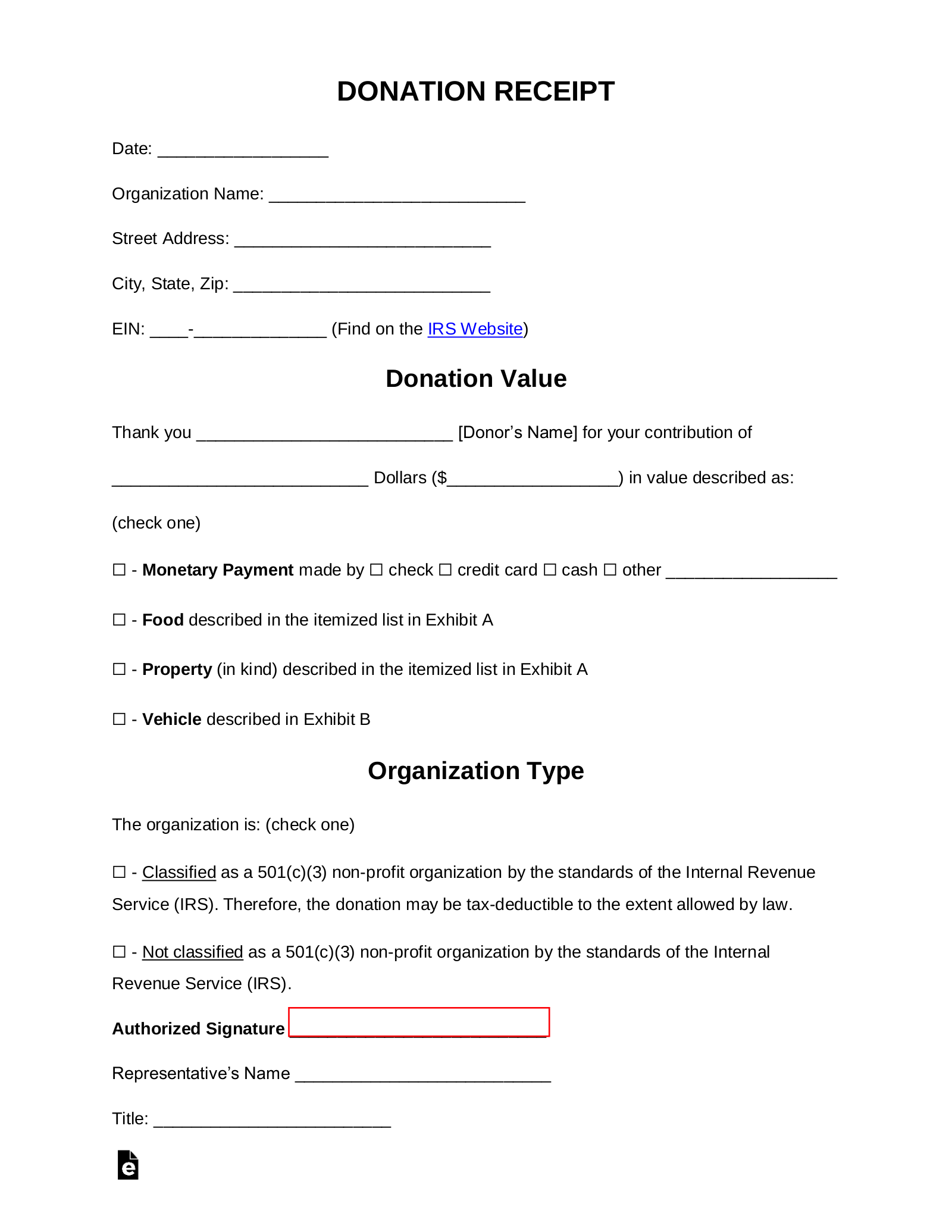

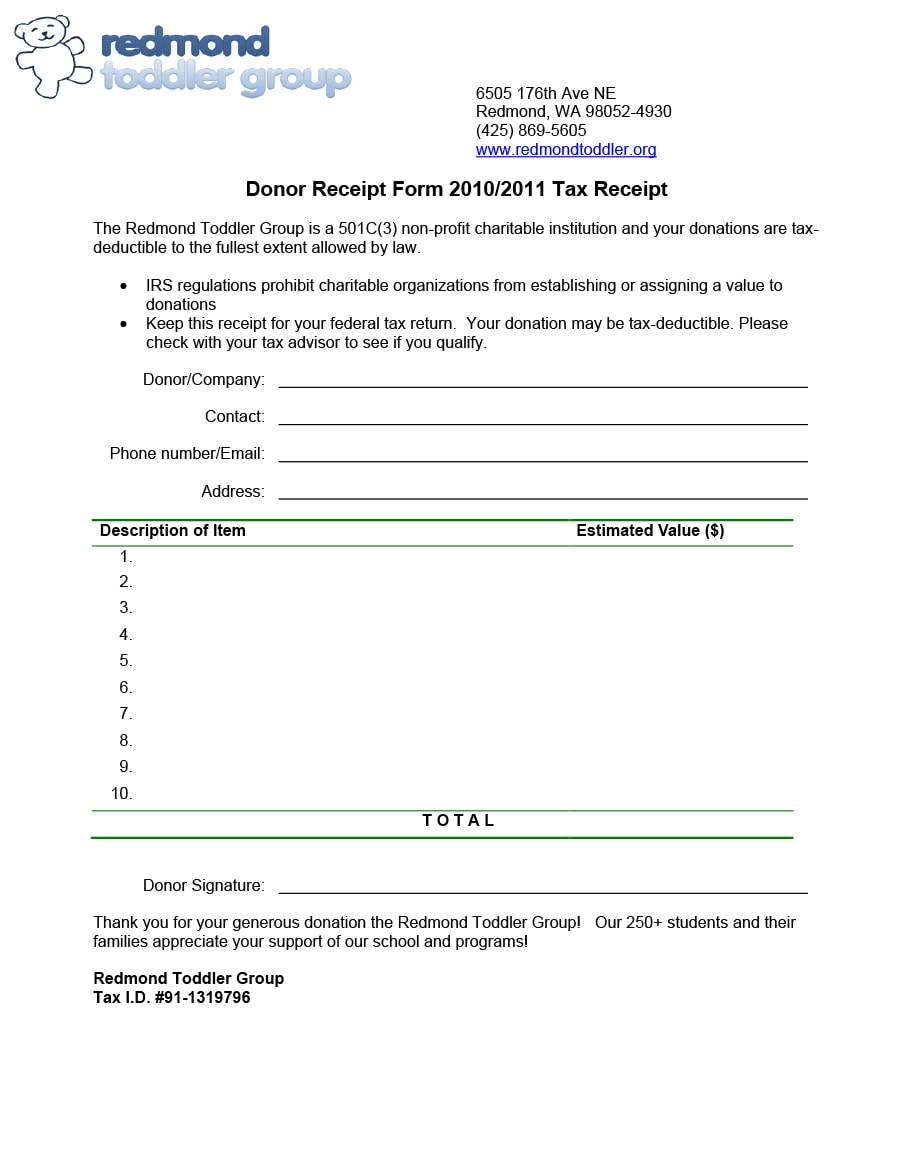

Eligible taxpayers may take charitable contribution deductions of up to 50 percent of adjusted gross income.

How much tax receipt for donating car. If you complete section b you must also obtain a written appraisal as documentation. Simply filling out the quick form to the right or call 1 877 431 9474 and we take care of the rest. How much will my tax receipt be. There isnt a hard and fast rule or an easy way to predict an auction value especially when sales are as is.

