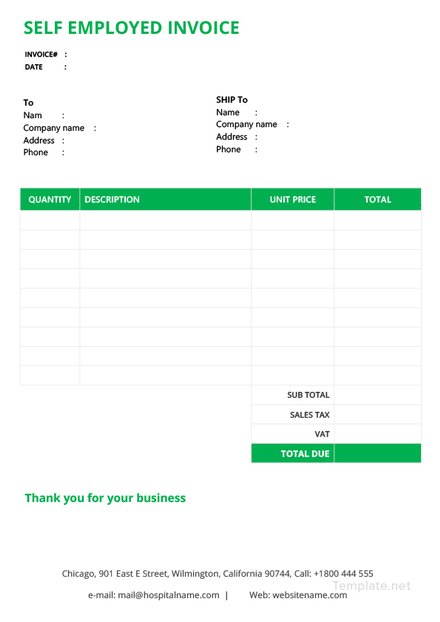

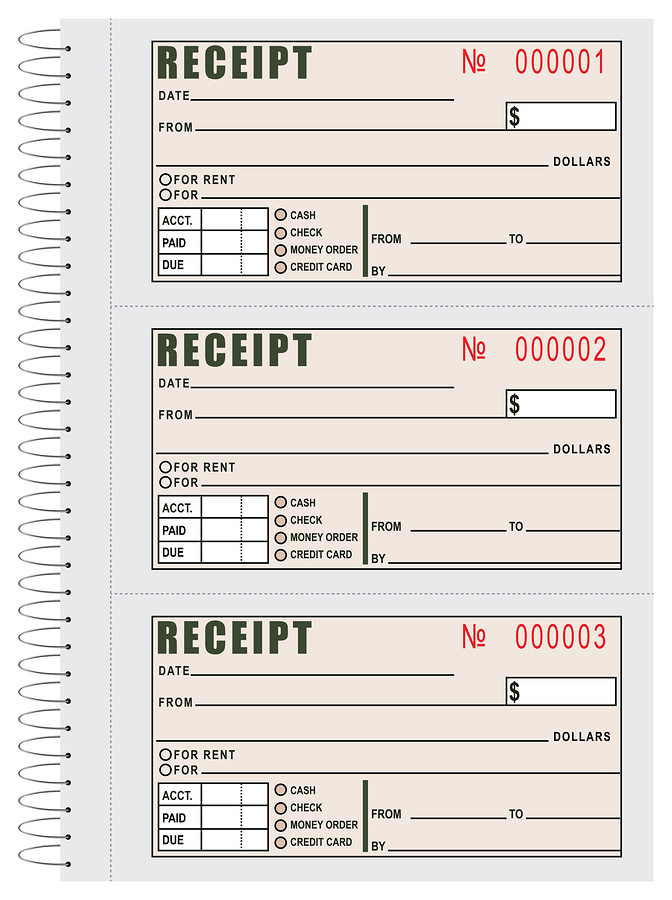

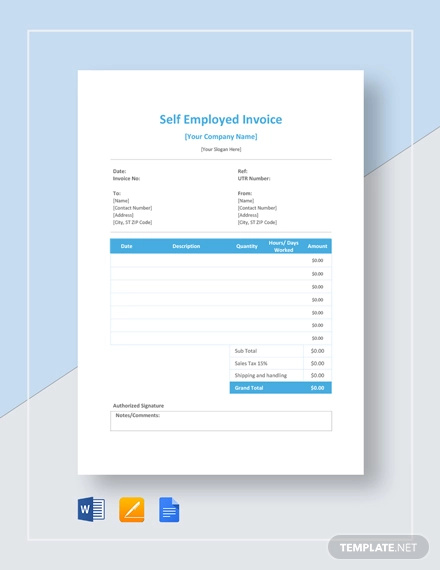

Self Employed Receipts

Check what being self employed means.

