Nonprofit Liquidity Policy Template

This resource from propel nonprofits includes considerations for reserve planning and two sample policies.

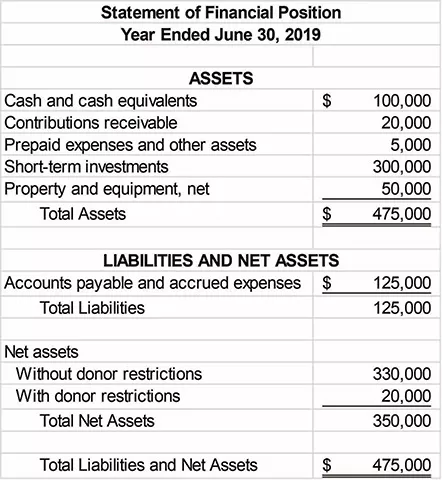

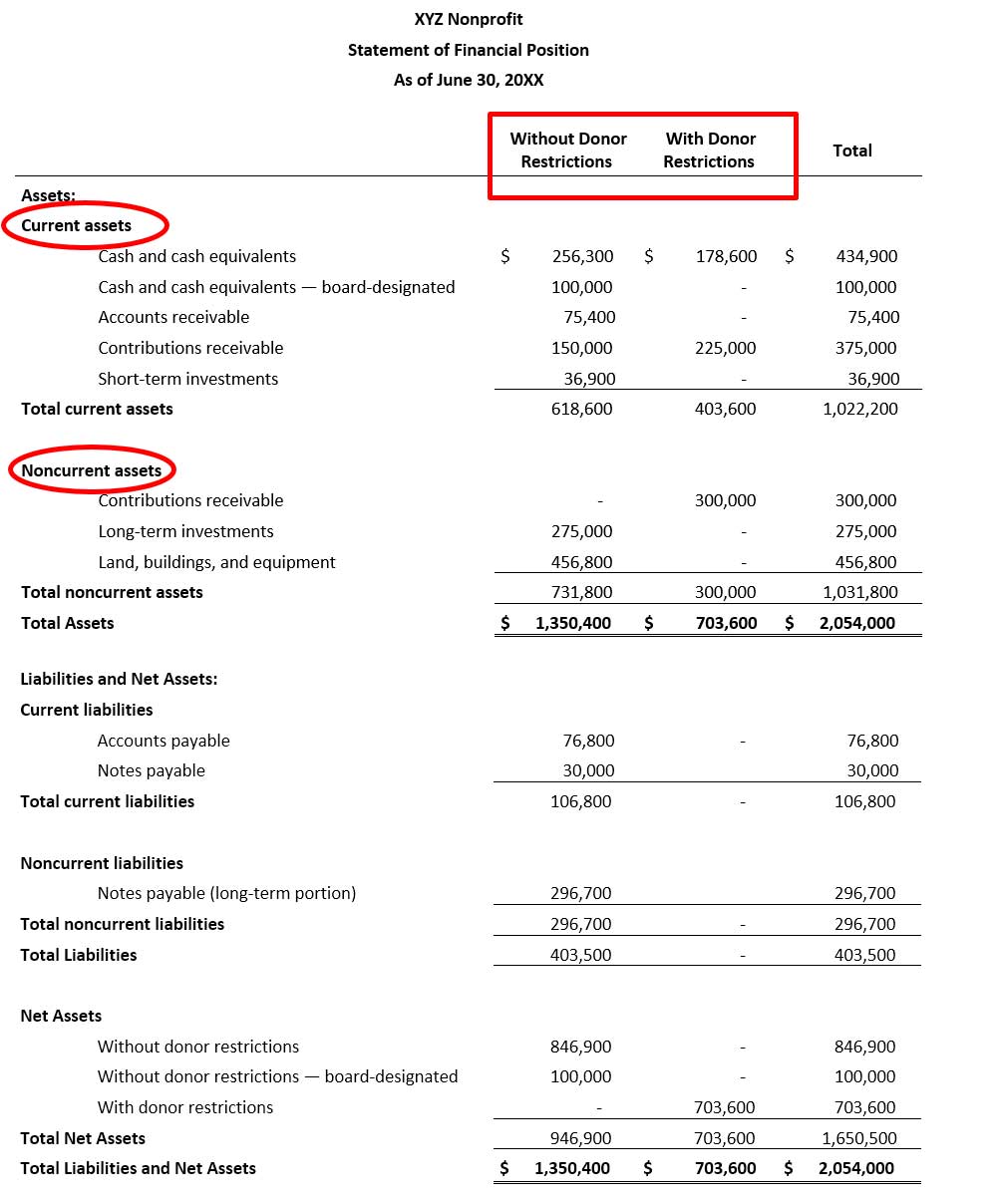

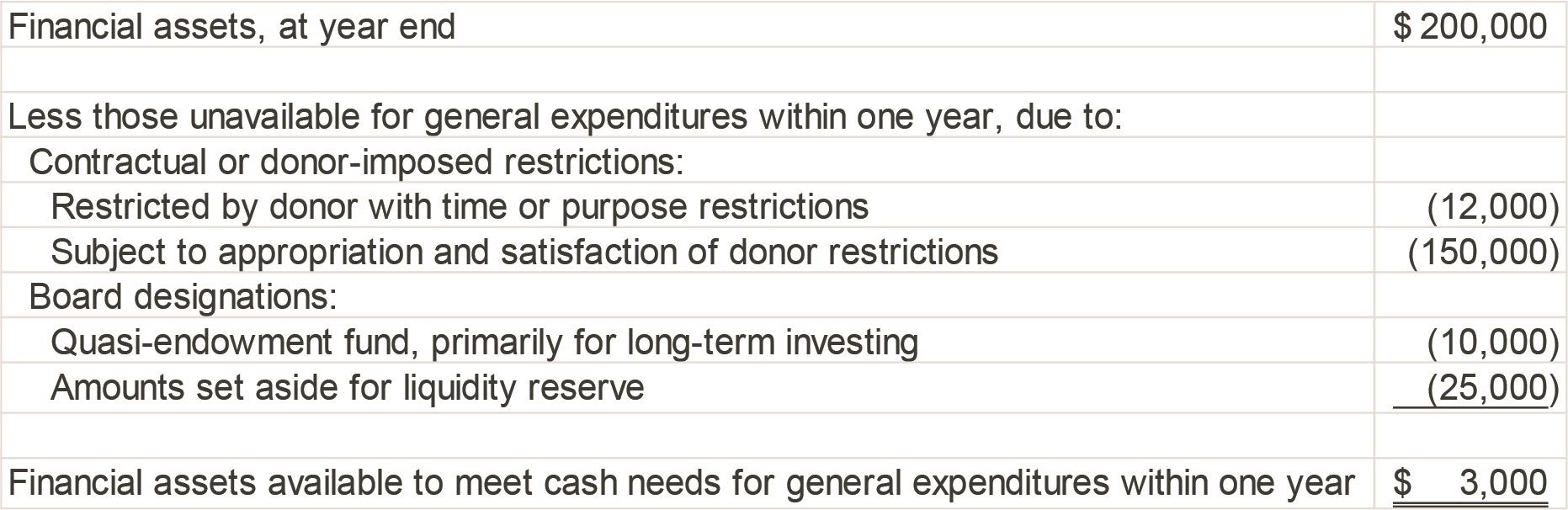

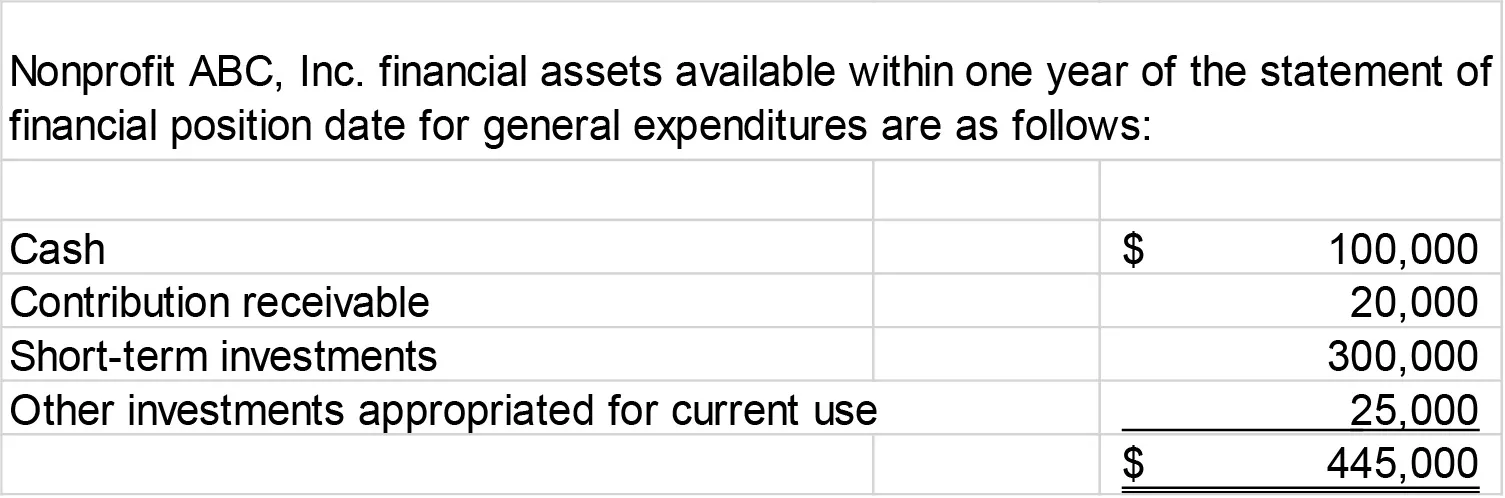

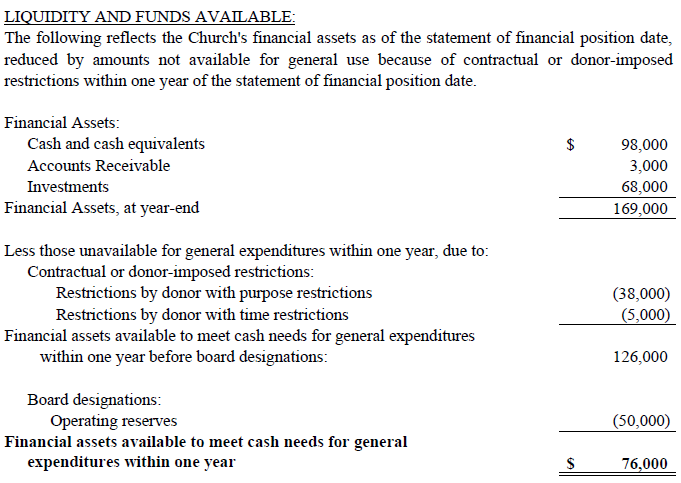

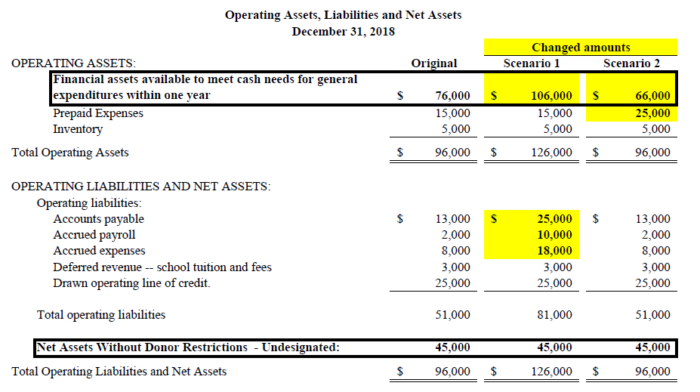

Nonprofit liquidity policy template. Specifically nonprofits must show assets available to meet the cash needs of the organization within one year of the balance sheet date. Nonprofits must disclose qualitative and quantitative information regarding the management liquidity and availability of their financial assets. Nonprofit operating reserves and policy examples. Not for profits will need to have a policy in place to comply with qualitative information disclosure requirements for managing liquidity and liquidity risk.

If such a policy doesnt currently exist an organization might consider working with its management team and governing board to put one in place. This resource includes considerations for reserve planning and two sample policies. The organization has a policy to structure its financial assets to be available as its general expenditures liabilities and other obligations come due. In the liquidity policy the nonprofit will need to define the purpose and intention of the designation for the liquidity reserve if any and whether or not it will be used to support the general expenditures within one year or unanticipated future liquidity needs.

A nonprofit may set aside a cash reserve to provide a cushion for planned or unplanned future needs. Qualitative disclosures include how the nonprofit manages its liquid resources to meet its general expenditure cash needs within one year of the balance sheet date. Nonprofits should also determine the best way to disclose the liquidity information in the financial statements.