Resale Certificate Form

If your address has changed please update your account.

Resale certificate form. If audited the new york department of taxation and finance requires the seller to have a correctly filled out form st 120 resale certificate. Certificate of sales tax exemption for diplomatic missions and personnel single purchase certificate. Form st 120111resale certificatest120 st 120 new york state department of taxation and finance new york state and local sales and use tax 111 resale certificate name of seller name of purchaser street address street address city state zip code mark an x in the appropriate box. A is registered as a new york state sales tax vendor and has a valid certificate of authority issued by the tax department and is making purchases of tangible personal property other than motor fuel or.

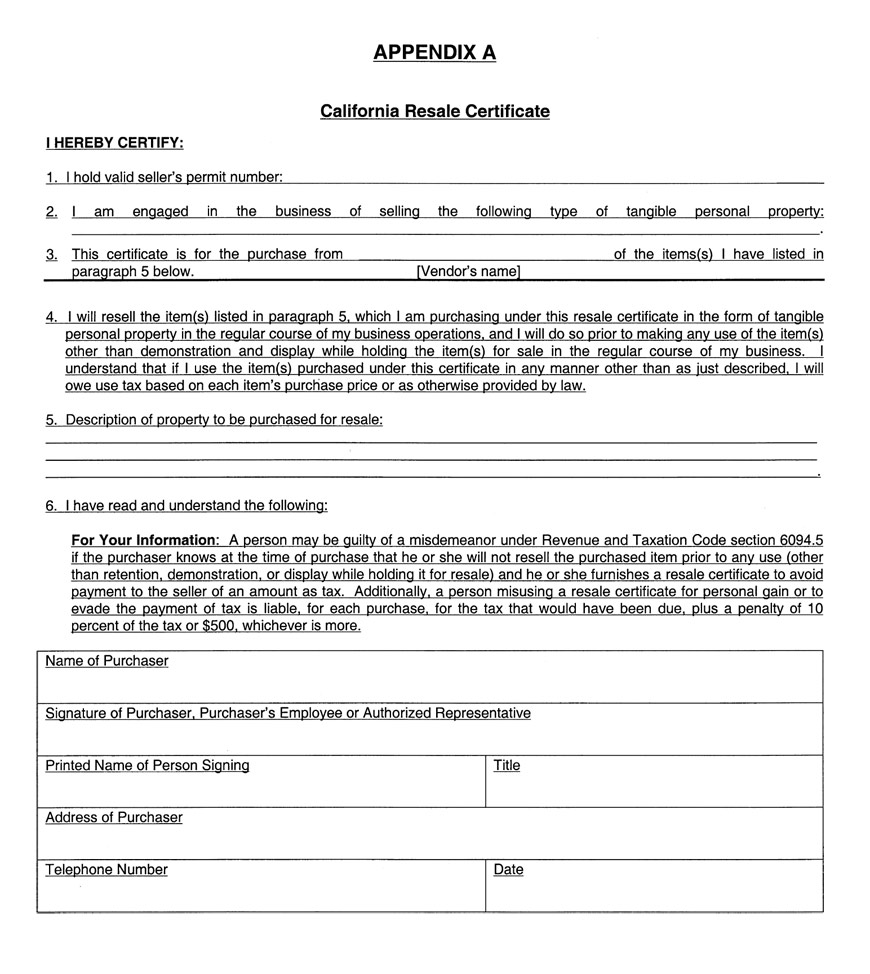

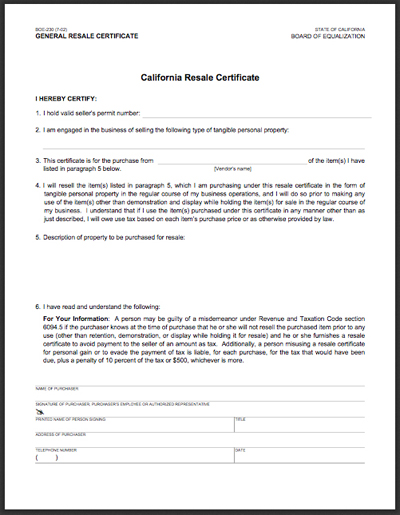

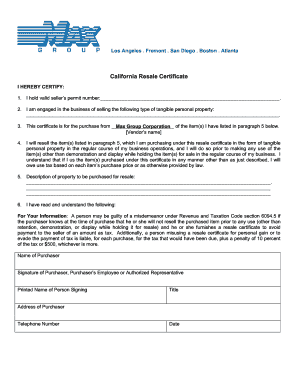

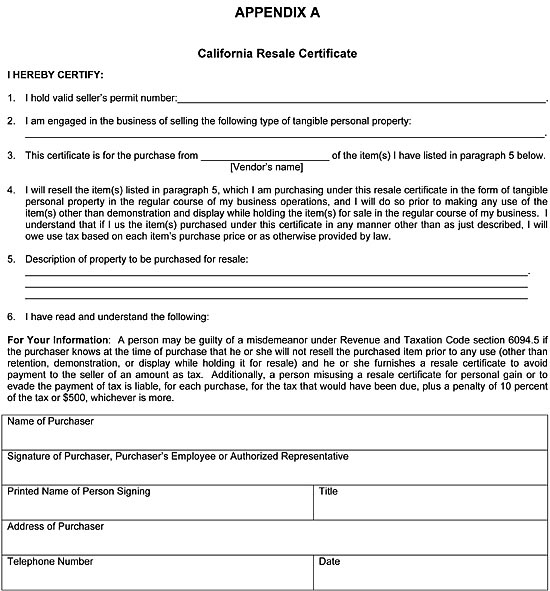

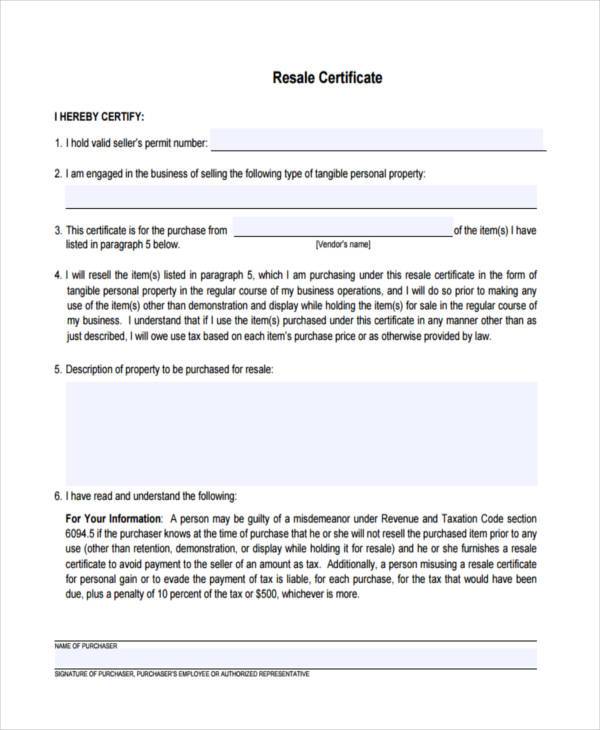

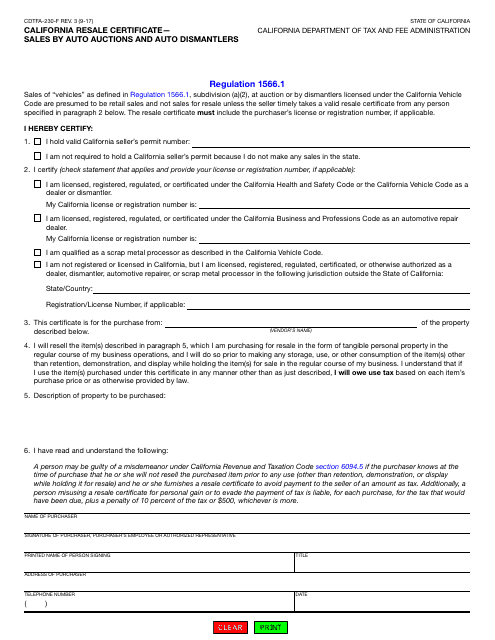

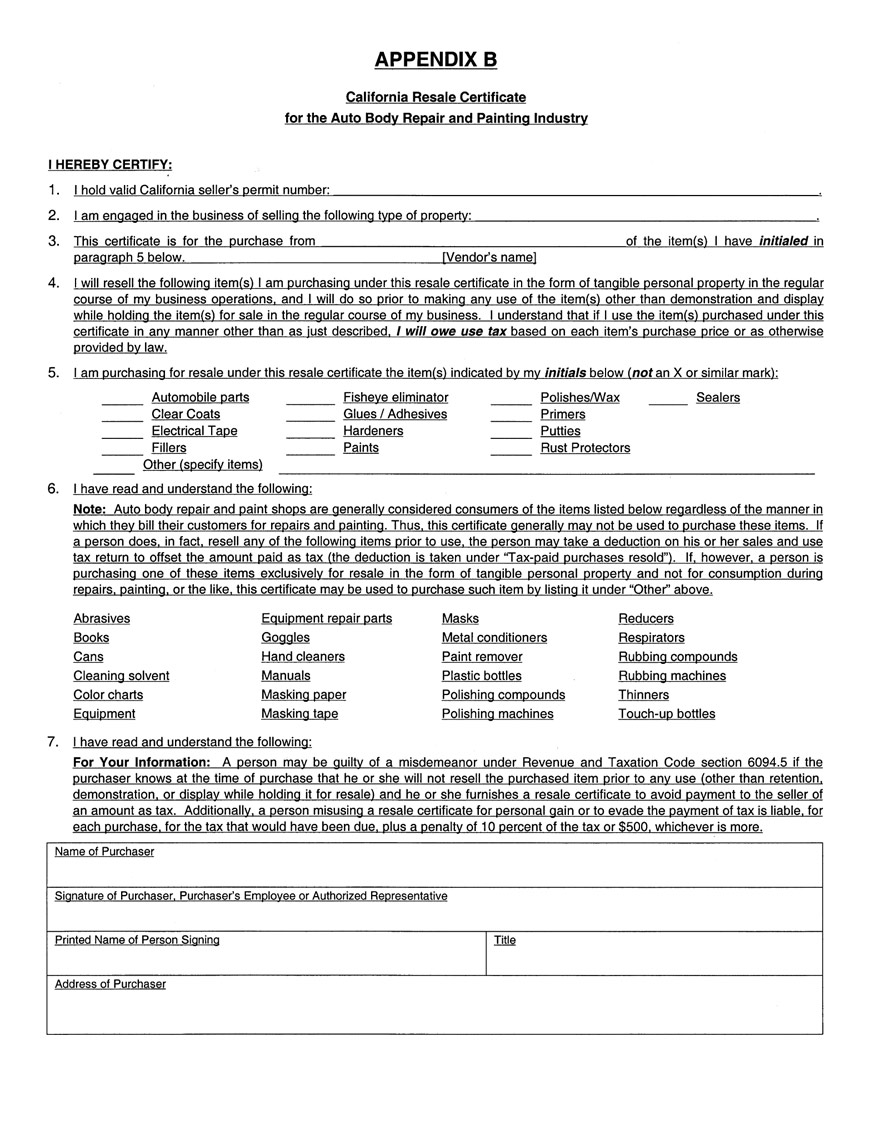