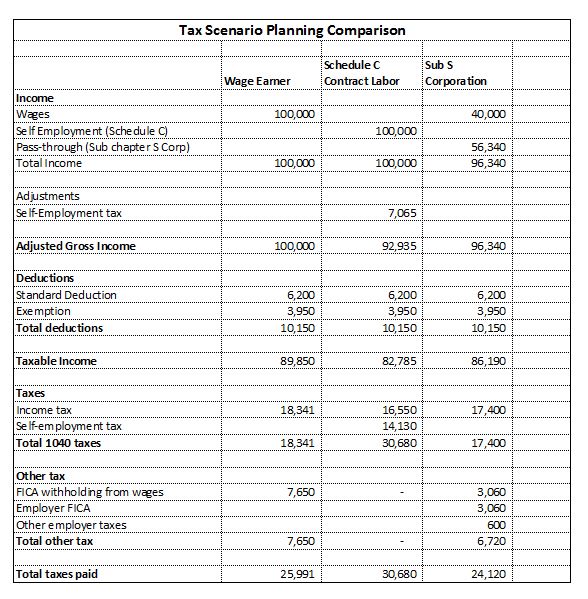

Self employed receipts. Additional medicare tax applies to self employment income above a threshold. A limited company. As a self employed individual generally you are required to file an annual return and pay estimated tax quarterly. It then takes 153 of that amount which works out to 4239.

It is similar to the social security and medicare taxes withheld from the pay of most wage earners. The other half also 145 percent is paid by the employee. Check if you should set up as one of the following instead. The medicare portion of the self employment tax is also a flat tax at a rate of 29 percent on all compensation income.

