International Taxation Certification

Register as a student today.

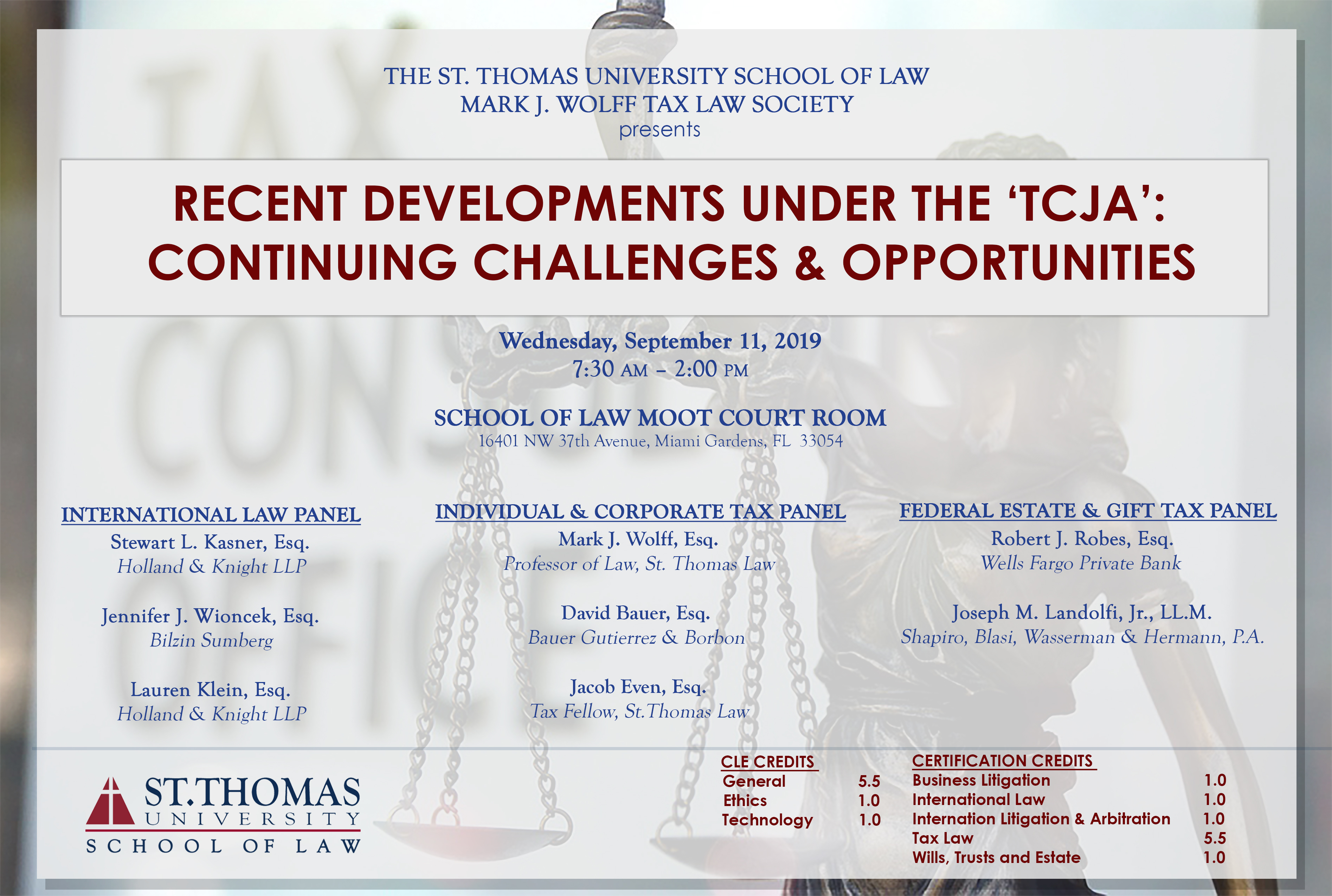

International taxation certification. The institute through its cmi designation program is the first to recognize professional achievement in state income taxation. And foreign trained lawyers as well as non attorney tax professionals and can be completed together with the tax llm. In 2006 the institute for professionals in taxation adopted a professional designation program certified member of the institutecmi for qualified state income tax members. In addition if you are seeking a further qualification as a financial services professional you may choose to take additional financial services training courses over the next two years and earn an international certification in financial services and wealth management.

Ibfd certificates are designed for tax professionals who wish to reach a new milestone in the field of international taxation or in gcc vat and to obtain a qualification for their skills acquired in a time and cost effective way. The certificate is open to both us. International tax training offers a wide selection of tax courses on international tax topics ranging from introductory to advanced levels. Each year hundreds of open course participants from around the world attend ibfd international tax courses on tax treaties tax structuring transfer pricing and indirect taxation.

A candidate who has successfully passed the diploma in international taxation shall be awarded a diploma certificate in the appropriate form and be entitled to use the letters diit icai after his name. The diploma in international taxation shall include 120 hours international taxation professional training intt pt and assessment test intt at. Designed by a board of world leading experts it has been created to provide the robust foundation in international tax that todays professional needs to stand out from the crowd. International taxation this certificate program provides a broad based education in the international taxation field with an emphasis on corporate tax issues.

In addition if you are seeking a further qualification as a financial services professional you may choose to take additional financial services training courses over the next two years and earn an international certification in financial services and wealth management. Adit the international tax credential is an advanced level designation in cross border tax. International taxation certificate georgetown offers a certificate program in the increasingly important field of international taxation.