Savings Account Certificate

If you want a slightly bigger commitment than a.

Savings account certificate. For over 30 years comenity has been a trusted partner helping people get more for their money. 5 to open the youth certificate account. Federal law limits certain types of withdrawals on savings accounts to six per month. Additional deposits of up to 10000 per year from open date.

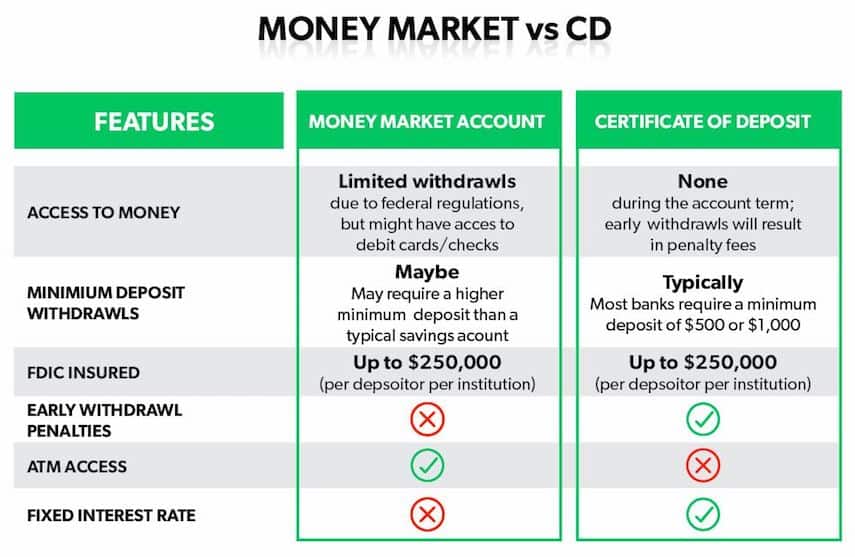

Savings accounts on the other hand change the interest rate as the market rates change. A savings account is an especially good place to keep your emergency fund because it offers fast access to your cash. 25 minimum balance maximum of 6 withdrawals per month dividends are paid monthly on daily balance the dividend yield may change monthly. This account is for the serious saver and requires a minimum deposit of 2500.

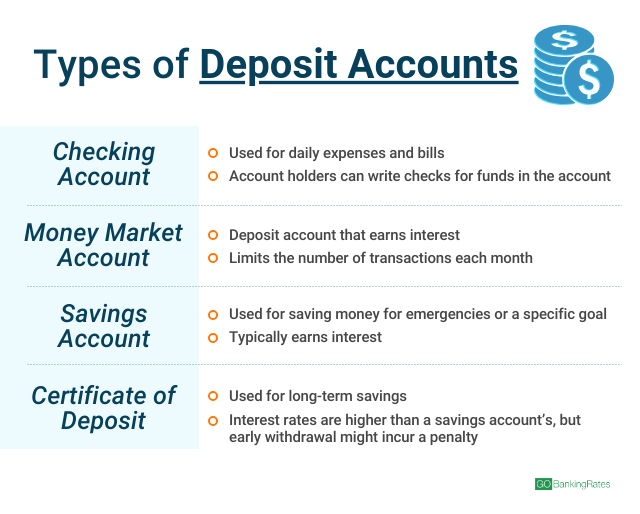

Dividends tiered based on length of term and are credited to account monthly. 1000 minimum opening balance maximum of 6 withdrawals per month. Share certificates which are the credit union version of cds are also low risk. Of these three types of accounts savings and money market accounts are the most similar.

Cds also typically dont have monthly fees. No monthly service fees. Savings accounts certificates primary share. But if interest rates fall your savings account will earn less while the cd will be locked in at the higher interest rate.

So if rates go up youll start earning a higher interest rate on a savings account but not a cd. Use this free savings calculator to estimate your investment growth over time. For example savings accounts are often the first bank accounts that children open with the help of their parents in order to teach them how to save their money. Just as with the interest earned on a money market certificate of deposit or checking account the interest earned on savings accounts is taxable income.

Experience simplified transactions and elevated customer care. With a deposit of just 5 this account is not just your way into the credit union. A savings account will make the most sense for those who have a relatively small balance and want to avoid paying unnecessary fees. Step up available once during certificate term.

The financial institution where you hold. Share savings account disclosures. 12 24 36 48 and 60 months. A savings account is a bank account that typically earns interest while letting you withdraw money to a point.