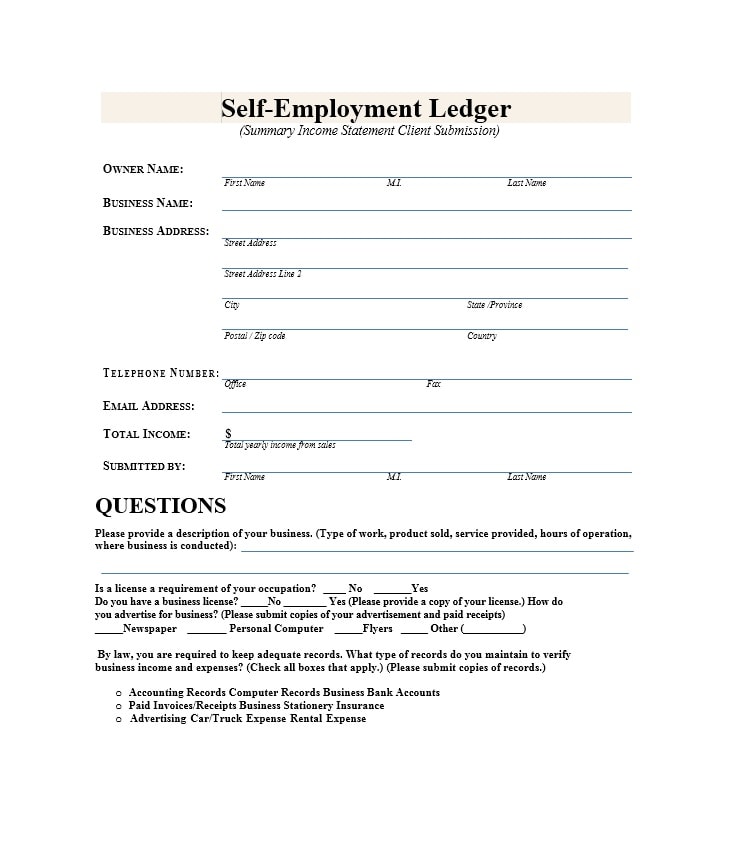

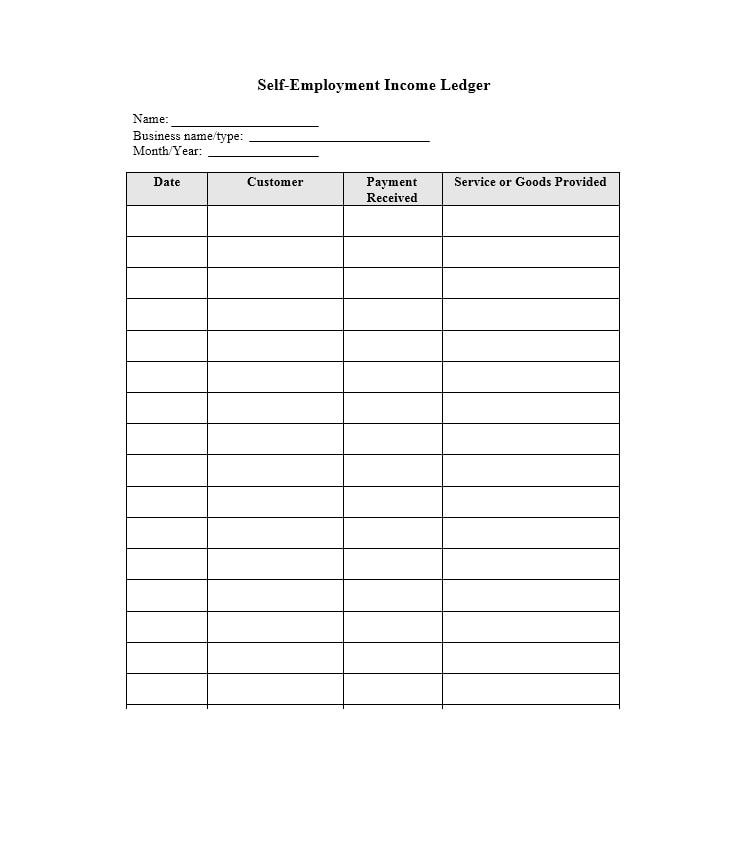

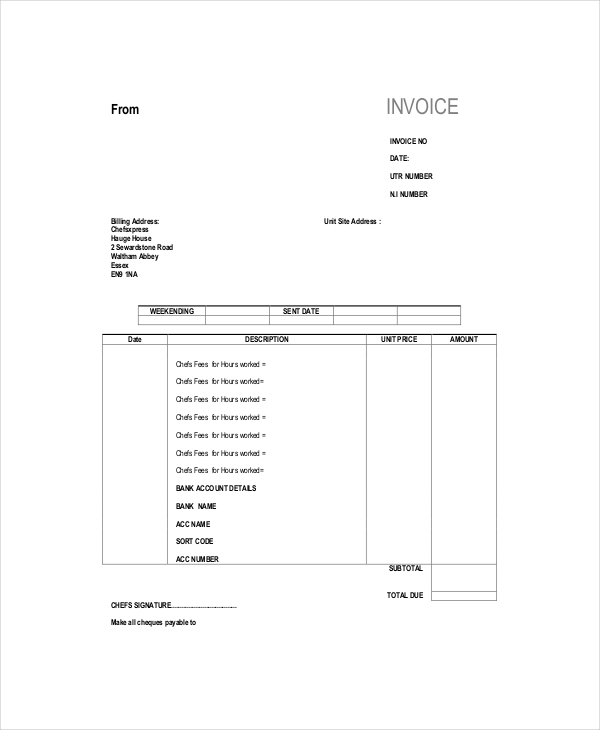

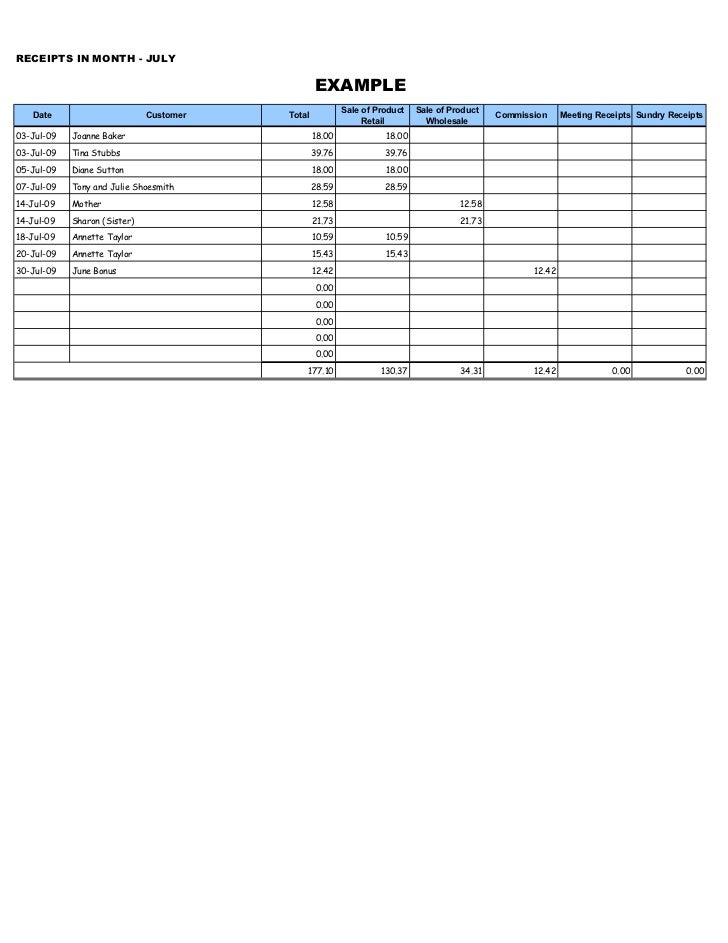

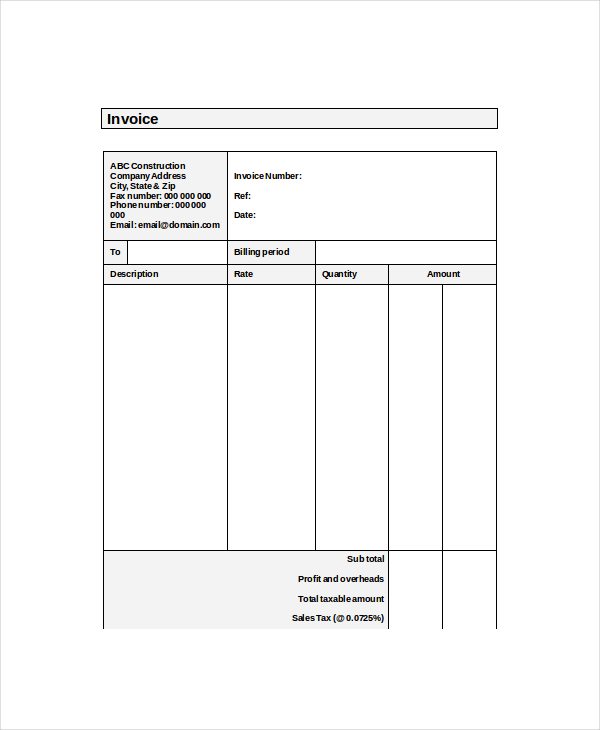

A partner in a business partnership. Self employed people must keep track of their own income estimate how much tax they owe and in most cases makes estimated tax payments throughout the year. Unless your self employment involves dealing and brokering investment securities interest and dividends are also not considered self employment income. Like the social security tax half the medicare tax or 145 percent is paid by the employer of an employed worker.

In the simplest one say you make 30000 from self employment income and have no other work. Calculating self employment income when you work for someone else you get a w 2 form from your employer at the end of the year telling you exactly how much money you made. There are other ways to work for yourself. Self employed individuals generally must pay self employment tax se tax as well as income tax.

They provide suggested guidance only and do not replace fannie mae or freddie mac instructions or applicable guidelines. The calculator takes your gross income and then reduces it by 765 coming up with taxable self employment earnings of 27705. Income for which you received a w 2which would mean you are an employeecannot be calculated as self employment income. Self employment tax is a tax consisting of social security and medicare taxes primarily for individuals who work for themselves.

Se tax is a social security and medicare tax primarily for individuals who work for themselves. The threshold amounts are 250000 for a married individual filing a joint return 125000 for a married individual filing a separate return and 200000 for all others. The same goes for income received from an activity that fits the narrow irs definition of a hobby. Schedule se form 1040 is used by self employed persons to figure the self employment tax due on net earnings.