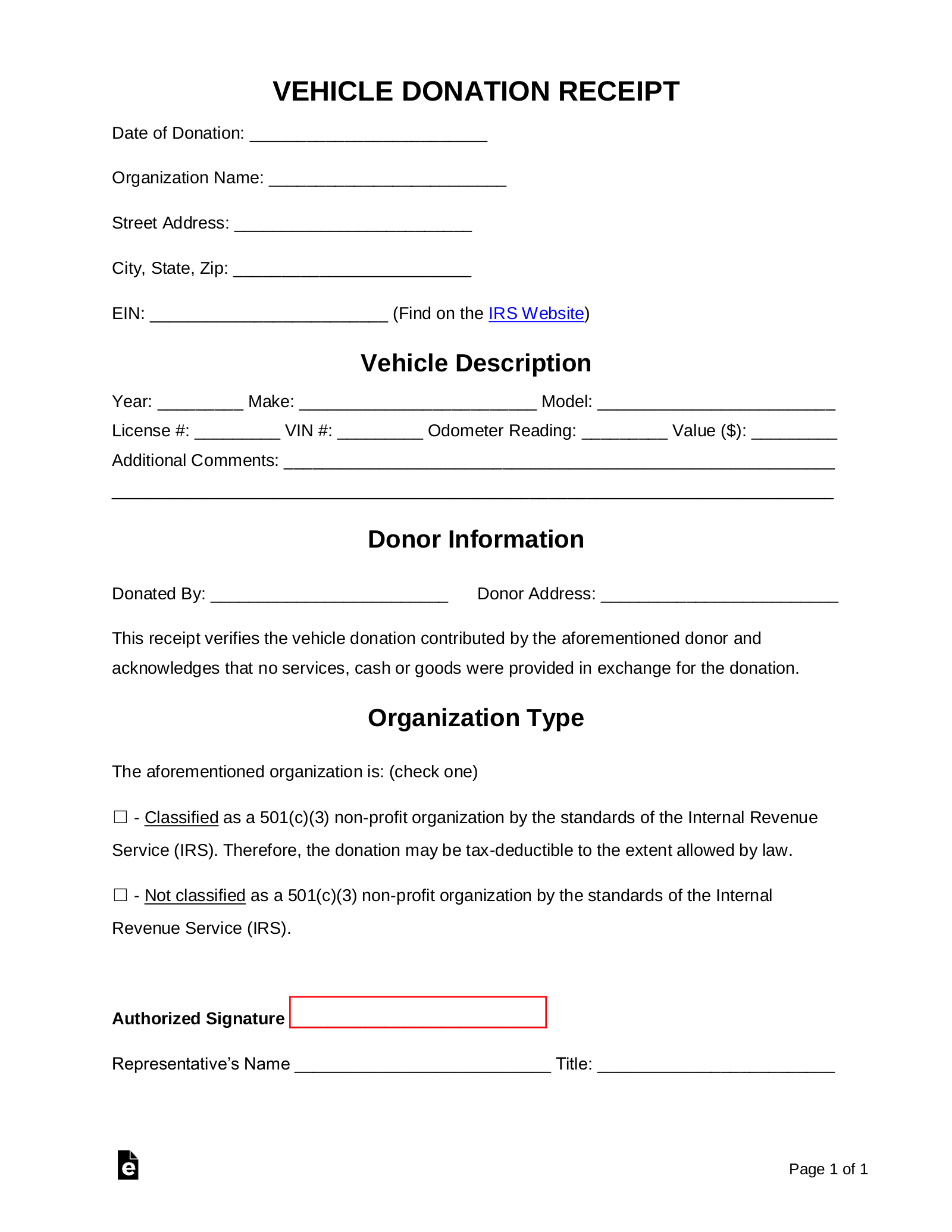

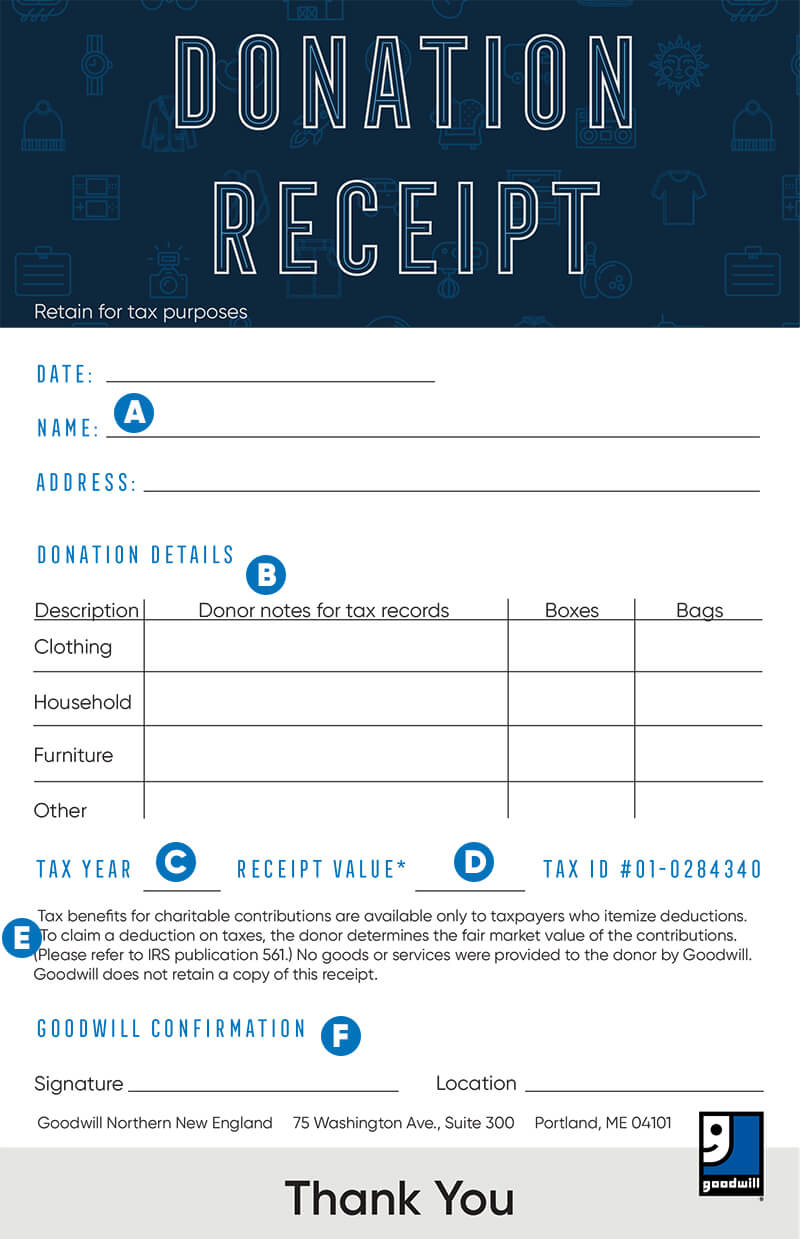

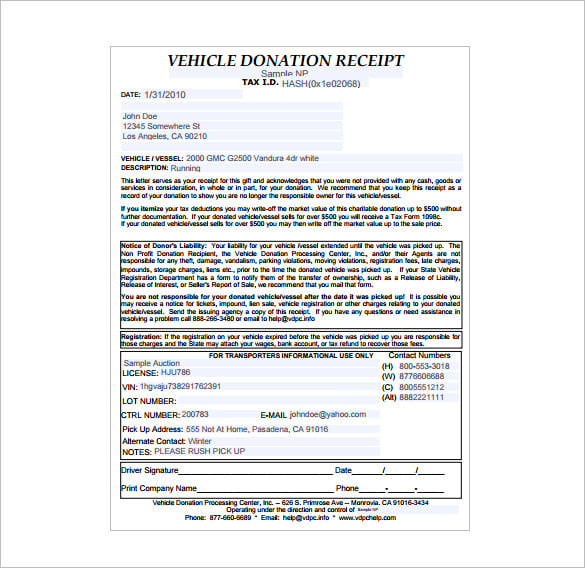

This is the amount of your vehicle donation tax deduction. The tax law changed in 2005 for most car donations the deduction you receive is now directly related to the selling price of the vehicle. Taxpayers who itemize deductions on schedule a of form 1040 are eligible to deduct a car donated to a qualified charity. If your deduction is greater than 5000 you must complete section b.

If your car sells for less than 500. I manage the program and can answer any and all of your questions. According to publication 4303 of irs when a donated car sells for more than 500 the precise amount it sold for will be reported on the receipt that is mailed to you. Your vehicle is picked up sold and proceeds benefit your local make a wish but you also get a 100 deductible receipt.