If you do not file electronically please use the preprinted forms we mail to our taxpayers. I will resell the items listed in paragraph 5 which i am purchasing under this resale certificate in the form of tangible personal property in the regular course of my business operations and i will do so prior to making any use of the items other than demonstration and display while holding the items. Contractors or other persons registered under a consumer number in the 900000 series may not issue a resale certificate for any purchase. Importantcertificate not valid unless completed.

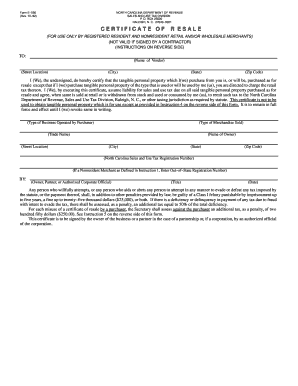

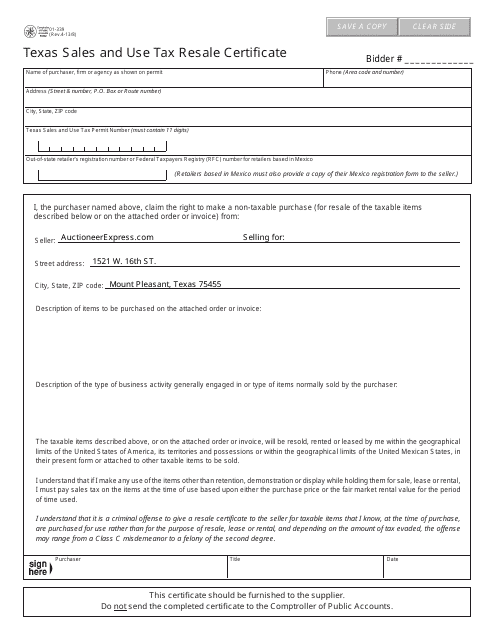

This certificate is only for use by a purchaser who. Texas sales and use tax forms. Ida agent or project operator exempt purchase certificate for fuel. A resale certificate indicates the item was in good faith that the purchaser would resell the item and report tax on the final sale.

Ft 123 fill in instructions on form. When purchasing items for resale registered sellers may avoid the sales tax by giving their supplier adequate documentation in the form of a resale certificate. Exempt organization exempt purchase certificate is available by calling 518 485. I understand that it is a criminal offense to give a resale certificate to the seller for taxable items that i know at the time of purchase are purchased for use rather than for the purpose of resale lease or rental and depending on the amount of tax.

It is to be filled out completely by the purchaser and furnished to the vendor. 01 339 texas sales and use tax resale certificate exemption certification pdf. Single use certificate temporary vendors must issue a single use. How to fill out the new york resale certificate form st 120.

The vendor shall retain this certificate for single transactions or for specified periods as indicated below. Form st 120 resale certificate is a sales tax exemption certificate. Filling out form st 120 is pretty straightforward but is critical for the seller to gather all the information. The purpose of the certificate is to document the purchase of tangible personal property for resale in the purchasers regular course of business.

Resale exemption certificate document title.