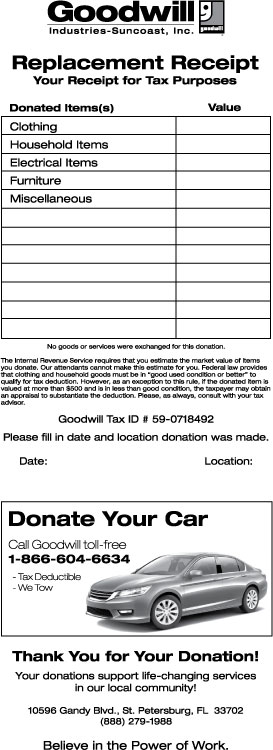

What we can tell you though is that we have had donations as high as 29000 as a result of our auction process so there really arent limits when you are considering donating a vehicle. Fair market value is explained as the blue book or guide book value of your vehicle. Your tax deductible receipt will be for the cars full sale price. We make it easy to get the maximum tax deduction for your vehicle donation.

The irs allows for a minimum deduction of 500 but for. If your deduction is between 501 and 5000 you must complete section a. Donate a car and if it sells for less than 500 you can take a tax deduction equal to the fair market value of your donation up to 500. Ask me anything about donating a car to charity ie process tax receipt purpose ever have a question about donating a car to the kidney car program.

Complete form 8283 if your car donation deduction is more than 500.